Who is LaunchLianGuaid really fooling with the ‘三无’ project IEO OPNX?

Who is LaunchLianGuaid fooling with the '三无' project IEO OPNX?Author: Qin Xiaofeng, Planet Daily

Today, the debt trading platform OPNX, founded by Su Zhu and others, announced the launch of its second LaunchLianGuaid project, Gameplan. Upon the news, the price of the OPNX platform token OX rose from 0.036 USDT to 0.041 USDT, reaching a peak of 0.04 USDT, with an increase of 11%.

Gameplan is claimed to be a sports metaverse platform founded by UFC champion Khabib Nurmagomedov and Magomed Kurbaitaev. It aims to provide sports fans with a one-stop platform for activities, games, shopping, and interacting with sports idols, while providing additional income for athletes. According to OPNX, the project has received investment from 3AC Ventures.

Currently, Gameplan only has a Twitter and Discord account, with no official website, whitepaper, or more detailed information. It is unknown how the token economics of Gameplan’s GPLAN token are distributed, and it is also unknown how many shares of GPLAN OX token stakers can obtain. In addition, the two games “Desert Off-road Racing” and “Fighting Game” that have been hyped on Gameplan’s Twitter since the beginning of the year have yet to be seen. As an IEO promoted by the exchange, the project as a whole gives an unreliable feeling.

- Projects awarded with Ethereum ERC-4337 bounties Cross-ChAAin, Seal Seal Seal, zkLianGuaiymaster.

- WorldCoin officially launches its token. Will it become the next epic-level crypto project?

- Review of the 13 award-winning projects at the ETHGlobal LianGuairis Hackathon

If Gameplan can still be considered to have a “celebrity” endorsement, the first LaunchLianGuaid project of OPNX, Raiser (RZR), is even more absurd.

(Left: Tweet release time, Right: Website registration time)

The Raiser project website was registered on June 20th (with only a static page, all functional buttons are disabled), and the first tweet was posted on Twitter on June 22nd. Just one day later, OPNX revealed that it would launch its first LaunchLianGuaid project and officially announced it on June 25th. From project registration to being discovered by OPNX and announcing the IEO, it took only five days. OPNX’s “efficiency” is jaw-dropping and is enough to show its value in the Raiser project.

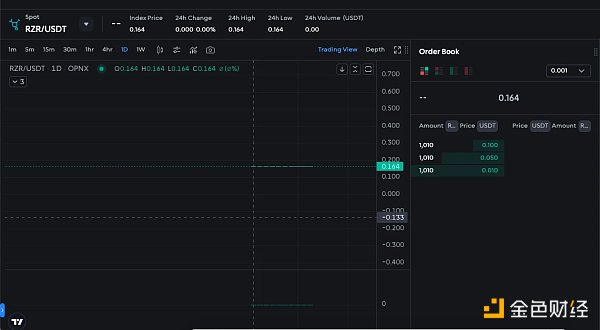

What’s more interesting is that the Raiser project has had no trading volume since the announcement of the IEO on June 25th. According to OPNX’s official website data, the RZR project was launched on July 17th with an initial price of 0.164 USDT, and there has been no trading volume in the past 10 days—mainly due to the absence of sell orders. Moreover, OPNX claims that all OX token stakers will share 10% of the RZR supply distribution, but this promise has not been fulfilled.

(RZR price trend, data from the OPNX website)

Without completing the first IEO project, OPNX hastily launched the second “three no” project within just one month. What is the purpose of OPNX? To empower the platform token OX and increase its price.

Data shows that after the announcement of the first IEO, the price of OX rose from 0.03 USDT to 0.055 USDT within two days, with a peak increase of over 80%; today’s announcement of the second IEO has once again pushed it up by more than 10%.

In addition to empowering OX staking through IEO, OPNX has also launched a project called Justice Token in June, with 75% of its total supply allocated to OX stakers (Note: Justice Token is a meme token with no intrinsic value, anchor or expected return). Interestingly, the OPNX official website has not launched Justice Token token trading.

With a series of measures, the price of OX has risen from $0.011 to $0.055 in the past two months, with a maximum increase of 400%, and the current increase is still 260%. As shown below:

Unlike other platforms that earn transaction fees through trading, OPNX allows users to trade for free by staking OX (Stake To Trade For Free), similar to the “transaction mining” model that was popular in 2018.

If the proportion of OX held by a trader is equal to or greater than the proportion of their total OPNX transactions, they can receive a 100% refund of the transaction fees. Stakers who exceed the free trading quota will receive a 50% refund of the transaction fees on the remaining amount. All transaction fee refunds will be paid in OX to the coin holders. Initially, OPNX allowed coin holders to trade for free at a value 12 times the current OX staking value. This multiple will decrease by 1 each month until it returns to 1.

Even though the latest data shows that its average daily trading volume in the past 30 days exceeded $50 million, with a total trading volume of $1.51 billion, OPNX is not making money at this stage.

Kyle Davies has also stated that he will donate the “future earnings” of OPNX to the creditors who suffered losses due to the bankruptcy of 3AC fund last year. Some early creditors have already been compensated. The compensation is likely to be in the form of OX tokens. If the price of OX cannot be raised, the early creditors will receive nothing but worthless air. This is probably the core of OPNX’s latest series of confusing operations.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Quick Look at the Cosmos Ecosystem Project TVL Data Changes

- LianGuai Daily | Twitter may change its logo to X-related; Terraform will release 9 projects but will not launch new tokens.

- A Review of the 20 Award-winning Projects at ETHShanghai 2023 Hackathon

- Telegram Bots are rising unexpectedly, which projects are worth paying attention to?

- Review of the 20 award-winning projects from ETHShanghai 2023 Hackathon

- Bankless Inventory of Eight Important Project Progresses in EthCC 2023

- ConsenSys’s zkEVM Linea mainnet goes live, providing an overview of its ecosystem development status.