Will the Bitcoin Liquid sidechain be more important than the Lightning Network in 2020?

Source / LongHash

In the past few years, the Lightning Network has caused a lot of heated discussions because it can achieve fast and cheap Bitcoin transactions without excessively sacrificing censorship resistance and decentralization. In 2017, in order to better support such second-layer protocol layers without sacrificing Bitcoin's core value proposition, SegWit was added to the Bitcoin network instead of simply performing basic block expansion. .

This greatly improves the experience when paying with Bitcoin. However, few people want to pay with Bitcoin. They just want to hold it. Currently, the two main use cases for Bitcoin are value storage and speculation.

- The road to DeFi on Bitcoin

- Opinion | Beyond BTC halving in 2020, these three major events will happen in the mining industry

- In 2020, the blockchain will scale from trials to large-scale applications in insurance, trade, notarization and other industry scenarios.

That's why the Liquid sidechain-a sidechain focused on inter-exchange transactions-will become a more important project in 2020.

Remove exchange activity from the underlying Bitcoin blockchain

According to Chainalysis's data last year, 90% of Bitcoin activity is related to exchanges. If these coins will inevitably go through a centralized, regulated entity, then it will be pointless for these transactions to continue to use the expensive (relatively speaking) Bitcoin blockchain. For example, if someone transfers coins from Binance to Coinbase, there is no reason to put these coins on a decentralized ledger. This user is already trusting the two entities and giving them their money.

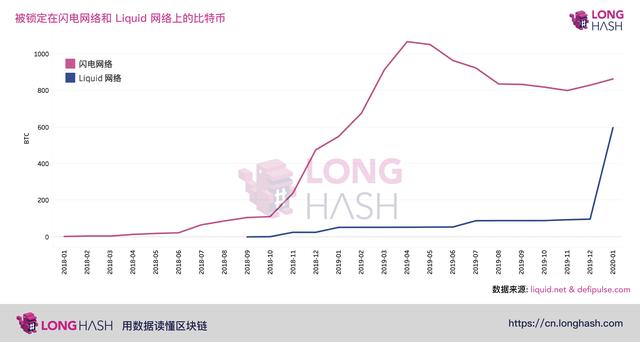

As shown above, Liquid's current adoption rate is still very low. However, it is important to realize that Bitcoin has now been operating in a relatively low-cost environment for several years. In the case where the upcoming halving time has spawned a large-scale bull market and caused transaction fees to start to levels not seen since the end of 2017, a large part of the total supply of bitcoin may be transferred to the Liquid sidechain, resulting in even lower Transaction fees and reduce the impact on the underlying Bitcoin blockchain transactions.

A similar effect was seen on SegWit. The market was full of complaints in the middle of 2010 that required greater transaction capacity. Although it has been several years since then, the adoption rate of SegWit is still below 60%. Peter Smith, the CEO of Blockchain, recently stated that they would only integrate SegWit as a priority only if the cost of bitcoin rose sharply. In addition, it should be kept in mind that wallets, exchanges, and other Bitcoin services will only integrate functions such as better transaction cost estimation and quantitative adjustment when the fees rise to a level that bothers users.

Lightning Network may eventually help exchanges

Of course, the Lightning Network (or at least similar technology) may still be useful for exchanges. Having said that, as far as deposits and withdrawals through the Lightning Network are concerned, the exchange has a series of potential problems that need to be addressed.

For example, out of concerns about security and cost, it is unlikely that a larger amount of transactions will be conducted through the Lightning Network. On the Lightning Network, fees are calculated based on a percentage of the amount sent, which means that after a certain threshold is reached, the transaction costs on the chain (or Liquid) will be lower than those of the Lightning Network.

People are also worried about how exchanges handle liquidity, because they need to bind a large amount of bitcoin to the online Lightning Network channel to be able to make payments through the exchange.

In addition, the payment layer of the Lightning Network needs major improvements to work more efficiently and integrate better with exchanges. Most of these issues were discussed during a panel meeting during the Bitcoin Conference 2019.

Nothing prevents Liquid and Lightning Network from being used together. In fact, the team behind c-lightning software experimentally introduced support for this feature last summer. One of the main benefits of the combination of these two technologies is the ability to enable instant atomic swaps between the underlying Bitcoin blockchain and the Liquid sidechain.

The difference between Liquid and the Lightning Network is a good example of Bitcoin's multi-tier expansion approach. However, this plan works only when people actually choose the upper layer of the network. If the Bitcoin network becomes congested in 2020, it may be Liquid rather than the Lightning Network that can alleviate this congestion.

LongHash , read the blockchain with data.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Global FinTech Financing Report 2019: Blockchain Financing Amount Leads Above 261.9 Billion

- Watch | Policies continue to assist, Bitcoin options go public, this week is a lot better

- DeFi weekly selection 丨 the total value of the lock position exceeds 1.1 billion US dollars, the DeFi era of sailing is beginning

- Observation | Blockchain accelerates the digital transformation of commercial banks

- Xiao Yan: What is the legal boundary of blockchain technology and its application?

- Featured | Examining various centralized and decentralized crypto lending platforms

- Money laundering, stolen money, murder, Malta's bad crypto dream