2019 Blockchain Industry Annual Report: Technology Giants and Governments of Big Powers Enter, Blockchain Technology Will Transform the World

Editor's Note: The original title was "Standards Consensus Annual Report 2019"

Overview

This article first displays various types of data (bitcoin prices, news hotspots, macroeconomics, etc.), and then uses logical derivation to connect these data in series to reveal the logic behind these phenomena for readers.

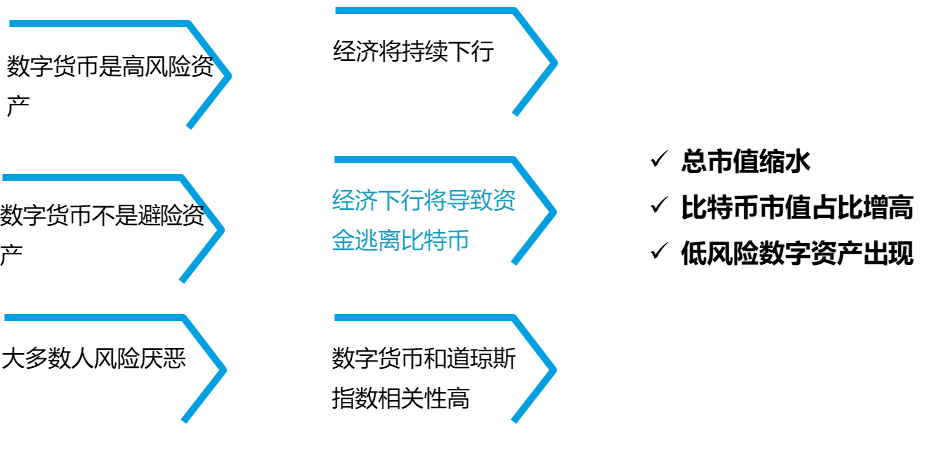

Under the risk-averse investment preference of most investors, the downturn in the macro economy will lead to a gradual reduction in investment in high-risk assets. The total market value of the digital currency market represented by bitcoin will gradually decrease, and the proportion of bitcoin market value will increase again. In order to meet the needs of investors, the digital currency market will have a large number of low-risk digital assets. In the process of scientific and technological progress, blockchain projects will compete with other technologies and projects, and projects with weak foundations and technologies will be rapidly eliminated. Although the current blockchain technology has not yet achieved improved production efficiency, the trend has emerged and major companies have already Began to apply blockchain technology for multiple attempts, and blockchain technology will eventually transform the world.

Report

2019 review of the blockchain industry

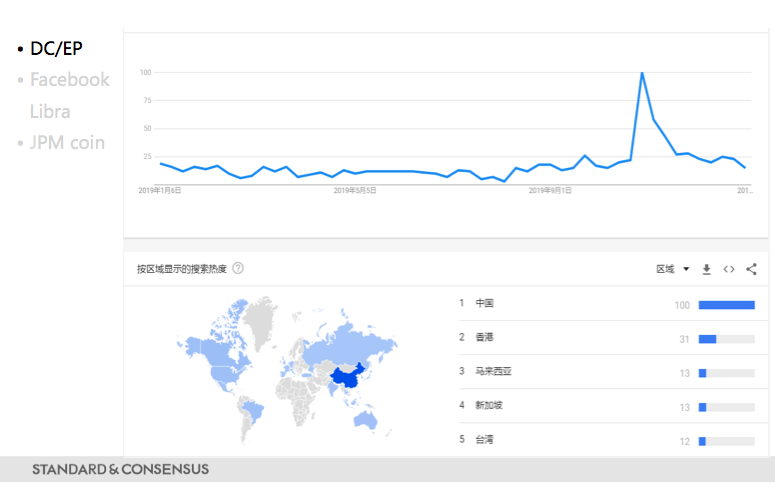

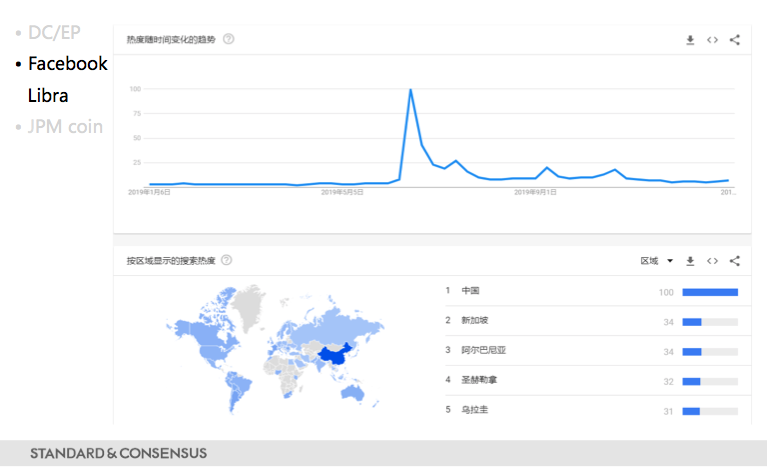

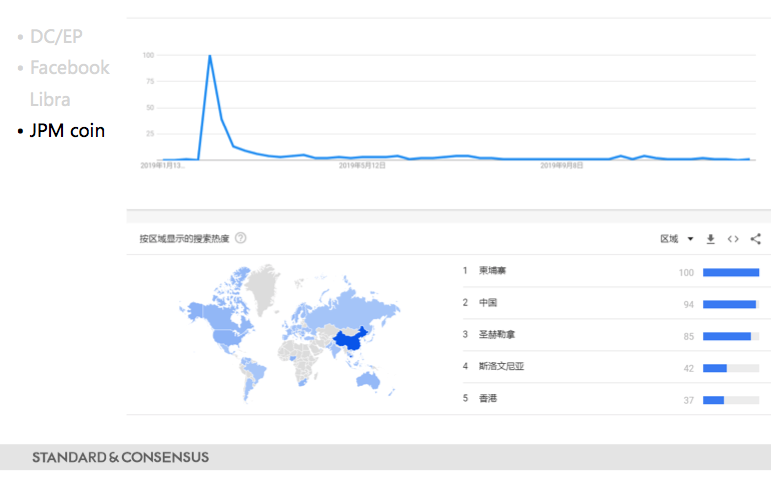

After the resumption of 2019, the entry of the technology giants and the governments of the major powers has brought unprecedented attention to the blockchain industry and achieved short-term prosperity. The standard consensus considers DC / EP, Facebook, Libra, and JPM Coin to be major landmark events throughout the industry. From the statistics, it can be seen that most of the highest search popularity comes from China, and the search popularity increases and decreases rapidly and fluctuates greatly.

- Zhu Jiaming: Blockchain will be the basic structure to rebuild human trust

- Global Fintech Financing Report 2019: Financing Amount Exceeds 261.9 Billion, Blockchain Financing Leads Amount

- Supervision boosts Fintech innovation, blockchain application tide starts

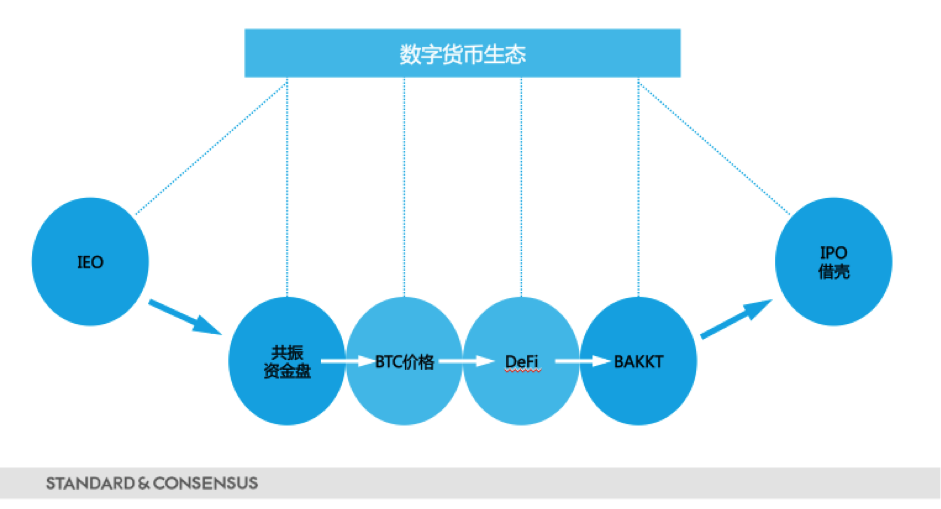

As far as the ecology of the currency circle is concerned, we have found through data analysis that there are many concepts and they have a high degree of popularity after the new concept was created, but the duration is short. The market in 2019 started with IEO, and then various resonant concept tokens appeared, followed by the BTC price soaring to 14,000 and then falling back to $ 7,000. In the middle, the concept of DeFi and the concept of Stake have been heated up again. However, few people have mentioned it at present. At the beginning of the launch of BAKKT, its trading volume was very frustrating, with daily single-digit volume. Jianan Yunzhi and Huobi started to enter the traditional capital market, but their market performance was unsatisfactory.

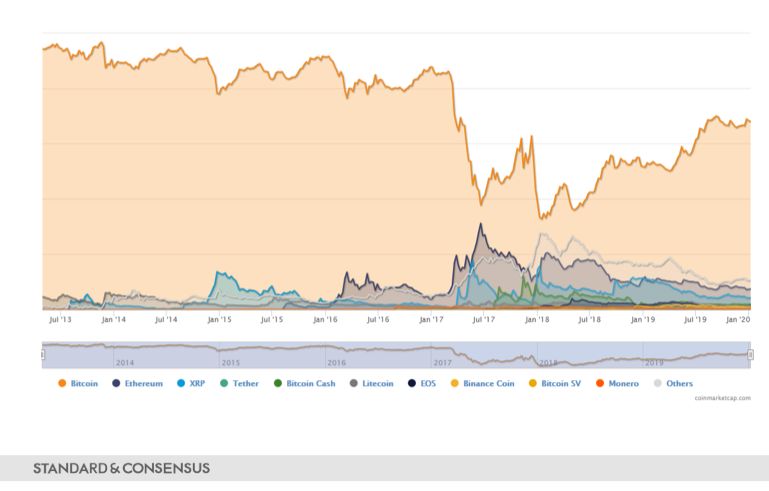

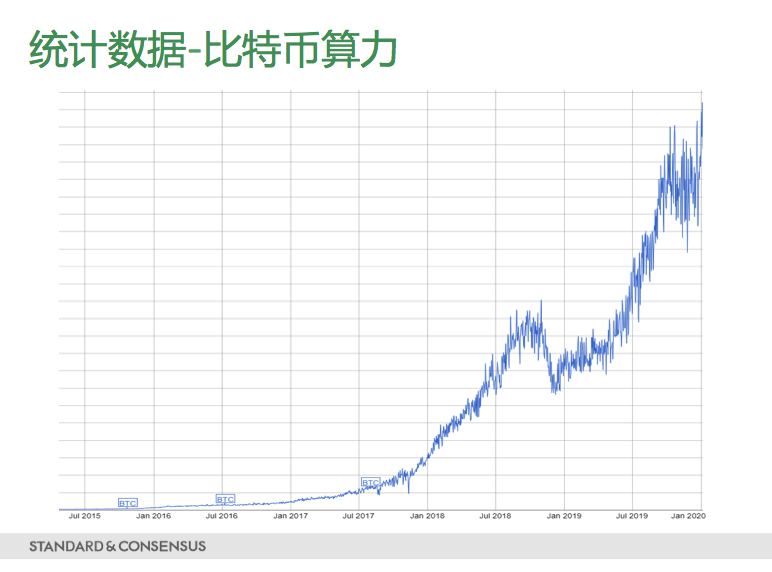

According to CoinMarketCap data, the total market value of digital assets has fallen from a peak of 2 trillion yuan to 1.5 trillion yuan. Interestingly, the market share of BTC increased from the lowest value in 2017 to 68%. At the same time, the computing power of BTC broke a new record high and exceeded 100 EH / s. Mining is a typical traditional manufacturing industry, and its rise and fall are closely related to the overall economy.

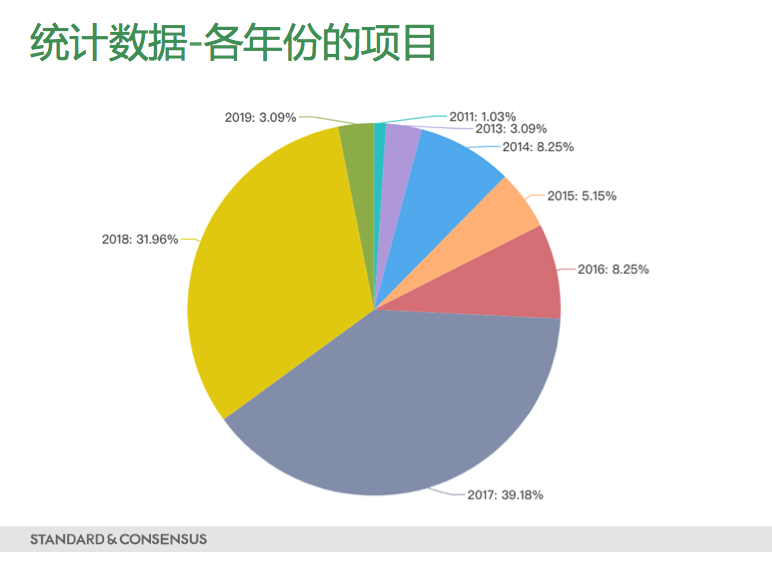

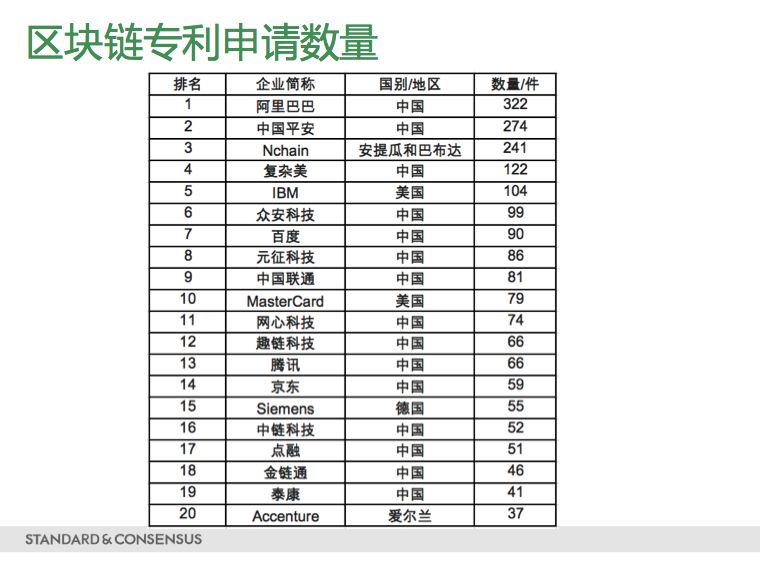

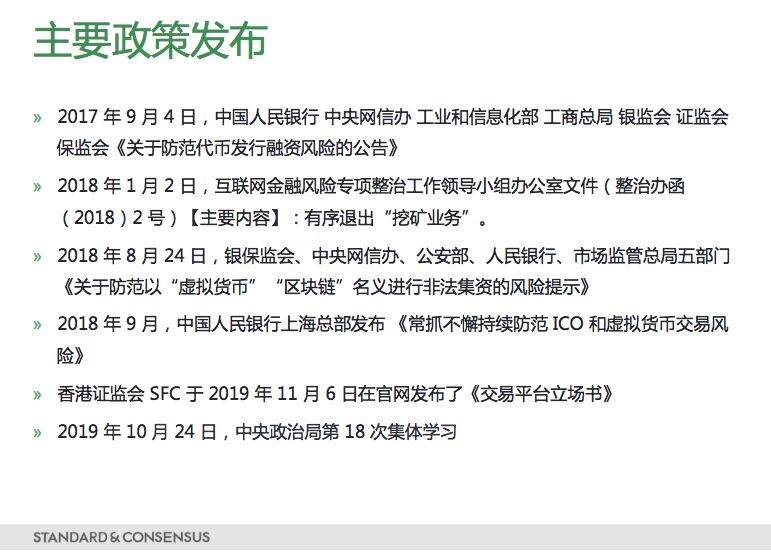

According to CoinMarketCap data, the top 100 digital currency project landing trading platforms by market capitalization are mainly concentrated in 2017 and 2018, and the digital currency projects landing on the trading platform in 2019 have returned to the level of 2013, and the project development is slow and in situ . While traditional companies are gradually exerting their strengths, mainly Internet technology and financial companies, only Alibaba has applied for 322 blockchain patents. The entry of the "regular army" will change the industry structure and accelerate the opening and landing of the scene. In terms of policy, the CCP ’s collective learning of blockchain-related knowledge is far beyond expectations, but the prevention of token financial risks is still in a state of prohibition and strong supervision.

Macroeconomic Review 2019

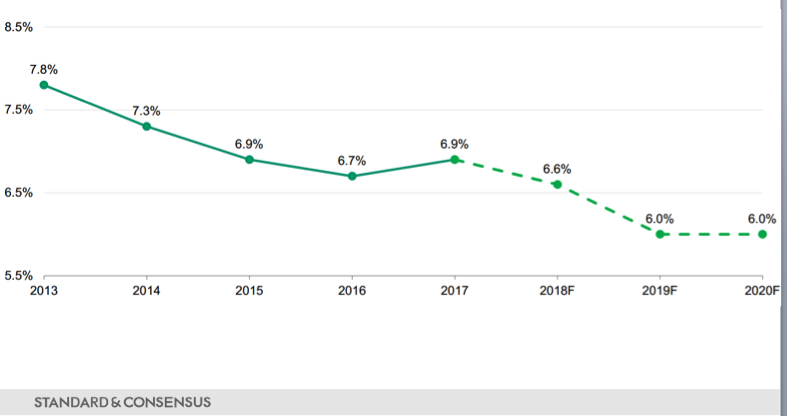

For China, the macroeconomic downward trend in the next few years is obvious. Local government / enterprise debt continues to grow, GDP growth slows, land transfer fees fluctuate, policy adjustments, and actual trade-offs.

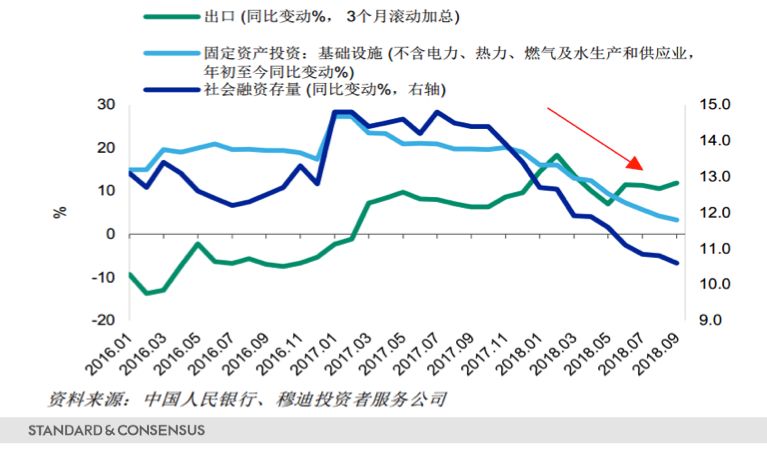

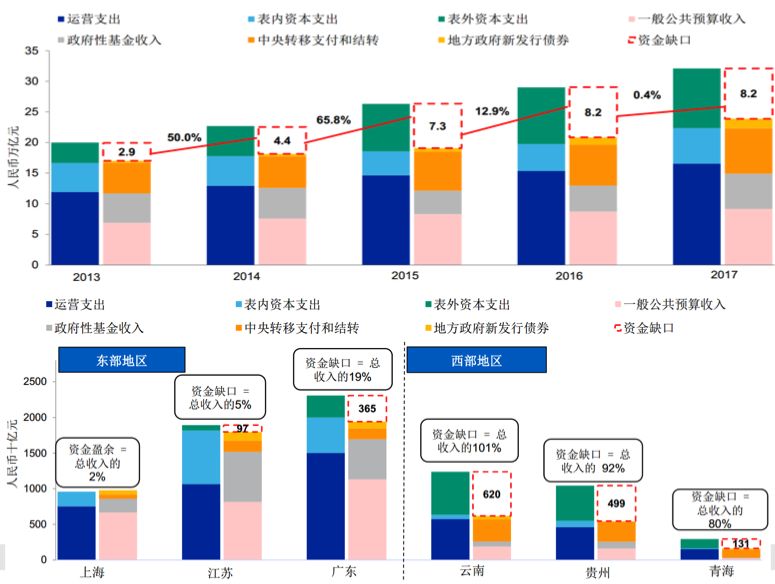

The "troikas" that drove China's economic growth in the early years were investment, consumption and exports. At present, exports and investment in infrastructure are gradually declining, putting great pressure on economic growth. In addition, the local capital gap is also increasing year by year. The proportion of capital gap in the eastern region is relatively small, while the capital gap in the western region has reached more than 80% of the total income. The trend of shortage of social funds is also becoming more apparent.

These seemingly cluttered and unrelated types of data have deeper logic behind them to keep them connected. We will connect these data based on logical derivation.

Intrinsic logic and trends

We will comb the internal logic of various data and events from the perspective of the currency circle ecology and industry.

Data and Internal Logic from the Perspective of the Ecological Circle

Many people have suggested that Bitcoin is a safe-haven asset, and during the conflict between the United States and Iran, the price of Bitcoin has also increased to a certain extent with gold and other hedge assets. But in fact, digital currencies such as Bitcoin are still high-risk assets, and the current market value of digital assets is affected by investor risk appetite. And the macroeconomic and external environment will also profoundly affect the scale of digital assets. In the process of economic growth, technology is the first productivity. Blockchain projects are facing other technologies and project competition at the same time. Although projects that use blockchain technology to improve production efficiency have not yet appeared, the trend has emerged.

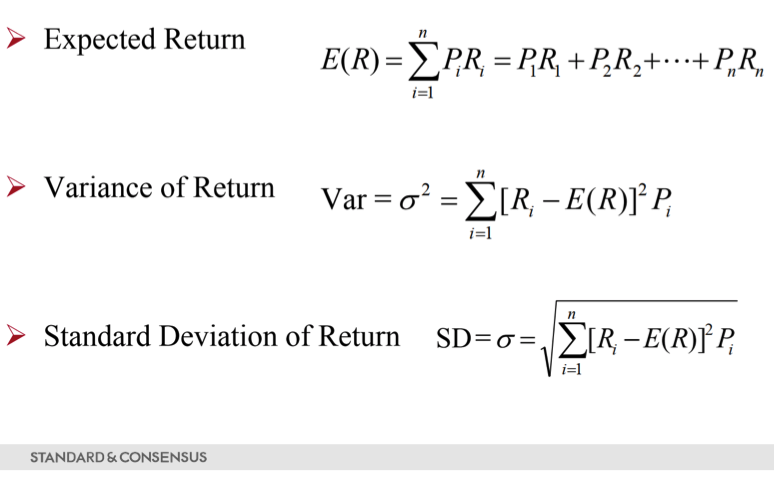

Risk is defined as the uncertainty of expected returns. Standard deviation is interpreted as a measure of risk. The mathematical expression formula is:

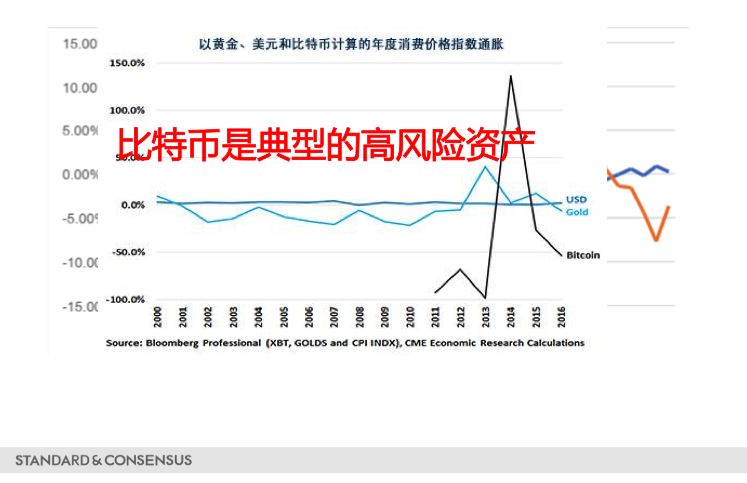

From the perspective of asset volatility, the higher the volatility, the more violent the price of financial assets, and the greater the uncertainty of the return on assets; the lower the volatility, the smoother the volatility of financial asset prices, and the The greater the certainty. Gold has the potential to be a tool for long-term inflation hedging, especially in response to changes in US CPI, especially during periods of high inflation. The limited stock of gold and the lack of short-term price elasticity increase the perception of gold as a hard currency. In the case of high inflation, gold can effectively maintain assets against depreciation, so it is called a safe-haven asset. According to the volatility trend after the analysis of the data, it can be found that under the same situation with the US dollar, the volatility of Bitcoin is much higher than the volatility of gold and the US dollar. At the same time, when analyzing the trend of Bitcoin and gold, it can be seen that there is no correlation between the trend of Bitcoin and gold prices, which shows that Bitcoin is a typical high-risk asset.

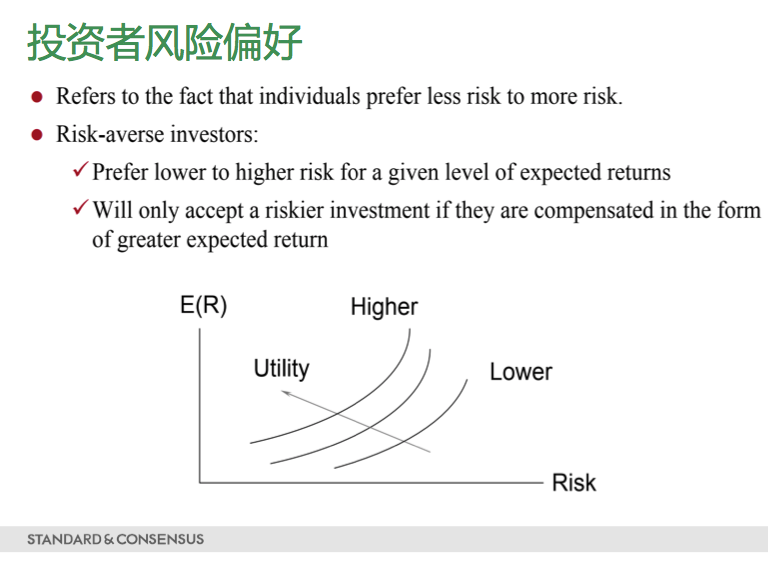

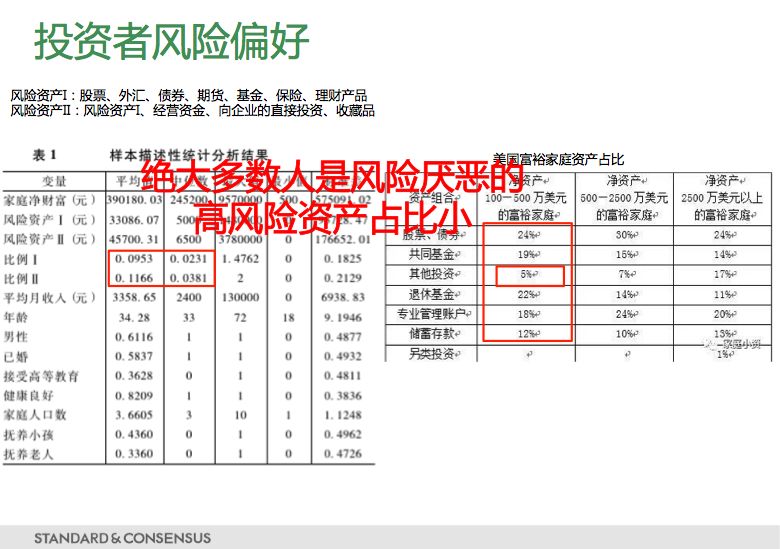

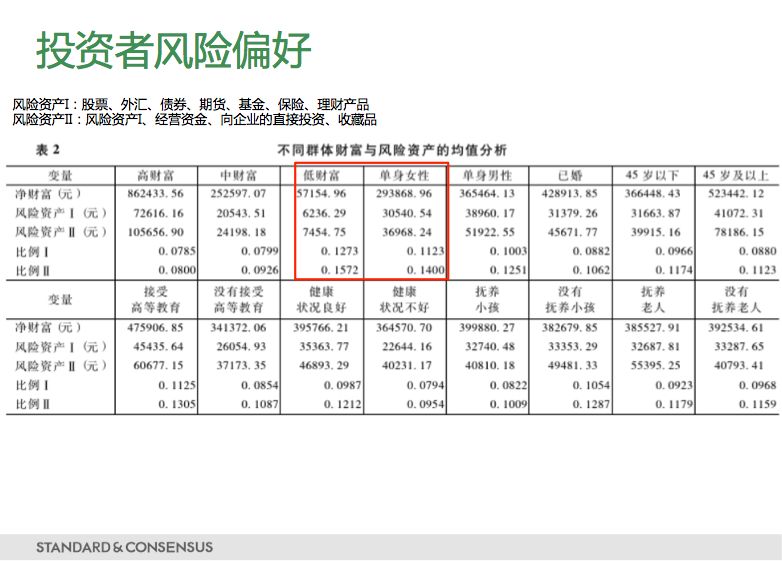

The vast majority of investors are risk-averse, and the proportion of high-risk assets is small.

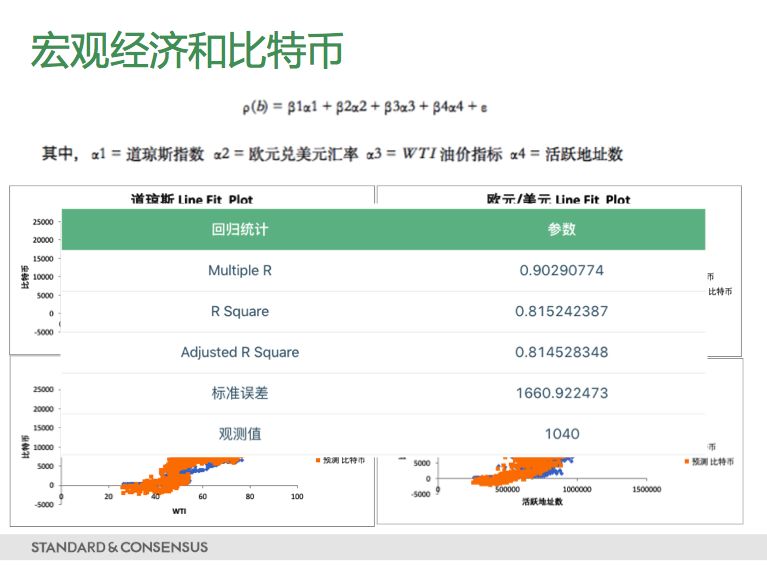

At the same time, according to statistics, global macroeconomic and financial development plays a significant role in determining the price of Bitcoin, including variables such as stock exchange indexes, exchange rates, and oil prices. There is no correlation between Bitcoin price and precious metals such as gold, but there is a clear correlation with the Dow Jones Index. For details, see our research report on the correlation between Bitcoin and gold

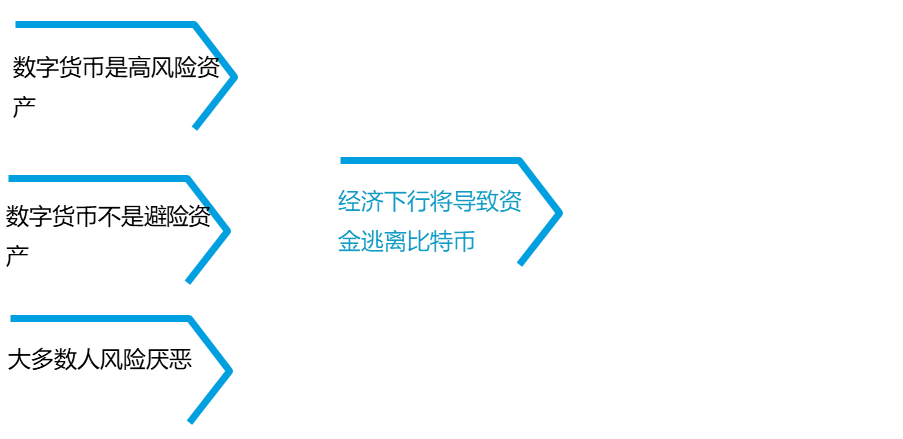

It can be inferred that with the economic downturn, investors will withdraw wealth from high-risk assets and allocate them to low-risk assets. As a high-risk asset, digital currency is in the risk aversion range of most investors. Therefore, funds will continue to flee the digital currency market led by Bitcoin, which will cause the total market value of the digital currency market to decrease. Investors staying in the digital currency market will invest in bitcoin with a relatively low risk, resulting in a further increase in the market value of bitcoin. This will eventually lead to the emergence and prosperity of low-risk digital assets.

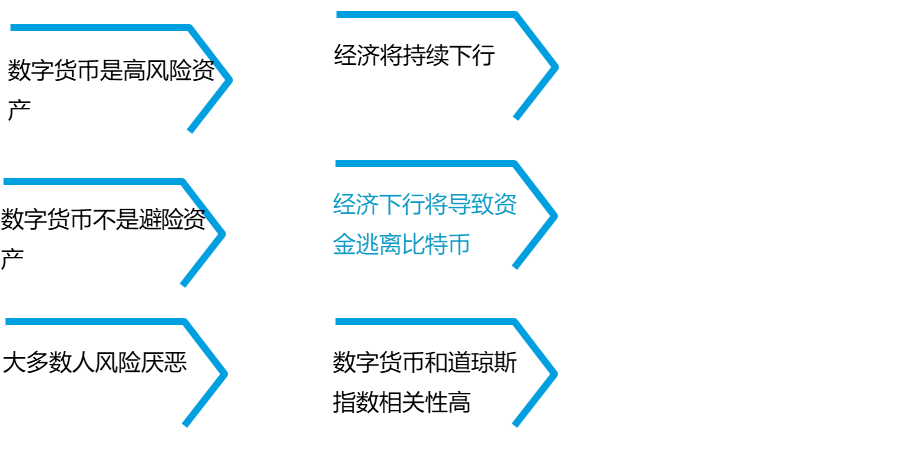

Digital assets such as Bitcoin are high-risk assets, not safe-haven assets, and most people are risk-averse, causing funds to flee Bitcoin in the event of an economic downturn  Economic indicators such as Bitcoin and Dow Jones are strongly correlated, and the economy continues to decline

Economic indicators such as Bitcoin and Dow Jones are strongly correlated, and the economy continues to decline  These conditions will lead to a reduction in the total market value, an increase in the market share of Bitcoin (hedging effect Bitcoin is less risky than other digital assets), and low-risk digital assets will meet user needs

These conditions will lead to a reduction in the total market value, an increase in the market share of Bitcoin (hedging effect Bitcoin is less risky than other digital assets), and low-risk digital assets will meet user needs

Reviewing JPM Coin from an industry perspective

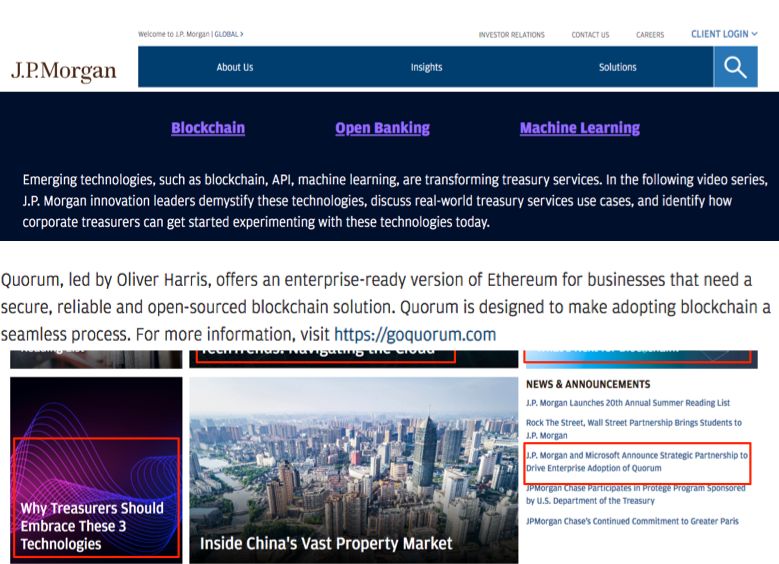

On February 14, 2019, JPMorgan Chase announced in a high profile that it was the first U.S. bank to successfully issue cryptocurrencies anchored in fiat currencies. This move represents the formal start of the traditional financial power to build a new financial order. From the homepage of JPMorgan Chase, it can be seen that it attaches great importance to the role of technology in finance, especially blockchain technology.

JPM Coin White Paper

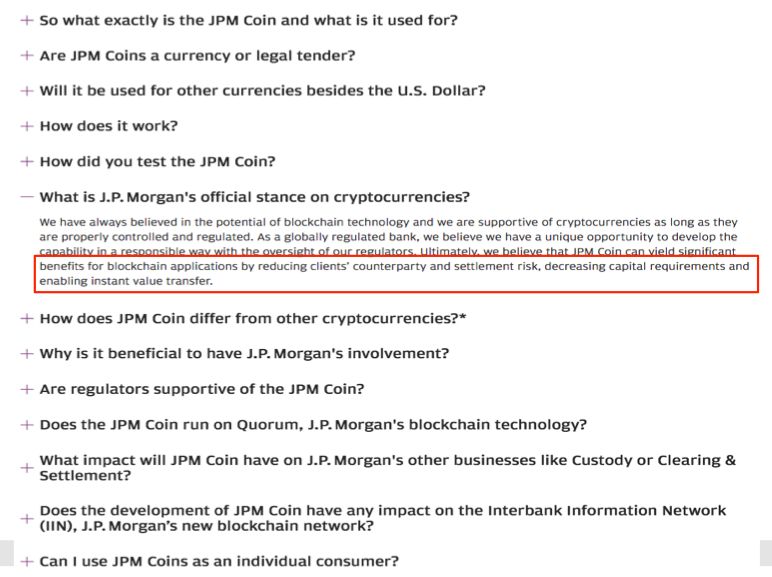

The JP Morgan JPM Coin white paper stated that their application of blockchain technology will benefit from reducing counterparty risk, settlement risk, reducing capital requirements and being able to trade quickly. Are these characteristics of JPM Coin required by financial institutions like commercial banks? We will further explain the importance of risk cost in banking business through business analysis of commercial banks.

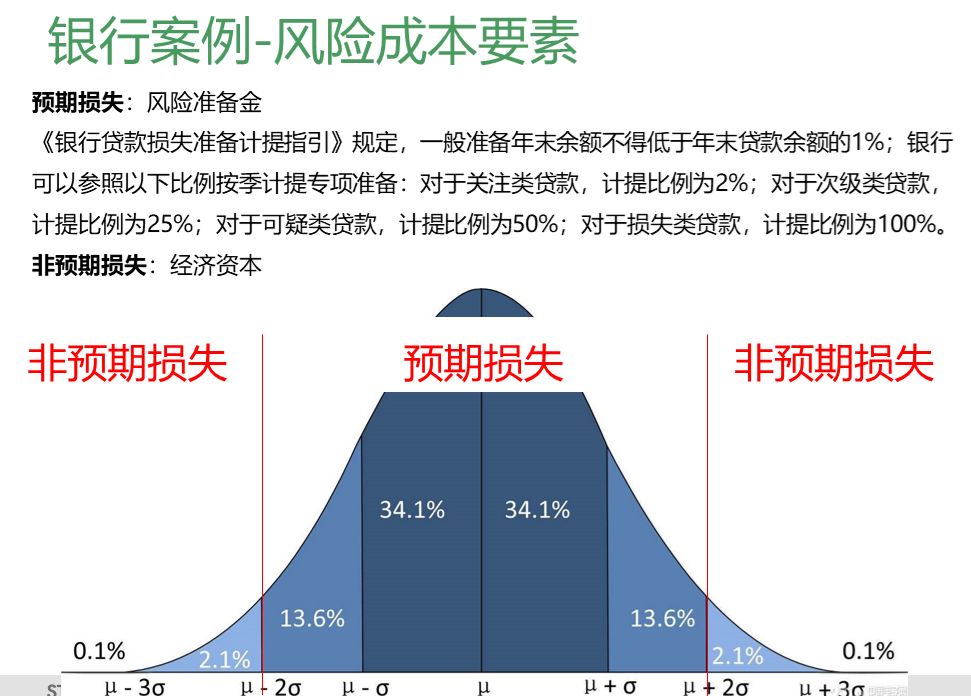

At present, the main income composition of banks mainly comes from net interest margin income, but it is in a crude operation in terms of risk control of loan loss provisions. According to statistics, the average interest rate of domestic banks is about 85%, and the net interest margin is less than 3%. This means that the spread will seriously affect bank profits. With such a low net interest margin, fluctuations in costs will lead to greater fluctuations in profits. Among the components of cost, risk cost is an important component. The risk cost situation is shown in the figure below.

Risk consists of two types: expected loss and unexpected loss. The method of dealing with expected losses is to make provision for losses, and the method of dealing with unexpected losses is economic capital.

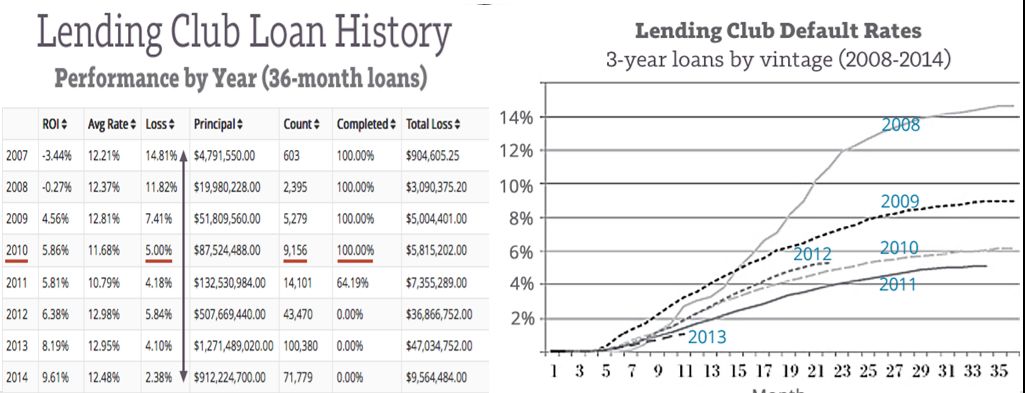

According to data from Lending Club, its default rate and losses are high.

According to the "Guide to Withdrawing Provisions for Bank Loan Loss Provisions", the year-end balance of general preparations must not be less than 1% of the year-end loan balance; banks can refer to the following ratios to make special provisions on a quarterly basis; for concerned loans, the ratio is 2%; With regard to substandard loans, the withdrawal ratio is 25%; for suspicious loans; the withdrawal ratio is 50%; for loss loans, the withdrawal ratio is 100%. This kind of loan loss preparation is difficult to prevent large-scale risks, or unnecessary capital preparation waste during this operation. Only the development of technology can solve the above problems.

According to the previous business analysis, the risk cost of commercial banks affects profits. If JP Morgan Chase uses the blockchain technology (JPM Coin) to effectively reduce the risk cost, it will obtain huge benefits from the blockchain technology.

Conclusion

Although blockchain technology has not been able to improve productivity on a large scale, the trend has emerged, and more and more companies are using blockchain technology to reduce costs and improve efficiency. Such as DC / EP, JPM Coin, Libra, securitization STO, intellectual property protection, logistics traceability, etc., the emergence of these projects that significantly improve production efficiency will lead to accelerated differentiation of blockchain projects and explore blockchain in more aspects Application scenarios of technology.

Some views suggest that bitcoin has certain hedging properties, but the price fluctuations of bitcoin compared with gold are huge, proving that he is a high-risk asset rather than a hedging asset. In the investment process, the vast majority of investors are risk-averse, so with the decline of macroeconomic data, investors will further reduce the investment in high-risk assets; and digital assets represented by Bitcoin are strongly related to economic indicators. In the case of resonance, the funds will escape from digital assets, and the escape for other digital currencies will be faster than Bitcoin. Therefore, the total market value of digital assets will further shrink in the future, and the market share of Bitcoin will continue to rise. In order to meet the needs of investors, low-risk digital assets will flourish.

In addition, because the current blockchain projects are still unable to effectively improve production efficiency, the emergence of such projects as Libra that can improve production efficiency will lead to accelerated differentiation of blockchain projects and the blockchain will begin to transform the world.

risk warning:

- Beware of illegal financial activities under the banner of blockchain and new technologies. The standard consensus resolutely resists illegal activities such as illegal fundraising, online pyramid schemes, ICOs, various variants, and dissemination of bad information.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 2020 high-profile aviation bitcoin hopes to dedicate the strongest first quarter performance in nearly eight years

- Biyuan Chain released a white paper on MOV stable financial system, which can truly realize multi-asset mortgage

- Shanghai: Support the establishment of the fintech company in Shanghai by the Digital Currency Research Institute of the People's Bank of China

- The Supreme Court of India is preparing to hear the case of "crypto industry vs Indian central bank". Can the country's crypto ban be lifted?

- Bitwise withdraws application to SEC, bitcoin ETF approval is hopeless?

- Investment and financing inventory of the blockchain industry in 2019: total domestic financing has fallen by 40%, and institutions are more cautious

- Black-producing gang exploits Apache Struts 2 vulnerability and SQL blast control server mining