“The Three Pain Points” of Digital Asset Trading

"Challenges in Digital Asset Trading"Robinhood, an online trading platform for retail investors that once bloodied Wall Street and was popular among young Americans, has decided to remove a range of cryptocurrencies from its platform, including Solana, Polygon (MATIC), and Cardano, among others, all of which are among more than 50 types of cryptocurrencies that the U.S. Securities and Exchange Commission (SEC) recently banned from trading on U.S. platforms. The total market capitalization of these cryptocurrencies on the ban list exceeds $100 billion. The SEC has also filed lawsuits against Binance and Coinbase. These events have undoubtedly dealt a severe blow to the cryptocurrency trading market.

From inclusive regulation to gray regulation, from commodity trading to securities trading, cryptocurrency trading has been powerfully attracted to the magnets of regulation and compliance in various parts of the world where legal clarity is low, and is referred to as “friendly regulation.” However, once regulatory authorities are no longer “friendly,” cryptocurrency trading begins to plummet like demagnetized scrap iron. The problem is that cryptocurrency trading has three painful feet that have never really “landed”… but how does it stand and walk independently?

The first painful foot—the legal attributes of cryptocurrencies are virtually non-existent, which determines the “original sin” of so-called cryptocurrency issuance.

- Multichain crisis reappears as over $130 million in token liquidity is withdrawn

- Why Frax Finance is worth watching: Three investment themes, five catalysts

- Multiple bridge contracts operated by Multichain have experienced large-scale abnormal outflows of various tokens, with a total value exceeding 130 million US dollars.

Can anyone develop and issue cryptocurrencies without legal recognition or regulatory intervention? Indeed, in terms of development, there is no clear legal prohibition or support. Without legal limitations, how can issuance be standardized? Without standards, it is entirely up to the parties involved to decide, so is cryptocurrency trading conducted as commodity trading or securities trading? In reality, this is a problem that regulatory authorities must face directly.

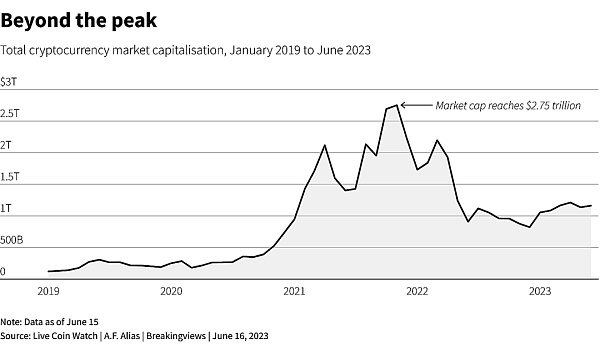

As with the development and issuance of Bitcoin, which did not go through any legal process, the problem naturally extends to the trading phase. At first, various regulatory authorities often had no stance on this and did not want to intervene directly. As it developed, regulatory authorities tended to make gray choices, and various cryptocurrencies quickly flocked in, with issuance and trading expanding rapidly, making for a magnificent sight. To be frank, inclusive and friendly regulation are gray regulation, which has promoted the global cryptocurrency trading market to continue to sing all the way, coupled with the so-called flood of the US dollar caused by loose monetary policy a few years ago, a large number of investors have supported the huge scale of the cryptocurrency trading market and the shocking trading prices in the market. By the fall and winter of last year, the Federal Reserve and the International Monetary Fund, among others, were warning against cryptocurrency trading, believing that it would undermine financial stability and threaten financial security.

The problem is that the legal status of digital financial assets themselves has never been clarified from the source, and the legislative authorities are unwilling to face it directly or even do nothing about it. Everything is left to administrative judicial or regulatory authorities. Historically, the lag of the law is often a common fact. In many cases, it is not based on the so-called legal rationality to make presumptions. It is often the induction of empirical facts or the accumulation of problems to the turning point before all legal breakthroughs or innovations occur. In reality, digital assets cannot be lightly handled in legal terms, and their transactions have become a hot potato. Falling into the hands of regulatory authorities, and after a series of friendly regulation, inclusive regulation, and even gray regulation, it is still inevitable to deal with it.

After a series of scandals, the US authorities began to implement strong regulatory measures to ban their transactions, and all companies that own these digital assets objected to the SEC’s charges and expressed the hope that the legal clarity of US digital assets could be improved. All parties did not make any judgments on the legal attributes of digital assets themselves, bypassing where its “original sin” lies, so can digital assets be traded as securities?

The second pain point-the lack of regulatory compliance guidelines and systematic shortcomings.

Inclusive regulation and even gray regulation are actually “unsound” regulatory measures of “turning a blind eye”. However, if there is a sound follow-up of perfect compliance guidelines, the compliance system of digital asset transactions can still rise step by step and gradually mature and develop. That is to say, inclusive regulation or gray regulation needs to be kept, and you need to take care of it and take care of it without problems. The problem lies here-so-called inclusive regulation, friendly regulation, is actually gray regulation, and there is no willingness or ability to proactively improve regulatory compliance guidelines. Technically speaking, whether the legal system of existing commodity trading or securities trading is suitable for digital asset trading itself is a problem, and there is a lack of sufficient resources and capabilities to improve compliance in this direction. Therefore, everything can only wait for the follow-up outbreak of the problem, and accumulate to a certain extent before making “after-the-fact remedy”, in fact, it can only be a prohibitive “blocking”, not “guiding”.

If there is a lack of regulation and compliance guidelines are not timely and effective, then digital asset trading is like a leaky ship going out to sea, breaking through warehouses, and then seriously sinking, and sea accidents become a high probability event, or even a certainty. There are three important compliance guidelines: operating procedures, customer protection, and funding procedures.

First of all, regarding operating procedures, regulatory authorities do not have the ability or willingness to make compliance guidelines or guidance, that is, there is actually a situation where regulation is not in place or vacant. Strictly speaking, regulatory compliance for digital asset trading may not even have entered the operating procedures, or there may be serious trading opacity. Secondly, with regard to customer protection, regulatory authorities have not provided effective compliance guidelines, and existing compliance guidelines for commodity trading or securities trading cannot fully cover the scope of trading customer interests. The exchange or trading platform has not fully or actively taken corresponding measures, or has purposefully used regulatory loopholes to take action, at least lacking motivation to increase trading costs and reduce efficiency. As a result, the potential losses or risks to customers are inevitably high and accumulate… Third, in the trading rules of digital assets, bank funds and digital assets are arranged in different accounts, and there is a “natural” gap in the connection (Gap), and the so-called trading funding rules composed of trading instructions, authorization, account security, etc. are missing.

Insufficient regulatory compliance guidelines, in fact, is to embody gray regulation as opaque regulation, and the result is that if nothing happens, everything will be fine, and once something happens, it will be a disaster, often banned. The so-called friendly supervision “turns its face” into an unfriendly supervision, just like a revolving door. The problem is, what kind of disaster? If there is only a situation within the existing scope of digital asset trading and there is no significant external impact, then gray regulation can continue.

The problem lies precisely in the situation of the bank side that is closely related to digital asset trading, so regulatory authorities must intervene forcefully. This is the third pain point of digital asset trading…

The third pain point-bank fund trusteeship and digital asset holding.

Digital asset trading is often a seamless 24-hour trading, and trading customers are all over the world. The frequency and complexity of bank fund inflows and outflows and the transfer of traded digital assets exceed that of all types of securities trading. Therefore, in terms of technology, “trusteeship” and “holding” arrangements must be made, and precisely because of trusteeship and holding, there are delays or breaks in the issuance, acceptance, and execution of trading instructions and fund transfer instructions, and similar situations exist for the extraction of digital assets. This determines that there are inherent difficulties in the overall improvement, security, transparency, and equal responsibility of the digital asset trading system.

For banks, there is a risk exposure. However, banking institutions often use existing legal and regulatory systems to exempt themselves from legal liability, but ultimately, customer losses are often unavoidable. On the other hand, this has also actually achieved regulatory risk exposure. However, regulatory authorities often use existing legal and regulatory systems skillfully to exempt themselves from regulatory responsibilities, which highlights the responsibility of digital asset trading platforms and makes regulatory authorities have to pursue them severely. The problem is that compared with the maturity and perfection of existing securities or commodity trading, digital asset trading often has various situations or problems, and it often lacks sufficient willingness to improve compliance operations, or even there are intentional evasions, malicious evasion, fraud and deprivation…

Strengthening the supervision of the existing bank and the asset custody and transfer responsibility of the digital trading platform can help improve and enhance the security of digital asset trading. This requires the formation and coordination of regulatory forces, especially the comprehensive improvement of the digital regulatory capabilities of relevant authorities, which also means that the cost of digital asset trading will be invisibly increased. More importantly, it exposes the potential risks of banks participating in digital asset trading, increases their risk control costs, and compresses their profit margins. Banks are unwilling to get involved and often choose to “effectively” evade related risks in legal terms, making gray choices. Banks have ample reasons to exempt themselves from liability, and even if the digital asset trading platform assumes related responsibilities, customer losses are irretrievable, and ultimately it will affect the banking system.

In short, this third painful foot is the most painful, difficult to land, and even if it cannot be landed, it hurts when touched, and there is no regulatory coordination at all. Therefore, only when major problems occur will the digital asset trading platform be held responsible.

To completely correct and even repair the three painful feet of digital asset trading, there is a chance, but the problem is that it is completely handled in accordance with the existing securities trading supervision, which will undoubtedly make the digital asset trading industry feel difficult to get rid of suffocation, and open up new regulatory models or systems. In fact, there is no strength, resources, and willingness, so that all parties turn a blind eye, make gray choices, take advantage of the opportunity, and miss or even squander all kinds of opportunities in the past.

Currently, the fraud cases in digital asset transactions have broken the record of financial fraud in the United States. It is difficult for the economy and society to tolerate and ignore it repeatedly, and the relevant authorities cannot shirk their responsibility and must take action. The three major problems in digital asset trading are still interrelated and difficult to solve. The US SEC has banned more than 50 digital assets from trading on US platforms, but this is only a temporary solution to the problem and at most a stopgap measure.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Vertex: Derivative DEX rookie, with a market share of about 10% in daily trading volume in Japan.

- The Battle for Hong Kong Dollar Stablecoin: Government Issued VS Private Issued

- Multichain crisis resurfaces, with over $130 million in token liquidity withdrawn.

- Construction and Case Studies of zk-SNARK

- Six Catalysts for the Growth of Algorithmic Stablecoin Frax Finance

- Even Zuckerberg’s Threads is using ActivityPub. What makes this decentralized protocol capable of challenging Web 2.0 giants?

- Evening Must-Read | Meta Launches Twitter Rival Threads: How to Use and What’s Its Biggest Feature