When will SEC Chairman Gary Gensler step down as proposed by US lawmakers?

When will the SEC Chairman, Gary Gensler, resign, as suggested by US lawmakers?Today, US Representative Warren Davidson tweeted that he had officially submitted the “Stable Act” to the US Securities and Exchange Commission (SEC), calling for a restructuring of the SEC and the dismissal of its chairman, Gary Gensler. The bill was supported by another US Representative, Tom Emmer.

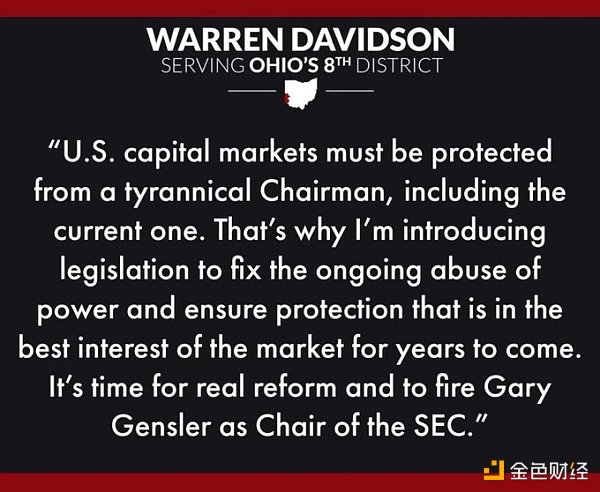

In the tweet, Warren Davidson wrote: “The US capital market must be protected from the tyranny of power, including the current chairman. The purpose of this legislation is to address the current abuse of power and ensure that protection measures that best serve the market are in place in the future. It’s time for real reform and to dismiss Gary Gensler as SEC chairman.” The tweet received nearly 4 million views, 44,000 likes, and 16,000 retweets.

“US investors and the industry deserve clear and consistent supervision, not political games,” Tom Emmer said in a press release. “The ‘US SEC Stable Act’ will make common-sense changes to ensure that the SEC’s priority is the investors they are responsible for protecting, not the whims of their rash chairman.”

- Will on-chain video games for BTC become a reality? Mythic receives revolutionary upgrade

- Understanding SEC’s Regulatory Timeline and Responses from All Parties in One Article

- How can Frax reveal the essence of LSD War through a product?

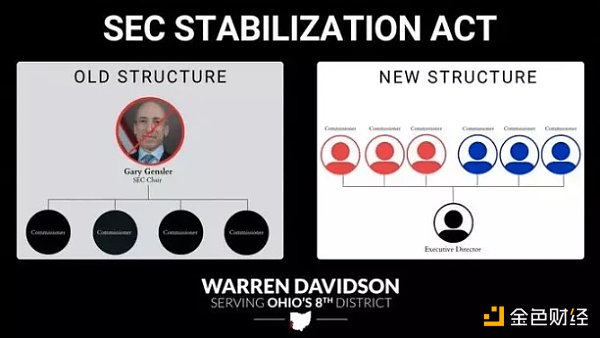

According to the bill’s idea, after dismissing Gary Gensler from the chairman position, the committee will be restructured, and the chairman’s rights will be assigned to other members. The development, execution, and investigation of all rules will also be led by these six members with a term of six years, and an executive director position will be established to supervise daily operations. In addition, to prevent control of the SEC by a political party, no party can have more than three committee seats, and a structure similar to the Federal Election Commission (FEC) will be implemented. As shown below:

In fact, Warren Davidson has been involved in various cryptocurrency issues and is the deputy chairman of the Republican Cryptocurrency Group, committed to cryptocurrency industry supervision and legislation. Last year, he and four other members of Congress jointly proposed a new bill to support adding cryptocurrencies to 401(k) retirement plans.

As early as two months ago, Warren Davidson announced at a hearing of the House Financial Services Committee that he would propose a new bill to remove Gensler and set up an executive director to fill the vacancy. Recently, the SEC has repeatedly taken strong action, suing cryptocurrency giants such as Binance and Coinbase, disrupting the stable situation of the US cryptocurrency market, further arousing the dissatisfaction of members of Congress such as Warren Davidson, and leading to the introduction of the bill today.

Although Gary Gensler is currently receiving a lot of negative attention in the cryptocurrency market and has made conflicting statements in the past (for example, in 2019, Gary praised the Algo platform for its technological innovation, but now categorizes it as a security), there is still a long way to go before he is truly overthrown.

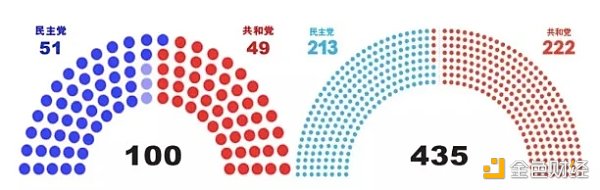

As for today’s proposal, it was proposed by two Republican lawmakers, but to truly become law, it needs to be formally voted on by both the U.S. House and Senate: the House needs at least 218 members to vote in favor; the Senate first needs 60 senators to agree to stop discussing the proposal and agree to vote, and then needs 51 votes to move on to the next step.

(Seats in both parties of Congress)

Looking at the current situation of the two parties in the U.S. Congress today, even if the “U.S. SEC Stability Act” is passed in the House of Representatives, it will be difficult to continue in the Democratic-controlled Senate, after all, SEC Chairman Gary Gensler is also a Democrat. Moreover, the Democrats have been hoping to make the SEC the primary regulatory agency for regulating cryptocurrencies and are unlikely to cut off their own arm and give up power.

The “U.S. SEC Stability Act” is destined to come to nothing, and a viable way out for the Republican Party is to support the CFTC (U.S. Commodity Futures Trading Commission) to compete with the SEC. As for the cryptocurrency market, the CFTC’s regulation is relatively “mild” and the list of prosecutions has not been that long so far.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- New Directions for Web3 to Take in the AI Era

- Exploring the Development Potential of Instadapp: Understanding the Mechanisms Behind Its Component Operations

- Why is DOT considered software while multiple well-known public chain tokens are recognized as securities by the SEC?

- Former SEC official: Why is the US Department of Justice reportedly filing criminal charges against Binance?

- From Productivity Boosts to Nightmare Scenarios: 10 Areas Where Cryptocurrency and Artificial Intelligence Could Overlap

- Explaining the Maverick protocol mechanism, which entered the top five in DEX after three months of release.

- Binance US hires former chief of the US SEC enforcement division to lead defense