Resolution to the US debt crisis and inflation

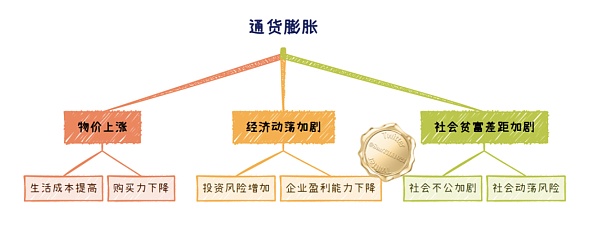

US Debt and Inflation Resolution1. The Hazards of Inflation:

The hazards of inflation:

Price increases: Inflation can cause prices to rise, increasing the cost of living and reducing people’s purchasing power.

Economic instability: Inflation can cause economic instability, increase investment risks, and may lead to a decline in corporate profits.

- Summary of evidence related to the SEC’s lawsuit against Binance

- Application of Traditional Corporate Finance Theory in the DAO Field

- Latest developments in SEC’s “Operation Thunder”: Coinbase refuses to take down tokens and services, while Binance retaliates by actively seeking Gensler’s advice as a consultant.

Widening Rich-Poor Gap: Inflation may exacerbate the rich-poor gap, leading to social injustice and social unrest.

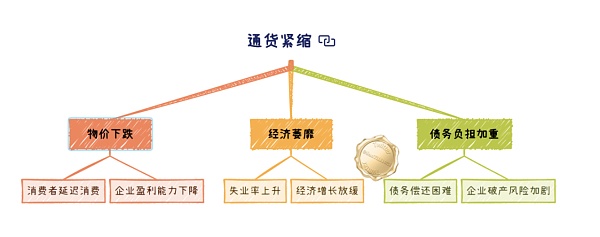

2. The Hazards of Deflation:

The hazards of deflation:

Price decreases: Deflation can cause prices to fall, which could lead to consumers delaying purchases and a decline in corporate profits.

Economic contraction: Deflation can lead to economic contraction, rising unemployment rates, and slowing economic growth.

Increased debt burden: Deflation can lead to an increased debt burden, making it difficult to pay off debts and increasing the risk of bankruptcy.

If the debt ceiling continues to be raised and new debts continue to be issued, it will aggravate the inflation crisis. At the same time, continued rate hikes, which raise interest rates, will lead to deflation and debt defaults, especially if bank and government debt risks occur simultaneously.

3. How to Break the Deadlock of Inflation and Debt Crisis at the Same Time?

Gradually Adjust the Debt Ceiling: Since the debt ceiling set by the United States is not particularly large, there is still room for gradual adjustment. If the debt ceiling is suddenly raised significantly, it may further increase the market’s concern about the US fiscal situation and exacerbate concerns about inflation. Therefore, the United States may need to gradually and steadily raise the debt ceiling to avoid market panic. Gradual

Debt Restructuring: Extend the term of the debt, lower the interest rate of the debt, issue new debt to repay old debt (refinancing, which can temporarily alleviate the crisis but cannot solve the crisis), partially write off the debt, debt reset, debt-to-equity swap and other means. Although debt restructuring can help reduce debt quickly, it often occurs during relatively more critical times, especially when it involves national debt, it will also involve the credibility of the country and market risks.

Therefore, this means that debt restructuring often occurs before or after a crisis, such as a debt default, excessive debt burden, economic crisis, or reform, when national income declines and debt restructuring is used to ease economic pressure and release new space.

Moderate monetary policy: The central bank can control inflation by adjusting interest rates and money supply. The Federal Reserve needs to find a balance between controlling inflation and avoiding economic cooling. This may mean moderate interest rate hikes, increasing borrowing costs, reducing money supply, curbing inflation, but the speed and magnitude of interest rate hikes need to be carefully controlled at this moment to avoid triggering market panic and debt defaults. The current economic environment is completely different from 2022, and it is not too much to describe it as walking on thin ice.

Fiscal policy: The United States may need to carry out some fiscal policy reforms, including government cuts in unnecessary spending, tax system reforms, tax increases, and finding new sources of revenue (whether this includes increasing protection fees for enterprises with abundant oil in gray industries or certain small and medium-sized countries is uncertain).

Promoting economic growth: By promoting economic growth, government tax revenues can be increased, thereby helping to alleviate the debt burden. This may require a series of policies, including investment in infrastructure, improving education and skills training, and promoting technological innovation, etc.

Structural reforms: The government can improve economic production efficiency and competitiveness by implementing structural reforms, thereby increasing the growth potential of the economy and helping to solve debt problems.

International cooperation: In today’s globalization, inflation and debt problems often require international cooperation to solve. For example, countries can seek help through international financial institutions such as the International Monetary Fund (IMF) and the World Bank, or stimulate economic growth through international trade and investment. As a major power in the world economy, the United States can cooperate with other countries and international financial institutions to jointly address inflation and debt crises.

Social Security System: Governments can protect the most vulnerable groups in society and alleviate the impact of inflation and debt problems on them by establishing and improving social security systems, such as retirement pensions and medical insurance.

Attention Shift: Increasing the promotion of the gaming industry, virtual industry, entertainment industry, digital industry, and new reservoir industry can relatively weaken the harm brought by default risk and inflation risk and shift thinking to relatively mentally happy and prosperous areas.

Shift Contradictions: Transforming internal contradictions into international contradictions and external contradictions can relatively resolve pressure and negative emotions. Although the latter two methods cannot solve the fundamental problem, they can reduce the threshold and negative emotions of problem solving. (Attention shift and contradiction shift can only be effective in the short term and cannot solve long-term fundamental problems, so they can only be used as temporary tactical means.)

These solutions need to be adjusted and applied according to specific economic environments and market responses. It can be seen that not only the United States, but many countries around the world are facing similar problems, and many policies and strategies have different effects. However, the current economic environment has reached a stage that requires a great deal of wisdom for harmony, integration, and reconciliation. Therefore, this is a great test of the wisdom and courage of policy makers, and it requires the overall market confidence and the understanding and support of all people to complete this difficult task.

Four, summary of use strategy:

Change: Everything is constantly changing, and we need to adapt to this change rather than resist it. In the current economic problem, we need to adapt to the market changes and adjust our economic policies and strategies in a timely and rapid manner to adapt to the new economic environment. This change may occur in half a year, one month, one week, or even change every other day. Move with the changes.

Balance: Yin and Yang balance, everything and strategic strategy has two-sidedness. We need to strive to find the direction that is favorable to us. In the problem of inflation and debt crisis, we need to find a balance point, both to control inflation and to solve the debt problem. Or find a harmonious or nodal point of deflation in the inflationary area, and find a relatively stimulating area that is relatively inflationary, to gradually achieve balance by point-to-face. This may require us to find a balance between monetary policy and fiscal policy.

Derivation: If a crisis is unavoidable but it is not clear which type it is, we need to analyze the future economic trend, deduce adjustment strategies under different situations, so that we can make preparations in advance, take precautions, and avoid or mitigate the impact of economic problems.

Harmony: Harmony is the foundation of everything. In solving the problems of inflation and debt crisis, we need to seek harmony among all parties, including the government, enterprises, and the public. And this point may benefit us greatly from the ancient Chinese wisdom of Zhou Yi and Chinese culture, helping us to get through this crisis. When the crisis comes, we may temporarily maintain the most important relationship of mutual generation, weaken the antagonistic link in the less important areas.

5. Trend Forecast:

Pattern 1:

Raise the debt ceiling, reduce spending, search for new revenue streams (inspections/taxes/recoveries/seizures/lawsuits/new businesses), and issue new bonds for financing.

Postpone interest rate hikes, rebound in inflation, continue to raise interest rates, the crisis is difficult to sustain, and the debt pressure continues to increase, which is difficult to maintain.

Partial defaults, damaged credit, crisis strikes, thunderous, debt restructuring, and reduced burden.

Restart the economy, multiple stimuli, enter the virtual world, a new inflationary period, a new era.

Pattern 2: Directly release water, enter the era of inflation, and rely on new reservoirs to absorb water (virtual assets, metaverse, VR, AI, etc.)

As people in Pattern 2 will only directly experience inflation without sharp contrast, I personally feel that the probability is not high. I tend to the trend forecast of Pattern 1.

This speculation is completely based on personal and relatively limited and narrow views, without any directional recommendation or investment guidance. I hope that different people will have different opinions and jointly analyze the shocks before the coming of the new era.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Four narrative shifts in the Ethereum ecosystem’s cycles

- Understanding Binance’s Decentralized Global Operating Model from SEC Lawsuit Documents

- 5 Misconceptions About the Metaverse

- Attacker’s liquidation price for BNB bridged to Venus Protocol is around $220. Venus governance proposal: Frozen, cannot be liquidated.

- Exchange sued by SEC: Future regulation in the US will be more transparent

- Explanation of Six LSD Stablecoin Protocols: Could It Trigger a New Round of LSDFi Conflict?

- Comparison of Stablecoins on New Decentralized Algorithms: Dai, GHO, crvUSD, and sUSD