LianGuai Daily|The Federal Reserve launches a new plan to regulate banks’ cryptocurrency activities; Founder of MakerDAO proposes to change the maximum value of EDSR to 5%.

LianGuai Daily|The Federal Reserve regulates banks' cryptocurrency activities; MakerDAO Founder proposes changing EDSR maximum value to 5%.Today’s headlines:

The Federal Reserve launches a new program to regulate banks’ cryptocurrency activities, requiring all regulated banks engaged in digital asset activities to obtain approval.

AntChain: The transfer period for digital collectibles has been adjusted to 24 hours.

Founder of MakerDAO proposes to change the maximum value of EDSR to 5%, increase borrowing rates, and establish retroactive airdrops for SLianGuairk borrowers.

- In-depth Research Can Algorand, a public chain focusing on developer and marketing, stage a comeback?

- Leading Ethereum-based project ETHS launches virtual machine, innovation seems to return to its origins.

- EigenLayer in-depth research report Ethereum’s middleware protocol leading the narrative of re-staking

Saddle Finance proposes to shut down operations and liquidate funds.

Bitstamp will stop offering trading of 7 tokens, including SOL, to US users.

Binance updates on the progress of asset recovery for XIRTAM: Assets eligible for recovery will be automatically returned on September 4th.

Web3 security company Cube3.ai completes $8.2 million seed funding round, led by Blockchain Ventures.

Report: Top 15 Ethereum NFT traders have made nearly $300 million in profit, with 70.6% of the profit coming from CryptoPunks.

Regulatory News

The Federal Reserve launches a new program to regulate banks’ cryptocurrency activities, requiring all regulated banks engaged in digital asset activities to obtain approval.

According to CoinDesk, the Federal Reserve is launching a new program to supervise banks’ cryptocurrency activities and further clarifying its requirements that banks under its supervision must obtain approval before engaging in digital asset activities. The Federal Reserve also issued a more comprehensive explanation, stating that regulated banks participating in stablecoin transactions need to obtain prior approval. Any institution that “issues, holds, or trades US dollar stablecoins” needs to demonstrate to regulatory authorities in advance that it can conduct this business in a “safe and sound manner” and requires formal approval from the Federal Reserve. This approval may be difficult to obtain as each bank needs to demonstrate its ability to “identify, measure, monitor, and control the risks of its activities,” and the Federal Reserve will look for any vulnerabilities in areas such as money laundering, customer runs, and hacking. The Federal Reserve stated that the new program will notify each bank when its digital asset exposure will be reviewed, and the level and intensity of regulation will vary based on the extent to which each regulated bank institution engages in digital asset activities.

NFT

AntChain: The transfer period for digital collectibles has been adjusted to 24 hours.

The “AntChain Digital Collectibles Platform User Service Agreement” was updated on August 9th, announcing a modification to the transfer rules stated in section 3.2.2 of the original agreement. The transfer period has been changed from users holding collectibles for 90 days to 24 hours. The updated agreement will take effect seven (7) days after the announcement.

Project Updates

Founder of MakerDAO proposes to change the maximum value of EDSR to 5%, increase borrowing rates, and establish retroactive airdrops for SLianGuairk borrowers.

Rune Christensen, the founder of MakerDAO, stated in a post that he proposes taking immediate action to optimize EDSR (Enhanced DSR) to ensure that it primarily benefits ordinary Dai holders rather than allowing ETH whales to profit on a large scale. Christensen believes that it is unintended for large-scale ETH and collateralized ETH whales to profit from EDSR through borrowing, but it squeezes out the ordinary Dai users who should be the primary beneficiaries of EDSR. The proposed changes include reducing the maximum value of EDSR from 8% to 5%, increasing borrowing rates to be equivalent to EDSR to end arbitrage opportunities (initially reaching a minimum of 5%), and establishing retroactive airdrops for SLianGuairk Protocol borrowers. The first two proposals have been submitted in “MIP102c2-SPXX: MIP Amendment Subproposal,” and the proposal for the last item is being prepared, which will provide more detailed information on how to calculate and distribute this retroactive airdrop.

Christensen pointed out that within 48 hours of the launch of EDSR, the supply of Dai increased by nearly 500 million, and the utilization rate of DSR (deposit interest rate) has almost reached the threshold of 20%, which will automatically decrease EDSR to about 5.8%. This provides two important data points: 1. Providing high returns for mature stablecoins will result in rapid and large-scale capital inflows, which will quickly consume excess returns and keep them in balance with the market; 2. The yield of holding Dai is higher than the cost of mortgage loans, which will lead to larger-scale capital inflows and borrowing activities for so-called “loan arbitrage”. We must pay attention to ensuring that the borrowing interest rate is high enough to prevent capital leakage.

Earlier news, after MakerDAO’s proposal to introduce Enhanced Dai Savings Rate (EDSR) on July 28, the DAI deposit rate of MakerDAO has been adjusted to 8%.

Progress of Steadefi attack: Approximately $418,000 of user funds recovered

The automatic yield leverage strategy platform Steadefi tweeted the latest progress of the attack, stating that the stolen funds (about 624 ETH) were transferred to a new address at 20:29 Beijing time on August 8. The Steadefi team successfully recovered approximately $418,000 of user funds from the remaining treasury at 20:43. Steadefi has reported the case to the relevant authorities and is currently cooperating with security companies to track the attackers’ on-chain and off-chain activities. The team will continue to investigate the attack and formulate an action plan. According to previous news, Steadefi announced that it was attacked and all funds were at risk. On-chain messages have been sent to the attacker’s wallet address for negotiation. According to CertiK Alert monitoring, Steadefi lost approximately $1.1 million in this incident.

Bloomberg: Former FTX executive Ryan Salame negotiating guilty plea with US federal prosecutors

Bloomberg cited people familiar with the matter as saying that Ryan Salame, former co-CEO of FTX Digital Markets, is negotiating with federal prosecutors to admit criminal charges related to FTX’s bankruptcy. The person familiar with the matter revealed that he may earliest plea next month, including crimes such as violating campaign donation laws. It is currently unclear whether he will reach a cooperation agreement with the prosecutor and testify against SBF in court. Salame has not been charged with anything related to FTX’s bankruptcy before, and the details of the potential plea agreement have not been finalized. Salame will be the fourth former FTX executive to plead guilty. Gary Wang, Caroline Ellison, and Nishad Singh have all pleaded guilty and will be key witnesses in the US government’s case against SBF. Salame has not been charged with anything related to FTX before, and the details of the potential plea agreement have not been finalized. According to previous news, in April of this year, the Federal Bureau of Investigation (FBI) searched Ryan Salame’s residence. In July, Ryan Salame was investigated by the Manhattan federal prosecutor on suspicion of violating campaign finance laws.

Saddle Finance proposes to shut down operations and liquidate funds

Decentralized exchange platform Saddle Finance will shut down its operations and distribute funds to investors, according to CoinDesk. Saddle founder Sunil Srivatsa proposed liquidating its funds into Arbitrum (ARB) tokens and airdropping the proceeds to SDL and veSDL token holders. Developers of the protocol are required to exit the project by September 30, 2023. Srivatsa stated that the recent Curve Finance attack served as a reminder of the potential vulnerabilities that Saddle’s team constantly faces. Saddle has previously raised over $10 million from venture capitalists. The platform primarily deals with stablecoin trading and currently holds user deposits worth around $2 million.

Bitstamp to cease trading of 7 tokens, including SOL, for US users

Bitstamp, the cryptocurrency exchange, will stop offering trading of Axie Infinity (AXS), Chiliz (CHZ), Decentraland (MANA), Polygon (MATIC), Near (NEAR), Sandbox (SAND), and Solana (SOL) tokens to US users starting from August 29, according to Cointelegraph. In an announcement made on August 8, Bitstamp stated that due to “recent developments,” US customers will soon be unable to trade the aforementioned 7 cryptocurrencies. While the company did not specify the reasons for ceasing trading, the US Securities and Exchange Commission (SEC) has accused these seven tokens of being unregistered securities in lawsuits against Binance and Coinbase. Bitstamp has advised users to close any open orders involving these assets by August 29, 2023. After this deadline, related trading activities will be permanently halted on the Bitstamp platform. Users are still able to hold and withdraw these 7 tokens from their accounts at any time.

EOS Network Foundation urges EOS community to reject Block.one’s $22 million settlement agreement

According to an official blog post, the EOS Network Foundation is urging the EOS community to reject Block.one’s proposed settlement, as it believes the proposed settlement does not serve the best interests of the EOS network and the entire EOS community.

The EOS Network Foundation states that the proposed settlement fails to adequately compensate community members for the losses suffered due to Block.one’s false statements and misconduct, and it prohibits collective members from seeking fair and just resolution of claims in the future. Block.one raised $4 billion from the community in an ICO and had promised to invest $1 billion into the EOS network and community, but failed to deliver on that promise.

Under the terms of the settlement agreement, community members who join the agreement will no longer be able to make any claims against Block.one and its founders, and Block.one will pay $22 million. The deadline to opt out is August 29, 2023, and failure to opt out by this date may result in automatic inclusion in the class-action lawsuit.

Binance provides update on XIRTAM asset recovery progress: Eligible user assets will be automatically returned on September 4

Binance employee (@sisibinance) posted an update on the progress of XIRTAM asset recovery on Twitter, stating that “after evaluation, the ‘automatic return’ time for all eligible user assets is September 4, 2023.”

Previously, on May 4, it was reported that the XIRTAM project, which had fled, transferred the raised 1,909 ETH to Binance. In response, Binance stated that the funds related to the fraudulent XIRTAM project had been frozen and that they would cooperate with law enforcement agencies in the investigation. On July 2, Binance released an XIRTAM refund application form to collect victim addresses.

SpiritSwap: Multichain event leads to project funds depletion, if no new team takes over, it will shut down on September 1st

SpiritSwap, a Fantom ecosystem DEX project, announced in a Discord announcement that due to the Multichain event, the project’s funds have been depleted. The project no longer has funds to support daily operations, including regular development costs, operational salaries, monthly expenses, and marketing activities. Currently, SpiritSwap is looking for a new team to take over the project. If no potential team is found, SpiritSwap will automatically shut down on September 1st, providing an opportunity for community members to safely transfer liquidity.

In addition, SpiritSwap mentioned that it will release another announcement specifically for ConvergeX in the coming days.

Temasek, Sequoia Capital, Softbank, and other 18 venture capital companies face a collective lawsuit due to their relationship with FTX

According to Cointelegraph, in a collective lawsuit filed in Miami, 18 venture capital companies, including Temasek, Sequoia Capital, Sino Global, and Softbank, have been named as defendants and accused of having a relationship with the now bankrupt cryptocurrency exchange FTX.

The lawsuit alleges that these investment companies are responsible for “assisting and abetting” FTX’s fraud. These companies used their “power, influence, and substantial financial resources to push FTX’s ‘house of cards’ to a scale of billions of dollars.” The defendant venture capital companies, especially Temasek and others, provided a false picture of the exchange, claiming that they had conducted due diligence. Therefore, these venture capital companies directly “implemented, conspired to implement, and/or assisted and abetted FTX Group’s fraud of billions of dollars” for their own financial and professional interests.

Regarding the role of venture capital companies in assisting and curbing FTX’s fraud, the plaintiffs quoted Temasek and its statement on FTX’s financial condition. Temasek claimed that they conducted extensive reviews of FTX’s finances, audits, and regulatory checks for a period of 8 months, and found no signs of danger. The lawsuit further claims that these venture capital companies guaranteed the security and stability of FTX and promoted FTX’s alleged attempt to be properly regulated.

Microsoft partners with Aptos Labs to develop new AI blockchain solution

According to CoinDesk, Aptos is deploying new products that combine artificial intelligence and blockchain using Microsoft’s infrastructure, including a new chatbot called Aptos Assistant, which will answer users’ questions about the Aptos ecosystem and provide useful resources for developers building smart contracts and decentralized applications. This chatbot is supported by Microsoft’s Azure OpenAI service.

Investment and Financing

LianGuaircha AI, founded by former Coinbase executives, completes $5 million seed round financing

According to Fortune magazine, LianGuaircha AI, a generative AI fintech startup founded by former Coinbase Senior Product Director AJ Asve, announced the completion of a $5 million seed round financing. Kindred Ventures, Initialized Capital, as well as angel investors including YC President Garry Tan, Datadog President Amit Agarwal, and Google Vice President Bradley Horowitz, participated in the funding. The funds will be used to continue building their products and hire more employees.

According to reports, LianGuaircha AI mainly helps fintech companies, including cryptocurrency companies, automate physical labor. It utilizes large-scale language models to handle operations such as fraud detection, understanding business compliance, and customer acquisition. Currently, its clients include cryptocurrency payment company Bridge and US financial services and technology company Brex.

Web3 security company Cube3.ai has completed an $8.2 million seed round of financing, led by Blockchain Ventures.

According to The Block, Web3 security company Cube3.ai has completed an $8.2 million financing round led by Blockchain Ventures, with participation from Dispersion Capital, Symbolic Capital, Hypersphere Ventures, ICLUB, and TA Ventures. This round of financing will be used to expand the platform to enhance the security of Web3 and educate the community on transaction security risks and their exploitation.

Cube3.ai uses machine learning to prevent malicious transactions on blockchain. If a malicious transaction is detected, the algorithm will alert the company and require the deployment of smart contracts to block the transaction. This startup protects transactions on Ethereum, BNB Smart Chain, Arbitrum, and Polygon, with Avalanche launching later this month.

Mining News

Marathon Digital produces 2,926 BTC in the second quarter, a 33% increase from the previous quarter.

According to Blockworks, executives of Bitcoin mining company Marathon Digital stated during a financial report conference call that the company’s hashrate increased by 54% in the second quarter, from 11.5 EH/s to 17.7 EH/s. The company produced 2,926 BTC in the second quarter, a 33% increase from the 2,195 BTC produced in the first quarter. The BTC produced in the second quarter accounted for approximately 3.3% of the available Bitcoin network rewards during the same period.

In addition, Marathon sold 63% of its produced BTC during the quarter to fund operating costs, generating total revenue of $23.4 million. The company reported a net loss of $21.3 million for the quarter, higher than the net loss of approximately $7 million in the previous quarter. Marathon’s total revenue increased from approximately $51 million in the first quarter to nearly $82 million in the second quarter.

Important Data

Data: Certus One transfers 1 million LDO to Binance again, totaling over 6.51 million LDO transferred to Binance since July 14th.

According to on-chain analyst Yu Jin, 4 and a half hours ago, Certus One transferred another 1 million LDO (worth about $1.85 million) to Binance.

It is reported that Certus One has transferred a total of 6,517,487 LDO (worth about $12.1 million) to Binance since 26 days ago (July 14th). The average sale price of the LDO transferred to Binance by Certus One is approximately $2.05. Certus One currently holds 3,482,513 LDO (worth about $6.47 million).

Report: Top 15 Ethereum NFT traders have made nearly $300 million in profit, with 70.6% of the profit coming from CryptoPunks.

According to data released by CoinGecko on Twitter, the top 15 Ethereum NFT traders have made a profit of $299 million, with over 94.5% of the total profit coming from blue-chip NFT collections launched by Larva Labs, Yuga Labs, and Art Blocks. CryptoPunks accounts for 70.6% of the profit of top traders, CryptoPunks V1 accounts for 2.0%, Art Blocks accounts for 12.2%, Bored Ape Yacht Club (BAYC) accounts for 5.5%, and Meebits accounts for 3.4%.

The report states that the top-ranked anonymous NFT trader is SethS, who has earned 55,291 ETH (worth about $100 million) from NFT investments. These profits were collected through 9 addresses and transferred to the NFT whale address starting with 0x2238.

Data: Bitcoin mining difficulty increased by 0.12% to 52.39T, and the current network hash rate is 376.52 EH/s.

Bitcoin mining difficulty experienced a mining difficulty adjustment at 20:27 today (block height 802,368), with a slight increase of 0.12% to 52.39T. The current average network hash rate is 376.52 EH/s.

LianGuaiNews APP’s Points Mall officially launched

Hardcore prizes for free redemption: imKeyPro hardware wallet, First Class Research Report monthly pass, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections. First come, first served, experience it now!

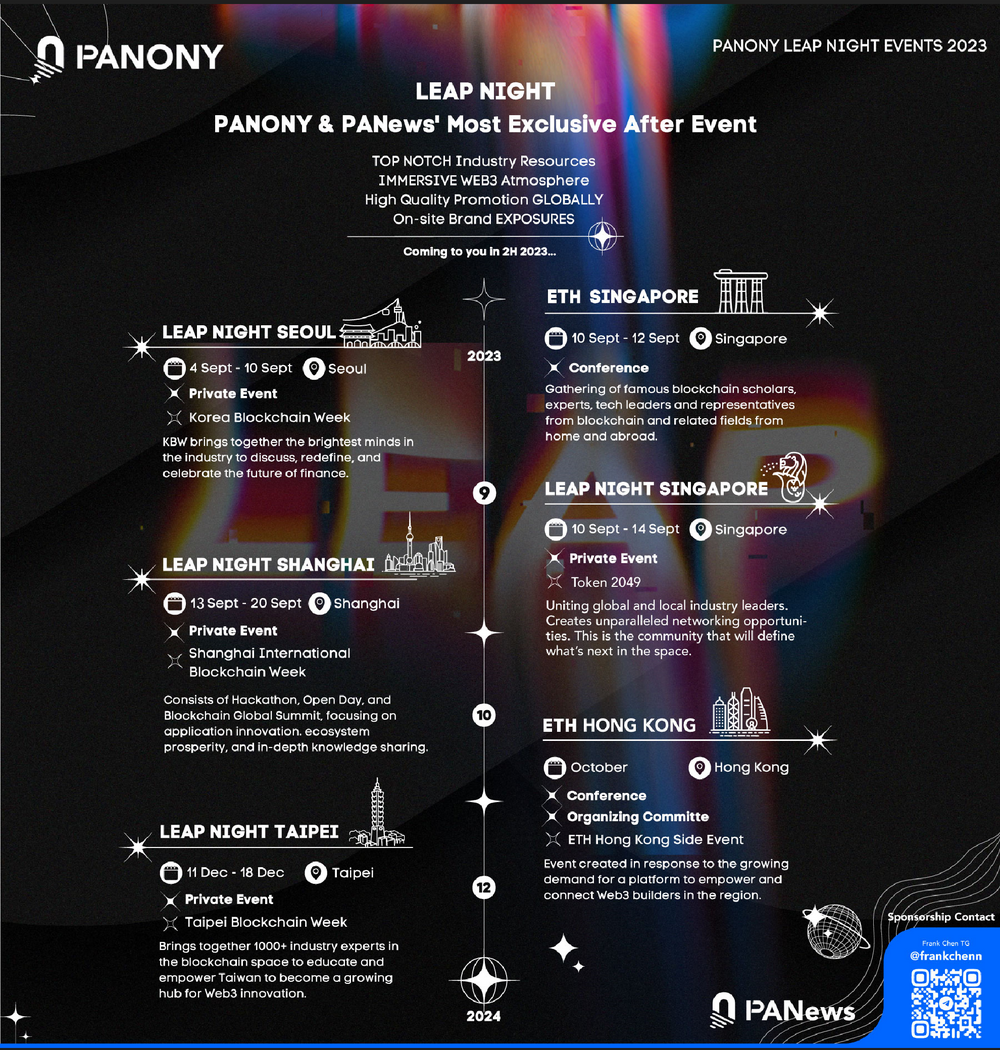

LianGuaiNews launches the global LEAP tour!

Korea, Singapore, Shanghai, Taipei, various locations will come together from September to December to witness a new era of globalization!

📥Multiple events are being jointly built in different locations, welcome to communicate!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Observation | All In Imports Elements of the Coin Circle, Coin with the Same Name Rides on the Heat

- The Success Story Behind the Explosion of TG Bots A Successful Tale of On-Chain Marketing and Grassroots Counterattack

- Will going online mean the end? BALD plummets a thousand times, what is the future of Base public chain?

- The hype of room-temperature superconductor triggers the meme token craze of LK-99 Innovation or cutting-edge?

- AlterVerse Research Report Web3 Sandbox Game Based on Binance Chain

- LianGuai Daily | Hackers have returned all stolen funds to Alchemix Curve pool; US SEC provides over $104 million in rewards to 7 whistleblowers

- Decoding Decentralized Order Book The Best Combination of Pricing Quality and Fund Security