Who is the winner in the XRP ruling?

Who won the XRP case?Author: Jack Inabinet, Bankless author; Translator: Blockingxiaozou

Although 2023 is only halfway through, we may have already seen the most important legal ruling of the year… Judge Analisa Torres has issued a summary judgment in the SEC’s (U.S. Securities and Exchange Commission) lawsuit against Ripple Labs!

The SEC’s lawsuit against Ripple Labs and its key personnel, CEO Brad Garlinghouse and founder Chris Larsen (defendants), has been pending since December 2020. In this case, the SEC alleges that Ripple did not register XRP as a security before selling 1.38 billion worth of XRP tokens.

Now, let’s analyze the significance of this summary judgment, examine why it is bullish for certain cryptocurrencies, and analyze why the judgment result leaves both Ripple and the SEC dissatisfied.

- An Analysis of a16z’s Core Investment Philosophy: Focusing on Non-Consensus

- Has the full-stack game engine MUD v2 abandoned the ECS architecture? Is ECS suitable for creating full-stack games?

- Coinbase’s Base releases mainnet for developers, aiming to launch publicly in August.

1. Is XRP a security?

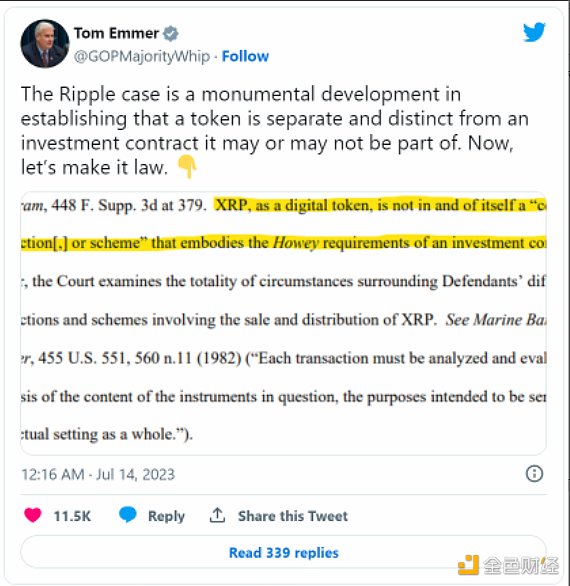

The court held that XRP, as a digital token, does not meet the requirements of the Howey test and is therefore not a security! This is a big win for cryptocurrencies.

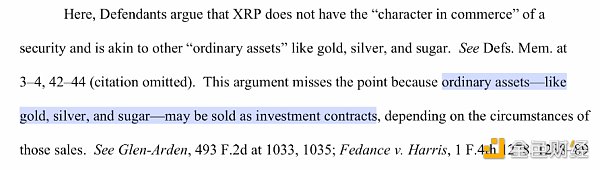

However, the regulatory status of XRP tokens is not relevant to whether XRP transactions constitute investment contracts. After all, even some commodity transactions can be considered investment contracts depending on the specific sales situation.

To determine whether a transaction qualifies as an investment contract, U.S. courts have taken a very subtle approach and separately examine the validity of such claims for each type of transaction.

The SEC claimed that multiple forms of transactions constituted unregistered XRP sales, but after careful review, the court found that only one type of transaction constituted unregistered XRP sales, namely Ripple’s institutional sales.

Experienced buyers participating in Ripple’s institutional sales directly purchased XRP from the company. Therefore, they had reason to expect Ripple to use the funds from their sales to improve the XRP ecosystem, thereby increasing the price of XRP. This operation meets all four aspects of the Howey test.

On the other hand, buyers of XRP tokens sold through Ripple’s programmatic issuance are conducting blind transactions and cannot know whether Ripple has received their funds. The court held that such transactions do not constitute investment contracts.

For key personnel at Ripple Labs and those who sell XRP tokens directly to investors, this situation has just begun! Ripple Labs and the co-defendants inevitably need to confront the SEC in court unless they successfully appeal the ruling that their institutional sales were unregistered securities issuances.

The consequences of failing to successfully defend against the charges are severe, as the SEC is seeking to recover the illegal fundraising (Ripple raised $729 million through institutional sales) and hopes to ban the defendants from offering or selling XRP to any entity or individual.

Only time will tell us the result of the SEC’s case against Ripple, but despite dissatisfaction on both sides in the current ruling, it is clear that investors see the ruling as a positive development for entities in the cryptocurrency industry that are also under SEC scrutiny.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Deep Analysis of MKR On-Chain Data: Slow Growth in Holding Addresses, Majority of Large Holders in Profitable Positions MKR On-Chain Data Analysis: Slow Growth in Holding Addresses, Majority of Large Holders in Profitable Positions

- Ripple wins brief legal victory, XRP token not a security?

- Ripple wins ruling that XRP is not a security

- Written on Binance’s 6th anniversary: Will there be a warm spring after the crypto winter?

- What makes Sound.xyz, the leading player in the music NFT field, attractive to a16z’s investment?

- The Crossroads of GameFi: Continue with P2E or Seek Breakthroughs

- The true meaning and future expectations of an inverted yield curve