Deciphering the new regulations from the Monetary Authority of Singapore: Will cryptocurrency firms face stricter supervision?

Will cryptocurrency firms face stricter supervision due to new regulations from the Monetary Authority of Singapore?On May 31, 2023, the Monetary Authority of Singapore (MAS) released a new notice called “MAS Notice FSM-N01” aimed at regulating the business conduct of financial advisory service providers more strictly. This new regulation affects all companies that provide financial advisory services in Singapore, including those that provide cryptocurrency advisory services.

The new regulation details the code of conduct that financial advisory service providers should adhere to. These rules include how to handle and resolve customer complaints, how to handle customer personal information, and how to provide appropriate financial advisory services to customers. If a company violates these rules, they may be subject to penalties by the Monetary Authority of Singapore.

The possible penalties include:

1. Fines: MAS may impose fines on non-compliant companies. The amount of the fine is usually determined based on the severity of the non-compliant behavior and the size of the company.

- Is this the darkest moment for the NFT leader? Multidimensional interpretation of Yuga Labs’ performance in May

- Integration of Crypto and AI: Four Key Intersection Points

- SharkTeam: On-Chain Data Analysis of RWA Raceway

2. Revocation or suspension of license: If a company’s non-compliant behavior is very serious, MAS may suspend or revoke their license, which would prevent them from continuing to provide financial advisory services in Singapore.

3. Warning or censure: For less serious non-compliant behavior, MAS may issue a warning or censure requiring the company to correct their behavior.

4. Legal proceedings: In some cases, MAS may take non-compliant companies or individuals to court.

Industry Impact

For the cryptocurrency industry, first, cryptocurrency companies need to conduct more rigorous customer due diligence, including identifying and reporting “high-risk customers” they serve, such as politically exposed persons (PEPs) and their close associates. This may increase their compliance costs, but it can also help them better understand their customer base and take appropriate risk control measures.

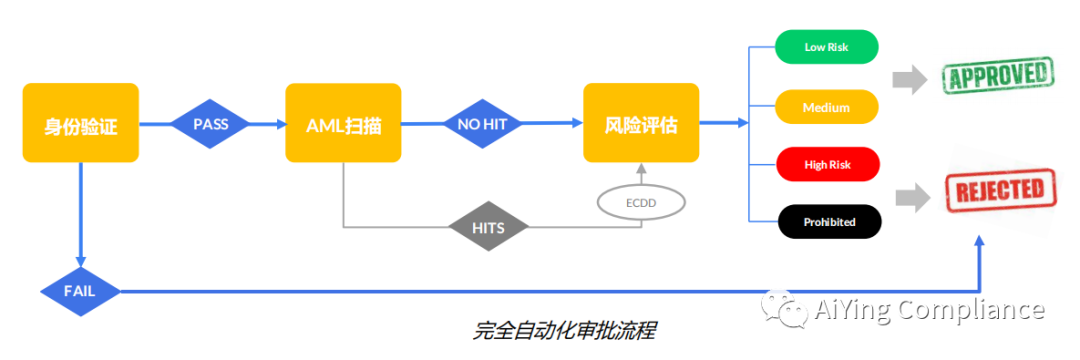

Therefore, an efficient, globally comprehensive, and cost-effective automated AML&KYC compliance solution is an indispensable tool in the current global trend of tightening regulations.

Secondly, the new regulations emphasize how financial advisory service providers should handle customer complaints and protect their personal information. This may increase the protection of cryptocurrency investors, but it may also pose some challenges for companies in handling customer privacy.

Overall, the new regulations from the Monetary Authority of Singapore bring new challenges and opportunities to the cryptocurrency industry. Companies need to adapt to these new regulations to ensure that their businesses can operate in a more transparent and fair environment.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LD Capital: Analysis of L2 Head Liquidity Customization DEX Mechanism of Trader Joe, Izumi, and Maverick

- Aave community initiates a temperature check proposal to integrate MakerDAO’s DSR into Aave V3 Ethereum pool.

- Everything you need to know about LSD Summer

- Decoding Tornado Governance Attack: How to Deploy Different Contracts on the Same Address

- Evening Must-Read | Reasons, Impacts, and Solutions to the Crisis of American Banks

- Assessment of the Decentralization Level of the Top 5 PoS Public Chain Validators

- eZKalibur: Ecosystem-centered DEX and LaunchBlockingd