Why Frax Finance is worth watching: Three investment themes, five catalysts

Why Frax Finance is worth watching: Three investment themes, five catalysts ## 三大投资主题 1. 稳定币市场需求增长,Frax是由稳定币和算法稳定币组成的混合型稳定币,值得投资。 2. Frax是去中心化的金融协议,可以提供更好的去中心化金融体验,有望在DeFi市场取得成功。 3. Frax建立在区块链上,可以为区块链基础设施提供更多的应用场景。 ## 5大催化剂 1. Frax与Chainlink合作,提高稳定币的稳定性。 2. Frax与Curve Finance合作,促进DeFi市场的发展。 3. Frax计划在全球范围内推广其稳定币和金融协议,扩大其用户群体。 4. Frax发行了治理代币FX,用户可以通过持有FX代币参与Frax协议的治理,从而获得更多的收益。 5. 随着稳定币市场和DeFi市场的不断发展,Frax有望在未来持续成长。Original Title: FXS – Coiled Spring

Author: Ouroboros Capital; Translation: Blockingcryptonaitive

Overview

This report provides a detailed introduction to our investment thesis for Frax Finance (FXS), one of our highest conviction investments in the cryptocurrency space over the next 6-12 months. We believe FXS will outperform most other tokens over the same period and seek to convey our views through this report.

The report is structured as follows:

- Multiple bridge contracts operated by Multichain have experienced large-scale abnormal outflows of various tokens, with a total value exceeding 130 million US dollars.

- Vertex: Derivative DEX rookie, with a market share of about 10% in daily trading volume in Japan.

- The Battle for Hong Kong Dollar Stablecoin: Government Issued VS Private Issued

1. Investment Thesis: We emphasize why we believe purchasing FXS at current levels offers an asymmetric risk-reward.

2. Value Accrual: How we view FXS accruing value over time.

3. Valuation: Our practical, non-academic approach to valuing FXS.

4. Myth-Busting: Common misunderstandings about Frax.

5. Appendix: Mainly links to other useful information related to Frax.

This report is the first in our research series, where we will cover our highest conviction investments – from small to large market cap, in various forms (written, video, audio, etc.).

While this is an in-depth report that covers the elements of Frax’s investment thesis, it is not a complete beginner’s guide. We will not introduce Frax and its history, nor will we detail every element of Frax.

However, we understand that readers may need to brush up on their Frax knowledge. Thus, we have included external resource links in the Appendix section at the end of the report (kudos to Flywheel DeFi), which we believe will be a great resource for anyone looking to learn more about Frax.

1. Investment Thesis

Summary: Our investment thesis for FXS is straightforward. We believe purchasing FXS at current levels offers an asymmetric risk-reward due to 1) the current level of FXS valuation support; and 2) the market likely providing significant appreciation to the token over the next 6-12 months.

Specifically, we believe FXS has lower downside risk compared to other tokens because 1) it now has valuation support following FIP-256 (with more active FXS buybacks if FXS falls below $5); and 2) our valuation exercise (in the latter part of the report) indicates key portions of FXS are still not priced in, especially considering the upcoming catalysts of FraxChain and frxETH v2.

Most importantly, we observe the team’s record in building and launching, which gives us confidence in the execution of the catalysts mentioned above. We believe that FXS will perform well at least among most other tokens, and with the launch of FraxChain and frxETH v2, it may even become a multi-fold growth in the bull market.

Investment Theme 1: Asymmetric Risk/Return – $4-5 FXS Buyback

On June 16, 2023, shortly after Frax restarted the FXS buyback program and completed a $2 million, 6-month TWAMM (Time-Weighted Average Market Maker), we proposed a suggestion for the protocol to optimize its buyback design to better achieve the intended goals. In our proposal, we emphasized that a more aggressive buyback at lower levels, but stopping the buyback when the price goes above $5, can help the protocol: i) signal a valuation floor to the market; ii) acquire FXS at lower prices for future use; iii) accumulate value for the protocol’s ownership liquidity (POL).

While such a proposal may seem only for the sake of FXS price at first glance, it is far from it. Signaling a valuation floor to the market, and thus obtaining a strong FXS price, has enormous strategic value for the protocol, as will become clear upon deeper reflection.

Issuing about 12,000 FXS per day (4.38 million FXS per year, or $21.9 million at $5) to the weighting pool and bribes can be said to be crucial to the most efficient use of the issuance for the protocol. These are the complex mechanisms that drive the operation of the protocol-AMOs, bribes, etc. A strong FXS price and low-cost storage of FXS can ensure the efficient functioning of these mechanisms, so we have proposed this proposal. In addition, we have illustrated in the following figure that FXS at the $4-5 level is definitely undervalued.

Considering the progress the protocol has made in development and the upcoming developments, we believe that setting the price at the low point of that range (only for itself and relative to other alternative currencies) is unreasonable.

FXS has made significant progress and has more to come. The low point price is unreasonable.

FXS-the low point price and the price relative to competing currencies-considering i) progress, ii) roadmap, iii) low inflation/unlocking, and iv) A+ team.

The buyback proposal was passed on June 30, 2023, and we believe it sends a strong signal to the market that FXS has a valuation bottom when it falls below $5. This provides an asymmetric risk-return profile for accumulating FXS, not only for the range below $5, but also for the range between $5 and $6, as the risk below the “buy zone” is limited.

Investment Theme 2: Striking It Big – The Catalyst Storm of the Next 6 Months

Now that we have emphasized the limited downside risk, let’s talk about upward growth – the roadmap for FXS in the next six months. We believe that the next six months will be very exciting for FXS due to i) the growth of value accumulation indicators such as frxETH supply, ii) the protocol expanding into parts of the market that will confer important value (FraxChain), and iii) eliminating existing drags (such as Frax v3 and frxGov). We have ranked them based on importance and proximity, as shown below:

Catalyst 1: Adoption of frxETH

For us, sfrxETH is the most exciting growth engine for FXS in the near term. Although frxETH has achieved impressive growth since its launch, with a total locked value (TVL) of $450 million in less than six months, we believe there is still a lot of room for growth when it surpasses rETH’s $1.5 billion TVL (the next highest total locked value for staked ETH). We believe that two important factors will drive frxETH’s growth in the next few months:

sfrxETH on AAVE: For those who remember, the formation of a loop on AAVE for stETH (i.e. leveraged returns for stETH) triggered a large supply creation for stETH, and we believe a similar phenomenon will occur after the listing of sfrxETH. The proposal to include sfrxETH into Aave has been passed on Snapshot, so we believe this is an upcoming catalyst.

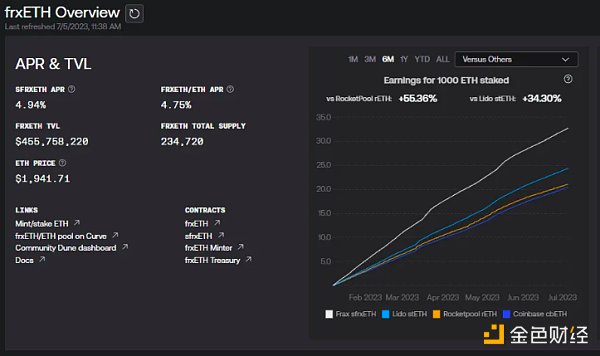

frxETH v2: One of the goals of building frxETH v1 was to optimize user returns. Currently, frxETH v1 has the highest returns in the ETH LST. As of July 3, 2023, the returns for 1000 ETH locked in sfrxETH over the past six months are higher than rETH (RocketPool) and stETH (Lido) (56%/35%). You can track sfrxETH’s returns versus competitors in real-time on Frax’s dashboard.

So far, the yield of 1 ETH on sfrxETH has always been higher than that on rETH (Rocket Pool), stETH (Lido) or cbETH (Coinbase). This is intentionally achieved through the mechanism of frxETH, where the ETH staking yield is not distributed to all frxETH, but only to sfrxETH (frxETH stakers). Therefore, the same numerator (ETH staking yield) is allocated to a lower denominator (sfrxETH) for higher returns as not all frxETH are staked.

This is only a unique advantage achieved through the 3.65 million CVX owned by Frax. In addition, sfrxETH charges the same or lower fees compared to most major ETH staking tokens. Read “What is FrxETH? An Interpretation of Frax’s ETH Liquidity Staking Derivative” for more details on how frxETH and sfrxETH achieve higher returns.

Source: DefiLlama

Source: DefiLlama

FrxETH v2 will introduce mechanisms to attract the best validators, i.e. high-quality validators, which will further increase user returns. Sam Kazemian hopes to establish a market mechanism that prioritizes “the most outstanding, knowledgeable, and knowledgeable entities who know how to operate good nodes.” The market mechanism can be based on multiple factors, including “MEV income, minimum hardware cost, maximum internet speed, block propagation, proof of response,” etc.

FrxETH v2 will introduce mechanisms to attract the best validators, mainly including 1) fees (how much yield validators give up to stakers of ETH-currently 90% for FrxETH and Lido, which may be lower in frxETH v2) and 2) the amount of ETH validators need to provide (i.e. the leverage they get). Although most ETH staking protocols currently charge fixed fees to validators, frxETH v2 will introduce dynamic fees-allowing validators to pay lower fees when there are more ETH stakers needing validators, and higher fees when there are more validators than ETH stakers.

Therefore, frxETH v2 will have the most competitive fees-dynamically adjusted between validators and ETH stakers. In addition, validators on frxETH v2 will also be allowed to provide less ETH than competing ETH staking products, making them the natural choice for the best validators. Sam Kazemian believes that validators only need to provide 4 ETH as collateral to lend out 28 ETH. Compared with competitor Rocketpool, the latter requires 8 ETH plus additional RPL bonds. If you want to know more about frxETH v2, please read “Everything about FrxETH v2 with Sam Kazemian”.

When will Fraxchain be launched? Sam Kazemian mentioned in a recent podcast that Fraxchain is most likely to be launched by the end of this year.

Revaluation case study: INJ successfully transitions to an application chain, resulting in 4x growth in the market.

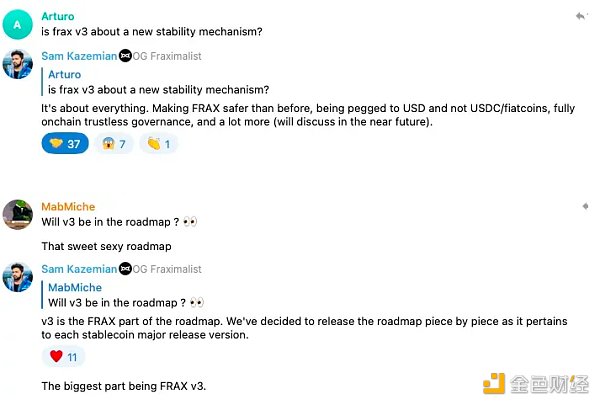

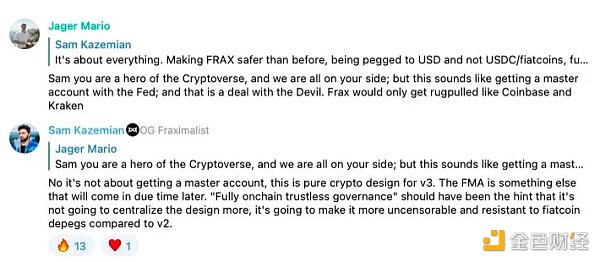

Catalyst 4: Frax v3

Frax v3 is an updated version of the Frax stablecoin. Little is known about Frax v3, except for the following:

-

It aims to reduce the risk of FRAX, especially considering the recent USDC de-pegging incident.

-

It involves fully on-chain, trust-minimized governance, not limited to USDC or the underlying stablecoin supporting FRAX.

-

It will make FRAX more decentralized and resistant to fiat-backed stablecoin de-pegging.

-

This will have a positive impact on FXS.

The following are some snippets about Frax v3 details:

Most importantly:

Catalyst 5: frxGov

Currently, although veFXS holders are the ones who vote on proposals and thus decentralized governance protocol, the execution of these proposals is still done through the protocol’s multisig smart contract. The multisig is composed of core team members of Frax such as Sam Kazemian, Travis Moore, etc.

Therefore, the protocol is still at significant risk if a majority of multisig signers are unable to sign. An example of this risk is the increasingly hostile attitude towards cryptocurrencies in certain jurisdictions. Assuming certain governments were to arrest enough core team members today, it could lead to a scenario like OKX, which was unable to process withdrawals for months until CEO Star Xu was released.

Although frxGov is unlikely to bring value accrual, we list it as a key catalyst because it can alleviate investor concerns about the recent regulatory environment and make more investors comfortable owning FXS. For more details on frxGov, see “Frax 101: Governance 2.0-What is frxGov?”.

Investment Theme 3: Sam Kazemian and A-Team

The first part of our investment theme emphasized valuation support (limited downside risk). The second part emphasized growth from upcoming developments (catalysts). However, it is the last part that gives us the greatest confidence, which is the quality of the core team.

The Frax team makes us believe that its promising roadmap will be successfully executed. In the cryptocurrency space, promises and hopes are a dime a dozen, but reliable teams that can firmly take control are few and far between. By observing the past records and history of the Frax core team, we are reassured.

We have spoken with some people who work closely with the core team, including those who have been working together even before Frax Finance was established. More details about Sam Kazemian’s background can be found in the “Sam Kazemian” section in the appendix.

2. Value Accretion

Sam Kazemian stated in Frax’s public Telegram chat that Frax generates approximately $20 million in revenue annually, demonstrating the protocol’s revenue vitality. For context, according to Token Terminal, this puts Frax in the top 30 out of 176 listed protocols. Unfortunately, Frax is not on Token Terminal. This section of the report aims to break down the existing and future key elements driving Frax’s revenue accretion.

Frax currently generates approximately $20 million in revenue annually.

Value Accretion 1: frxETH

The fee structure of the protocol distributes 90% of all deposit revenue in the form of frxETH to sfrxETH stakers. The remaining 10% is allocated to the Frax protocol treasury (8%) and the penalty insurance fund (2%). The 8% allocated to the protocol treasury in the form of frxETH will ultimately be distributed to FXS holders. The 2% allocated to the insurance fund will be used to cover any potential penalty events, effectively maintaining overcollateralization of frxETH. $500m * 5% * 8% = $2m. While this may not seem exciting, we have already noted in the investment theme section that we expect frxETH to quickly surpass rETH. At rETH TVL (approximately $1.5 billion of staked ETH), frxETH’s revenue accretion to FXS is expected to be close to $8 million.

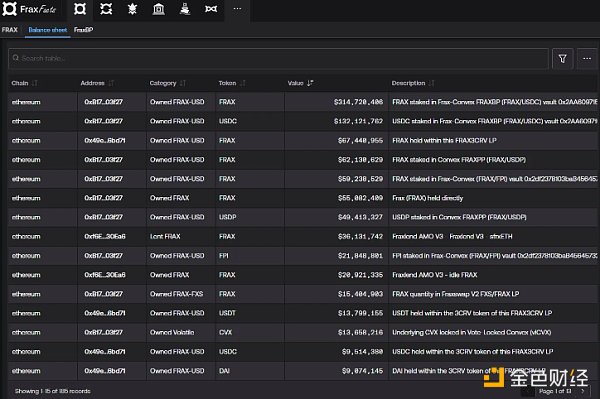

Value Accumulation 2: AMO

AMO (Automatic Market Operations) is one of the primary revenue drivers for Frax, but undoubtedly one of the most complex internal concepts of Frax. Therefore, we provide a detailed introduction in the appendix for readers who want to know more about how it works. In short, AMO has two goals: 1) to ensure anchoring stability of Frax’s native assets (FRAX and frxETH); and 2) to generate revenue by utilizing the protocol’s liquidity.

In this process, it mints FRAX/frxETH and moves POL. For example, if FRAX deviates from its anchoring on Curve (i.e. the FRAX/USDC pool is imbalanced and there is more FRAX), the protocol withdraws the FRAX it owns and burns it, thereby maintaining anchoring by rebalancing the allocation of FRAX and USDC. Similarly, if FRAX exceeds its anchoring on Curve, the protocol mints new FRAX, deposits it into the FRAX/USDC pool, and brings FRAX back down to anchoring or below.

This page provides a good understanding of how AMO deploys the protocol’s liquidity.

We estimate that the primary AMOs (i.e. the Curve/Convex AMO, frxETH AMO, and FraxLend) generate revenue of approximately $14 million individually (most of which is in CRV and CVX tokens). Considering the $2 million contributed by frxETH and Sam Kazemian’s estimate that the protocol generates $20 million in revenue overall, the total revenue of all AMOs is expected to be close to $16 million.

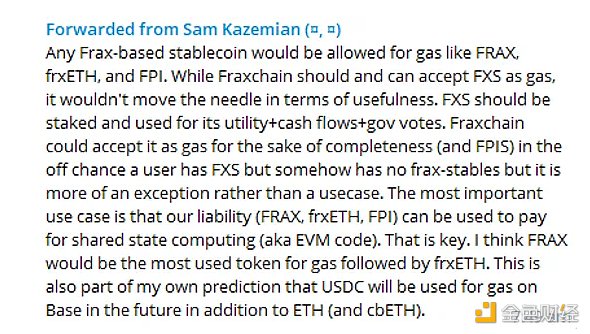

Value Accumulation 3: Fraxchain

Since Fraxchain may not launch until 2024, it is a future value accumulation driver that we must consider.

We currently know that Fraxchain will allow the use of native Frax assets (FRAX, frxETH, etc.) as Gas. Therefore, it will certainly indirectly generate value accumulation through frxETH and Frax stablecoins.

We conservatively estimate that FraxChain’s gas fees could be $5,000 per day (or $1.8 million per year), similar to Fantom, zkEVM, and Osmosis. This would easily make FraxChain’s revenue 10% of the current protocol fees (approximately $20 million). But more importantly (which we will detail in the valuation section of the report), we believe the market will assign significant incremental market value to FXS on FraxChain. We have seen this phenomenon in other successful application chain transitions.

3. Valuation

Before we start this section, we want to note that we don’t like to use traditional valuation models in the cryptocurrency space. Traditional valuation models, such as target multiples and discounted cash flow analysis, often have arbitrary variables that are highly sensitive to the valuation output (discount rate, multiple, TAM analysis, etc.), which are merely academic exercises for us.

However, we still believe this section is valuable because it provides the following: 1) how cheap the current valuation of FXS is and how much value has yet to be assigned; 2) how high FXS can go in a bull market (“fundamental” valuation model and imagination prevailing).

Our valuation exercise breaks down the market cap of FXS into three key parts: i) the stablecoin Frax; ii) frxETH; iii) Fraxchain.

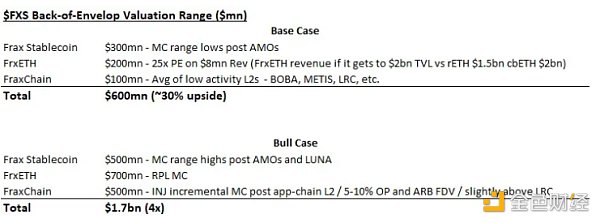

We start from a conservative perspective (baseline valuation), and divide the value of these parts as follows:

1. Frax stablecoin : $300 million. This is the low end of the FXS market cap range, post-AMO introduction. Considering the significance of AMO as a revenue-driving factor (nearly $20 million in revenue and the majority of FXS revenue), we believe this is a fair timeframe to use when evaluating the conservative value of the stablecoin component.

2. frxETH: $200 million. We use a conservative 25x multiple for expected frxETH revenue ($8 million annually), which is after it has grown to the scale of rETH and cbETH. Considering the superior yield of frxETH, we believe it is necessary for it to grow to the scale of rETH and cbETH and the advantages of frxETH v2 in decentralization and validator aspects.

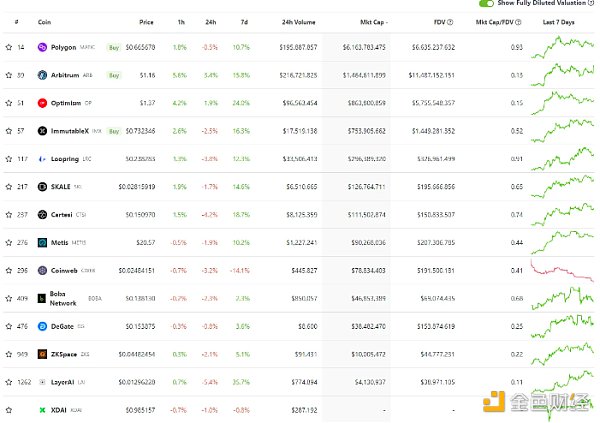

3. Fraxchain: $100 million. This is a conservative valuation given that we use the average of low activity L2s such as BOBA, METIS, and LRC.

The above exercise also seems to allocate more value to each part over time, which we think is wise and conforms to the Lindy effect.

With the launch, development, and increasing bullish sentiment of Frax, we expect this sliding scale to be closer to our bull case valuation as follows:

1. Frax stablecoin: $500 million in market capitalization. This is the highest point of the FXS market cap range, after the introduction of AMO and the collapse of LUNA, but before the introduction of FrxETH, as that would have considered some factors of FrxETH’s price. We chose to take a cautious approach, including the market cap range after the collapse of LUNA.2. frxETH: $700 million. On par with RPL, as the supply of frxETH exceeds rETH.3. Fraxchain: $500 million. This is the incremental market cap gained after a successful transition of INJ to an application chain. For reference, this is only slightly higher than LRC ($300 million), and roughly 5-10% of FDV of ARB and OP.From the above, it can be seen that each section is given equal value in a more bullish scenario. This makes sense in a bull market, as participants are more willing to pay for future growth and look forward, thus assigning more value to it.The above can be reinforced by a simple exercise of valuation and reporting of early charts, reinforcing our view that the current market cap valuation of FXS is significantly undervalued, and value appreciation will occur with more evidence of frxETH and Fraxchain development.4. Myths Analysis: This section addresses common misconceptions about Frax.Myth 1: Like LUNA and other algorithmic stablecoins, FRAX has a risk of a death spiral. A sub-1 collateralization ratio of frax means it’s unsafe and may become unpegged.Absolutely not. The total non-POL (Protocol Owned Liquidity) FRAX is $300 million, backed by equivalent stablecoin assets held by the protocol and $37 million of volatile assets (such as CVX, CRV, etc.). The collateralization ratio is calculated as (non-POL FRAX) / (protocol-owned non-FRAX/FXS/FPI assets).This means that currently, over $100 million of non-POL FRAX/stablecoin liquidity providers (LPs) have locked it up for over a year. This means that only $200 million of FRAX can be sold for protocol-owned stablecoin equivalent assets worth $237 million. But what happens after a year? According to our estimates, the protocol is likely to achieve a collateralization ratio of over 1 within a year.

Myth 2: The Frax team is located in the United States, which means that if the United States takes a strong stance against cryptocurrencies, the protocol will face an existential crisis.

As described in the investment theme and frxGov section above, frxGov addresses this issue. Once deployed, frxGov will hand over complete control of the protocol to veFXS holders, so there are no centralized operational elements in the protocol, and any form of regulatory action risk is eliminated.

The existing core team can still work on the protocol and promote upgrades through governance proposals and other means, while eliminating the risk of regulatory action threatening the survival of the protocol.

Myth 3: Frax is a patchwork project with almost no innovation.

This is completely incorrect. While some parts of Frax are not new ideas, such as FrxETH (liquidation-minting ETH), FraxFerry (bridge), FraxSwap (AMM), and FraxLend (lending), they are built to complement existing Frax products. The construction of FrxETH aims to provide the highest yield in ETH liquidity collateral, taking advantage of Frax’s position as the largest protocol holder of CVX.

The construction of FraxFerry is to avoid the risk of native Frax assets (FrxETH or stablecoin Frax) being attacked, as users want these assets to be available across multiple chains.

The construction of FraxSwap is to allow the protocol to effectively use its balance sheet for repurchases.

FraxLend gives the power of lending AMO, allowing the protocol to mint Frax as collateral for lending, similar to CDP.

Conclusion

We reiterate the investment theme, which we presented at the beginning of this report. We believe that owning FXS is an asymmetric risk/reward ratio for the next 6 months or even longer, and we believe it is currently one of our most confident investments in the field.

We have detailed many short- to medium-term catalysts and developments that make us inclined to own FXS, while we are also comfortable with our long-term ownership of FXS as we see the quality of the core team and their history in driving protocol growth.

Frax has come a long way: Frax v1 (survived after LUNA crashed and witnessed the death of other algorithmic stablecoins) → AMO (innovative solutions for stablecoin anchoring and value accumulation) → frxETH → FraxFerry (response to bridging vulnerabilities and CCTP) → Frax v3 + Fraxchain + more (frxBTC, frxBonds, etc.).

We cannot see the trend of constantly launching, developing, and further developing agreements stopping at any time due to the team’s dedication and perseverance. Move forward, upward.

5. Appendix

About Sam Kazemian

Sam Kazemian is an Iranian-American software engineer who has achieved significant success in the blockchain and cryptocurrency industry. He studied philosophy and neuroscience at UCLA, demonstrating his interdisciplinary knowledge and problem-solving approach. Kazemian’s outstanding achievements and contributions have earned him recognition, including being nominated for the Forbes 30 Under 30 List for 2023.

IQ.wiki: In December 2014, Kazemian co-founded IQ.wiki, which has grown into the world’s largest blockchain encyclopedia. He launched the project from his dorm room while studying at UCLA. It should be noted that as the company behind IQ.wiki, Everipedia attracted famous Wikipedia co-founder Larry Sanger to join as Chief Information Officer in December 2017. The project received $30 million in funding from Galaxy Digital in February 2018, a milestone that was widely reported in authoritative media such as Fortune, Reuters, and Business Insider. With the launch of OraQles in 2020, Everipedia’s influence continued to expand. OraQles is a groundbreaking one-party oracle service used by the Associated Press to record events on Ethereum. As President, Kazemian leads the development of Everipedia, transforming it from an online encyclopedia into a blockchain knowledge platform.

Frax Finance: In June 2019, Kazemian embarked on a new adventure, Frax Finance. The team’s relentless pursuit of innovation led to the launch of Frax v1, an important milestone in the development of decentralized algorithmic stablecoins. Frax became the first stablecoin to combine collateralized backing with algorithmic stable mechanism. On December 21, 2020, shortly after its launch, Frax Finance’s total locked value (TVL) exceeded $43 million, demonstrating its immediate success. Kazemian played a key role in driving the growth of the Frax Finance ecosystem, launching groundbreaking innovative projects such as Frax V2, veFXS, Frax Price Index (FPI), and Fraxswap. As of July 2, 2023, Frax Finance’s TVL exceeded $1.08 billion, solidly ranking it as the 14th largest DeFi protocol in the cryptocurrency industry. The team will continue to drive development, including upcoming projects such as Fraxv3 and Fraxchain.

Flywheel DeFi Links

A shoutout to the Flywheel DeFi team in the Frax community. They were definitely key community members for Frax at the time of writing this report and their content saved us a lot of time in writing this report. Below are some of their links explaining key concepts of Frax:

Frax 101 – The Complete Guide to Using Frax Finance — video tutorials and demos that cover the entire range of Frax products.

Fraxchain: The Ultimate Driver of FrxEth Currency Premium and Yield Potential — known information about Fraxchain as of June 16th, 2023.

Deep Dive into Everything FrxEth v2 with Sam Kazemian.

What is Liquidity Mining, and How Does FrxEth v2 Completely Change It?

Frax 101: FrxEth and sFrxEth — explains why FrxEth has higher yields than other competitors and has better liquidity relative to market cap.

Frax 101: Governance 2.0 – What is FrxGov?

Frax 101: What is FRAX? The Complete History of the Protocol’s Flagship Stablecoin.

Analysis of the FrxEth AMO and Its Economic Mechanism.

Frax 2022 Retrospective: The Birth of DeFi Trinity (and More!) — a good look back at Frax’s development in 2022.

Twitter Links

Twitter links we found helpful along the way.

Zero_13x1 on Frax – A good overview of Frax (March 7th, 2023)

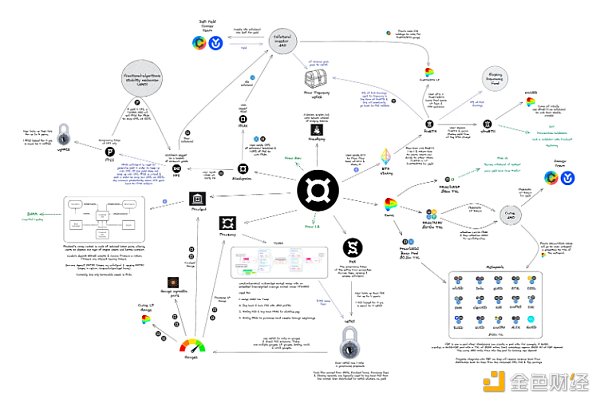

Riley_GMI’s Infographic on Frax (May 22nd, 2023)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Multichain crisis resurfaces, with over $130 million in token liquidity withdrawn.

- Construction and Case Studies of zk-SNARK

- Six Catalysts for the Growth of Algorithmic Stablecoin Frax Finance

- Even Zuckerberg’s Threads is using ActivityPub. What makes this decentralized protocol capable of challenging Web 2.0 giants?

- Evening Must-Read | Meta Launches Twitter Rival Threads: How to Use and What’s Its Biggest Feature

- Six Catalysts Driving Growth for Algorithmic Stablecoin Frax FinanceFrax Finance

- What is GameFi?