Investment and financing inventory of the blockchain industry in 2019: total domestic financing has fallen by 40%, and institutions are more cautious

Source of this article: China Financial Information Network , the original title "Union Data and China Financial Information Network launched a heavy | Blockchain industry investment and financing inventory in 2019"

The main points of the report are as follows:

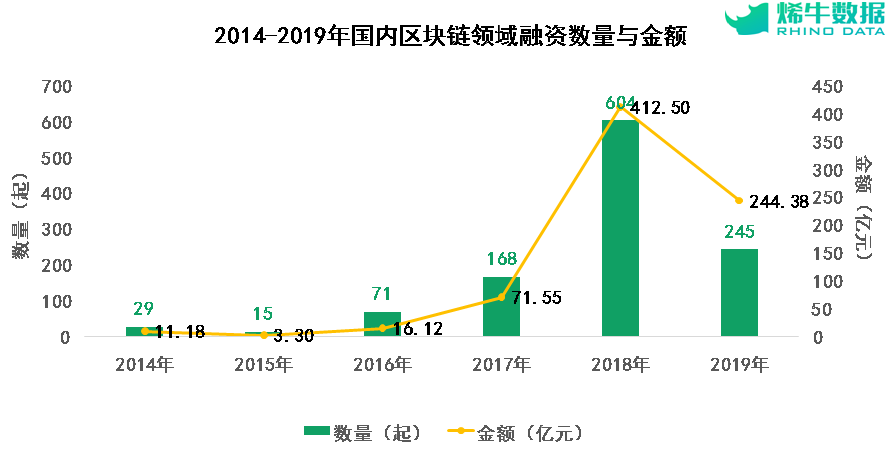

1.In 2019, the domestic blockchain industry disclosed a total of 245 investment and financing events, with a total financing of 24.4 billion yuan, a decrease of 59.4% and 40.8% compared to 2018;

2. Early financing events accounted for 43.3%, and the proportion of strategic investment and mergers and acquisitions in the second half of 2019 increased significantly.

- Black-producing gang exploits Apache Struts 2 vulnerability and SQL blast control server mining

- Global blockchain private equity financing of 21.612 billion yuan in 2019

- Everything you want to know about NFT (non-homogeneous tokens) is here

3. Blockchain market information, digital currency exchanges, and blockchain finance in the subdivided field have received considerable attention;

4. 292 institutions participated in the investment, and the institutions were more cautious in their shots;

5. The number of projects invested in Shenzhen, Hangzhou, and Beijing has been the largest, and the development trend of second-tier cities cannot be underestimated.

I. Overview of investment and financing in the blockchain industry

According to statistics from Niu Niu, the domestic investment in the blockchain industry has dropped sharply in 2019. A total of 245 financing events were disclosed, a 59.4% decrease compared to 2018, and the total financing amount reached 24.4 billion yuan, a 40.8% decrease compared to 2018. There are 212 items. The amount of financing and the amount of money both fell. Compared with 2017, it is still a substantial increase. With the promotion of policies and more rational capital support, the domestic blockchain industry may usher in healthier development in 2020.

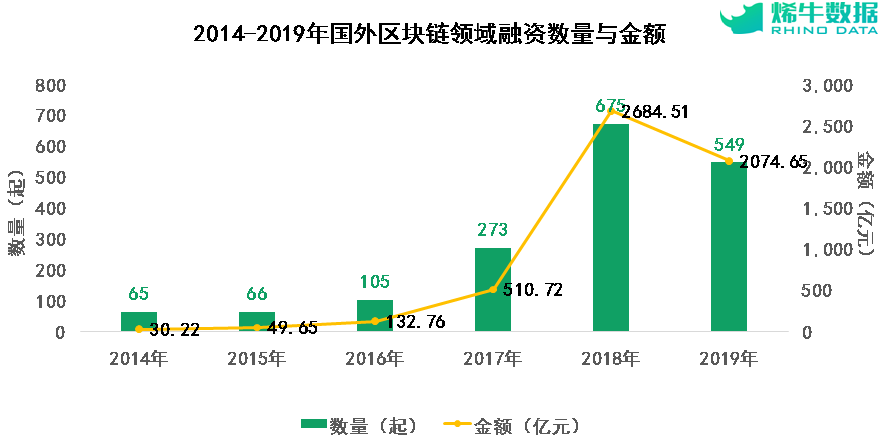

Compared with foreign countries, the changes in the amount and amount of financing in the domestic blockchain sector are basically consistent. The decline in China in 2019 is relatively larger, which is not unrelated to the many overseas teams that have ventured abroad. In terms of the amount of financing for a single project, due to the impact of the development stage of the blockchain industry, domestic and foreign countries are increasing year by year. In 2019, the average financing amount of domestic blockchain projects is 100 million yuan, which is about 1/4 of the average foreign financing amount.

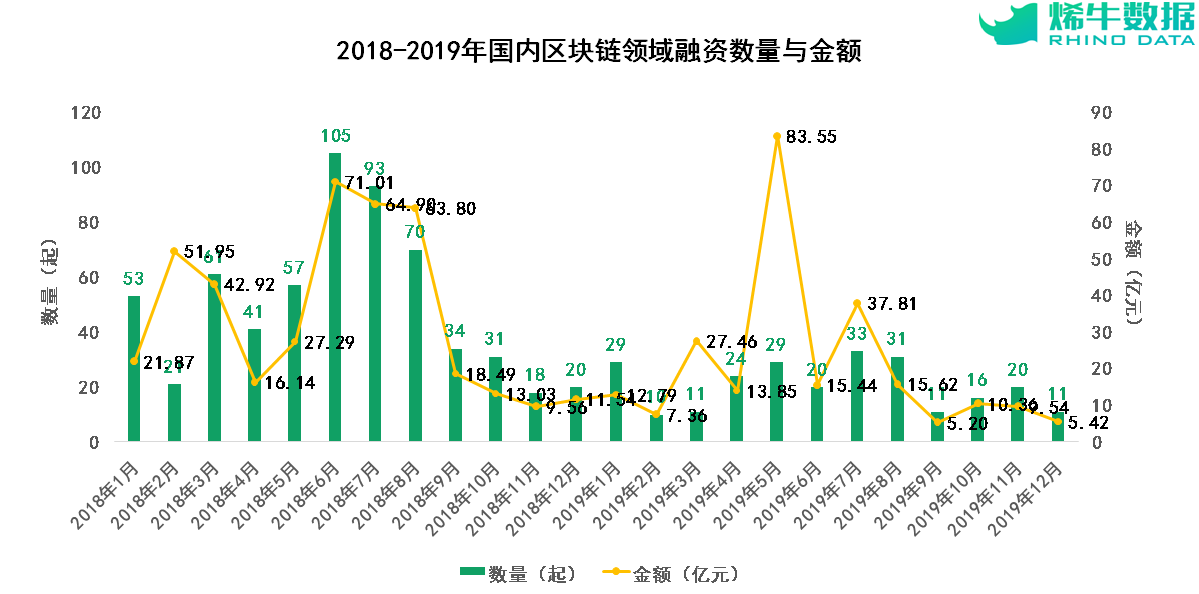

From the perspective of time distribution, the enthusiasm of capital for domestic blockchain projects dropped sharply at the beginning of the year, began to rise in March, and remained at a high level in April-August. It was affected by Bitfinex's huge US $ 1 billion ICO financing and became May 2019 The month with the highest annual financing amount, since then, the enthusiasm for capital investment has subsided, and September has become the month with the lowest financing amount. On October 24, the Chinese government emphasized the need to regard blockchain as an important breakthrough in independent innovation of core technologies. The central government set a strong impetus for the development of the blockchain industry. The financing enthusiasm in the blockchain sector picked up in October-December.

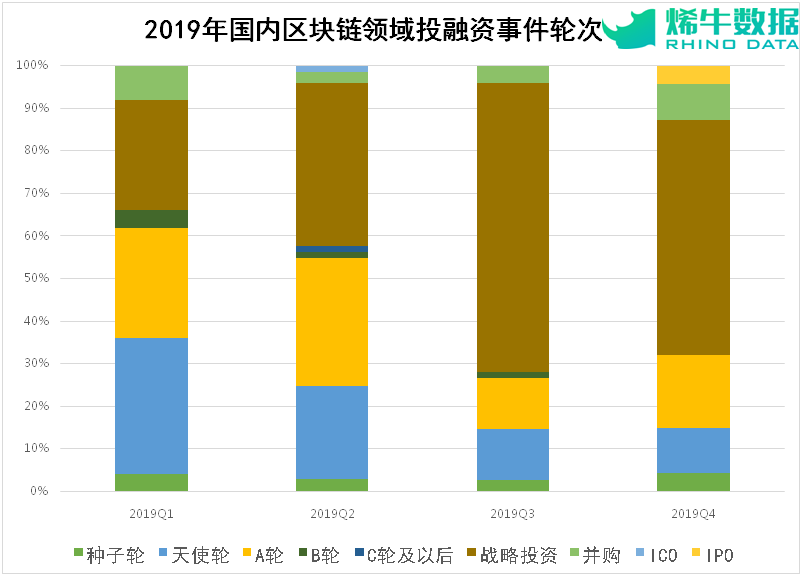

From the perspective of the financing stage, the financing of the blockchain industry is dominated by strategic investments. Early-year financing in 2019 (8 seed rounds / 46 angel rounds / A round 52) accounted for 43.3% of the total financing events. The proportion of financing is gradually decreasing, and the proportion of round A and previous rounds has dropped from 62.0% at the beginning of the year to 31.9% in the fourth quarter. In contrast, the proportion of strategic investment and mergers and acquisitions has increased significantly.

Brief analysis of the subdivided fields of the blockchain industry chain

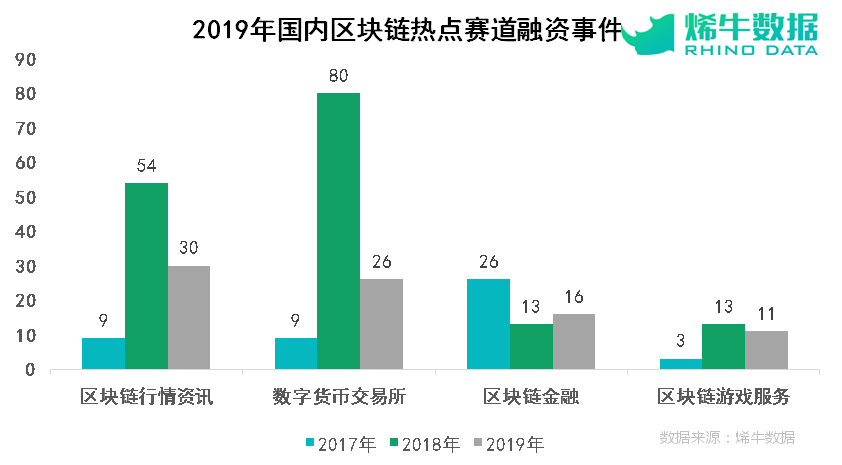

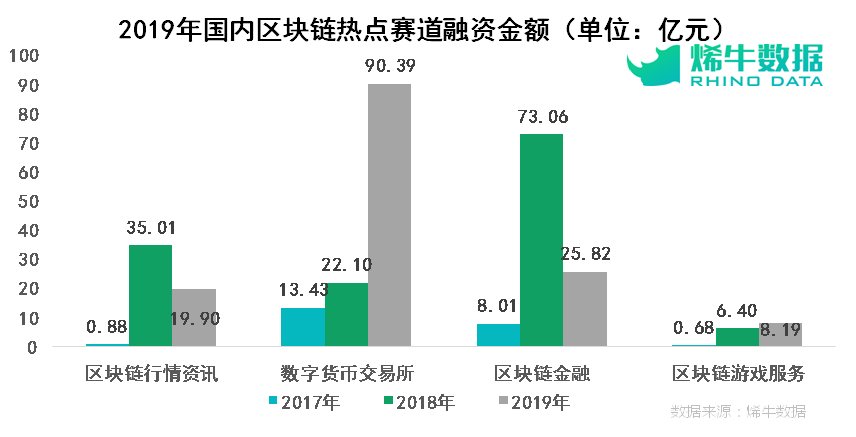

In 2019, in the field of blockchain segmentation, the number of financing events disclosed in the blockchain market information, digital currency exchanges, blockchain finance, and blockchain game services was the largest. Among them, the number of financing events in the field of digital currency exchanges fell the most year-on-year, and the number of financing events in the field of blockchain finance increased slightly year-on-year.

In the above hot track, due to the huge financing of Bitfinex, the amount of financing in the digital currency exchange field increased sharply in 2019. Except for the 1 billion US dollars financing, it was basically the same as in 2018. Blockchain market information and blockchain financial areas fell significantly. The amount of financing for the blockchain game service sector rose slightly.

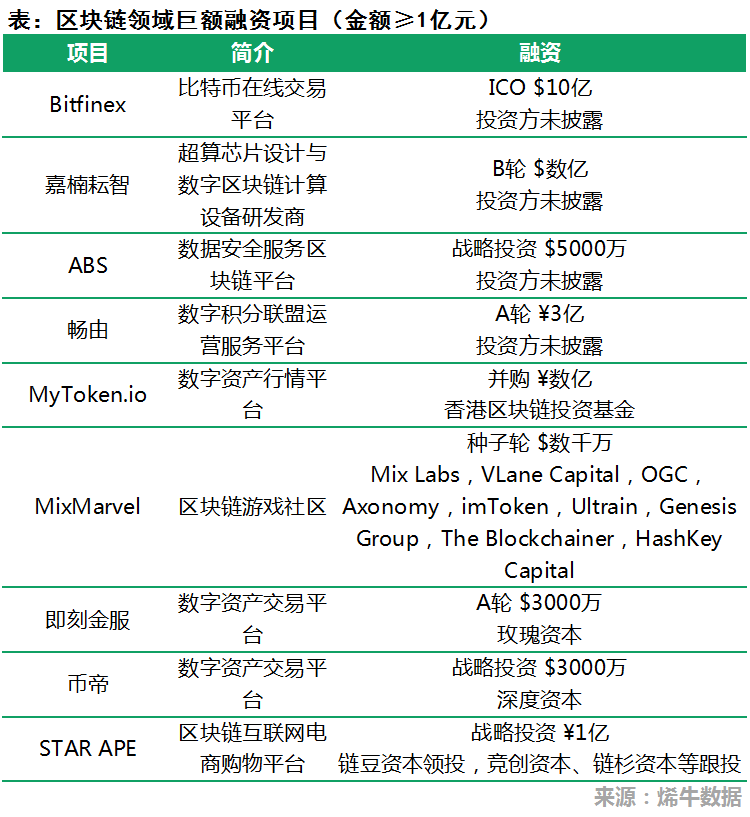

Tracking of huge financing in the blockchain industry

Cryptocurrency exchange Bitfinex announces $ 1 billion in funding to finance the largest amount of domestic blockchain in 2019

On May 13, Paolo Ardoino, CTO of Bitfinex, a Taipei-based digital asset exchange, tweeted that Bitfinex had completed a $ 1 billion fundraising. As the world's leading cryptocurrency exchange, Bitfinex has been in the turmoil. According to media reports, this round of financing Bitfinex was financed by the issue of platform currency, and the funds replaced by its issued platform currency LEO were mainly due to its 850 million funds Frozen. On April 26, CoinDesk reported that the New York Attorney General's Office claimed that the crypto exchange Bitfinex lost $ 850 million, and that it subsequently used Tether's funds to cover the loss in secret. Since then, Bitfinex has been caught in lawsuits several times.

Jianan Yunzhi completed a new round of hundreds of millions of dollars in financing and officially landed on NASDAQ on November 21.

On March 11, Jia Nan Yunzhi, a developer of supercomputing chip design and digital blockchain computing equipment, announced the completion of a round of financing worth hundreds of millions of dollars. After this round of financing, its valuation has reached billions of dollars. After that, Jia Nan Yunzhi formally submitted the prospectus to the US Securities and Exchange Commission (SEC) on October 29. On November 21, Jia Nan officially landed on NASDAQ with the stock code "CAN" and became a domestic blockchain. The company went to the US for the first share IPO. It is reported that the funds raised by Jianan Yunzhi's IPO will be used in 5 major areas-1. Strengthen the company's leadership in supercomputing solutions and enhance the competitiveness of blockchain and AI products; 2. Continue to invest in high Energy efficiency chip design; 3. Continue to launch new AI products; 4. Launch AI Saas platform; 5. Continue to expand overseas business.

ABS chain receives US $ 50 million investment from an investment institution in Saudi Arabia, ABS chain business expands to the Middle East

ABS Chain is a data security service blockchain platform. On June 11, according to Arab Wire Business Wire, ABS Chain received a $ 50 million investment from a large investment institution in Saudi Arabia. The investment company will cooperate with the ABS chain team for a long time to help the ABS chain expand to the Middle East market and provide data security solutions for the Arab world. Going to sea may become a big choice for domestic blockchain companies to develop enterprises.

Fourth, the inventory of blockchain investment institutions

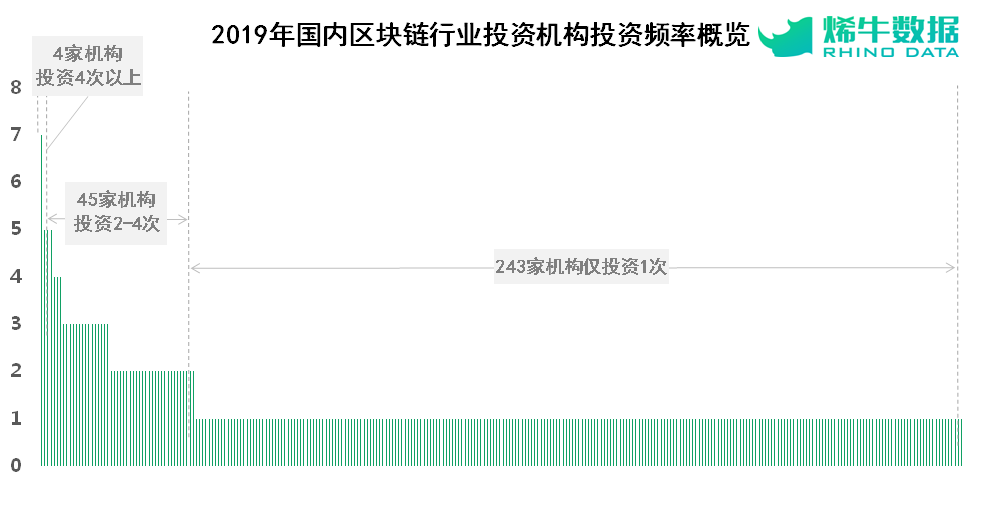

From the perspective of investment institutions, eneco data shows that a total of 292 institutions participated in domestic equity investment in the blockchain industry in 2019. Among them, 243 institutions only shot once, accounting for 83.2% of the total number of institutions; of the remaining 49 investment institutions, 45 institutions with a frequency of 2-4 investments, and only 4 institutions invested more than 4 times.

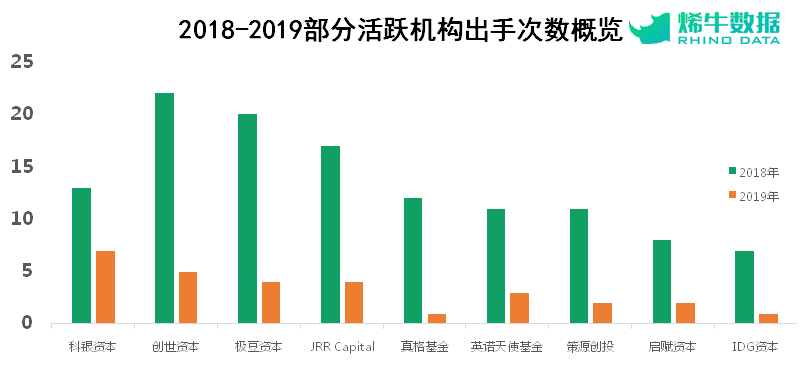

Of the 18 institutions that have made more than 10 attempts in 2018, only four institutions, such as KBank Capital, Genesis Capital, JRR Capital, and Extreme Bean Capital, have made 4 or more attempts in 2019. More cautious. Most of the active institutions are emerging blockchain investment institutions. Among traditional VCs, the institutions that were more active in 2018, such as IDG Capital, Zhenge Fund, Ceyuan Venture Capital, Inno Angel Fund, Qifu Capital, also significantly reduced their shots in 2019. frequency.

There are many joint investment projects among active institutions (4 or more shots), such as BT Exchange, Star Planet, Echoin, D Agency, etc., which share the risk and share the institutional resources.

V. Regional Distribution of Blockchain Investment

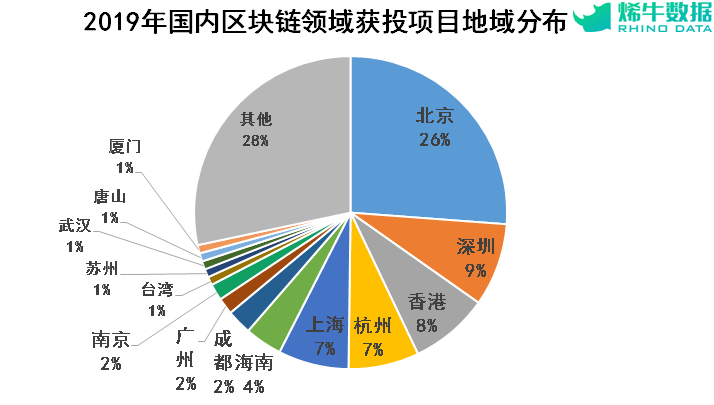

From the perspective of the geographical distribution of the invested projects, the eneco data found that Beijing ranked No. 1 with 61 financings, and the Shenzhen, Hong Kong, Hangzhou, and Shanghai ranked first. . After the central and local governments strengthened supervision in 2019, the proportion of blockchain projects in Hong Kong and Taiwan rose, and their more relaxed local policies were more favored by entrepreneurial teams.

After the central government set the pace to promote the development of blockchain technology and industrial innovation, the local policies of the blockchain were intensified. Guangzhou, Kunming, Chengdu, Chongqing and other cities responded quickly and issued supporting policy documents, local policies and resources. It will bring continuous momentum to the development of blockchain projects in second-tier cities.

Risk Warning: This article does not constitute any investment advice for you, so you do it at your own risk.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Jinan City officially launches "Blockchain + invalid resident ID card verification and valid resident ID card information application service" system

- Babbitt Column | Trustworthy Lightning Network: Or Solve the Problem of Expensive and Slow Bitcoin Transfers

- Russian officials: cryptocurrency bill expected to pass this spring, will define digital assets

- Japan's Financial Services Agency: Proposes to reduce leverage on crypto margin trading to less than double, or implement this spring

- How does the secret whale "liquidator" help DeFi run smoothly?

- Bitcoin hashrate continues to climb, rising 167% over the past year

- Babbitt Site | Li Lihui: We should be more wary of global digital currencies, and super-sovereignty and super-banking will lead to financial disruption