DYDX competitor, encrypted derivatives platform MEKE, first round of public testing ends on August 10th.

MEKE, a competitor of DYDX in the encrypted derivatives platform space, will conclude its first round of public testing on August 10th.Since the launch of Bitcoin perpetual contracts in 2016, the perpetual contract market has been growing rapidly in the entire cryptocurrency field. By 2023, the market potential of perpetual contracts has gradually expanded, completely surpassing the spot market of cryptocurrencies.

From the launch of the first cryptocurrency perpetual contract trading platform to the present, the development of perpetual contract trading platforms has also undergone qualitative changes. Initially, perpetual trading platforms could only be built using centralized technology due to technical limitations. However, with the rise of DeFi and the improvement of blockchain performance, decentralized perpetual contracts have become a new direction.

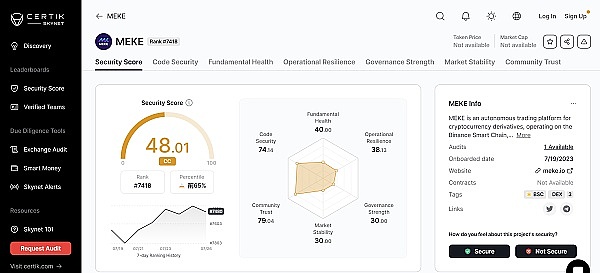

In July 2023, MEKE, a derivative trading platform developed by a US technology team, was launched. MEKE’s main functions are deployed on the blockchain and can be used for perpetual contract trading of various mainstream cryptocurrencies such as BTC and ETH. In addition, MEKE will also involve perpetual contract trading of various physical assets such as gold, foreign exchange, and US bonds in the future.

MEKE has been loved by cryptocurrency traders around the world since its launch. Since the introduction of perpetual contracts, some decentralized perpetual trading platforms have also appeared in the market, but most of them have discouraged users due to their cumbersome operation steps and laggy user experience. MEKE, on the other hand, has excelled in this aspect. MEKE not only realizes features such as on-chain trading, tamper-proof trading, transparency, and traceability but also provides a smooth experience similar to centralized user contracts.

- Why are there so many Layer2 chains?

- LianGuaiWeb3.0 Daily Report | Uniswap has been deployed to the Base network

- LianGuai Morning News | Federal Reserve Launches New Regulatory Program, Banks Participating in Cryptocurrency Face Stricter Scrutiny

In the entire decentralized perpetual contract trading market, dydx and GMX can be considered as the leaders of the industry. However, MEKE is not inferior to them in terms of technology and user experience.

Take dydx as an example. Compared to dydx deployed on starkware, MEKE is deployed on layer2 opBNB launched by the world’s largest exchange, Binance. opBNB has performance that is not inferior to all current L2 networks. The block time of this network is 1 second, the gas fee for transfers is as low as $0.005, and it can process over 4000 transactions per second (TPS). In terms of user experience, MEKE has already started its first round of public beta testing on July 31, and the beta experience is also on par with dydx. Currently, dydx chooses to launch its own trading chain through Cosmos Stack, so perhaps MEKE and dydx will be fierce competitors in the future.

Compared to GMX, MEKE differs in that it uses the classic order book model, making the trading data more clear and visible, more in line with the trading habits and experience of a large number of traders, and more conducive to market makers. On the other hand, MEKE uses the weighted average price of oracle prices and platform real-time transaction prices as the implementation guidance price for assets. This kind of price is more stable and can largely avoid oracle attacks. GMX uses liquidity pool trading and uses pure oracle prices for pricing.

Compared to spot trading, perpetual contracts have the allure of leveraging small investments for larger gains. Compared to traditional fixed-term contracts, perpetual contracts offer the flexibility to trade at any time, making them more suitable for the ever-changing cryptocurrency market. Therefore, perpetual contracts have gained favor among many cryptocurrency traders. Until now, perpetual contracts have become a major source of income for many centralized exchanges such as Binance and OKEX.

According to data from Binance’s research, the cryptocurrency derivatives market currently occupies a market share of 74.2% in terms of total trading volume. The monthly trading volume of cryptocurrency derivatives has reached $1.9 trillion, tripled in the past three years. With the booming development of the cryptocurrency derivatives market, it is estimated that the market revenue will grow to $231.2 billion by 2030. In recent years, as regulatory pressures increase and people’s desire for transparent trading grows, decentralized perpetual contract trading has become the trend in the industry. It can be imagined that in the future, the on-chain cryptocurrency derivatives market will give rise to leading products similar to Binance and Coinbase. MEKE may be one of them.

In addition to MEKE’s strong technological advantages and broad market potential, MEKE’s token model is also worth noting. The total supply of MEKE tokens is 60 billion, distributed as follows:

10% will be distributed to early investment advisors and technical advisors, with a large portion being airdropped to early participants in MEKE’s public beta testing.

50% will be used to incentivize market makers and users. Users can obtain MEKE tokens through trading mining and providing liquidity to the exchange. The mining period will last for at least ten years.

20% will be reserved for investment institutions. The tokens held by investment institutions must be locked up for one year before being released. After one year, they will be released linearly every two months for ten years.

10% will be owned by the project team and used for market maintenance and various promotional activities.

The remaining 10% will be reserved as an insurance fund, and its handling will be determined by community voting in the event of a major incident.

MEKE tokens can be used for 1) platform DAO governance, 2) reducing transaction fees by holding MEKE, 3) periodic repurchase of MEKE by the platform, 4) staking MEKE to share platform transaction fees, and 5) in the future, MEKE will open a public chain where MEKE can be directly used for gas fees.

From the above, it can be seen that over 90% of MEKE tokens will be gradually released over ten years, with less than 10% being airdropped to early participants in MEKE’s public beta testing. The first phase of MEKE’s public beta testing began on July 31st and will end on August 10th, with only about one day remaining. Currently, the progress of MEKE’s public beta testing is quite lively, with a large number of users participating every day, and the total number of users participating in the testing has exceeded 20,000.

For users participating in MEKE’s public beta testing, MEKE will airdrop platform tokens based on the quantity of USDT traded by the user and their contribution to the platform’s traffic. The public beta testing is divided into three phases, and the earlier the participation, the more cost-effective the airdrop. If there are any remaining MEKE tokens planned for airdrop after the testing period, they will be directly destroyed.

It is worth mentioning that the underlying L2 opBNB deployed by MEKE has not yet issued tokens, and the opBNB mainnet will also be launched at the end of August. This means that participating in the MEKE public test not only allows you to receive MEKE airdrops, but also may have the opportunity to receive opBNB airdrops. The first phase of the MEKE public test is about to end. For more details, please long-press to copy and enter the MEKE community.

Official Website:

https://meke.io

Telegram:

https://t.me/MEKE_Club

Discord:

https://discord.gg/meke

Twitter:

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Data Analysis ERC-4337 Adoption The Moment of Breakthrough Arrives?

- 3iQ Research Director The stability of LianGuaiyLianGuail stablecoin may trigger competition and force regulatory agencies to take action.

- Is DAI’s 8% excess risk-free rate a Ponzi scheme?

- How will the issuance of the US dollar stablecoin PYUSD by LianGuaiyLianGuail impact the cryptocurrency industry?

- Dialogue with Linea Product Manager How does Linea, backed by ConsenSys, achieve progressive decentralization?

- Interpreting the stablecoin PYUSD issued by LianGuaiyLianGuail which trends are worth paying attention to?

- Impact of Curve Finance Vulnerability on MEV Approximately 6000 ETH Earned