Supervision boosts Fintech innovation, blockchain application tide starts

Source: Keith Communication

Summary

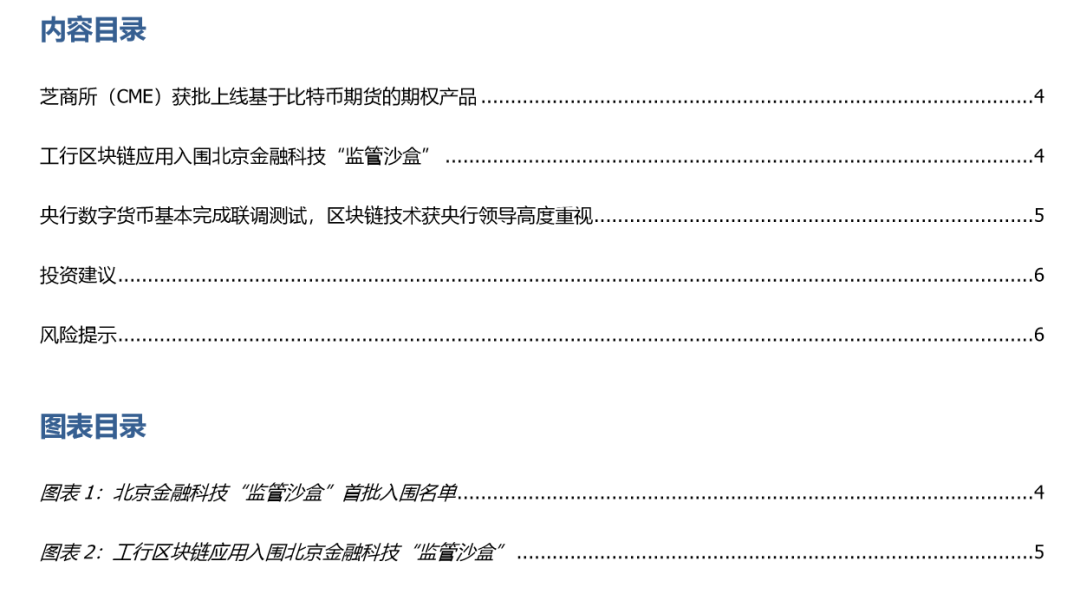

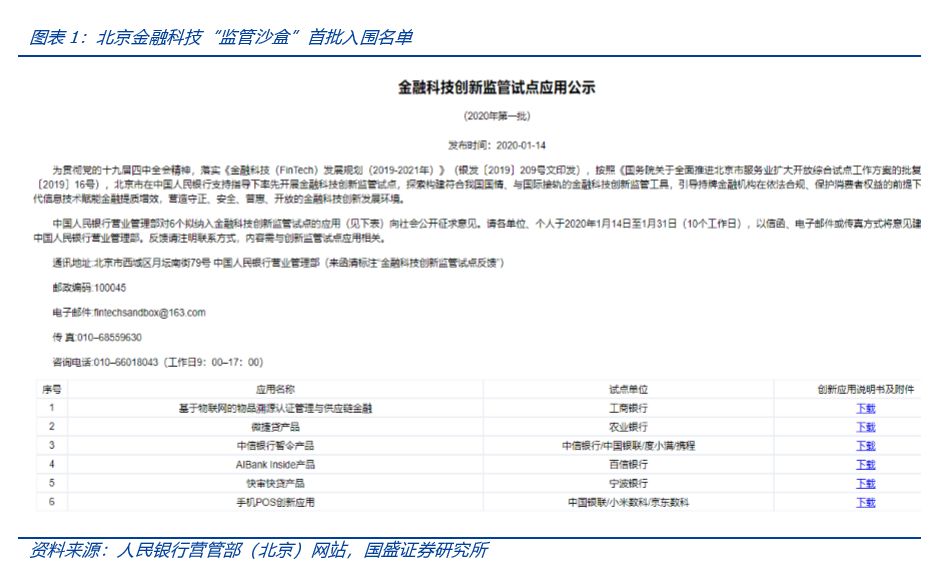

The Business Management Department of the Central Bank announced the first batch of shortlisted projects for the financial technology "supervisory sandbox" in Beijing, and ICBC's blockchain traceability application was shortlisted. On January 14, the six projects announced by the central bank involved innovations such as the Internet of Things, micro-credit, smart banking, and mobile POS. ICBC's "Internet of Things-Based Authentication Management and Supply Chain Finance" was shortlisted. The application will collect data such as manufacturing, quality inspection, inventory, logistics, and sales of products based on the Internet of Things, which cannot be tampered with and recorded on the blockchain. ICBC said that after the application is fully promoted, it will involve more than 300,000 individual customers, more than 1 million transactions per year, and an annual transaction value of more than 50 million yuan. The “sandbox” is a pilot for innovation supervision. It insists on licensed operation, encourages the participation of multiple themes, sets flexible boundaries, and reserves space for innovation. Earlier, Hong Kong, China launched a fintech regulatory sandbox. We believe that the successive launch of regulatory sandboxes in Hong Kong and Beijing will drive the tide of blockchain applications.

- 2020 high-profile aviation bitcoin hopes to dedicate the strongest first quarter performance in nearly eight years

- Biyuan Chain released a white paper on MOV stable financial system, which can truly realize multi-asset mortgage

- Shanghai: Support the establishment of the fintech company in Shanghai by the Digital Currency Research Institute of the People's Bank of China

The central bank's digital currency has basically completed the joint debugging test. Blockchain technology has been highly valued by the central bank's leadership. On January 10th, the People's Bank of China released a paper "Inventory of the Bank of China's 2019 Fintech", the article stated that the central bank basically completed the top-level design, standard formulation, and functions of legal digital currencies on the premise of adhering to two-tier operation, M0 substitution, and controlled anonymity Research and development, joint testing, etc .; will conduct solid research on digital currencies, and track and study the international cutting-edge information on digital currencies.

Earlier, on December 9, 2019, Caijing magazine reported that the digital currency of the People's Bank of China (DC / EP) is being piloted in Shenzhen and is already on "the eve of birth", and is about to enter the life application scene. It is reported that 1) DC / EP is led by the central bank's currency, gold and silver bureau, and the central bank's digital currency research institute has implemented it. The Digital Currency and Anti-Counterfeiting Management Office under the Currency Gold and Silver Bureau is the only official office related to DC / EP. 2) The pilot institutions include the four major state-owned commercial banks of Industry, Agriculture, China, and Construction, and the three major operators of Mobile, Telecom, and China Unicom. 3) The pilot scenarios include transportation, education, medical treatment, and consumption. They will reach C-end users. The pilot banks can choose pilot scenarios based on their own advantages. 4) DC / EP is being piloted in Shenzhen. The pilot plan is divided into two phases: a small-scale scene closed pilot at the end of this year, and a large-scale promotion in Shenzhen next year. 5) Testing of DC / EP related standards and payment system access are progressing simultaneously. 6) DC / EP is also expected to land in Suzhou. Recently, the Yangtze River Delta Financial Technology Co., Ltd., a subsidiary of the central bank, is urgently recruiting blockchain-related talents. 7) The four major banks have set up DC / EP closed development project teams in Beijing.

Blockchain is a DC / EP alternative technology, which has received great attention from the central bank's digital currency leaders.

-The central bank's magazine "Financial Electronics" published a signed article by Di Gang, deputy director of the Digital Currency Research Institute of the Central Bank, saying that blockchain technology is expected to solve many difficulties in the field of current trade financing.

On January 13th, the Peking University International Development Institute held a seminar on "the future of digital currencies" and a press conference on "digital currencies-reading books for leading cadres." Li Lihui, leader of the Blockchain Working Group of the China Internet Finance Association, and the Institute of Finance of the Chinese Academy of Social Sciences Leaders and scholars including Assistant Minister Yang Tao attended the meeting.

CME Group Approved to List Bitcoin Futures-Based Options Products

ICBC's Blockchain Application Shortlisted in Beijing Financial Technology's "Supervision Sandbox"

This application will collect product manufacturing, quality inspection, inventory, logistics, sales and other data based on the Internet of Things, and it will be recorded on the blockchain irrevocably, establishing a trusted alliance chain mechanism. The application is planned to be officially launched in January 2020. ICBC said that after the application is fully promoted, it will involve more than 300,000 individual customers, more than 1 million transactions per year, and an annual transaction value of more than 50 million yuan. The “sandbox” is a pilot for innovation supervision. It insists on licensed operation, encourages the participation of multiple themes, sets flexible boundaries, and reserves space for innovation.

ICBC stated in the "Partnership Agreement" attached to the application note that the application provides customers with online transaction services through ICBC's e-commerce platform, with ICBC's service network covering 600 million individual customers worldwide, achieving straight-through and precision Marketing.

Earlier, on December 9, 2019, Caijing magazine reported that the digital currency of the People's Bank of China (DC / EP) is being piloted in Shenzhen and is already on "the eve of birth", and is about to enter the life application scene. It is reported that 1) DC / EP is led by the central bank's currency, gold and silver bureau, and the central bank's digital currency research institute has implemented it. The Digital Currency and Anti-Counterfeiting Management Office under the Currency Gold and Silver Bureau is the only official office related to DC / EP. 2) The pilot institutions include the four major state-owned commercial banks of Industry, Agriculture, China, and Construction, and the three major operators of Mobile, Telecom, and China Unicom. 3) The pilot scenarios include transportation, education, medical treatment, and consumption. They will reach C-end users. The pilot banks can choose pilot scenarios based on their own advantages. 4) DC / EP is being piloted in Shenzhen. The pilot plan is divided into two phases: a small-scale scene closed pilot at the end of this year, and a large-scale promotion in Shenzhen next year. 5) Testing of DC / EP related standards and payment system access are progressing simultaneously. 6) DC / EP is also expected to land in Suzhou. Recently, the Yangtze River Delta Financial Technology Co., Ltd., a subsidiary of the central bank, is urgently recruiting blockchain-related talents. 7) The four major banks have set up DC / EP closed development project teams in Beijing.

Blockchain is a DC / EP alternative technology, which has received great attention from the central bank's digital currency leaders.

-Published by Di Gang, the Deputy Director of the Digital Currency Research Institute of the Central Bank, an article entitled "Blockchain Technology to Promote the Reform of Trade Finance Business" by the central bank's magazine "Electronic Finance", which states that the unique information of blockchain technology cannot be tampered with and can be traced back The characteristics of real-time sharing of unified ledgers and peer-to-peer collaboration have a natural fit with the trade financing business, which is expected to solve many difficulties in the current trade financing field.

On January 13th, the Peking University International Development Institute held a seminar on "the future of digital currencies" and a press conference on "digital currencies-reading books for leading officials". Leaders and scholars including Assistant Minister Yang Tao attended the meeting.

This article is an excerpt from the report "Guosheng Blockchain | Supervision Assists Fintech Innovation, Blockchain Application Tide Is Opening", which was published by Guosheng Securities Research Institute on January 15, 2020. For details, please refer to the relevant report.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Supreme Court of India is preparing to hear the case of "crypto industry vs Indian central bank". Can the country's crypto ban be lifted?

- Bitwise withdraws application to SEC, bitcoin ETF approval is hopeless?

- Investment and financing inventory of the blockchain industry in 2019: total domestic financing has fallen by 40%, and institutions are more cautious

- Black-producing gang exploits Apache Struts 2 vulnerability and SQL blast control server mining

- Global blockchain private equity financing of 21.612 billion yuan in 2019

- Everything you want to know about NFT (non-homogeneous tokens) is here

- Jinan City officially launches "Blockchain + invalid resident ID card verification and valid resident ID card information application service" system