Analyzing the Unique Aspects of Puffer Finance’s Design from the Perspective of Node Validation Rights

Analyzing Puffer Finance's unique design from a node validation rights perspective.Only in dreams can one truly be free.

On September 15, 2022, at 14:44, Ethereum officially completed the merge. With the panda appearing on the screen and the words “POS Activated,” a new era has arrived. The original execution layer of Ethereum is combined with the new Proof of Stake (POS) consensus layer beacon chain, abandoning Proof of Work (POW) and eliminating the need for energy-intensive mining. This reduces energy consumption by approximately 99.95% and also eliminates individual Ethereum nodes.

The requirement for an Ethereum network individual staking node converted to POS is 32 ETH. Even at the low price of $1,000 for ETH, it amounts to $32,000, which is an unaffordable price for most participants. Therefore, most people turn to pool staking and centralized exchanges to entrust their Ethereum to larger entities. Currently, there are four staking methods for Ethereum:

- In-depth Analysis of Base Standing on the shoulders of giants, emerging in the fiercely competitive Layer2 race.

- How can Base chain without tokens start Onchain Summer?

- Interpreting US Cryptocurrency Taxes General Taxation, Cryptocurrency Taxation, and Future Development Trends

- Individual Staking: Running your own hardware and staking 32 ETH to become a validator.

- Staking as a Service: Staking 32 ETH but paying someone else to run the hardware.

- Pool Staking: Staking less than 32 ETH in a validator pool. Some mining pools provide ERC-20 liquidity tokens to represent staked ETH.

- Centralized Exchange: Staking less than 32 ETH on a centralized exchange, the simplest method.

Among these four methods, centralized exchanges are subject to direct government regulation and are most likely influenced by a single will. Mining pools mitigate risks by increasing the number of node operators and running multiple validator sets. Lido, as a representative, also adopts various methods to reduce its centralization risk, such as using distributed validator technology to minimize the risk of misconduct by a single operator. However, ultimately, these institutions, just like centralized exchanges, are still legal entities and are exposed to the risk of being regulated by regulatory authorities.

So, what if we change our perspective and return the right to validate to the users?

The first and foremost issue is funding. Only by reducing the requirement for staking ETH can more people participate. Secondly, simplifying the operation is crucial. Ethereum randomly selects validators to build and propose blocks and randomly selects a validator committee to prove these blocks. Any validator who fails to fulfill these responsibilities when required will be economically penalized. Validators who commit more serious violations, such as proposing two different blocks for the same slot or proving two different proposers for the same block, will face more severe penalties, known as slash. Node operators, as professionals, can avoid this to the greatest extent possible. However, it is not realistic for ordinary people to spend a lot of time and effort to avoid double signing and prevent slash. Therefore, a tool that lowers the staking threshold and automatically prevents slash is the best choice for ordinary people to set up a validation node.

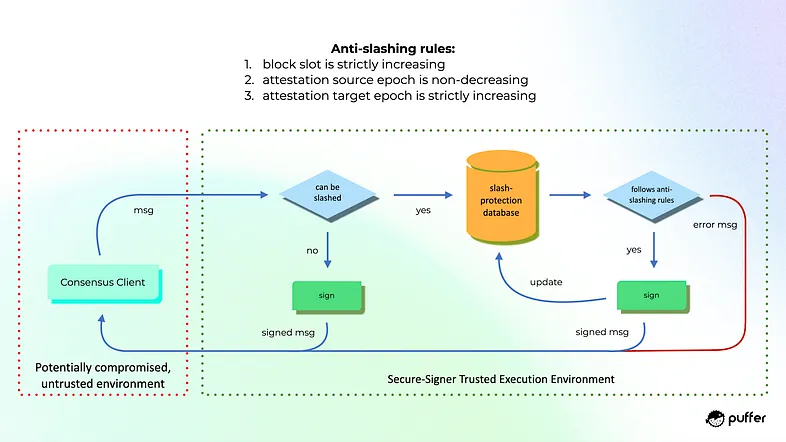

Of course, the Ethereum Foundation also attaches great importance to and funds the development of such technologies. Secure_Signer technology is one of them, which can minimize the risk of slash. Secure-Signer is an independent implementation of ConsenSys’ Web3Signer remote signing tool, which aims to prevent two types of failures that may cause slash.

- User error: By preventing access to the validator’s private key (even to the validator operator), slash caused by poor key management can be completely avoided.

- Client error: If the consensus client of the validator is compromised or suffers a failure that leads to slash, Secure-Signer acts as a shield because the final signing operation is performed in a secure and isolated enclave.

Puffer finance is a pioneer in helping individuals regain the power to build Ethereum staking by lowering the threshold for staking to 2 ETH. It relies on secure-signer technology to prevent slash and builds restaking services on top of eigenlayer to provide validation and protection for other networks, thereby enhancing economic potential. With the launch of Secure-Signer, validators of all scales are encouraged to contribute to the security of the Ethereum network through Puffer Pool. The protocol implements innovative solutions such as permissionless delegator threshold validators (pDTV) and secure routers, which are used for efficient inactive management and effective transaction delegation, respectively.

To prevent slash caused by double signing, Secure-Signer generates and protects all BLS validator keys in its encrypted and tamper-resistant memory. These keys can only be accessed at runtime and remain encrypted in static state, making them inaccessible to NoOps unless used for signing irrevocable block proposals or proofs.

Given that the keys are securely encrypted and bound to Secure-Signer, they prevent misuse between multiple consensus clients, protecting NoOps from the impact of unintentional slash caused by double signing. In addition, if their systems are attacked, the keys are protected appropriately, safeguarding them from hacker attacks.

The integration with the new exchange brings strict security improvements, protecting honest NoOps from serious criminal activities. In the rare case of malicious NoOps breaking SGX, they only expose their validator private keys, thereby preserving the security of the mining pool. Remote Attestation Verification (RAVe) confirms that NoOps are using Secure-Signer, fostering trust and transparency throughout the ecosystem.

Puffer also charges only a 2.5% protocol fee. This is much lower compared to Rocketpool’s 15%, Lido’s 10%, Frax Eth’s 10%, and centralized exchange staking services (which can charge up to 25%).

After the Shapella upgrade, liquidity staking protocols such as Lido have experienced significant growth. As a leader among them, Lido currently occupies 31.7% market share, far exceeding competitors like Coinbase and Binance, and surpassing the market cap set by Vitalik. Moreover, members of the Lido DAO are allowing Lido to strengthen its monopoly position, as a proposal to limit the size of Lido was opposed by 99.81% of the participants.

We urgently need new participants to change this situation, including Puffer. Will the latest participants in this track become the brave ones who will slay the dragon?

Everything is an unknown.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Outlier Ventures What pain points does the Web3 marketing model solve?

- Ketacoin collides with All In and soars a thousand times, who will be the next Wang Dalu?

- Curve CEO Michael Egorov From Physicist to Cryptocurrency Pioneer

- Quick look at a16z’s new SNARK-based zero-knowledge proof tools Lasso and Jolt

- Social application Friend.tech is hot, how are individual stocks priced?

- A Brief Understanding of the Current Situation of CyberConnect

- Less than a week and it has absorbed $700 million, is MakerDAO’s 8% interest rate really that attractive?