Inverse Finance: A Rebirth from the Brink of Death?

Inverse Finance: A Comeback?1. Project Overview

Inverse Finance is an Ethereum-based CDP lending product that allows users to borrow the stablecoin DOLA by collateralizing cryptocurrencies. The project was established in 2020 and gained market attention after being recommended by YFI founder AC. At that time, the project provided a risk-free investment based on the stablecoin Dai. Users deposited Dai into the protocol treasury and received a deposit certificate inDai in a 1:1 ratio. Then, the treasury put the Dai into yield aggregator protocols such as Yearn to earn tokens like ETH and YFI.

Unfortunately, the project suffered two consecutive malicious attacks in 2022, resulting in the suspension of the product. In October 2022, the project transitioned to a fixed-rate lending market.

2. Team

- “The Three Pain Points” of Digital Asset Trading

- Multichain crisis reappears as over $130 million in token liquidity is withdrawn

- Why Frax Finance is worth watching: Three investment themes, five catalysts

The currently public member profile is the project founder Nour Haridy, who is from Egypt and has been a Web3 development engineer since 2018. Haridy has introduced himself as a developer in the Ethereum field for several years, mainly designing gas-free Dai smart wallets such as Metacash and Mosendo, in an interview with Cointelegraph. Nour is currently working full-time at Inverse Finance and has 28,000 Twitter followers, with a small social influence.

Figure: Founder’s Twitter

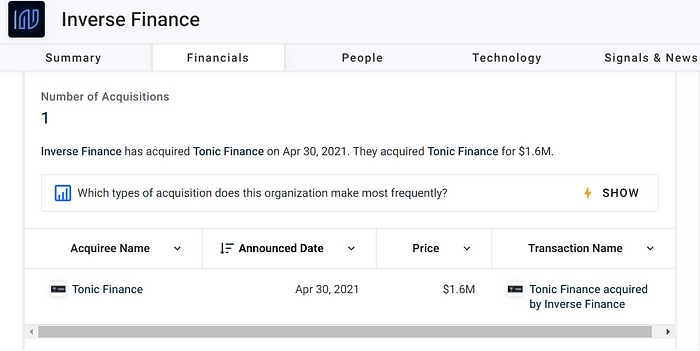

According to Crunchbase, Inverse acquired Tonic Finance for $1.6 million on April 30, 2021.

Figure: Inverse Finance Public Profile

3. Product

Inverse’s main products are the fixed-rate lending market FiRM and the stablecoin DOLA.

1. DOLA

DOLA is a decentralized stablecoin issued by Inverse Finance, anchored to the US dollar at a 1:1 ratio, and managed by the Feds smart contract.

Note: Due to a prediction market manipulation attack on Frontier (front-end), DOLA currently has some bad debts. These bad debts are being actively repaid by DAO, and the front-end product has been discontinued.

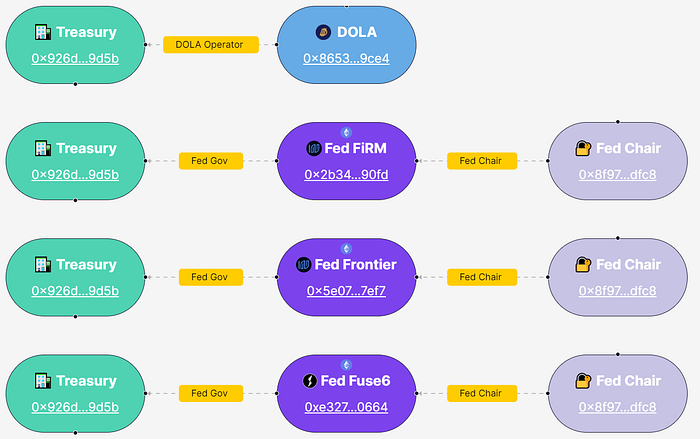

The Fed smart contract is controlled by the Inverse DAO and is divided into three different types, but all can mint DOLA and supply it directly to the liquidity pool or lending market, as well as withdraw and burn DOLA to stabilize the price of DOLA.

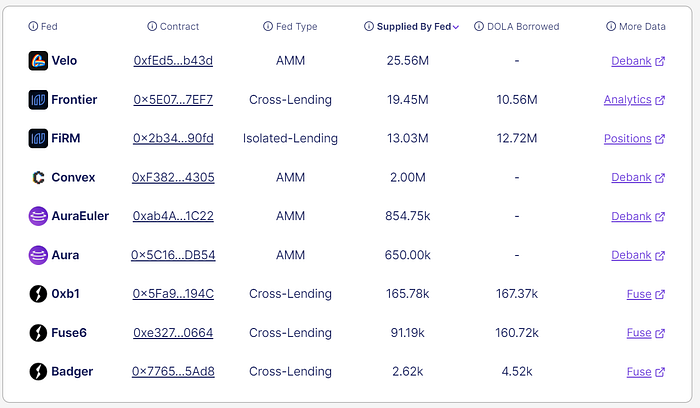

图: The types of Feds

Cross Collateral Feds: Frontier & Fuse, the front end has been deprecated.

Isolated Margin Feds: The FiRM lending market, which has a global DOLA limit and daily borrowing limits set for each asset market. We will introduce FiRM in detail below.

AMM Feds: Providing liquidity to protocols such as Velo, Convex, and Aura.

2. FiRM

In February 2021, Inverse and Anchor collaborated to issue the stablecoin DOLA, but with the collapse of the Terra ecosystem and two attacks on Inverse, the existing product frontend was discontinued. In October 2022, Inverse launched the fixed-rate lending product FiRM.

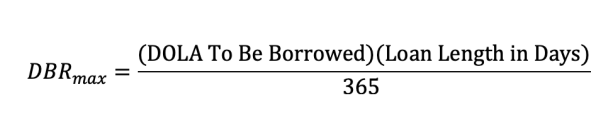

FiRM is a collateralized loan, which is consistent with other lending products. The reason why it is called a fixed-rate loan is that FiRM is a fixed-cost loan based on DBR (DOLA Borrowing Right). Users must hold DBR to borrow DOLA in FiRM. One DBR represents the borrowing cost of one DOLA for a period of one year. The number of DBRs required to be spent per day can be calculated based on the amount of DOLA to be borrowed and the borrowing duration. Therefore, users can estimate the number of DBRs and borrowing costs they need to pay before taking out a loan, and can add DBRs to their wallets at any time to extend the loan term.

The initial distribution of DBR was through airdrops: ① each INV staker who remained in the front-end application before October 30, 2022, received 2,000 DBR; ② completed the lottery activity and received up to 1,000 DBR.

DBR can be traded on the secondary market, so an increase or decrease in the demand for DBR by borrowers may cause the price of DBR to rise or fall. High demand will drive up the price of DBR, which is good for investors, but it will increase the borrowing cost for borrowers and reduce the attractiveness of FiRM loans, which is not good for the development of the Inverse protocol itself. Therefore, Inverse launched DBR Streaming, which issues DBR rewards to INV stakers, and users can earn DBR token rewards by staking INV in FiRM. The community can influence the price of DBR and user borrowing costs by adjusting the emission rate of DBR.

Figure: DOLA Issuance

Figure: DOLA Distribution

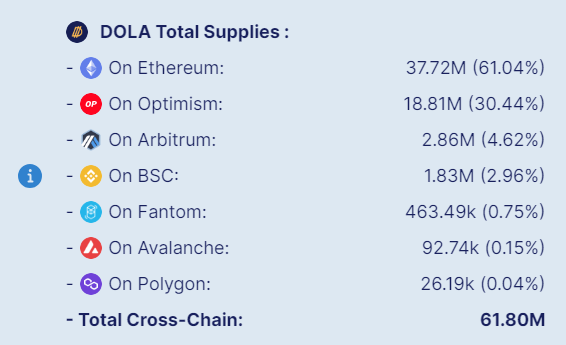

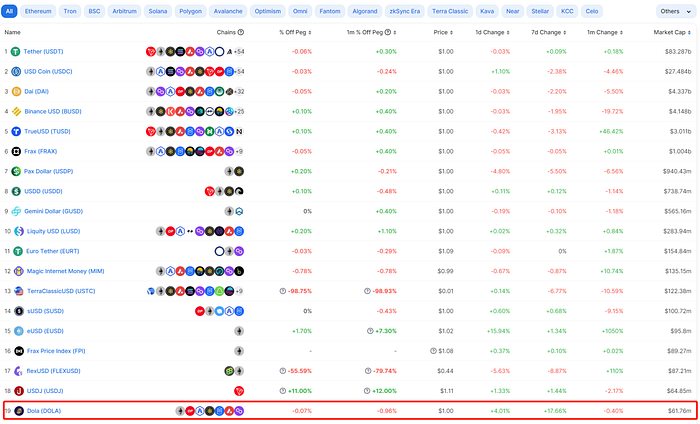

According to defillama.com data, DOLA ranks 19th in the entire stablecoin market capitalization, reaching only 1.4% of its market value compared to the decentralized stablecoin leader DAI (4.337 billion).

Figure: Stablecoin Market Cap Ranking

After experiencing the “hacking” turmoil, the token price of DOLA has been relatively stable since October 2022. There have been two significant price fluctuations recently, one on March 8th affected by the USDC off-peg event, and the other on April 9th for reasons unknown.

Figure: DOLA Price Trend

Five, Economic Model

There are three types of tokens in the Inverse protocol: DOLA, INV, and DBR. DOLA is a stablecoin product, which has been introduced in detail in the previous section. This part will focus on the description of INV and DBR.

1. INV

INV is the governance token of Inverse, and the current token usage only includes staking and governance.

The complete economic model of INV is currently unknown. Token supply is issued by governance proposal voting, and the previous practice was to approve a minting proposal every quarter, and determine the token emission according to liquidity strategy. On June 30th, a new proposal confirmed that 60,000 INV will be minted in the second half of 2023 for DAO operation in the next 3-6 months.

The current total token supply is 305,000, with a staking rate of 56.4%. 98,000 are staked through FiRM, and 74,000 are left over from the front-end staking. Due to the impact of the malicious attack incident, the Inverse front-end was abandoned in June 2022.

Figure: INV Token Supply

2. DBR

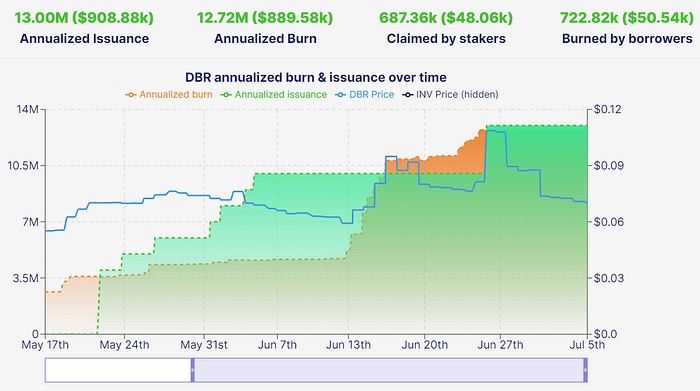

DBR has no supply limit and is controlled by the Inverse DAO for issuance. In the past year, 13 million DBRs were issued, 12.72 million were destroyed, and about 280,000 are currently in circulation. According to Coingecko, the total supply of DBR is currently 4.646 million.

Figure: Annual Supply and Destruction of DBR

Since March this year, the amount of DBR destroyed has increased significantly. In June, due to the active asset markets of CRV and cvxCRV, the amount of destroyed DBR was three times that of May, and the annualized destruction also exceeded the annual issuance, causing DBR to enter deflation.

Due to the increase in active borrowing in the FiRM market, to meet the growing demand for DOLA borrowing, the community proposed to increase the annual issuance of DBR from 10 million to 20 million.

Figure: Monthly Supply and Destruction of DBR

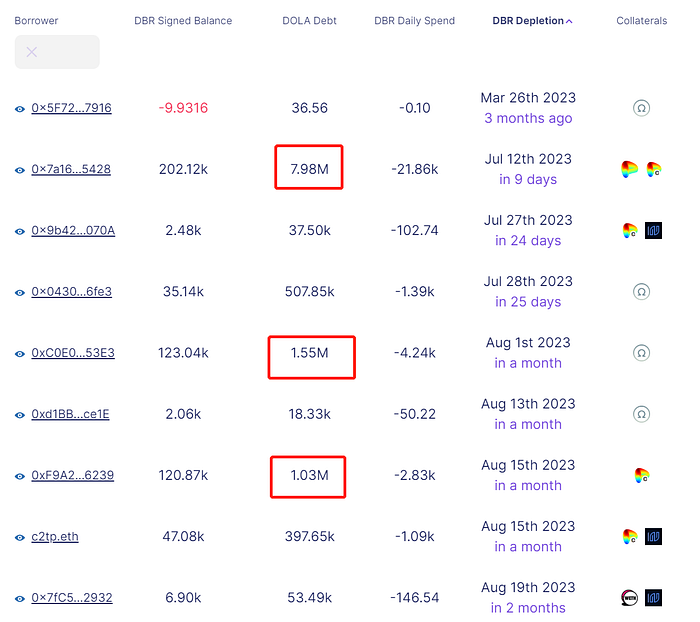

From the consumption of DBR, it can be seen that the main demand in the recent period is the CRV market, followed by OHM, and 0x7a16 is the position of the founder of Curve.

Figure: Consumption of DBR

3. INV and DBR

DBR is a necessary consumable in the Inverse protocol, with a real demand scenario. The demand for DOLA lending will directly affect the price increase of DBR. The increase in DBR price means that the borrowing cost increases. In order to ensure the good development of the product and suppress the borrowing cost, Inverse DAO will increase the emission of DBR, increase the supply of DBR, and thereby reduce the price of DBR.

DBR is mainly produced by INV stakers, and the demand for DBR will stimulate INV token holders to stake and empower INV tokens. The two complement each other.

6. Assets and Liabilities

1. Assets

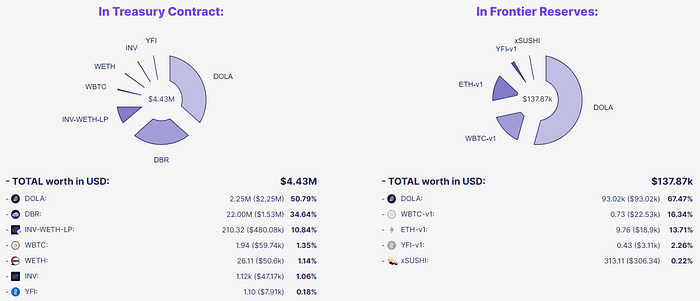

The total value of assets held by the Treasury is $4.57 million, including $4.43 million held by the Treasury contract and $137,800 in Frontier reserves. Most of the assets in the Treasury contract are DOLA, with an asset value of $2.25 million, followed by DBR assets, with a value of $1.53 million.

Figure: Distribution of Treasury Assets

2. Liabilities

On April 2, 2022, Inverse Finance suffered an attack due to a vulnerability, resulting in a loss of 4,300 ETH, worth about 14.964 million US dollars. On June 16, 2022, it was attacked again by a flash loan, losing about 1.2 million US dollars.

According to information disclosed by the official on Discord on June 28, the remaining bad debts of DOLA are approximately 9.42 million US dollars. Since June 2022, the team has repaid 1.372 million US dollars, including funds received from DWF and other entities through OTC sales.

The team is also selling INV and DBR assets to repay bad debts. The latest information:

1. New proposal: Mint 26 million DBR and sell them to whitelisted buyers at a 15% discount from the 30-day DBR TWAP price on Coingecko. The minimum amount for each transaction is 100,000 US dollars to be eligible for the discount. This proposal was officially executed on July 3.

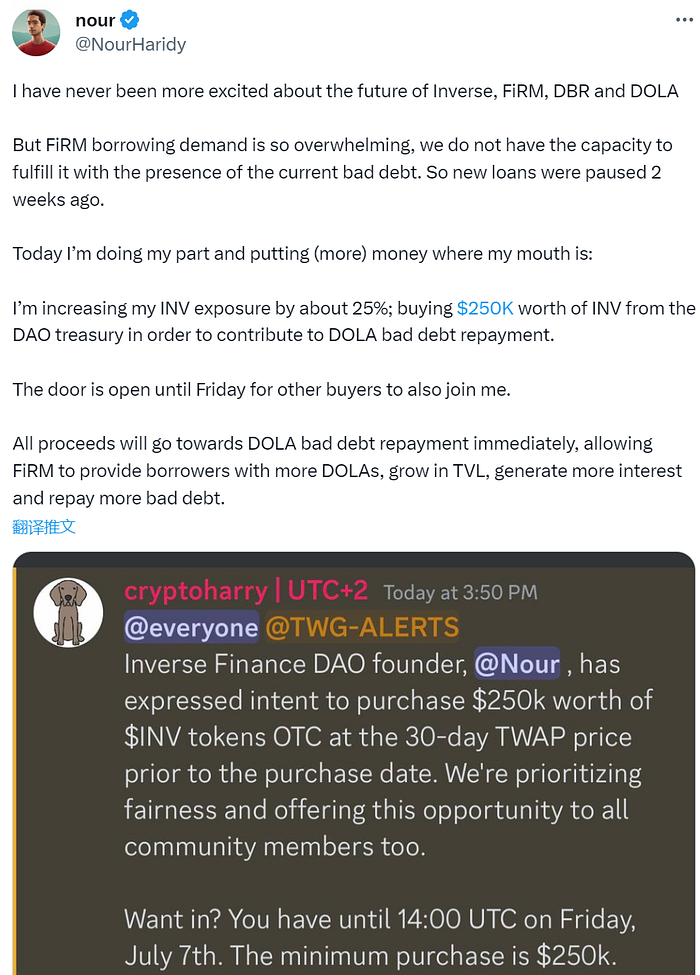

2. The founder posted on Twitter that he had purchased INV worth US$250,000 from the Treasury at the 30-day TWAP price, which will be used to repay bad debts, and welcomes other buyers to purchase. The OTC period will continue until July 7.

Figure: Founder Nour’s Twitter message

Summary: Inverse’s main problem at present is the large amount of historical bad debts. Currently, all protocol revenue and token sales are used to repay bad debts, which affects the expansion of the product. As Aave has reduced its risk exposure to CRV, Curve’s founder has transferred some lending activities from Aave to Inverse, and Inverse protocol has attracted market attention. Although the liquidity supply of CRV assets has reached the upper limit, the TVL of Inverse is still steadily increasing, which means that the Inverse protocol is gradually being recognized by the market, which is a good development signal.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Multiple bridge contracts operated by Multichain have experienced large-scale abnormal outflows of various tokens, with a total value exceeding 130 million US dollars.

- Vertex: Derivative DEX rookie, with a market share of about 10% in daily trading volume in Japan.

- The Battle for Hong Kong Dollar Stablecoin: Government Issued VS Private Issued

- Multichain crisis resurfaces, with over $130 million in token liquidity withdrawn.

- Construction and Case Studies of zk-SNARK

- Six Catalysts for the Growth of Algorithmic Stablecoin Frax Finance

- Even Zuckerberg’s Threads is using ActivityPub. What makes this decentralized protocol capable of challenging Web 2.0 giants?