Bitcoin hashrate continues to climb, rising 167% over the past year

Source: LongHash

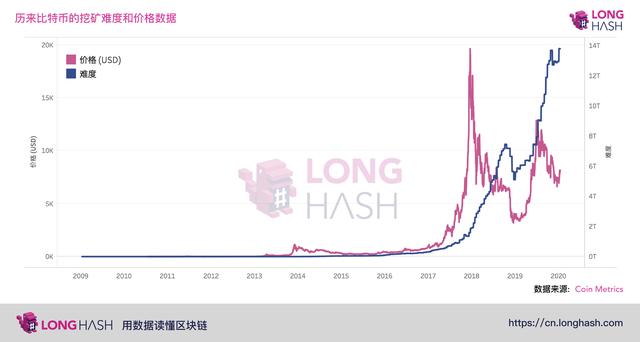

Although Bitcoin is still down by about 41.5% compared to the highest point in 2019, the computing power to ensure network security continues to climb, which indicates that people are investing in this asset in the long term.

According to data from Crypto This, the mining difficulty of the Bitcoin network is expected to rise again by 8% on Tuesday afternoon, US time, which will make the mining difficulty of the Bitcoin network reach approximately 15 trillion. According to BitInfoCharts, this shows that the hashrate of the Bitcoin network has increased by about 167% since January 2019.

Why is the computing power rising while the price is falling?

- Babbitt Site | Li Lihui: We should be more wary of global digital currencies, and super-sovereignty and super-banking will lead to financial disruption

- Facing quantum computing threatens digital currency to grow in confrontation

- Will it pull back after the rally? How long can this wave of market last

Of course, the price of bitcoin has also risen in the past year, from the $ 3,500 range a year ago to the $ 8,100 position on Monday. Obviously, higher bitcoin prices will of course lead to an increase in network computing power, because for miners, more miners will be able to make more profits online.

However, it is also worth noting that Bitcoin's mining difficulty declined at an unprecedented rate at the end of 2018, falling from 7.4 trillion to 5.1 trillion in just two months, a drop of about one-third. At the time, people were even hysterical about the so-called "mining death spiral," but it was easily dismissed.

In other words, Bitcoin's computing power has reached a low point near the end of 2018, so there is ample upside, especially after the price starts to rebound.

Although the price of Bitcoin reached its highest point in June 2019, its hashrate continues to rise. When considering the reasons for this, it is important to remember that crypto mining operates from a long-term investment perspective, the long-term costs of long-term leases of mining machines, sites, and electricity are high, and other factors need to be taken into account. In other words, hashrate follows long-term trends, not short-term fluctuations in the price of Bitcoin.

How will halving affect this trend?

Of course, some people will wonder if the upcoming halving-the number of new Bitcoins created every ten minutes will be halved-will have a negative impact on network computing power. In the case where all other conditions remain the same, this is the case, and in the long run, the decline in Bitcoin mining incentives should reduce computing power.

However, this does not mean that the computing power of the Bitcoin network will necessarily plummet immediately after the halving occurs. In fact, after the only two halvings in November 2012 and July 2016, Bitcoin's hashrate has increased significantly. Although these two increases in hashrate may be due to the massive bitcoin bull market that followed after halving.

In addition, the Bitcoin Cash network will also experience its own halving before Bitcoin halves about one month, which is problematic from a security perspective.

The hashrate always follows the long-term price trend, so how the halving will ultimately affect the hashrate will depend on how the halving affects the price of Bitcoin. Having said that, in the case of a sharp rise in the price of currency in the short term, the old mining machine can be online again soon.

At this node, there is a large divergence of opinion on whether the upcoming halving has reflected the price of the Bitcoin market. However, the fact that bitcoin's computing power continues to rise while the price of the currency is falling indicates that people have invested in this asset over the past year.

LongHash , read the blockchain with data.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- SEC: IEO may be unregistered securities, the relevant exchange may need to apply for a stock exchange

- Really sweet! Big data shows that 2020 blockchain will become the world's most popular hard skill

- Science | Exploring Validator Costs for Ethereum 2.0

- Demystifying the data on the Bitcoin chain in 2019: Global miners' annual total revenue is about $ 5.2 billion, and Coinbase has become the "gold king"

- Popular Science | Eth 2.0 Staking Logic

- 2019 Blockchain Security and Privacy Ecology Memorabilia

- From the network layer, consensus layer, data layer, smart contract layer and application layer, talk about the technical architecture of blockchain commerce