Global blockchain private equity financing of 21.612 billion yuan in 2019

Article 丨 Interlink Pulse Academy

As the year approaches, global cryptocurrency financing has once again fallen into a doldrums, and blockchain private equity financing has begun to heat up.

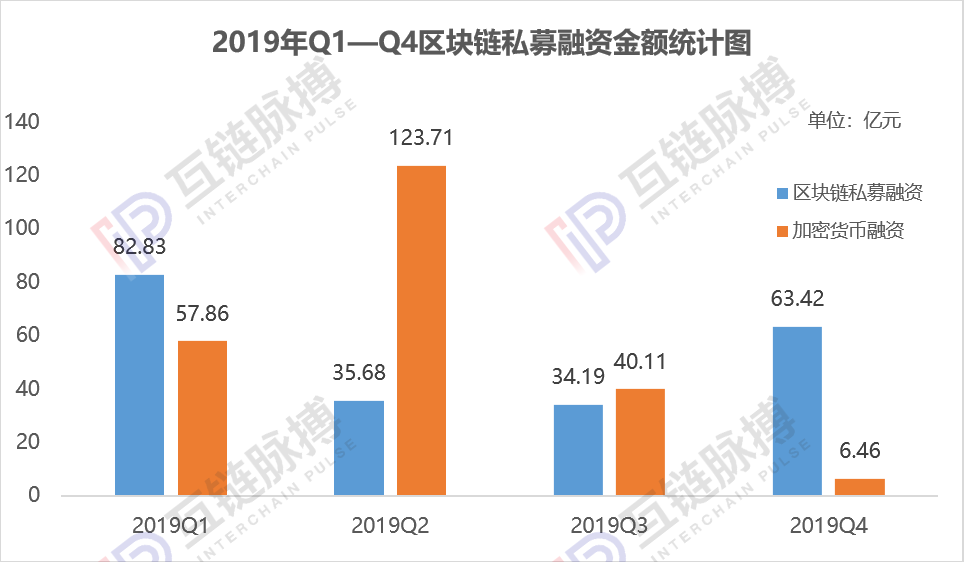

According to the statistics from the Interchain Pulse Research Institute (IPRI), the total amount of global private equity financing of blockchain in 2019 is approximately 21.612 billion yuan, of which the financing amount in the first quarter was 8.283 billion yuan, and the second and third quarters were respectively reduced to 3.568 billion yuan and 3.419 100 million yuan, rose to 6.342 billion yuan in the fourth quarter, which can be described as a roller coaster-like development.

China and the United States are still the main battlefields of global blockchain private equity financing. China has the largest number of financing projects, but the U.S. financing projects attract the most gold, and over 60% of the world's funds are invested in U.S. blockchain projects. From the perspective of industry distribution, public chains, cryptocurrency related, exchanges and finance are the four most popular areas of capital.

- Everything you want to know about NFT (non-homogeneous tokens) is here

- Jinan City officially launches "Blockchain + invalid resident ID card verification and valid resident ID card information application service" system

- Babbitt Column | Trustworthy Lightning Network: Or Solve the Problem of Expensive and Slow Bitcoin Transfers

(Drawing: Interlink Pulse Academy)

China has the highest number of projects in the world

On the whole, the global blockchain private equity financing market has been in a hot and cold state in 2019.

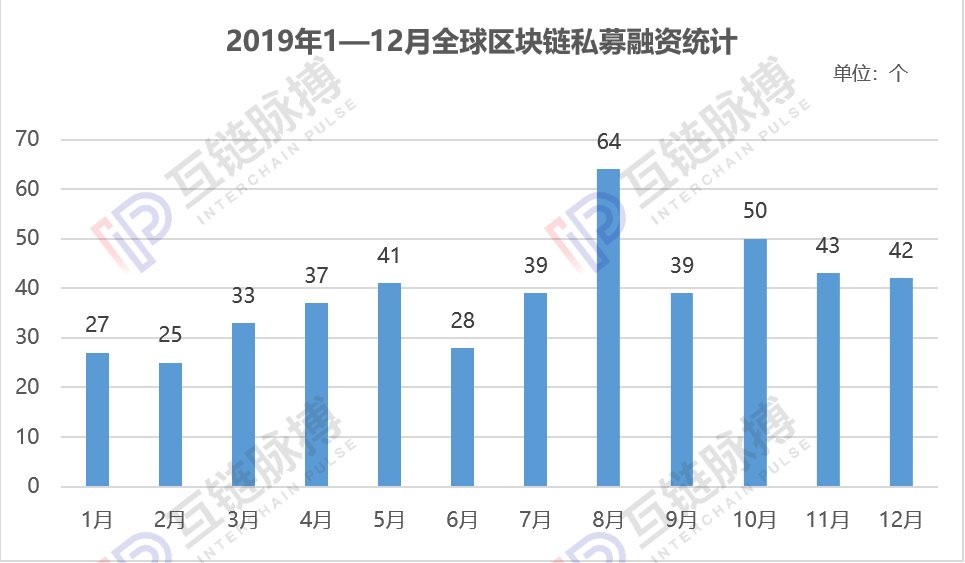

According to the statistics of the Interchain Pulse Institute (IPRI), from January to December 2019, a total of 468 global blockchain private equity financing projects, of which the number of projects in January, February and June are the smallest, and the monthly financing projects are low. At 30, it reached its peak in August, with a total of 64 financing projects in the month. In terms of financing amount, it reached the highest peak in March, with a monthly financing amount of up to 4.423 billion yuan, and then fell into a downturn. After entering the fourth quarter, the phenomenon of hot and cold alternation became more apparent.

(Drawing: Interlink Pulse Academy)

(Drawing: Interlink Pulse Academy)

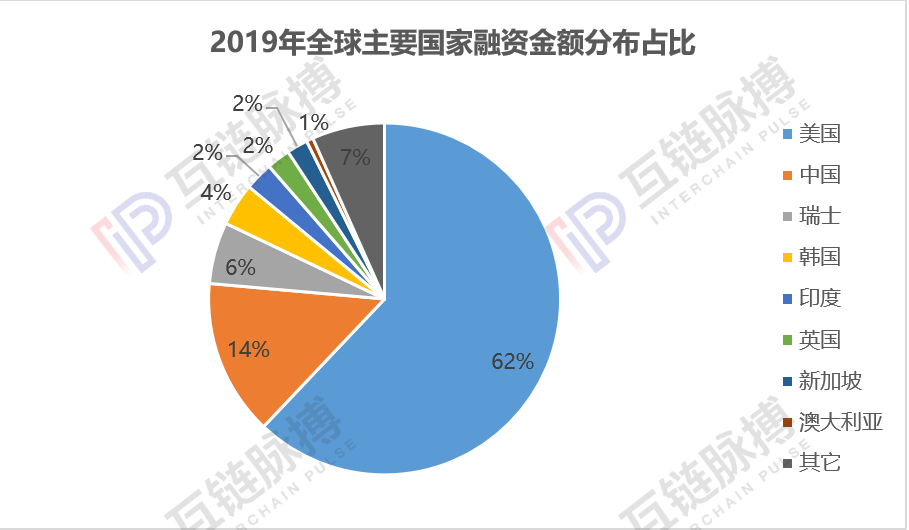

In terms of geographical distribution, China and the United States are absolute leaders, both in terms of the number of financing projects and the amount of financing. Among them, the number of China's blockchain financing projects ranks first in the world, but the amount of financing is far less than the US market.

According to the statistics from the Interchain Pulse Institute (IPRI), from January to December 2019, China disclosed 166 blockchain private equity financing projects, accounting for about 35.5% of the global total, of which the publicly disclosed financing amount was about 3.106 billion yuan. ; While the United States disclosed 122 blockchain private equity financing projects throughout the year in 2019, accounting for about 26%, but its publicly disclosed financing amount was as high as 13.46 billion yuan, 4.3 times that of the Chinese market.

Singapore, the United Kingdom, and South Korea are the most active countries in blockchain private equity financing after China and the United States. In 2019, there are 46, 17 and 13 financing projects in Singapore, the United Kingdom and South Korea, respectively, but the financing amount is not large. The private equity financing of the three blockchains is only 421 million yuan, 469 million yuan and 850 million yuan.

In terms of the ability to attract gold, the United States still occupies the top spot. In 2019, the US blockchain project took 62% of the global private equity financing.

(Drawing: Interlink Pulse Academy)

(Drawing: Interlink Pulse Academy)

The head effect is obviously more than 60% of the funds invested in the four major areas

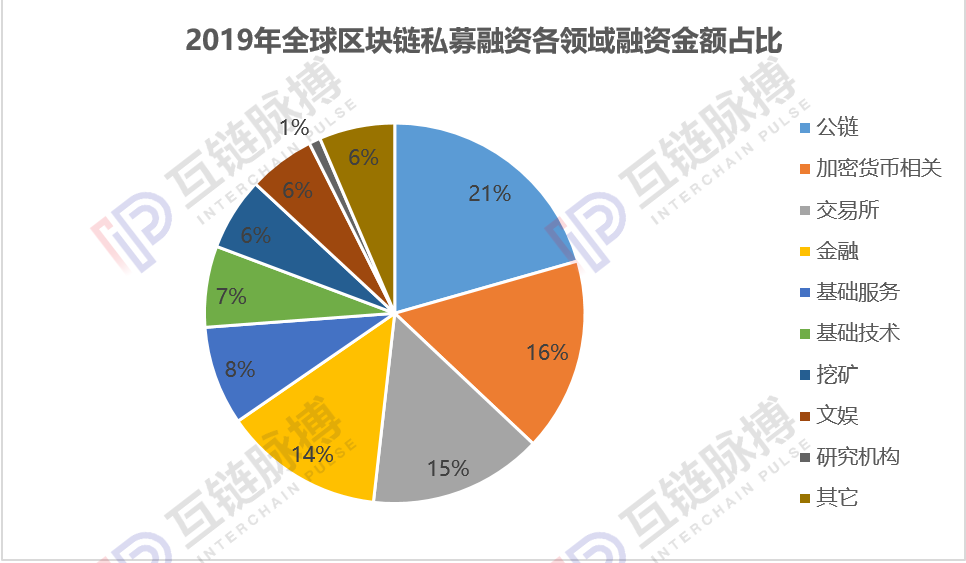

Of the 468 projects that were financed in 2019, the four major areas of public chain, cryptocurrency related, exchanges and finance are the most favored by capital.

According to the statistics from the Interchain Pulse Institute (IPRI), in 2019, the total amount of financing in the public chain, cryptocurrency related, exchange and financial fields was 4.446 billion yuan, 3.557 billion yuan, 3.19 billion yuan, and 2.944 billion yuan. The financing amount accounts for up to 66%.

(Drawing: Interlink Pulse Academy)

(Drawing: Interlink Pulse Academy)

It is worth noting that the head-on effect of the blockchain private equity market is very obvious.

Among the 468 financing projects, there were 56 financing projects with a financing amount of more than 100 million yuan, accounting for about 12%, of which 5 were 1 billion yuan. The remaining 88% of financing projects are mainly at the level of ten million yuan and million yuan.

Among the 1 billion yuan financing projects in 2019, the more representative ones include the 200 million US dollars (about 1.375 billion yuan) financing raised by the public chain Ripple; the 160 million US dollars obtained by the US blockchain venture capital agency Pantera ( (Approximately RMB 1.07 billion), and US $ 182 million (approximately RMB 1.22 billion) in financing from the US cryptocurrency exchange Bakkt.

The billion-dollar financing projects are mainly distributed in the fields of exchanges, public chains, finance, and mining.

For example, in the field of exchanges, in addition to Bakkt, India ’s BillDesk trading, Malaysia ’s other GOOD CHAIN exchanges, and the United States ’Symbiont exchanges have received Rs 6.02 crore (approximately 564 million yuan) and US $ 23 million (equivalent to 159 million yuan ) And USD 20 million (about RMB 134 million) financing.

In the field of public chain, the US public chain ThunderCore, Singapore public chain ATII and China public chain DACH Dash car chain have successively received 336 million yuan, 143 million yuan and 138 million yuan of financing.

In terms of finance, the Figure, Zero, and Compound_finance projects in the United States received 435 million yuan, 181 million yuan, and 176 million yuan in financing, respectively.

In the field of mining, Chinese mining machine manufacturer Jia Nan Yunzhi, American Catpool and Layer1 respectively won 672 million yuan, 30 million US dollars (about 200 million yuan) and 50 million US dollars (about 350 million yuan). ) Financing.

This article is the original [Interlink Pulse], the original link: https://www.blockob.com/posts/info/32757 , please indicate the source when reproduced!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Russian officials: cryptocurrency bill expected to pass this spring, will define digital assets

- Japan's Financial Services Agency: Proposes to reduce leverage on crypto margin trading to less than double, or implement this spring

- How does the secret whale "liquidator" help DeFi run smoothly?

- Bitcoin hashrate continues to climb, rising 167% over the past year

- Babbitt Site | Li Lihui: We should be more wary of global digital currencies, and super-sovereignty and super-banking will lead to financial disruption

- Facing quantum computing threatens digital currency to grow in confrontation

- Will it pull back after the rally? How long can this wave of market last