Mu Changchun Open Class: Libra conspiracy and DCEP

From the central bank's public voice on the central bank's digital currency, we can see that since July and August this year, the voice has been particularly dense, indicating that the central bank is not far from the issue of China's digital currency. By then, China will become the first real meaning. A sovereign state that issues cryptocurrencies.

Mu Changchun, director of the Central Bank's Digital Money Institute, released the "Libra and Digital Currency" open class last week, detailing the key features of Libra and its impact on the functional attributes and operating systems of China's DC/EP. He said: "I did this course in August of 2019. It is not far from launching our own digital currency by the People's Bank of China."

The course "Libra and Digital Currency" is divided into 8 lectures, all of which are nearly one and a half hours, and the manuscript is about 23,000 words. In order to facilitate the readers to quickly understand the main content, the author concentrates and refines important viewpoints, and adds his own thoughts and comments. But there are still 14,000 words. I wanted to cut it into the top and bottom, but after considering it, I found that the cutting is not conducive to the reader's understanding of the significant impact of Libra's success and the significance of the Chinese central bank's implementation of digital currency. In order to facilitate the reader's reading, the essence of Mu Changchun's exposition is refined as follows:

- Libra can be seen as a potential world-class currency change, but if this change is not handled well, it is likely to be a huge hidden danger.

- Libra can't be a pure blockchain. It uses a centralized architecture at the bottom. It only uses the blockchain when it is finally settled, and there aren't many nodes, because the more nodes, the slower the speed.

- Libra is difficult to achieve currency stability.

- Libra's success as a stable currency means that Libra's founding association will play the role of Libra's central bank and evolve into a private international monetary fund. Its influence is greater than that of the International Monetary Fund.

- Libra's currency stability and organizational profitability are a paradox.

- Libra faced great difficulties as a trading medium in the early days of a country, but this did not affect its prospects for cross-border payment scenarios.

- Libra said that he is inclusive finance and serves the people of the weak currency countries. However, for the weak currency countries, if the people use the local currency to exchange Libra for a large amount, they will push the local currency to depreciate, thus aggravating the poverty of people with only local currency assets. Instead, they did not achieve the purpose of what they called inclusive finance.

- In most countries, it is impossible for the monetary authorities to welcome Libra. However, the negative attitudes of countries may not be able to stop Libra.

- The central bank’s digital currency is on the horizon.

- The central bank's digital currency can be independent of the network, and it does not need to be bound to any bank account when paying. It can realize offline payment and offline payment.

- The central bank's digital currency has unlimited claims. You can reject WeChat and Alipay; you cannot refuse to accept DCEP.

- The central bank can't control all the user data, instead of commercial banks doing all the financial business, which leads to the planned economy. Therefore, with the central bank's digital currency, the original two-tier operating system of the People's Bank of China and the commercial bank is still adopted.

- DCEP does not use blockchain technology at the central bank level, and there is no pre-set route at the commercial organization level. However, in view of the current blockchain technology development, in order to meet the retail level concurrency requirements, commercial organizations may not be able to adopt blockchain technology. .

- Internet finance entrepreneurs rarely consider risk, and Internet entrepreneurial thinking is not suitable for the financial sector.

Why is 01Libra so important?

"It's not too much to think of Libra as a potential world-class currency change, but if this change is not handled well, it is likely to be a huge hidden danger."

As the director of the Central Bank Digital Money Institute, Director Mu first expressed his great concern for Libra: "If you have already felt this kind of attention and tension, then I want to say that your feelings are right, the world is Libra This kind of tension is not a worry, it has its real reason and background. As a researcher of digital currency or crypto assets, and as a central bank employee, I also think this matter is very important."

Libra is a very ambitious plan to build a banner of inclusive finance and a governance mechanism. There are a few points that are especially noteworthy:

- The main characteristics of digital currency Libra and China's countermeasures

- Getting started with blockchain | I heard that the counterparty trading on the trading platform is sometimes not a person?

- Opinion: Will the traditional currency circle “sit and wait” before the regular army arrives?

First, let's not talk about other organizations, just Facebook, plus its WhatsApp, a total of 2.7 billion users. This means that its user base and its social mobilization capabilities are enormous. Second, Libra has value support, which means it is very different from the crypto assets that were previously used as speculative tools, and it has the potential to become a currency in the usual sense. Third, it is aimed not only at the United States but from countries around the world.

It is no exaggeration to say that Libra is another milestone in the history of crypto assets or digital currencies since the 2008 Bitcoin White Paper was published.

02 Is Facebook using a pure blockchain technology route?

"Libra circumvents the technical shortcomings of the blockchain, using a hybrid architecture, a centralized hybrid processing architecture that combines a centralized distributed processing architecture with blockchain technology."

Mu Changchun's comprehensive analysis of the results of the blockchain technology used for payment and the code provided by the Central Bank Institute for the Libra community shows that Libra cannot be a pure blockchain, or that it is not fundamentalism. A blockchain—the bottom layer is a centralized architecture. Only the top layer is the final settlement layer. It uses the blockchain. It is layered, because only layering can improve processing performance, the bottom of the transaction is centralized processing, because the centralization process, the speed will be very fast, to the top, that is, the final settlement layer, used It is the blockchain, and the nodes are not many, because the more nodes, the slower the speed.

Mu Changchun came to this conclusion for several reasons:

First, the blockchain is not suitable for making payments. Blockchain has four major flaws, such as poor scalability, high storage requirements for nodes, security and privacy issues, and final settlement issues. It is worth noting that the course mentioned that Chainalysis (who has assisted the FBI and CIA in cracking down on several illegal transactions in the dark network) has mastered the true identity of more than 80% of Bitcoin traders. It relies on big data and exchanges. Data, coupled with node data, digs out your true identity in the real world.

In addition, the finality of settlement refers to the point in time at which each transaction is completed. This point is also a point that cannot be rolled back. If you do not have such a clear point in time, it will lead to a series of problems in law and economy. For example, a company declared bankruptcy today. According to some national bankruptcy laws, transactions that occurred at the zero point before the bankruptcy institution was declared bankrupt were invalid and were to be retired. However, if the blockchain is used for payment, it is legally difficult to determine at which point in time the transaction is finally completed. Before the relevant blockchain node is updated, strictly speaking, you can't determine exactly where this point is.

Secondly, after the release of the Libra white paper, the Institute's development community downloaded the Libra code published by Facebook and set up a test environment. It found a lot of problems and basically could not be run. At the same time, on the first day of the code release, Libra's development community submitted 52 questions, and later identified 33 bugs. At present, Libra is still in a very early stage, and the code quality is not very stable. Some technologies include it. For example, it does not say whether it will use a high-speed private network in the end. There is currently no viable option, even the timetable.

Finally, based on the information currently available, the number of research results in a conclusion: Libra circumvented the technical shortcomings of the blockchain, using a hybrid architecture.

Can the 03Libra currency be stable?

"A so-called basket of currencies as a reserve asset cannot achieve the stability of the currency. It will be affected by changes in the exchange rate between the currencies of the reserve assets and, like any other asset, by the market's confidence and expectations. "

Mu Changchun believes that from the current point of view, Libra is difficult to cope with the challenge of currency stability. Libra wants to achieve currency stability, and must have an intermediary such as the central bank or the International Monetary Fund to intervene and supervise.

First, "the asset reserve of a basket of currencies" is linked to "a basket of currencies" and is a completely different concept. Libra said that he would use a basket of currency deposits as an asset reserve, but did not say he would be linked to a basket of currencies. (The hook means that the exchange rate between the two currencies will not change.) And we know that a basket of currencies does not equal the value of the currency.

Second, even if it is changed to a hook, Libra does not have a mechanism at all to ensure that the weight of a basket of currencies remains the same . If there is no guarantee that the weight of a basket of currencies will be constant, with the exchange between Libra and different legal currencies, Its currency value is naturally changing.

04 What role does the Libra Association play?

"Libra as a stable currency, to be successful, means Libra's founding association, which plays the role of Libra's central bank, and may also evolve into a private IMF, and in the private sector. It will be more influential than the IMF."

First of all, in order to stabilize the currency value, if Libra is issued in the future, it is very likely that the exchange rate will be determined by the association, that is, its founding members will determine the exchange rate between Libra and other legal currencies. If you want to ensure that the exchange rate is stable, you need to control the proportion and exchange rate relationship between different currencies.

Secondly, if some weak currency countries exchange money for exchange for Libra, this will cause disorder of the entire international monetary system. Therefore, a super-sovereign, credible international organization is needed to govern, such as the International Monetary Fund.

Again, Libra itself may generate payouts and currency multipliers. Mu Changchun assumes that if Libra is widely used in the payment market, some financial assets will be priced with Libra, such as oil or commodities, futures. After the financial assets are priced by Libra, there will be behaviors such as credit sales, trade financing or consumer credit, just like Alipay's flowers and borrowing, Libra will also be used to price. At this time, if there is a credit product, such as credit sales or consumer credit, to use Libra pricing, this is equivalent to using Libra to issue loans.

What happens after I make a loan with Libra? From the perspective of money banking, there will be a survival clause, and with the survival money, there will be a money multiplier. In other words, Libra is no longer limited to M0, it will expand to the field of M1 or M2. Now, Facebook itself says it wants to have an equivalent reserve for Libra, but this equivalent reserve is actually a reserve for the M0 category. But if it enters the credit market and expands into the scope of M1 and M2, this part has no reserve, which means that it can't satisfy 100% currency exchange guarantee and currency stability, and inflation may occur. At this time, a neutral institution needs to accurately measure and control the currency multiplier to determine the equivalent reserve. This kind of function can only be achieved by the central bank.

Libra as a stable currency, to be successful, means Libra's founding association, which plays the role of Libra's central bank, and may also evolve into a private international monetary fund, and in the private sector, It will be more influential than the IMF.

05 currency stability and asset profitability is a paradox

"The profitability of assets and the stability of currency values are naturally conflicting between these two goals. It is currently difficult to judge which side it will swing to."

The system operation, the dividends of the founding agencies and the cost of system upgrades are actually very high. For a clearing house, its annual operating cost, no billion or 20 billion yuan is uncertain. According to Facebook's own white paper, Libra's asset reserve income does not pay interest to users and the proceeds from the assets are paid. Therefore, Libra has inherent asset profit requirements and does not require low yields.

However, Facebook has 2.7 billion users, even if only 10% conversion rate, that is, there are about 300 million people, can be converted into Libra users, one person to buy 10 dollars, there will be 3 billion dollars, each Individuals spend a hundred dollars, that is 30 billion, and the amount of assets is very large. Facebook has set up an operating agency for Libra called Calibra. The license it receives is called a currency service license, but the US currency service license does not allow asset custody. In this way, it must be custody of assets to other traditional Financial institutions, these other financial institutions include the central bank, or financial institutions such as commercial banks. If it is managed by the central bank, then the interest will definitely be given less, and it is impossible to meet its demand for system upgrades, system maintenance, and dividends. Therefore, this money can only be escorted to a financial institution, which is operated by financial institutions.

In the process of capital operation, this financial institution must emphasize stability, can't go wrong, can't rise or fall sharply, and can only buy low-risk, relatively stable asset portfolio. Generally speaking, only sovereign bonds or some 3A corporate bonds are met. For many government bonds, especially the sovereign bonds issued by some European countries, the current state of earnings is basically negative. If Libra's reserve assets have higher requirements for profitability, then take a proactive asset management model and look for assets with higher returns, but high returns must mean high risks. This is in contradiction with the positioning of Libra Stabilizer.

That is to say, the profitability of assets and the stability of the value of the currency, there is a natural conflict between these two goals, and it is difficult to judge which side it will swing to.

06 Can Libra become a strong currency?

"The cost of exchange rate fluctuations, as well as the cost of listing, will be more prominent in strong currency countries. Because strong currencies are inherently represented, the country's legal currency is stable and popular, and it is no longer necessary for domestic residents to trade with Libra. Therefore, like the United States or the euro countries, the space for using Libra as a medium of exchange will be relatively narrow."

As a trading medium, Libra's biggest advantage is the 2.7 billion user base, even if the conversion rate is 10%, there are nearly 300 million users. In addition, from the development of the Internet over the years, the network effect of the winners will lead to a natural monopoly. So Libra has a natural advantage as a trading medium.

However, as a trading medium, there are also great disadvantages. First, Libra's currency is unstable and exchange rate fluctuations, because its reserve assets are a basket of currencies, not a single legal currency. Second, there is a cost of listing. For example, in a single currency country, if you use Libra as a trading medium, it means that there are two parallel currency systems with the same price. The same commodity will have two pricing in the future. brand. Imagine that all the goods in a supermarket will have two sets of price tags, one is the price tag of the French currency, and the other is the price tag of Libra. Because of the exchange rate changes, it also means that the supermarket will change the Libra price tag every day. This is too costly for the merchant, including labor costs, and other costs.

In summary, it can be concluded that Libra faced great difficulties as a trading medium in the early days of the country. Especially in strong currency countries, the cost of exchange rate fluctuations and the cost of listing will be more significant, because the currency of strong currency countries is stable and popular, and it is no longer necessary for domestic residents to trade with Libra. Therefore, like the United States or the euro countries, the space for using Libra as a medium of exchange will be relatively narrow.

07 cross-border payment is Libra's biggest selling point, playing the banner of inclusive finance

Libra faces big problems as a trading medium within a country, but this does not affect its prospects for cross-border payment scenarios. In the current international remittance system, such as Swift, moneygram, Western Union, there are problems with expensive fees and long time periods, and the experience is not good. Coupled with the factors of foreign exchange control, for example, each of us in China cannot exceed 50,000 US dollars a year, and we must also fill in the use of foreign exchange. If you want to study abroad, you must also provide the name of the school. If you want to travel, you must fill in the travel agency and The name of the hotel and so on. This adds friction to the middle. These have led to a poor cross-border remittance experience.

Libra said that it would solve the problem of convenience for people from all over the world, especially in developing countries, and thus set a banner for inclusive finance. Facebook itself is a big global platform between two Facebook users, one in the US and one in Australia. But for Facebook, it is a platform, its social functions, social attributes and huge user base will lead to the launch of the product, the starting point is very high. Why does Libra use a basket of currencies as a reserve asset? Why not use the US dollar directly as a reserve asset? In fact, it is for cross-border payment, it is to tell you that anyone can exchange in their own currency.

So cross-border payments and cross-border remittances are considered to be Libra's biggest selling point.

However, the cost of traditional cross-border payment is high and the cost is high. There are many reasons, some of which are the regulatory costs brought about by supervision. No matter what new technology you use, this part can't be avoided. So at Libra’s hearing, the Federal Reserve, the Treasury and several US regulators, as well as Congress, objected to it, with special emphasis on fear that Libra would be used for money laundering and terrorist financing. The cost will not disappear because you have adopted new technology.

If regulatory costs are unavoidable, how does Libra solve the problem of facilitating remittances around the world? This remains to be seen.

08 Currency substitution by weak currency countries?

Assuming a relatively large breakthrough in cross-border transactions, a network effect is formed. Everyone will use Libra for cross-border remittances. Will Libra expand from cross-border scenarios to local scenes and local payments?

Although Libra is not a big space in a strong currency country, will it be attractive to some developing countries, especially the weak currency countries? Because in a country with a weak currency, the confidence of the people in Libra is likely to be much stronger than the confidence in the national currency.

This logic is true, but it is also complicated. From the perspective of the history of currency development, there has always been a phenomenon in which bad money drives out good money.

For example, in ancient times, the government issued copper coins, due to the development of smelting technology, private individuals can also cast, but the privately cast money is often short of two, and then more and more on the market will be private casting Money, that is, short money, because everyone will want to spend the first poor quality, good stay. Just like if you receive a counterfeit currency now, your natural impulse will come to mind on a small stall, and spend it first. Therefore, if everyone feels that Libra is stable and the national currency is unstable, for example, Zimbabwe is now a sack of local currency, it may only be able to buy a small glutinous rice back. In this case, what kind of currency will be traded on the market? It must be Zimbabwe’s local currency, they will spend the first money and save Libra.

That is to say, in the function of the trading medium, it is possible that bad money will drive out good money, but in the function of value storage, it is good money to drive out bad money, that is, in a country with weak currency, everyone will be willing to hold Libra. Moreover, in general, countries with weak currencies are often developing countries with underdeveloped financial markets. They also lack assets with high liquidity and security. Therefore, Libra may be in countries with high inflation and countries with unstable exchange rates. Countries with depreciation expectations have become a safe asset choice for local residents, thus forming a currency substitution. That is, the people are not willing to hold their own currency, but are willing to hold Libra. It is as if some countries are more willing to hold dollars in some countries.

Of course, there is actually a paradox in it. Libra said that he is inclusive finance and serves the people of the weak currency countries. However, for the weak currency countries, if the people use a lot of local currency to exchange Libra, they will push the local currency to depreciation. The depreciation of the national currency will cause those who have low incomes to be poorer, because their assets are all denominated in local currency, or they are holding assets of the local currency. For example, you cannot sell a house abroad. . Such assets will be greatly reduced due to the depreciation of the local currency, so it will only exacerbate the poverty of those who only have local currency assets, but will not achieve the purpose of what they call inclusive finance.

09 In most countries, monetary authorities are unlikely to welcome Libra

Libra's countries that want to enter a weak currency will surely encounter problems that are not welcome by these governments. In addition to the more extreme examples, countries like Zimbabwe have announced the welcoming of any currency last year, which is equivalent to giving up its own monetary sovereignty. But in addition to this extreme situation, other countries with weak currencies, such as Thailand or Vietnam, if they really allow Libra to enter, it is equivalent to letting their monetary and exchange rate policies take their initiative, because You can't control this currency, you can only control the local currency.

So in most countries, the monetary authorities are unlikely to welcome Libra. So we can also see that after Libra came out, virtually every country’s monetary authorities and regulators have a negative attitude: either you must be included in the regulation, not supervised, or you will definitely have a negative impact on me. I will not let you in. Of course, some countries are afraid of being accused of impeding innovation. At the same time, they say that I need to observe and observe, but no one will say that I welcome Libra to come to me.

The negative attitudes of 10 countries may also be unable to stop Libra

But it's not that regulation is not welcome to block Libra. Even if the government says that I don't allow you to use it in your home country, you can only do all the payment agencies and commercial banks in the country do not provide redemption and payment services for Libra. But there are still people who can use other methods to buy Libra abroad. It is unlikely that it will be completely banned.

Even in China, it's hard. Even though China doesn't even get in touch with Facebook itself, once Libra is released, there will be some people who will buy Libra through some sloppy ways. You can see Bitcoin. In fact, our country has long forbidden Bitcoin to operate in China, and the exchange has also blocked it. It also informs all payment institutions and commercial banks that it is not allowed to provide corresponding redemption and payment services for Bitcoin, but There will still be some channels saying "I will help you with purchasing" or "I will help you buy Bitcoin", you just give them RMB, and then they will go over the wall to buy at a foreign exchange.

Of course, there is also a situation in which if the United States bans Libra in the form of law, it will certainly not advance. But as long as there is no law prohibition, even if it is acquiescence, or enter a normal regulatory track, then central banks are also blind-minded, Libra is likely to become a strong currency, and ultimately Great.

It is even entirely possible that, as a payment instrument develops well, it will further break away from reserve assets and become a credit currency. In fact, modern credit currency has also developed in this way. For example, at the beginning of the sterling, a private bank, which was a bank voucher issued by the Bank of England, later became a credit currency and became a national currency. If Libra is accepted by everyone and becomes a popular payment tool, then it will be entirely possible to develop into a world-class super-sovereign currency after a while.

The above is the discussion of Mu Changchun. Seeing this, I believe readers have already felt that the central bank is facing Libra's concerns. This is no longer a small conspiracy, but Facebook's big fortune to raise the banner of inclusive finance and technological innovation.

11 DC/EP: How far is China's own digital currency?

"Our digital currency project is called DCEP (Digital Currency Electronic Payment), which is a digital currency and electronic payment tool. I did this course in August 2019, and launched our own digital currency from the People's Bank of China. Not very far."

In the middle of this year, Mu Changchun also publicly stated that "the central bank's digital currency is ready to go." In addition, the recent media coverage has provided us with some useful information for peek into the central bank's digital currency.

On August 20th, the English version of China Daily published an article saying that officials and experts said that China is testing various ways to launch China's first central bank digital currency (CBDC). They expect the private sector to be more involved in creating government support. Currency. Experts predict that if all goes well, the digital currency supported by the Chinese government may be earlier than Libra's official release date.

On August 28, according to Forbes, the People's Bank of China will launch a state-backed cryptocurrency in the coming months and issue it to seven major institutions. The seven institutions include the four major banks of workers and peasants, Ali Tencent and China. UnionPay. The news also pointed out that the technology behind the cryptocurrency was ready as early as last year, and the cryptocurrency will be released this year.

On September 5, according to CoinDesk, a dedicated team of the Digital Currency Research Lab of the People's Bank of China is currently developing a digital currency system in a closed-door environment. The “closed-loop test” of the central bank's digital currency (CBDC) has begun. The simulation test involves payment schemes for some commercial and non-government agencies.

From the central bank's public voice on the central bank's digital currency, we can see that since July and August this year, the voice has been particularly dense, indicating that the central bank is not far from the issue of China's digital currency. By then, China will become the first real meaning. A sovereign state that issues cryptocurrencies.

12 mysterious veil of central bank digital currency

"You can imagine a scenario like this: as long as you have a DCEP digital wallet on my mobile phone, even the network doesn't need it. As long as the mobile phone has power, the two mobile phones can touch the digital currency in one person's digital wallet. Transfer to another person. That is to say, when you pay, you do not need to bind any bank account. Unlike we now use WeChat or Alipay, we must bind a bank card, but DCEP is not required."

Mu Changchun focused on the positioning attributes of the central bank's DCEP and the reasons for the central bank's launch of DCEP, and gave detailed answers to the hot issues of market concern, such as the difference between WeChat and Alipay, and the impact on the two.

In terms of functions and attributes, DCEP is exactly the same as banknotes, except that its form is digital, and its definition is translated as a “digital payment tool with value characteristics”. To put it simply, it means “the value transfer can be achieved without an account”. In fact, the most fundamental advantage of DCEP, such as Bitcoin, is to get rid of the traditional bank account system control, because it is just an encrypted string. From this point of view, DCEP also has the same advantages.

However, the biggest difference between the central bank's DCEP and Bitcoin's private encryption assets is that the central bank's digital currency is legally indefinite, which means that you can't refuse to accept DCEP. We see that private payment institutions or platforms will set up various payment barriers. WeChat can't use Alipay, and Alipay can't use WeChat, but for central bank digital currency, as long as you can use electronic payment. It is necessary to accept the central bank's digital currency.

13 What is the difference between DCEP and Alipay and WeChat payment?

"In theory, commercial banks are likely to go bankrupt, so the People's Bank of China has established a deposit insurance system in these years; but if WeChat goes bankrupt, the money in WeChat wallet, it does not have deposit insurance, you can only participate in its bankruptcy liquidation, For example, if you have 100 yuan before, you can only pay you 1 cent, and you can only accept it. It is not protected by the central bank's last lender. Of course, this possibility is very small, but you can't completely rule out it. "

First of all, from the legal power, the effectiveness and security of DCEP is the best. DCEP belongs to M0 and is a central bank debt, which is legal. But when you use Alipay or WeChat for electronic payment, you use Alipay's e-wallet and WeChat e-wallet. They are not settled by the central bank's currency, but by the commercial bank deposit currency. Of course, the situation has changed after the deposits have been centrally deposited. In other words, WeChat and Alipay did not reach the same level as banknotes in terms of legal status and security.

Second, in some extreme cases, it is still necessary to use central bank digital currency or banknotes. The central bank DCEP can achieve “double offline payment” .

For example, in a big earthquake, communication is broken, and electronic payment will of course not work. At that time, there were only two possibilities, one for banknotes and one for the central bank’s digital currency. It can be paid without the network. We call it " double offline payment" , which means that both the payment and the payment are offline and can also be paid. As long as your phone has power, even if the entire network is broken, you can pay. We can also say something that is not so extreme, you can perceive, for example, you go to the underground supermarket to buy things, no cell phone signal, WeChat, Alipay can not use. Or, on the plane, there is no signal. If you are on a low-cost airline, you need to spend money to eat. In this scenario, you can only pay by credit card, and you can use the digital currency of the central bank in the future. . But this, digital currency like Libra can't do it.

Of course, some people may ask, does DCEP affect the status of Alipay and WeChat? Mu Changchun’s answer is: No. Because Alipay and WeChat are currently paid in RMB, in fact, they are paid in commercial bank deposit currency. After the introduction of the central bank's digital currency, it was only replaced by the digital renminbi, which is the use of the central bank's deposit currency. Although the payment instrument has changed, the function has also increased, but the channels and scenes have not changed.

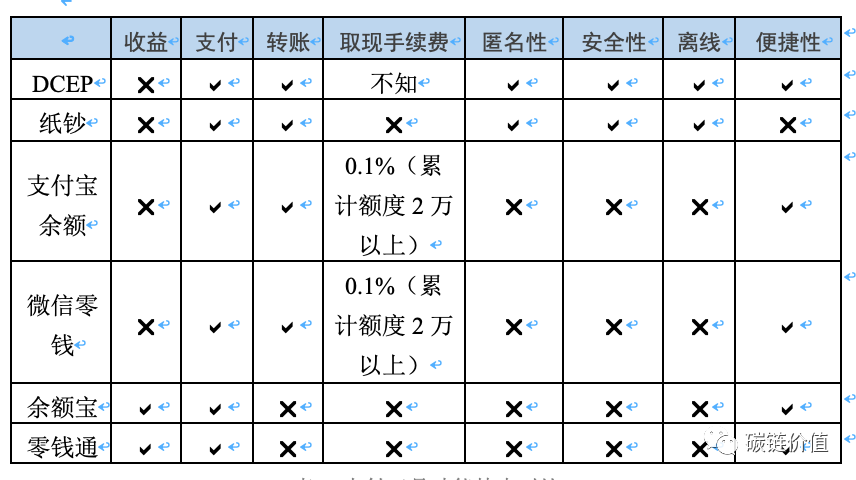

The following is a comparison table of the functional characteristics between the four payment instruments of the banknote, DECP, Alipay and WeChat produced by the author based on the public information. Readers can check out the table below, what is the difference between these four payment instruments.

Table 2 Comparison of features of payment tools

According to previous central bank information, the central bank DCEP does not pay interest to the holders of the currency. In view of the DCEP usage process described by Mu Changchun, the public only needs to download an APP, and then the bank account balance can be exchanged for DCEP, or the offline outlet can be exchanged for DCEP, and then DCEP can be used for daily payment.

It is still unclear whether the exchange of DCE and DCEP for legal currency is charged. Suppose there is no handling fee. Considering that there is one-thousandth of the handling fee for Alipay balance withdrawal or WeChat cash withdrawal, plus DCEP's legal, anonymity and dual offline payment functions, what tools will the public choose? What? What is the meaning of WeChat payment and Alipay? Although Mu believes that the introduction of the central bank's digital currency will not lose the impact of WeChat payment and Alipay, but think about it, this is indeed a question worth pondering.

In addition, Ali and Tencent may be among the first institutions to allow the operation of DCEP assets. What kind of response they will make to the central bank's digital currency, I think this is also a very interesting variable.

14 Why is the central bank still doing digital legal currency today when electronic payment methods are so developed?

First of all, in order to protect our monetary sovereignty and legal currency status, we need to plan ahead.

Secondly, the current cost of printing, returning, and storing all kinds of banknotes and coins is very high. It is also necessary to invest some costs in anti-counterfeiting technology. The circulation system is also hierarchical, and it is inconvenient to carry. Willing to bring cash.

Once again, except for criminals who are unwilling to let others know, or you may have some consumption that you don't want others to know, and deliberately use cash, most people now need cash to be less and less. Of course, as long as you don't sin, you want to make some consumption that you don't want others to know. We still have to protect this kind of privacy. That is to say, the public actually has the demand for anonymous payment, but the current payment tools, such as Internet payment and bank card payment, are closely tied to the traditional bank account system, and it cannot meet the demand for anonymity. It is impossible to completely replace the payment of cash, that is, the payment of banknotes.

Therefore, the central bank's digital currency can solve these problems. It can maintain the properties and main value characteristics of cash and meet the requirements of portability and anonymity.

15 How does the central bank's digital currency anti-money laundering?

The central bank's work on anti-money laundering, anti-tax evasion, and anti-terrorist financing can all use the big data mentioned above. That is to say, although ordinary transactions are anonymous, if we use big data to identify some behavioral characteristics, we can still lock the person's true identity.

For example, many transactions involving money laundering have behavioral characteristics. For example, a large number of gambling behaviors occur after 12 o'clock in the evening, and all gambling transactions are not fractional, which is an integer multiple of ten. Generally speaking, the beginning is to use a small amount, bigger and bigger, suddenly the cliff is gone, that is, there is no transaction, it means that it is lost, which is consistent with the characteristics of general gambling. The same is true for telecom fraud. If a large amount of scattered money is concentrated in one account, it suddenly and quickly spreads out and disappears into many accounts, which is consistent with the obvious characteristics of scams. Then we analyze these transaction characteristics, and then use big data and data mining technology to conduct identity comparison, and then we can find the latter person.

Therefore, due to anti-money laundering considerations, the central bank also has a grading and quota arrangement for digital wallets. For example, if you use a mobile phone number to register a wallet, then you can use this wallet, but the level must be the lowest, only to meet the daily small payment needs; but if you want to upload an ID card, or upload another one With a bank card, you can get a higher level digital wallet. If you can go to the counter to sign it, there may be no limit.

16 What is a two-tier operating system?

To put it simply, the upper layer is the People's Bank of China for commercial banks, and the lower layer is for commercial banks or commercial organizations for ordinary people. You can understand DCEP's delivery process as well: it is the same as banknote delivery. How is the banknote delivered? After the People’s Bank of China printed it, the commercial bank paid the People’s Bank a currency issuance fund, then shipped the paper money to the outlets, and then the people went to the outlets to exchange the cash. This is the process.

The exchange of digital currency will still maintain this structure: commercial banks open accounts at the central bank, paying the reserve in full 100%, and individuals and businesses open digital wallets through commercial banks or commercial institutions. Moreover, DCEP is a substitute for M0, which is a substitute for banknotes, not M1 and M2. This means that the central bank's digital currency held by the public is still the central bank's debt, and the central bank is credit-guaranteed and has legal liability.

So for the user, you don't actually need to go to the commercial bank. Just download an app and register it. The wallet can be used, such as receiving payment from others. If you want to redeem digital currency, then just use you. The bank card can be exchanged.

Of course, like cash, the central bank will set a certain amount of friction in accordance with current cash management regulations. For example, if there is a financial crisis, or if a bank has a redemption problem, everyone may go to the crowd and queue up to take the deposit out of the bank. In order to avoid this situation, the bank may set some thresholds. For example, if you exchange cash, you can take a small amount directly, but if you take a large amount, such as 500,000, you need to make an appointment in advance, and the digital currency is the same. s arrangement.

Mu Changchun’s explanation here is actually very specific and reveals many details. However, there are still many details that require us to wait for the time to give an answer. For example, the second-tier organization is handling DCEP to exchange bank account balances or whether banknotes require a handling fee; commercial banks or institutions need to process DCEP on APP or offline outlets. The business, then does it mean that like every bank now has its own mobile banking app, each institution will have APP that processes and processes DCEP transactions; what information these apps will record, who controls them, and so on.

17 Why use a two-tier operating system for DCEP R&D and redemption?

We adopt a two-tier operating system, which is also in order to fully mobilize the enthusiasm of the market, use market mechanisms to achieve resource allocation, and mobilize the enthusiasm of commercial banks and commercial institutions.

The issuance of digital currency by the People’s Bank of China is actually a very complicated project. A country as large as China has a large population. The economic development, resource endowment and population base of the localities are relatively different, so the whole process of design, distribution and circulation The central bank needs to fully consider the diversity and complexity it faces. If single-layer delivery and single-tier operation are adopted, it is equivalent to an institution of the People's Bank of China that faces all consumers in China. The environment is complex and the test is very severe.

On the other hand, although the central bank has also established many of its own systems, such as the existing large-value payment system, retail payment system, super online banking, UnionPay, network, etc., all are under the leadership of the central bank for development and operation, the central bank also Accumulated relevant experience. However, the users facing these systems were originally banking institutions and financial institutions, and did not directly face ordinary people. If the People's Bank of China wants to engage in such a large system that faces the people, it must satisfy the user's experience and achieve the system's efficiency. The People's Bank of China's own budget, resources, and talents will face objective constraints.

Commercial banks and other commercial organizations have matured in IT infrastructure applications and service systems. They have accumulated a lot of experience in financial technology, and their talent reserves are relatively full. There is absolutely no need to abandon existing businesses. Bank IT infrastructure, and then go to another stove, repeat construction. So this is why the central bank has to choose a two-tier operating system.

18 Avoid financial disintermediation

Another consideration in the two-tier operating system is that financial disintermediation can be avoided.

What is financial disintermediation? If we are using single-tier operations, the People's Bank directly issues digital currency to ordinary people, which means that the People's Bank will become a competitor of commercial banks.

Because ordinary people exchange digital currency, they will transfer the deposits of commercial banks to the People's Bank. Under this circumstance, the financing cost of commercial banks will increase, and the real economy will suffer. Moreover, the People's Bank of China directly issues money to ordinary people. All the information of the people is stored in the People's Bank. What does that mean? It means that the People's Bank of China knows the credit status of everyone and every company, and knows how much money you make each month, how much money you spend, and what kind of source of funds you have. These data are all available to the People's Bank of China. In other words, the People's Bank of China can replace commercial banks to do all financial business.

If you are older, you may remember that before 1984, China had only one bank of the People's Bank of China. This is the case with financial disintermediation. If you use a single-tier operation, does it mean that we can not need a commercial bank? Don't need a financial intermediary? The People's Bank of China directly lends money, and all the financial business has been done, directly eliminating the friction in the middle. Will this efficiency be higher? You will find out what it is like? Like a planned economy.

Some people say that in the era of big data, data is already rich enough to engage in a planned economy, which is very disagreeing. The planned economy is the ultimate, all economists and statisticians sit down and collect all the information in the world. In this case, the best situation for your resource allocation can be just to use the market as a resource. The level of configuration is the same. In case there is no information collected here, or the mathematical model is wrong, wrong, or the mathematical model gives you a result, but your decision is wrong, it may lead to the failure of resource allocation.

Our opposition to the planned economy does not mean that we are market fundamentalists, but the conclusions drawn after certain research, and also the conclusions reached through practice. Yugoslavia has done such an attempt in the past, and the lessons learned are very painful. . Therefore, it is not to say that there is more information and more data, so that you can engage in a planned economy. Because there is no competition in the planned economy and no incentive mechanism, once there is a problem, it will be a big problem.

We adopt a two-tier operating system, which is also in order to fully mobilize the enthusiasm of the market, use market mechanisms to achieve resource allocation, and mobilize the enthusiasm of commercial banks and commercial institutions.

19 What technical route does DCEP use?

"DCEP is essentially a substitute for cash. Although we don't use blockchain technology at the central bank level, we took the kernel of the blockchain, that is, it is a digital payment tool with value characteristics. , out of the account can also carry out value transfer, able to meet the control needs of controlled anonymity."

This sentence shows that in the DCEP two-tier operating system, the blockchain technology was not used at the level of the People's Bank of China for commercial banks.

As we said before, Libra is a hybrid architecture. Although DCEP is also a hybrid architecture, our hybrid architecture is not a preset technology route . This level of the central bank is technically neutral. That is to say, the central bank will not interfere with the technical route selection of commercial organizations. When commercial organizations exchange digital currency for ordinary people, what technology is used for exchange? Is it using a blockchain or a traditional account system? Is it an electronic payment tool or a mobile payment tool? No matter which technical route is adopted, the central bank can adapt to this level. As long as the business organization can meet our requirements for concurrency, our requirements for customer experience, and the requirements for technical specifications, no matter which technical route is adopted.

This paragraph tells us that in the face of users facing commercial organizations, that is, the user's exchange of DCEP and the use of DCEP to trade these business operations platform, the central bank does not preset the technical route, let go to the market institutions to choose. The central bank's requirement is to meet the retail level of concurrency, as well as experience and technical specifications.

The previous analysis of the Libra technology route shows that Libra's underlying transactions are centralized and the final settlement layer uses blockchains. For the transaction speed, the number of settlement layer nodes should not be too much, because the more nodes, the slower the speed. Even so, it is still difficult to achieve a transaction speed of 1000 pens per second, unless in the extreme case the nodes are concentrated in one machine room, 1000 pens/second can be achieved. Pure blockchain technology simply cannot support retail-level applications. Even if it can reach 1000 pens per second in the future, it can only be used for international exchange or cross-border remittance, because the speed is not too high only in the cross-border remittance scenario.

Libra's preliminary practice shows that the final settlement layer using blockchain technology can only meet the concurrent requirements of cross-border remittance even under extremely ideal conditions, and China DCEP requires commercial organizations to achieve retail-level concurrent performance requirements. Then, when a commercial organization exchanges digital money for ordinary people, what technology is used to exchange it? Is it using a blockchain or a traditional account system? Is it an electronic payment tool or a mobile payment tool?

Based on the above analysis, the author believes that the central bank does not adopt blockchain technology, and the commercial organization level does not pre-set the route. However, in view of the current blockchain technology progress, in order to meet the retail level concurrency requirements, commercial organizations are likely to adopt Blockchain technology.

20 Internet entrepreneurial thinking is not suitable for the financial sector

Mu Changchun said: "I was asked a question: Is there a company like Facebook that has the ability and willingness to take social responsibility and pay attention to financial security and stability?"

"My understanding is that in the financial sector, Internet entrepreneurs, even big Internet companies like Facebook, lack the risk awareness they deserve."

First, the financial industry is particularly external.

In the financial field, you use other people's money to do this. You use the public money to add leverage to do this. If you are in danger, it is not a problem for these people, but a systemic problem. That's why any person who traditionally does financial, before doing anything, before going to any new business, first asks a question: Is there any risk? He will not ask if this can make money first. So you see all the new business on the bank and the new project is slow. However, this is completely different from the lean entrepreneurship and small-step fast thinking mode advocated by Internet innovation. Finance is also going to try, the social cost will be great. Of course, if your product is out and successful, but many things have failed. One example is P2P, which in China can now be said to have become the biggest financial risk in the past two years and has been governed. It brings losses to the people, and some of them are broken.

Second, entrepreneurs of Internet finance rarely consider risk.

We must know that for the entire Internet finance, there has not been a complete financial cycle, and a financial cycle is longer than the economic cycle. Many Internet financial products pose significant risks before they are tested through a full financial cycle. For example, we now say that many Internet financial institutions say that you can achieve "310", that is, three minutes of money, one minute to arrive, zero personal review, and the bad debt rate is very low, a few tenths. But you have to know that these things are done in a liquidity environment. It has not been tested in a complete financial cycle. Once the liquidity is not good, there may be a large area that cannot be repaid. The situation led to the failure of a product and even dragged down the entire system.

Say back to Libra. Libra's two-tier operating system, which the Libra Association authorizes other organizations to do, is similar to authorized dealers, and these dealers are likely to play the role of market makers. What does a market maker mean? On the one hand, when Libra buys and sells, there will be price fluctuations in the middle, and market makers can arbitrage through the spread of the sale; but when the liquidity is not good, in theory, the market maker should have smooth liquidity. However, if the real liquidity is tight, according to the historical experience of the market, the market maker will definitely run, he will not take care of you. The risk of relying on such third-party institutions to make market arrangements is actually very high.

Therefore, this is also why, incorporating the regulatory framework and entering the normal regulatory track is very necessary for Libra. We also need to be prepared for Libra to become an important player in the international monetary system.

Author: Whitefish

Editor: Tang Wei

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt column | "Does one chain alone" feasible?

- You have to look at the status of PoS: hot back, Staking is still worth looking forward to?

- Tongcheng Holdings plans to change its name to Firecoin Technology, and its share price has risen by more than 18%.

- China's first 5G+ blockchain folk technology open source community and 5G chain network engineering task force will be officially launched

- At the 5G Chain Network Industry Innovation Summit, consider the impact of super-smart rise on 5G, artificial intelligence and blockchain

- When the insurance industry encounters blockchain

- Blockchain Industry Weekly: Total market capitalization fell 2.11% from last week, 70% of the top 100 projects fell to varying degrees