Is this the darkest moment for the NFT leader? Multidimensional interpretation of Yuga Labs’ performance in May

Is Yuga Labs facing its worst performance yet? A look at their May stats from different angles.Author: NFTGo Research Compilation: Luffy, Foresight News

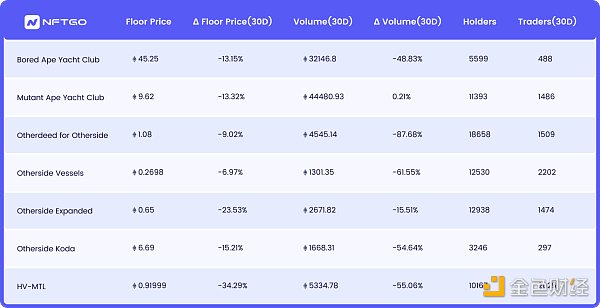

Over the past month, Bored Ape Yacht Club, Mutant Ape Yacht Club, and Otherdeed for Otherside have all dropped to their lowest levels of the year. On May 10th, a large number of traders entered the market to snap up their favorite NFT collections. Surprisingly, among all NFTs created by Yuga Labs, MAYC had the highest monthly trading volume, at about 44,480 ETH.

BAYC Data Performance

Touching the lowest point of the year on May 10th

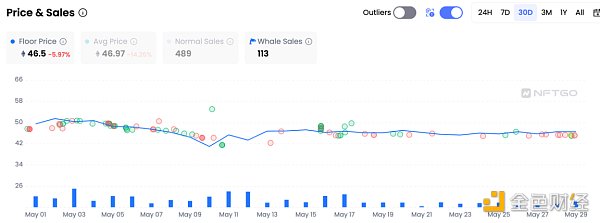

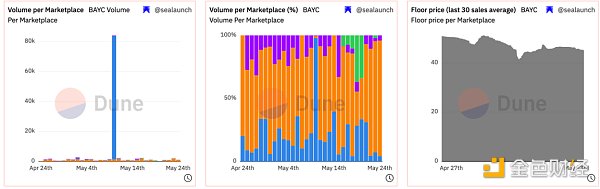

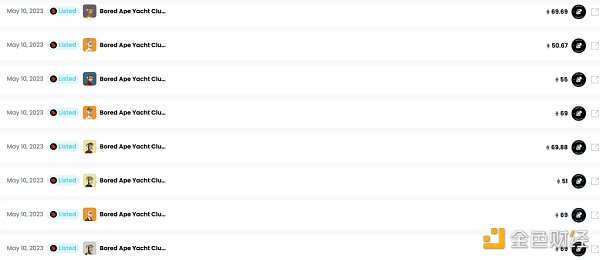

On May 10th, BAYC’s floor price fell to its lowest level in a year, reaching 40.95 ETH. Despite the decline, this day was also the second highest trading volume day of the month, and since then BAYC prices have been steadily rebounding.

- Integration of Crypto and AI: Four Key Intersection Points

- SharkTeam: On-Chain Data Analysis of RWA Raceway

- LD Capital: Analysis of L2 Head Liquidity Customization DEX Mechanism of Trader Joe, Izumi, and Maverick

Market sentiment affects trading volume

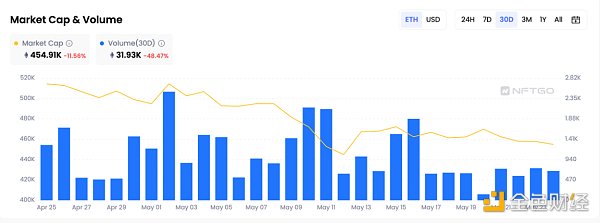

An important observation is that BAYC’s market capitalization has been in a continuous downward trend, falling from 820,000 ETH to 460,000 ETH, a drop of 44%. Looking at a longer time frame, the trading volume in May was only half that of April, which indicates the overall market sentiment since we entered the meme season.

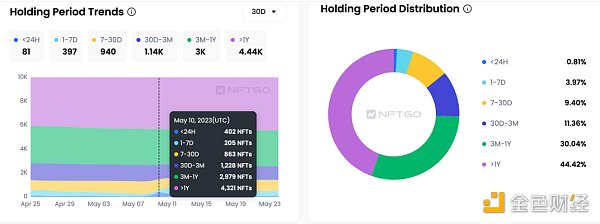

On May 10th, the length of time users held NFTs changed, with some holders holding NFTs for less than 24 hours. This suggests that new investors may have entered the market and are seeking quick profits. It’s worth noting that nearly 44.5% of holders have held NFTs for more than a year, and this number is steadily increasing. 10.51% of holders have not sold their BAYC NFTs since they were minted.

Number of holders begins to rebound

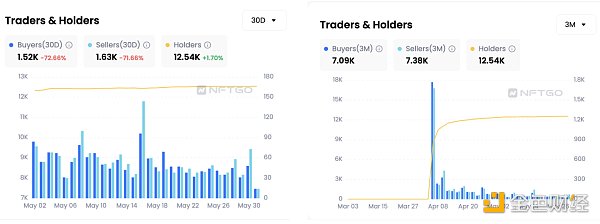

According to NFTGo data, the peak trading volume this month occurred on May 2nd, followed by May 10th, with a daily trading volume of about 50 transactions, and reached its lowest point on May 20th.

Since last month, the number of BAYC holders has been on a downward trend. However, this trend seems to have reversed on May 10th, and the number of holders began to increase.

Analysis of BAYC Holder Trading Activity

Blur is the most frequently used platform by holders

According to Sealanuch data, over 90% of BAYC trading activity occurs on Blur, while OpenSea currently only accounts for 4.2%.

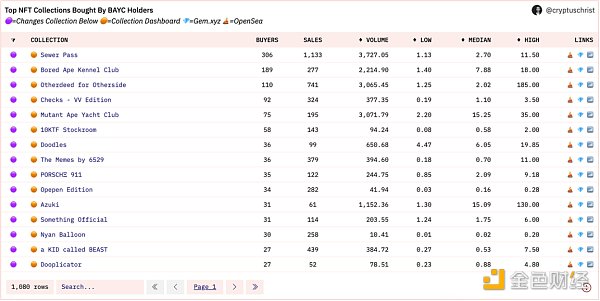

Top-tier Collections Purchased by BAYC Holders

Currently, the top five collections held by BAYC holders are Sewer Blockingss, BAYC, Otherdeed, Checks, and MAYC. It is worth noting that three of these series belong to Yuga Labs. In addition, some BAYC holders have chosen to invest in other popular collections this year, such as Checks-VV edition and open edition.

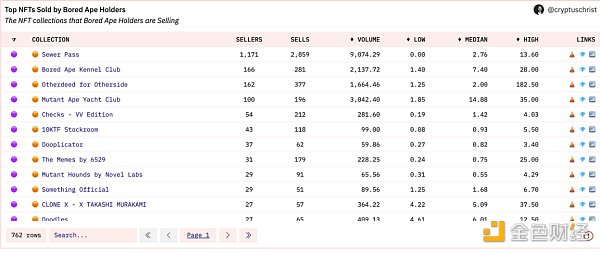

Top-tier Collections Sold by BAYC Holders

Similarly, the top five collections sold by BAYC holders are Sewer Blockingss, BAYC, Otherdeed, MAYC, and Checks. Therefore, we can assume that these collections have good liquidity.

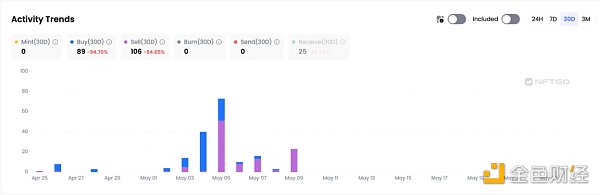

Whale Reversal

machibrother.eth has been an active trader in the market, and his recent on-chain activities can provide valuable reference for investors. Last month, machibrother.eth was one of the largest traders, with 89 buys and 106 sells. After analyzing the trend, it was found that May 10th was the lowest floor price of BAYC, only 40 ETH, which may be a potential buying opportunity for those interested in investing in BAYC.

In addition, on May 10th, machibrother listed more than ten BAYCs and MAYCs on Blur. This move by machibrother may be to earn Blur rewards, but it is important to consider past reversal experiences and market trends before making any investment decisions.

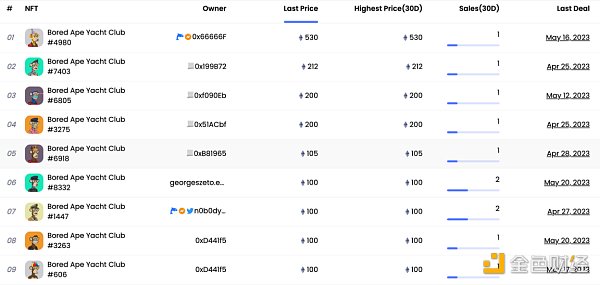

Highest Transaction Price

In the past 30 days, the most expensive BAYC sold was #4980, which was sold for a price as high as 530 ETH. The owner of this ape is 0x66666F, a whale with a portfolio value of 743.91 ETH. After #4980, the next most expensive BAYCs are #7403 and #6805.

Yuga Prices and Predictions

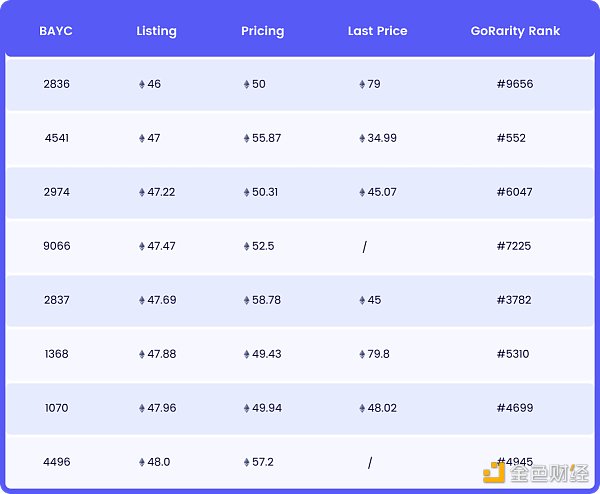

Bored Ape NFT Prices and Listings

If you want to estimate the prices of more NFTs, NFTGo provides a test version of an NFT pricing tool that covers most mainstream NFTs. You can get an API key by filling out this form.

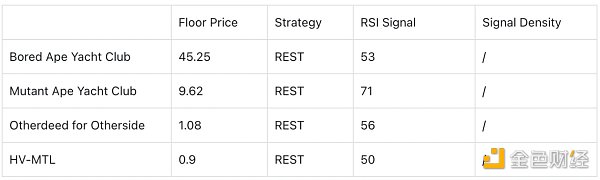

Trading Signals for Yuga NFTs

Probability of Increase and Decrease (NFA)

RSI Strategy: A trading signal designed based on the strength of buying and selling signals according to RSI. Buying signals are below the fluctuation range, while selling signals are above the fluctuation range. The greater the deviation, the stronger the signal.

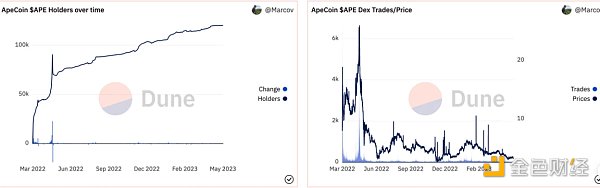

Apecoin Analysis

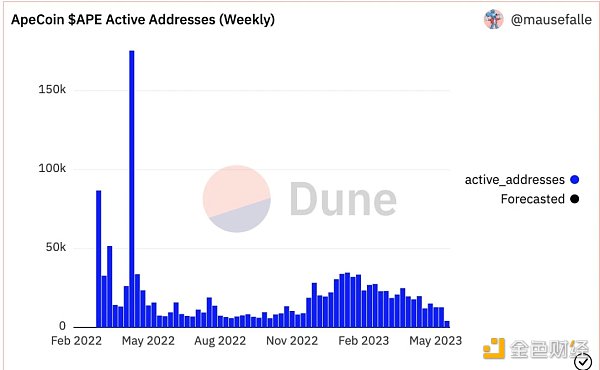

Currently, the price of APE is $3.47 (note: approximately $3.1 at the time of publication), and the last high point was in February 2023, when Otherside 2nd trip and Dookey dash were launched. Despite the cooling market, APE holders have been steadily growing in the past few months.

Currently, the number of APE holders’ addresses has exceeded 120,000. However, the number of active addresses holding APE has been declining since February 2021 and is currently less than 10,000.

Yuga’s NFTFi Ecosystem

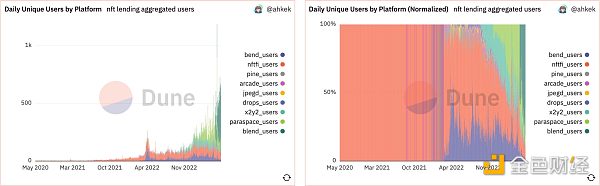

In terms of borrowing volume and daily users, Blend has become a top NFT lending platform. As of now, Blend’s daily active users are around 300-400 people, equivalent to the total number of users on other lending platforms.

These platforms have lent out more than 6,000 apes, of which 88 have been liquidated. Among all platforms, MAYC is still the largest NFT collection in terms of custody volume.

NFT and Gaming Economy

Legends of the Mara provides a complex game mechanism with a lot of strategic choices, each of which leads to different results.

Otherside Vessels

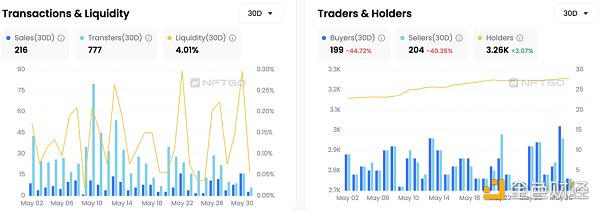

When the game was initially released, the market was dominated by sellers, with sales activities significantly exceeding buying activities. However, this trend changed significantly after the first update. Both buying and selling activities saw significant declines, dropping by about 70%, indicating that the market has shifted from hype-driven release to a more stable and mature trading environment.

However, despite the decrease in trading activity, there has been a slight 1.7% increase in the number of holders. This means that dedicated players are steadily accumulating Vessels NFTs.

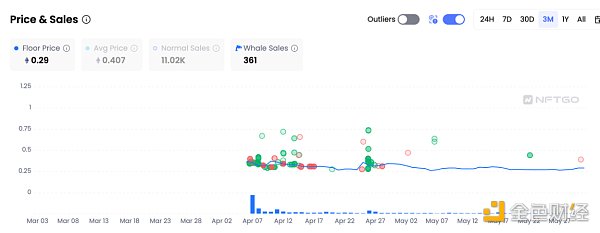

From the initial release to the second update, the floor and average prices of Vessels NFTs have been steadily decreasing. Specifically, the floor price has dropped from 0.35 ETH at the time of release to 0.29 ETH at the time of the second update. However, the trading volume has decreased significantly from 1.37 K ETH at the time of release to 86.15 ETH at the time of the second update. Essentially, these trends depict a market that is maturing after the initial hype.

Otherside Koda

In the strategic ecosystem of Legends of the Mara, Otherside Koda plays a crucial role. As the primary guardian of Otherside, they are skilled in farming, spellcasting, and hunting, and are therefore differentiated from Vessels in terms of functionality and value.

The trading activity of Otherside Koda NFTs forms an interesting contrast with that of Vessels. Unlike Vessels, the buying and selling activity of Koda appears to be more balanced, indicating a relatively matched interest and supply. However, the number of Koda holders has increased by 3.07%, which is a larger increase than that of Vessels. This may be because Koda’s enhanced functionality in the game attracts a wider or more dedicated group of players.

Koda’s floor and average prices have decreased, while the initial price was notably higher. From a floor and average price of 10.48 ETH and 10.85 ETH, respectively, at initial release, we see that they have dropped to 6.8 ETH and 7.34 ETH, respectively, at the time of the second update.

Legends of the Mara has vast potential in the NFT gaming market. Developers and players alike need to strike a balance between economic incentives and gameplay enjoyment. Perhaps introducing in-game tutorials or comprehensive guides can help new players better understand game mechanics.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Aave community initiates a temperature check proposal to integrate MakerDAO’s DSR into Aave V3 Ethereum pool.

- Everything you need to know about LSD Summer

- Decoding Tornado Governance Attack: How to Deploy Different Contracts on the Same Address

- Evening Must-Read | Reasons, Impacts, and Solutions to the Crisis of American Banks

- Assessment of the Decentralization Level of the Top 5 PoS Public Chain Validators

- eZKalibur: Ecosystem-centered DEX and LaunchBlockingd

- Understanding Gyroscope: A Newcomer in the Field of Stability Starting from the Polygon Ecosystem