Application of Traditional Corporate Finance Theory in the DAO Field

Traditional corporate finance applied in DAOs

Definition of the Current Stage of DAO

DAO Basic Situation

A decentralized autonomous organization (DAO) generally refers to an organization that maintains the interests of all parties through a designed token economy, based on blockchain technology, and carried out through smart contracts, with participants connected by a common goal and collaborating through a network. Unlike traditional corporate hierarchical design, DAO does not have a central node or hierarchical structure, and all decisions are voted on by DAO members. Since the concept of DAO was first proposed in 2014, DAO has rapidly developed and grown, and has now differentiated into various types of DAOs such as funding, investment, protocol, collection, media, and social.

According to DeepDAO data[1], as of April 7, 2023, there are a total of 12,353 DAOs worldwide with $25.3 billion in assets, with the top five DAOs being Optimism Collective, Arbitrum One, Uniswap, BitDAO, and Polygon, with a total of about $16.5 billion in assets and a CR5 of 65%. At the beginning of January 2023, there were only 10,752 DAOs worldwide with $8.8 billion in assets, with the top five DAOs being Uniswap, BitDAO, ENS, Gnosis, and Wonderland, with a CR5 of about 63%. DAO is still in the stage of barbaric growth, and the number of organizations, asset size, and competition pattern are still in a phase of rapid iteration.

Due to the imperfect organizational structure of DAO, many organizations currently adopt a dual structure of company + DAO, with the company serving as the developer, operator, asset custodian, and owner of the underlying protocol of DAO. A typical example is Uniswap Labs, which is responsible for the development of the underlying protocol of Uniswap, while Uniswap is an open and free DAO.

- Latest developments in SEC’s “Operation Thunder”: Coinbase refuses to take down tokens and services, while Binance retaliates by actively seeking Gensler’s advice as a consultant.

- Four narrative shifts in the Ethereum ecosystem’s cycles

- Understanding Binance’s Decentralized Global Operating Model from SEC Lawsuit Documents

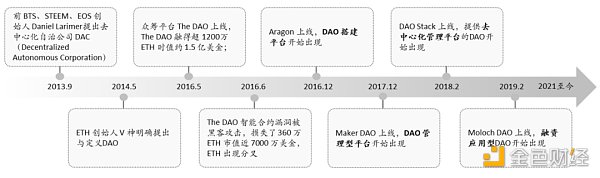

Figure 1. Overview of DAO Development History

Basic Framework of Corporate Finance and DAO Finance Research

DAO is considered a resource organization form that can be compared with the corporate system and is the basic production unit of the future metaverse. Compared with companies with asset sizes of hundreds of billions of dollars, the development of DAO still has a long way to go. The rapid development of asset size under the corporate system is partly due to capital operations such as equity debt financing, mergers and acquisitions, and restructuring that accelerate operating efficiency. The expansion of high-quality DAO asset size in the future will require equity and debt financing, while poor DAOs may face bankruptcy restructuring and debt restructuring issues.

The basic framework of traditional corporate finance theory is to analyze ① the market risk-free rate and then analyze ② potential financing channels (including primary PE/VC/IPO and secondary stock issuance/bond issuance), ③ the internal delegation and agency governance structure of the company, ④ the optimal capital structure (equity and debt ratio under MM theorem), and then calculate ⑤ the company’s valuation level (DCF/PE/PS and other methods), providing a valuation basis for further analysis of ⑥ mergers and acquisitions. The development of basic corporate finance theory is relatively complete. The goal of corporate governance is to maximize shareholder interests, not company interests or creditor interests.

Although there are significant differences from the corporate system, the research framework of traditional corporate finance can also be applied to DAOs, providing theoretical references for DAO governance and future possible capital operations. The basic framework for analyzing DAO finance by analogy to corporate finance is to analyze ① the risk-free rate of the cryptocurrency market (although this rate may not exist), ② potential financing channels, ③ the governance structure of the DAO (voting mechanism, organizational structure), ④ the optimal capital structure (equity-debt ratio, token initial allocation ratio), and then calculate ⑤ the DAO valuation level, providing a valuation basis for ⑥ mergers and acquisitions among DAOs. In comparison with corporate finance, the goal of DAO governance should be to maximize the interests of all token holders, but this conclusion has not yet achieved market and academic consensus. Maximizing DAO asset size, maximizing the interests of governance token and utility token holders, and maximizing DAO valuation, etc., may also become DAO governance goals, and the direction of market consensus remains to be observed. This article will take the maximization of the interests of all token holders as the starting point for DAO governance goals, and briefly discuss DAO finance from six aspects: risk-free rate, potential financing channels, governance structure, optimal capital structure, valuation level, and mergers and acquisitions.

Six financial dimensions of DAO research

Risk-free rate faced by DAO

The risk-free rate in the financial market is usually the bond yield or stock index yield. Government bonds are guaranteed by the government to repay the funds, and there will be no default except for extreme factors such as war. The cryptocurrency market has no government guarantee, and there are always risks in the market mechanism. For example, FTX, the world’s second-largest cryptocurrency exchange, went bankrupt rapidly in a week at the end of 2022. In addition, there are risks such as account theft by hackers. Therefore, there is no completely risk-free rate in the cryptocurrency market, but there is a low-risk rate as an opportunity cost of cryptocurrency market investment. Investors who invest “valued in BTC/ETH” and investors who invest “valued in USD or other fiat currencies” face two different types of opportunity costs. The former is usually a new cryptocurrency fund, and both fundraising and investment are carried out through BTC/ETH; the latter is usually a traditional financial investment institution and individual investor, who need to bear additional exchange rate risks of cryptocurrency and issuance.

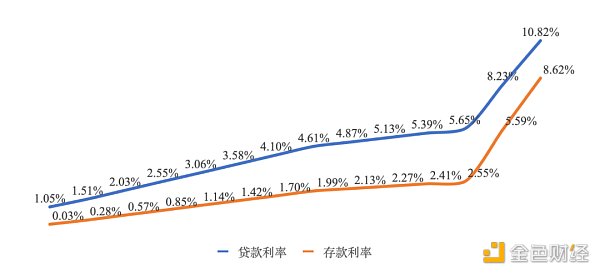

Table 1 Compound Platform Interest Rates for Various Tokens

Data source: Compound official website, data as of April 7, 2023

Figure 2 Compound Platform ETH Interest Rates

For investors valuing in Bitcoin/Ethereum, the low-risk interest rate can be referred to Defi’s borrowing and lending rates. There are many cryptocurrency exchanges and institutions that provide decentralized finance (DeFi) lending, and due to differences in transaction costs and liquidity, the same currency often has different prices between different exchanges. This article uses the Compound project, which has first-tier liquidity in the industry, as an example to introduce low-risk interest rates. First, Compound’s deposit and loan mechanism is roughly introduced. Compound sets up a separate fund pool for each type of borrowing and lending asset. When a depositor deposits 1 ETH, the Compound platform issues 10 Compound tokens as a deposit certificate (exchange rate 0.1). Assuming that the exchange rate rises to 0.12 when the user redeems, the user can obtain 1.2 ETH, corresponding to a 20% return. Borrowers need to pledge certain assets to borrow, such as pledging 1 Bitcoin to borrow an equivalent amount of 0.75 Ethereum (pledge rate 0.75).

The pledge rate is usually between 0 and 0.75. When the price of the pledged assets fluctuates too much, the borrower will be required to add positions, otherwise it will be liquidated. This mechanism to a certain extent guarantees the safety of the depositor’s funds. It is worth noting that Compound’s low-risk interest rate is not fixed, but is determined based on the supply and demand of funds. Taking ETH as an example: the deposit interest rate is between 0% and 12.75%, and the loan interest rate is between 0% and 16.18% [2]. Compared with the risk-free interest rate of traditional finance (usually between 2% and 10%), the low-risk interest rate of cryptocurrencies has a larger fluctuation range, which means that the valuation of cryptocurrency assets has a naturally large fluctuation.

For investors who calculate investment returns based on the US dollar, their low-risk interest rate can be the US Treasury bond yield in the traditional financial market, the cryptocurrency market’s pledged ETF index, and the arbitrage return of buying and selling cryptocurrencies at the same time. The US Treasury bond yield method is not applicable to certain directional funds in the cryptocurrency field, and LPs are also unlikely to agree; the cryptocurrency market’s pledged ETF index method is the most ideal method, but considering the few tradable cryptocurrency ETFs in reality, it is not currently applicable, and the effectiveness of this index is expected to improve in the future; the arbitrage return includes space-based arbitrage across exchanges and time-based futures arbitrage, which requires a large capital capacity for the hedging strategy and the rate of return has stability, otherwise it cannot be used as a general interest rate.

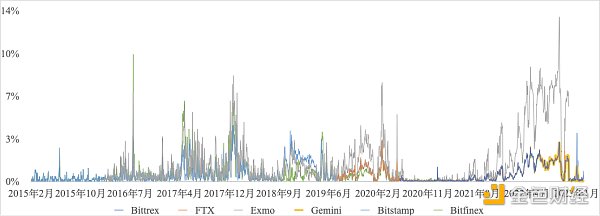

①Cross-exchange arbitrage refers to the large price differences between different exchanges. Taking Bitcoin as an example, buying on exchange A and selling on exchange B can still result in a positive return even after accounting for fees. For example, using the closing price data of six major exchanges such as Bittrex and Exmo from 2015 to the end of 2022, the daily trading price difference is around 1%, reaching as high as 13.65%. However, in recent years, it has declined, meaning that as liquidity increases, the prices of various exchanges tend to converge, and arbitrage opportunities disappear. ②Spot-futures arbitrage involves using the price difference between futures contract prices and spot prices to arbitrage. Investors can buy a certain amount of spot and sell the same amount of futures to earn the price difference on the delivery date. If the exchange supports using the margin for the sold futures to pay for the purchased spot, then low-risk arbitrage can be achieved. Otherwise, there is a risk of margin calls if the price rises sharply. There are still issues with limited capital capacity and potential risks for cross-exchange arbitrage and spot-futures arbitrage strategies. The former has the risk of insufficient liquidity and slow trading speed leading to failed trades, while the latter has a significant risk of margin calls when unable to use spot to pay for margin. Therefore, for investors who use USD as the benchmark, a long-term low-risk rate still needs to be sought.

Figure 3 BTC price difference among major exchanges

Data source: Cryptodatadownload

Potential financing channels

Primary market: DAO acquisition of venture capital sources mainly includes VC institutions priced in traditional fiat currency, VC institutions priced in cryptocurrency, and DAO funds priced in cryptocurrency. The top ten cryptocurrency funds before 2022 are all US-based funds. Except for Sequoia, which is a traditional VC, the others are newly established funds focusing on the cryptocurrency field. Only the top funds, such as Blockingradigm and a16z, have a fund size of over $2 billion, while the fund sizes of other funds such as Blockingntera and Sequoia are mostly below $1 billion. VC institutions priced in traditional fiat currency/cryptocurrency still use traditional VC structures, limited to high-net-worth individuals or high-risk-tolerant individuals in specific countries or regions, and their investment goals are to obtain financial returns or strategic advantages. DAO funds refer to community members collectively raising funds or raising funds from LPs. Members initiate investment proposals and investment resolutions through governance tokens.

DAO funds mainly include three types: ① DAO venture capital funds raise funds through LP and adopt a management fee + commission profit model, which is more in line with the current legal framework; ② Syndicate DAO consists of Blockingrent DAO and sub-DAOs, Blockingrent DAO conducts due diligence, and sub-DAOs are established by Blockingrent DAO for each investment, with no more than 99 members. Sub-DAO members can get investment returns and bear investment risks; ③ Service DAO provides consulting services to third-party funds in exchange for project equity or fixed service fees, but does not directly participate in investment decisions.

Table 2 Top 10 Cryptocurrency Funds Before 2022

Source: Web3 VC Database

Primary Market : Another financing channel for DAOs in the primary market is the initial crypto-token offering (ICO), which generally refers to blockchain start-ups issuing encrypted tokens to raise general digital currencies such as bitcoin and ether. Issuing tokens can be used as payment tokens for platform-developed features in the future, or can be exchanged for other cryptocurrencies on exchanges. There is no consensus method for valuing tokens, and some researchers propose to comprehensively consider factors such as token liquidity, future unlocking time, and future supply-demand relationship to value them [5].

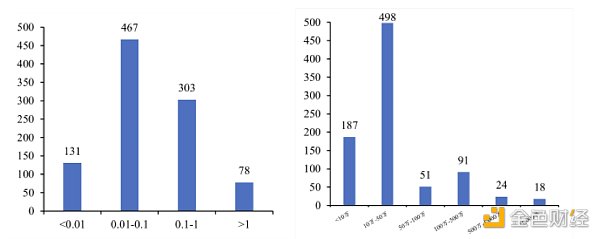

Compared with the traditional IPO model, ICOs have obvious differences in issuers, issuers, and institutional services. ① The issuer of an IPO is a mature company that has established a relatively complete organizational framework, business model, and more complete historical financial data, and can only be a limited liability company after the share reform; while an ICO is usually in the early stage of development of the blockchain start-up project, entity legal person/non-entity team/individual/DAO organization can issue tokens. Some projects can even conduct ICOs with only white papers and no actual products, such as Ethereum, which raised 18.4 million US dollars in Bitcoin in 42 days in 2014 with only white papers. Most project tokens are priced at less than $1, and the fundraising scale is less than $500,000.

② Compared with limited liability companies, tokens issued by ICOs may adopt two types of mechanism designs with fixed total quantity and no upper limit, such as Bitcoin with a total quantity of only 21 million and Ethereum’s ether with no upper limit. Taking Polygon as an example, its white paper stipulates that the total supply chain of the MATIC token is 10 billion, and the ICO sells 1.9 billion MATIC tokens in exchange for BNB tokens worth 5 million US dollars. ③ The stock of a limited liability company represents ownership, dividend rights, voting rights and other rights, while blockchain start-up projects may adopt a double-token mechanism, that is, governance tokens have limited supply, investment value, and similar to stocks, while game tokens have unlimited supply and only generate and consume on the platform. For specific discussions on the dual-token mechanism, please refer to Appendix One: Token Economic Model. ④ ICO issuance does not have mandatory intermediary agencies. Although there are third-party agencies such as UD Blockchain that provide token issuance consulting services, they are not mandatory, but IPOs must hire many intermediary agencies such as underwriters, accountants, and lawyers.

Figure 4 ICO issuance price (USD) from 2019 to 2022

Figure 5 ICO fundraising scale (USD) from 2019 to 2022

Data source: Coinmarketcap

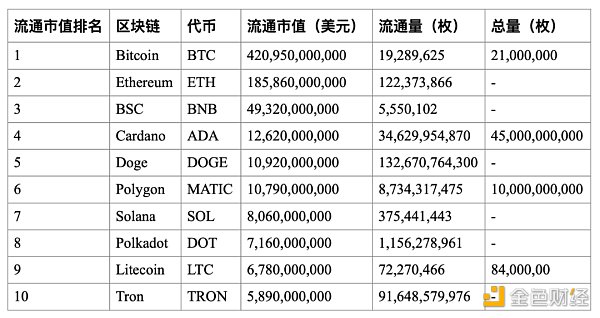

Table 3 Top 10 blockchain token totals by the end of 2022

Data source: Coinmarketcap, as of December 31, 2022

Secondary market : After a limited company goes public, it can finance in the secondary market through stock issuance or bond issuance. DAO’s secondary market fundraising may be through token sales or bond financing. The former refers to the project party of DAO usually selling only some tokens during ICO and storing the tokens needed for the future development of the project in the treasury (the concept of treasury can refer to Appendix 1: Token economic model), so after initiating a proposal in the community and obtaining approval through voting, the tokens can be sold directly to the secondary market to quickly raise funds. Debt financing refers to DAO applying for short-term (less than 1 year) or long-term (several years) token loans in the lending market, or issuing bonds to traditional capital markets to obtain fiat loans. Due to factors such as a lack of long-term token loan products, DAO not having the legal entity qualification to issue bonds, and the need to repay loans, secondary financing of DAO has not yet formed an obvious volume. However, for DAOs with stable organizational structure and good future profit expectations, the cost of debt financing is much higher than that of token financing, so the scale of debt financing will continue to grow with the development of DAOs.

Token-based governance structure

Same voting rights and dividends for limited companies are mandated by law. Except for special AB share structures, one share represents one voting right, and the one share one vote model effectively guarantees the interests of shareholders. The tokens issued by DAO do not naturally represent governance rights, only the right to use tokens to access the platform’s future developed functions. The one-token one-vote model is no longer applicable, and how to allocate governance rights is determined by each community through discussion.

Considering that there are many community members, it is difficult for all community members to participate in voting and reach consensus, so some innovative governance rights allocation mechanisms have been proposed [6]. ①The quadratic voting mechanism allows a single voting subject to vote repeatedly for the same option, but the voting cost is the square of the number of votes, which weakens the control of users with a large number of tokens and allows projects supported by a large number of users to pass. The typical application is Gitcoin, but since forging identities will invalidate the voting mechanism, social accounts need to be bound, making the voting unable to achieve anonymity. ②Weighted voting and reputation voting link voting influence with holding time and locking time, avoiding the risk of large-scale borrowing of funds to manipulate project voting, but a large amount of funds being locked suppresses project liquidity. The typical application is Polkadot.

Knowledge extractable voting refers to the proposal being divided into different themes, each corresponding to different knowledge tokens. Those who hold a certain type of knowledge token have a higher voting influence, solving the investment problem in professional fields. However, the reasonable distribution of knowledge tokens still needs to be studied. A typical application is the Dit protocol.

Rage quit mechanism means that any member can withdraw their corresponding share of funds from the DAO and quit the DAO organization at any time. In theory, voting cannot harm any member’s main interests. However, the stability of the organization under this mechanism is limited. A typical application is DAOhaus.

The design of DAO governance mechanisms is constantly evolving, striving to find the optimal solution between voting efficiency and member consensus. The solution to the optimal DAO governance mechanism is no longer just a financial problem, but needs to be further explored in practice. This will be a key factor in determining whether the scale of DAO assets can grow exponentially.

The Optimal Capital Structure

The purpose of planning the optimal capital structure is to maximize the value of the DAO, focusing on the ratio of token and debt capital, and token allocation and release.

Under certain conditions, the Modigliani-Miller (MM) theorem holds that the proportion of equity financing or debt financing does not affect the total value of the enterprise, so changing the capital structure cannot increase the value of the enterprise. The Modigliani-Miller theorem can be expressed as follows:

The holding income of DAO tokens includes capital gains from token price increases and dividend rights corresponding to tokens. As long as the dividend rights of DAO tokens are consistent with the principle of one share, one dividend of traditional stocks, the MM theorem can be applied to the DAO field. On the contrary, if the DAO dividend violates the principle of one share, one dividend, the MM theorem does not apply. However, since dividend behavior will classify tokens as securities, DAOs currently try to avoid dividends to token holders and benefit all parties through capital gains.

Overall, under the premise of one token, one dividend, the value of DAO can be increased by appropriately increasing the proportion of debt, and the value is mainly derived from the tax shield effect. The increase of the proportion of debt also leads to the increase of the capital cost of tokens.

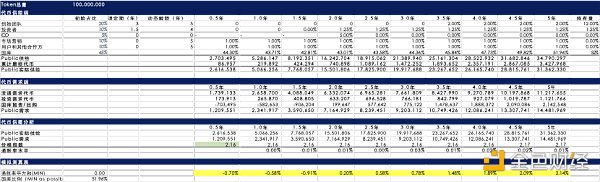

Initial token allocation refers to the distribution of the total fixed amount of tokens in single-coin or dual-coin models among multiple parties such as the founding team, marketing, investors, ICOs, and treasuries. There is no unified view on the basic principles of token allocation and release, and two basic viewpoints can be summarized through numerical simulation: ① the token release cycle should match the user growth cycle; ② the treasury should hold more tokens to stabilize token price fluctuations.

Figure 6 Token inflation simulation calculation table

DAO Valuation Method

Yash Agarwal proposed a framework for valuing the DAO community[7], analyzing the indicators and dimensions that DAO valuation should focus on, but did not propose a quantitative model method. Kristof Lommers proposed a preliminary quantitative idea for valuing DAO tokens[5]. The valuation method is divided into relative valuation and absolute valuation, and relative valuation refers to benchmarking DAOs based on certain indicators and recognized valuations, thereby obtaining the valuation of the target DAO. Kristof initially proposed TVL, protocol transaction volume, token transaction volume and speed, user net present value and other indicators that can be used as benchmark indicators for relative valuation, but due to the lack of stable and recognized valuations for fewer DAOs, the current application scenario of relative valuation is limited.

As for the absolute valuation method, Kristof proposed that the value of DAO tokens can be divided into the discounted value of token expected cash flow, the discounted value of governance power implied value, and the discounted value of expected pledge reward for tokens. The essence of this method is that the value of tokens is equal to the capital gains, governance income, dividends, and pledge income that can be obtained by holding tokens. Among them, governance income is difficult to measure and token holders with different holdings of tokens enjoy different governance income, so different holders will get different valuation results.

Kristof’s absolute valuation method has important reference significance in token investment pricing, but it is not completely applicable to DAO mergers and acquisitions. The valuation of DAO mergers and acquisitions should be based on all tokens with voting rights, not all circulating tokens or all tokens. It is mainly that as long as a DAO controls all tokens with voting rights, it can grasp the full control of another DAO. Therefore, the valuation of DAO is equal to all voting rights tokens * token valuation.

Key Points of DAO Mergers and Acquisitions

As DAO moves from savage growth to orderly growth, small DAOs with poor operations can be realized through bankruptcy liquidation, and large DAOs with poor operations may be realized through acquisitions to realize asset activation. DAOs with sound operations may also achieve rapid growth through mergers and acquisitions. On December 8, 2021, the proposal for the merger of xDai and Gnosis was approved, and 1 xDai token STAKE was exchanged for 0.032 Gnosis token GNO, and xDai Chain was renamed Gnosis Chain[8]. On December 22 of the same year, the merger proposal between Rari Capital and Fei Protocol was approved by members of each DAO, and Rari token RGT was converted to TRIBE[9], with a total lock-up value of 2 billion US dollars after the merger. The merger terms stipulate that RGT token holders can exchange RGT for TRIBE at a ratio of 1:26.7 (RGT:TRIBE) within 180 days; those who do not agree to the merger can exchange a certain share of Fei Protocol’s fund pool with TRIBE within 3 days.

During the DAO merger and acquisition phase, attention should be paid to two aspects: organizational structure integration and transaction price. Regarding the organizational structure integration, if the merger and acquisition targets have the same organizational structure and belong to the same public chain, the technical difficulty of the integration is limited. The key issue is how to avoid KOL loss caused by the integration. If the organizational structures are different, the determination of whether to use a completely new structure or one party to integrate into the other party’s structure needs to be based on the operating conditions and future development strategies of the two parties, and both methods are far more difficult than the former. If the merging parties belong to different public chains, there are limited case studies available at present, but there is logical feasibility, and it is worth observing in the future. In terms of transaction price, there are logically cash and equivalent payment, token exchange payment, debt loan payment, and several methods of hybrid payment. Considering the operational difficulty, token exchange payment will still be the mainstream method in the short term. The token exchange payment ratio can be determined by the valuation method mentioned in (5) DAO valuation method.

References

[1]DeepDAO https://deepdao.io/organization/10edb97a-9dba-448a-88b1-ca263a7c75ad/organization_data/finance.

[2]ETH Interest Rate Model https://compound.finance/markets/ETH.

[3]Cryptodatadownload https://www.cryptodatadownload.com/data/.

[4]Web3 VC Database https://codygarrison.notion.site/Web3-VC-Database-2022-de9c391f8dd14a8a9a3e01a69f4e0b7f.

[5]A Framework for DAO Token Valuationhttps://mirror.xyz/kristoflommers.eth/koszUqhfZ83GN5_UuxIo7orjSmRB1lBRL24EWMYfJ64.

[6]The 7 Common Voting Mechanisms for DAOs https://www.panewslab.com/zh/articledetails/1642043584042534.html.

[7]How to value a community? — DAO Valuation Frameworks https://yashhsm.medium.com/how-to-value-a-community-dao-valuation-frameworks-7a5e80e3e11d.

[8]xDai / Gnosis Merger AMA https://docs.gnosischain.com/updates/archive/2021/xdai-gnosis-merger-ama/.

[9]DAO mergers: the future of M&A? https://www.gtlaw.com.au/knowledge/dao-mergers-future-ma.

[10]Tokenization and Token Economy Solution https://www.ud.hk/sc/blockchain-solution-tokenization-tokenomics-ico-ido-ieo-sto.

[11]Comparison of Single Coin and Dual Coin Models https://foresightnews.pro/article/detail/13933.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 5 Misconceptions About the Metaverse

- Attacker’s liquidation price for BNB bridged to Venus Protocol is around $220. Venus governance proposal: Frozen, cannot be liquidated.

- Exchange sued by SEC: Future regulation in the US will be more transparent

- Explanation of Six LSD Stablecoin Protocols: Could It Trigger a New Round of LSDFi Conflict?

- Comparison of Stablecoins on New Decentralized Algorithms: Dai, GHO, crvUSD, and sUSD

- How can cryptocurrency exchanges move towards compliance after heavy regulation?

- How to establish a compliant cryptocurrency exchange following the consecutive lawsuits against Binance and Coinbase?