What should you pay attention to when playing MEME?

What to keep in mind when playing MEME?Author: Jar Seed

Since the cryptocurrency market entered the MEME season, countless myths of prosperity and overnight returns to zero have been playing out. People marvel at the hundreds and thousands of percent gains of $PEPE, $Turbo, $AIDOGE, and $MILADY, but when they buy MEME tokens, they lose money and end up with nothing. Many people despise MEME tokens for having no value, but others say that trading MEME tokens is about trading emotions and attention. Both of these statements are somewhat mechanistic in nature. Today, I will analyze MEME tokens from the perspective of chip distribution and how to query on-chain addresses. I hope to provide some support for those who choose to trade MEME tokens, although I may not be able to help you choose the tokens that will perform the best, I may be able to help you identify the tokens that are relatively poor.

If we view token issuance as a business, we need to recognize the following points:

- Interpretation of investment trends from top 5 VC firms in the years after 2023

- Key factors for the future large-scale adoption of DID and specific investment directions

- Is the father of ChatGPT’s ambition to solve AI threats with cryptocurrency by airdropping to one billion people grand or is he just trying to make a quick buck?

The project team is creating a commodity, although the entire commodity has no specific use, the project team must find ways to get more people to buy it.

Any business needs to consider the input-output ratio. The project team can choose to take more at the initial distribution of the token (first level), and then sell it when the time is right; or they can distribute it at a low price to the public at the beginning and then buy it back from them (second level); or they can directly rug the trading pool, wash the money, and run away.

Some MEME tokens may even undergo changes in ownership. The tokens held by the project team in the early stages have already been sold out, but the enthusiasm for trading still hasn’t faded, and there are funds to continue trading. So the story can continue.

So how do you start this business? I think the following issues need to be addressed:

Lock in seed users

There are many cases in this stage, such as the vampire attack method of $AIDOGE, which is based on whether or not the user has the qualifications to receive the Arbitrum airdrop; or by setting up Presale or LGE/TGE (Liquidity Generate Event/Token Generate Event) through various IDO platforms or Alpha communities; or by distributing fake tokens in bulk (as will be demonstrated below).

Create initial liquidity

For on-chain assets to be able to circulate and trade, there needs to be funds to provide initial liquidity. The project party will create a liquidity pool by using the Uniswap factory function to create tokens with ETH (usually). This way, everyone can buy and sell tokens through this liquidity pool.

Media matrix coverage

If everyone in our CT information flow is talking about a certain MEME token, curiosity will surely drive us to take a look. KOLs who can generate traffic naturally, those who are paid to do things, and those who try to cater to deconstructive ideological shifts and sell other products are all involved in sales.

Rise in volume and price

To facilitate shipment, the project party holds a large number of early tokens to achieve the effect of controlling the market and raising prices. With the increase of transaction volume and price, major quotation websites such as Dextool and Dexscreen will recommend the tokens to the Gains list and enter the view of retail investors.

Next, I will give you two specific cases to see how these two project parties lock in seed users and cold-start the distribution of project tokens, and what kind of trends the tokens will develop under such circumstances. It needs to be specifically stated that the tokens mentioned below have no investment recommendations, and we hope that everyone will be responsible for their own investments.

Case One:

Simpson

Contract address:

0x44aad22afbb2606d7828ca1f8f9e5af00e779ae1

Main trade pool:

0x7945819d6cab17f94c4089c28767e164ed4acf3e

Contract deployment address:

0xC43b6eCaF08b515001d58f4f427e03A4CE4758dd

Total token supply: 420,000,000,000,000,000

Let’s try to use Arkham to interpret the initial distribution of Simpson token:

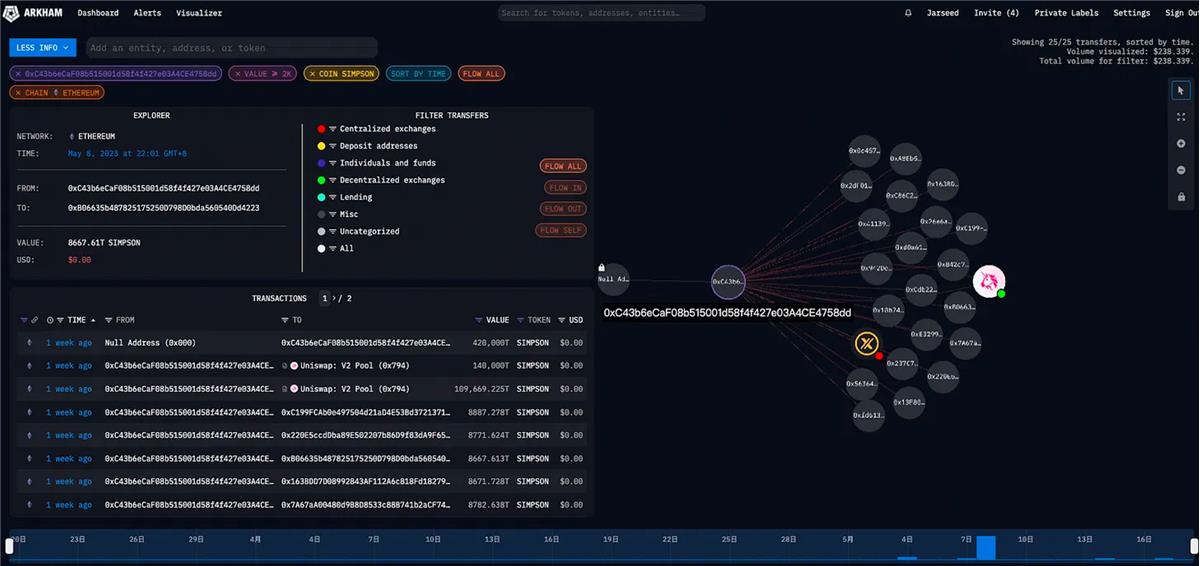

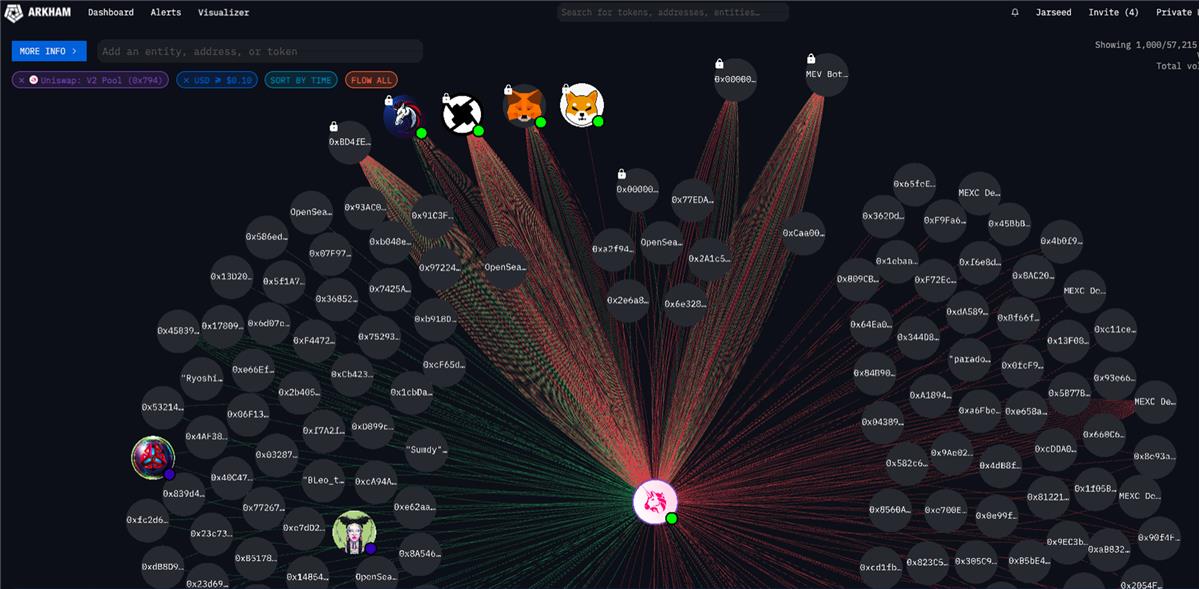

Simpson creator address distributes tokens

From the above figure, we can see that:

The creator of Simpson tokens deployed about 1/3 of the initial tokens to the Uniswap liquidity pool.

The token creator distributed 8800T Simpson tokens to 20 addresses, each holding about 2% of the total for a total of 40%.

With this operation, 70% of the tokens have already been distributed, and now it’s time for the token creator’s next move.

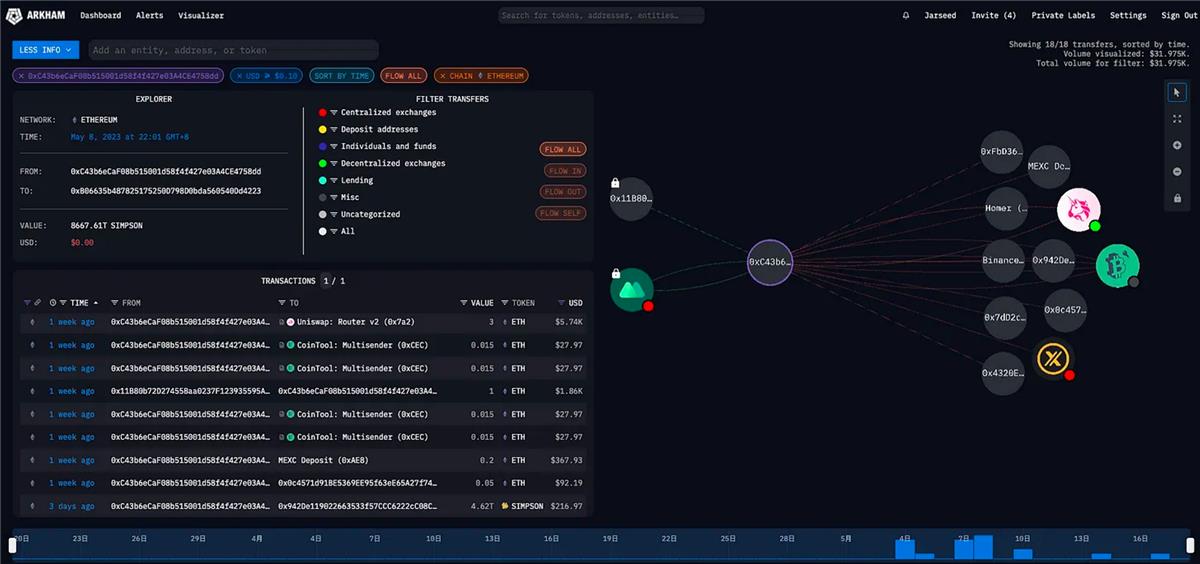

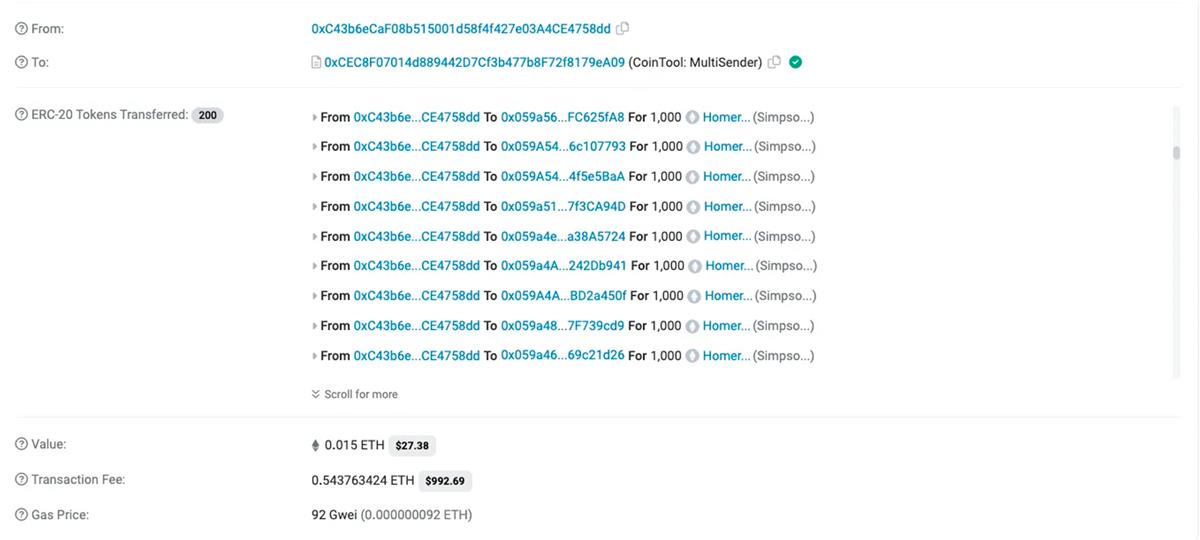

Using the Multisender function of CoinTool, the token creator sent Simpson tokens to a large number of addresses. Those familiar with on-chain data may be familiar with CoinTool, which used to dominate the ETH gas consumption leaderboard. The token creator used CoinTool to distribute Simpson tokens to a large number of addresses, and we can see from the browser tool that the token creator used CoinTool four times, sending a total of 1000 Simpson tokens to 800 addresses.

CoinTool token distribution

We can also see that these addresses have a common feature: they all start with 0x059a. For those familiar with hash algorithms, this is batch-generated addresses, or some addresses whose private keys are unknown even to the project party, just randomly distributed. Because 1000 Simpson tokens are not much for a total of 420Q, this operation gave the project 800 on-chain holders in the early start.

We also know the rest of the story, with Binance’s listing of $PEPE on May 5th reigniting the enthusiasm of the majority of coin traders, and everyone started looking for the next $PEPE. What are the general criteria for finding coins? New coins, a certain number of holding addresses, a certain trading volume, simple yet easily spreadable imagery, and decent social media performance.

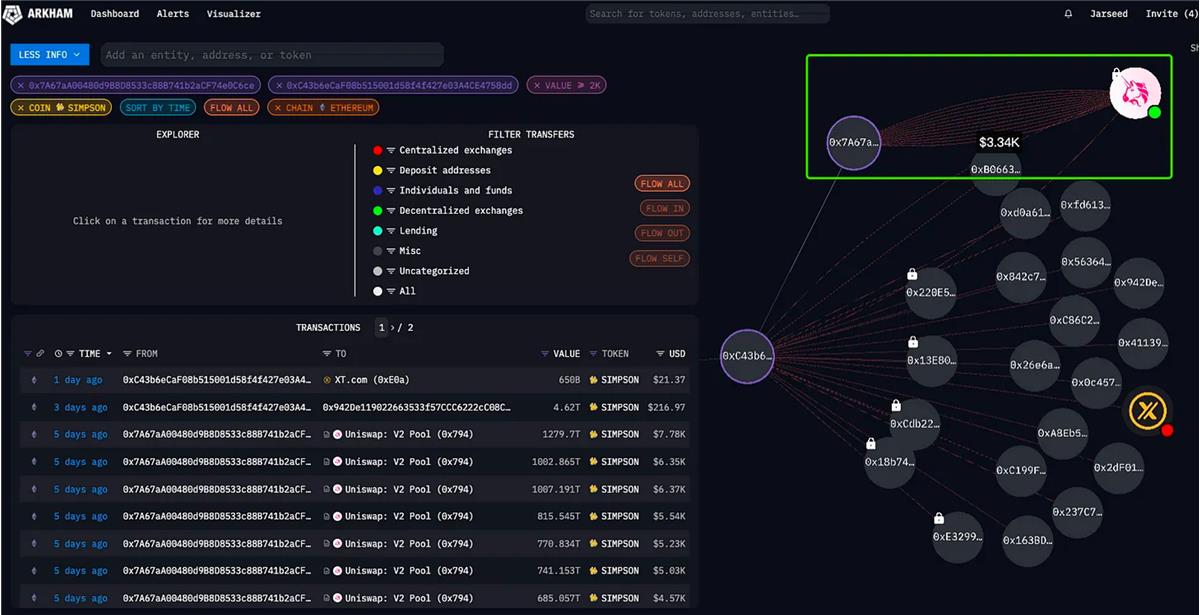

However, while buyers were dreaming of getting rich quick, the early-staged chips had already dumped these tokens for cold hard cash.

In addition to token distribution, we also have another perspective to observe: transaction pool interaction.

We can see that in addition to some common retail trading and trading aggregators, there are also some participants who have helped fuel the MEME craze, namely MEV Bots.

Various MEME tokens have easily achieved daily trading volumes of millions or even tens of millions of US dollars, mainly thanks to MEV Bots. It can be said that for almost all of the MEME tokens, 90% of the trading volume comes from MEV Bots, because some tokens have a mechanism of transaction tax, in which case the traders have to increase the slippage of the transaction, becoming the fat sheep of MEV.

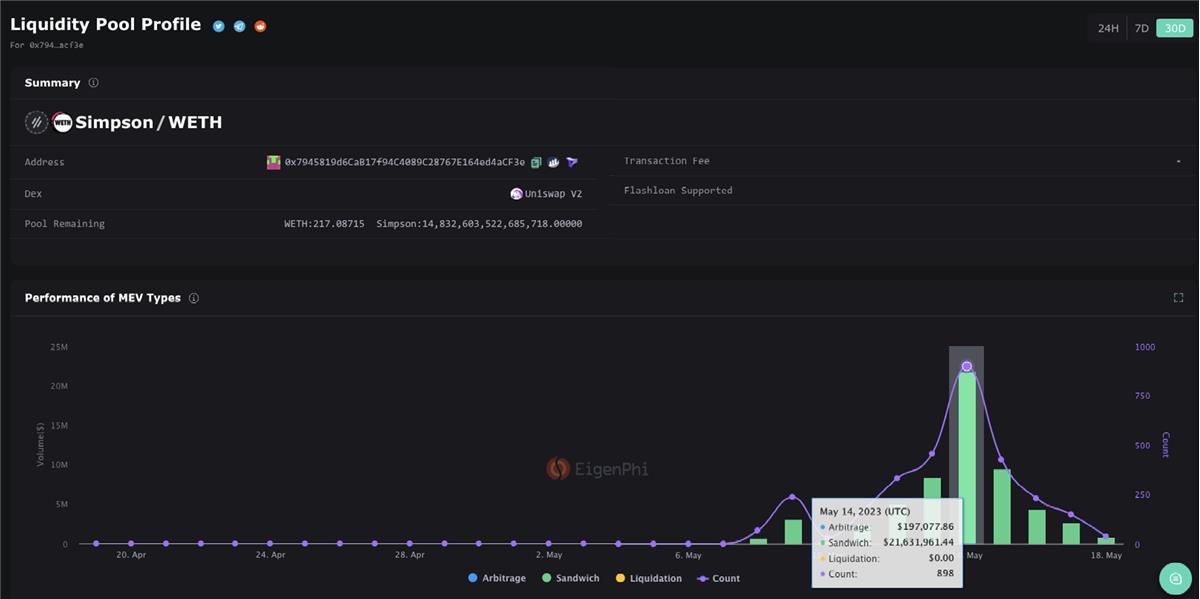

Here I recommend a tool called Eigenphi. You can enter the trading pool address of the token you want to trade, and Eigenphi will show you the MEV trading volume it has calculated for you, so that you can estimate the real trading volume of buying intentions and further compare the situation among various MEME tokens horizontally.

Summary:

In this Simpson case, we can summarize the following two points:

In order to play the game well with the project party, we need to calculate the cost of the project party. In this project, the project party spent 6 ETH as the initial liquidity pool, spent 2 ETH as Gas and used CoinTool to create 800 holding addresses for themselves. In addition to the cost of promotion and pulling, we can roughly estimate the cost of the project party.

Focus on selling. It can be seen that the 20 addresses distributed early were concentrated in selling and cashing out on May 13th. If you continue to participate in this game at this time, it may not be a good choice.

Case Two:

GenerationalWealth (GEN)

Contract Address:

0xcae3faa4b6cf660aef18474074949ba0948bc025

Main Trading Pool:

0x1ca4713fc4a95f76fcb498b2a5fe8759c53df1a1

Contract Deployment Address:

0x6579116367e0090d1cA6F5F712e172996E527E4c

Total Token Supply: 420,690,000,000,000

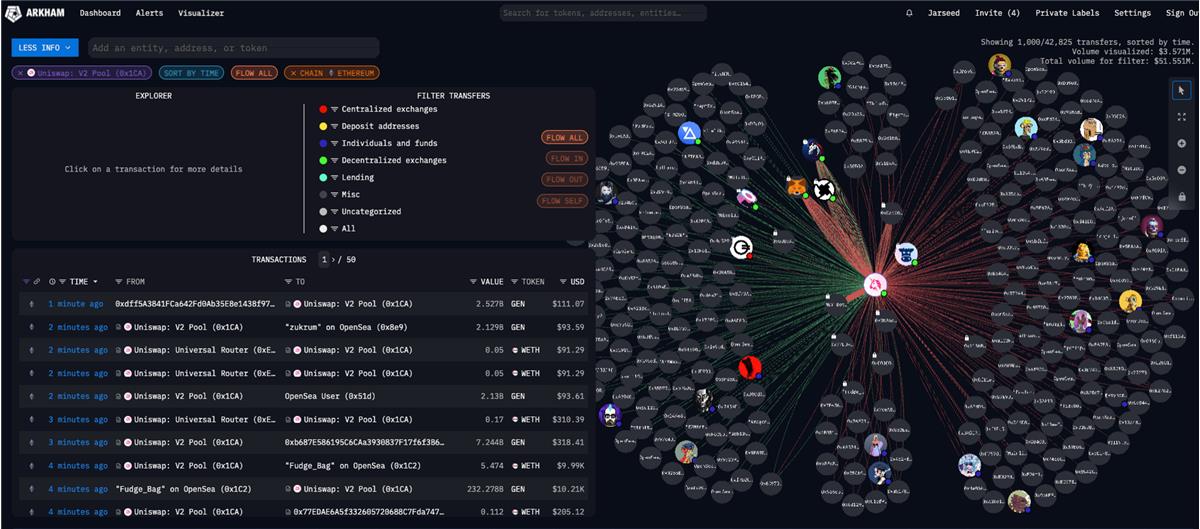

Let’s try to use the same method to interpret the initial distribution of the GEN token:

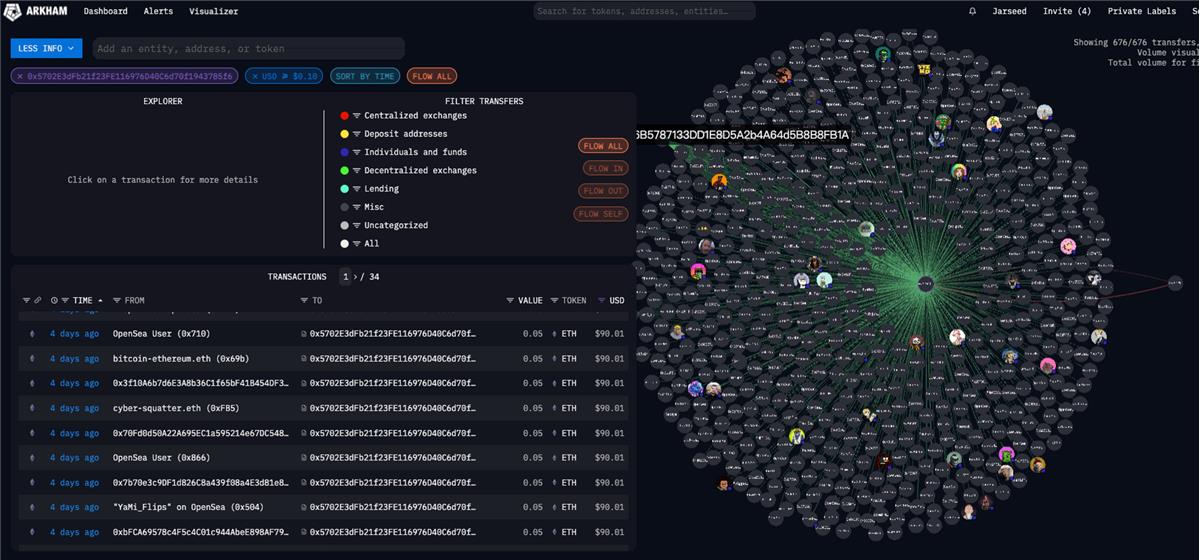

The initial distribution of the GEN token has a Presale process. First, we need to find the address of the Presale contract (contract address link).

According to the project description, 15% of the GEN tokens will be initially sold through Presale. From the on-chain data, we can see that a total of 672 people participated in the Presale, each paying 0.05 ETH and receiving 105B GEN tokens.

Here we can see that among the addresses that participated in the Presale, there are many with ENS domain names, and many are also marked by Arkham as Opensea users. These addresses have diverse characteristics, with more or less some on-chain activity records. These seed users are healthy and diverse, and were successful in the initial token sale.

On the other hand, in the addresses holding large amounts of tokens, we can see that:

The GEN token creator deployed 302T GEN tokens, which account for 72% of the circulating supply, to the Uniswap liquidity pool.

The three associated addresses with large holdings, 0x83Fae943b5381eCE611bda1fA44f744966Bc9552, 0xa0F06e6Ab3A999294E4b6B1EF8f4689c5D785482, and 0x7E0DaBBC101402880D281f86E51E439f897A752a, respectively hold 6.9%, 3.68%, and 2%, totaling about 12.5% of the circulating supply. By observation, it can be found that two of these addresses currently have no ETH and cannot transfer tokens.

So what did we discover when speculating on such tokens? What else do we need to pay attention to?

First, we found that the seed user group of this token may come from the NFT/Alpha community or some NFT circle KOL’s hype. The users who participated in the Presale participated at a price of 0.05 ETH and have now made over 20 times profit.

Next, we found that the project publicly reserves 12.5% of the tokens, but because there is no ETH in the accounts yet, we can continue to monitor the actions of these large holders.

Is it possible for the project to Rug? The action taken by the token creator is to deposit the LP Token into the GEN token contract, and there is currently no further action, so it can be continuously monitored.

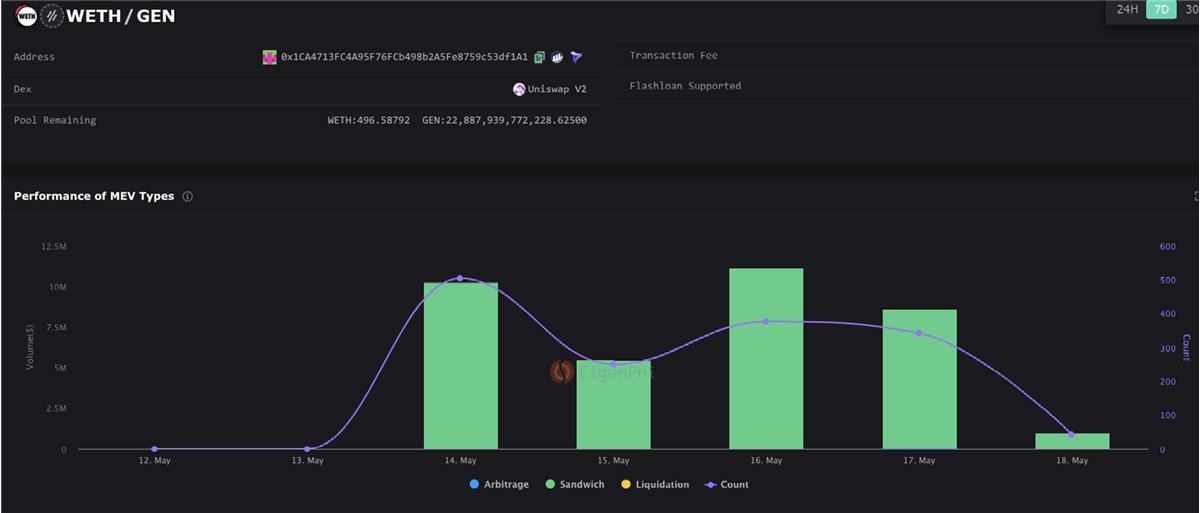

Through Eigenphi we found that GEN did indeed have strong buying interest during certain time periods.

Looking at the interaction level of the trading pool, it is also more active.

Summary:

In the case of GEN, we can summarize the following two points:

The diversity of seed users can bring many surprises to the early stage of the project, especially with the wealth effect.

By removing MEV transaction volume to find the true demand transaction volume, it is more convenient to make horizontal comparisons between MEME projects.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Sui Explorer Browser User Manual: Quickly Understand the Development of the Network

- The Sustainable Path of Integrating Environment and Finance: Can ReFi Reshape Web3?

- What is the purpose of the world coin that features iris authentication, global airdrops, and the creator of ChatGPT?

- Can the combination of decentralized derivative exchanges and account abstraction open up the next incremental entry point?

- US House Stablecoin Hearing: State and Federal Regulatory Authority Dispute Focus of Both Parties

- Conversation with Sui Developer Relations Manager: How to start developing on Sui from scratch?

- Analysis of Dune: A powerful and practical free on-chain analysis tool