Social application Friend.tech is hot, how are individual stocks priced?

Friend.tech, a popular social application, has sparked interest in individual stock pricing.Author: Loopy Lu

friend.tech is one of the most popular projects on the current base chain. In the distant “ancient internet” era, the “friend trading” mini-game was once active on major SNS websites. Friend.tech is a Web3 product similar to the “friend trading” model.

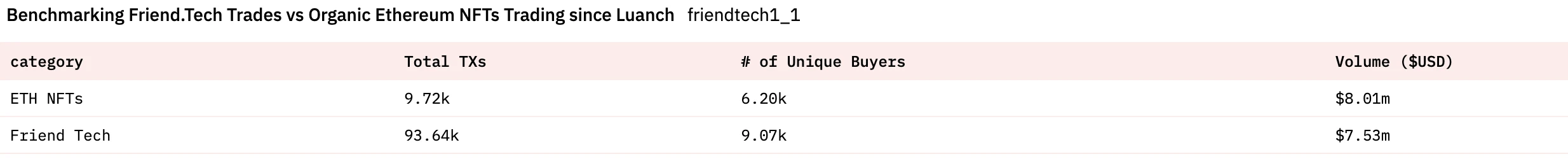

The product sparked community discussions on its first day of launch, and Dune data shows that it has generated over 8 million US dollars in transactions.

- A Brief Understanding of the Current Situation of CyberConnect

- Less than a week and it has absorbed $700 million, is MakerDAO’s 8% interest rate really that attractive?

- IMF Working Paper (Part II) How to Tax Cryptocurrencies?

What are the highlights of this popular product, and how is it different from the previous SocialFi?

Web3 People Trading Platform

friend.tech is built on the L2 network base launched by Coinbase. The product is forcibly linked to Twitter to obtain users’ Web2 social identities. Without linking to Twitter, users cannot use this product.

This product is quite mysterious. If you directly visit its official website, you cannot obtain any information about the product. Currently, there is no product introduction or official documentation.

If users want to learn more about this product, they can only access and use friend.tech via mobile.

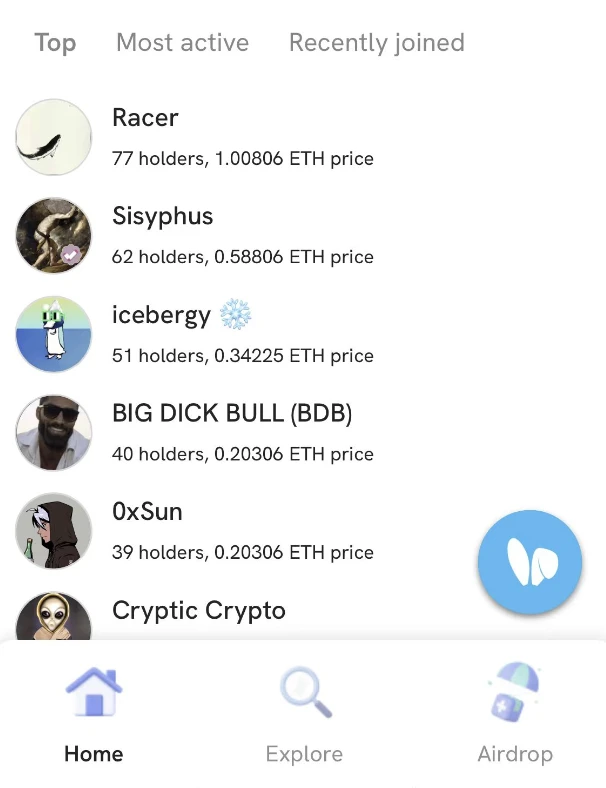

In friend.tech, each user is tokenized. Users’ influence can be directly priced by the market.

Specifically, users are abstracted as a type of encrypted asset. A user can purchase shares of “other users”.

Why would someone be willing to pay real money to buy other people’s shares? For those who have strong social influence (such as popular analysts, project founders, etc.), many of their fans hope to have private conversations with them or directly consult with them.

On traditional social platforms like Twitter, the private messaging function is often abused due to its lack of restrictions. KOLs receive a large number of private message requests and cannot handle all of them. This is different on friend.tech. By default, users cannot have private conversations. For buyers, they can only have the permission to initiate private chats with someone after owning shares of that person. The price of shares will also fluctuate with market supply and demand. Users can also resell the shares they hold to earn profits.

For social influencers whose shares are bought, each buy and sell transaction allows them to earn “subject fees”.

How are real-person stocks priced?

Roughly speaking, the more popular a person is and the more their stocks are traded, the higher their stock price.

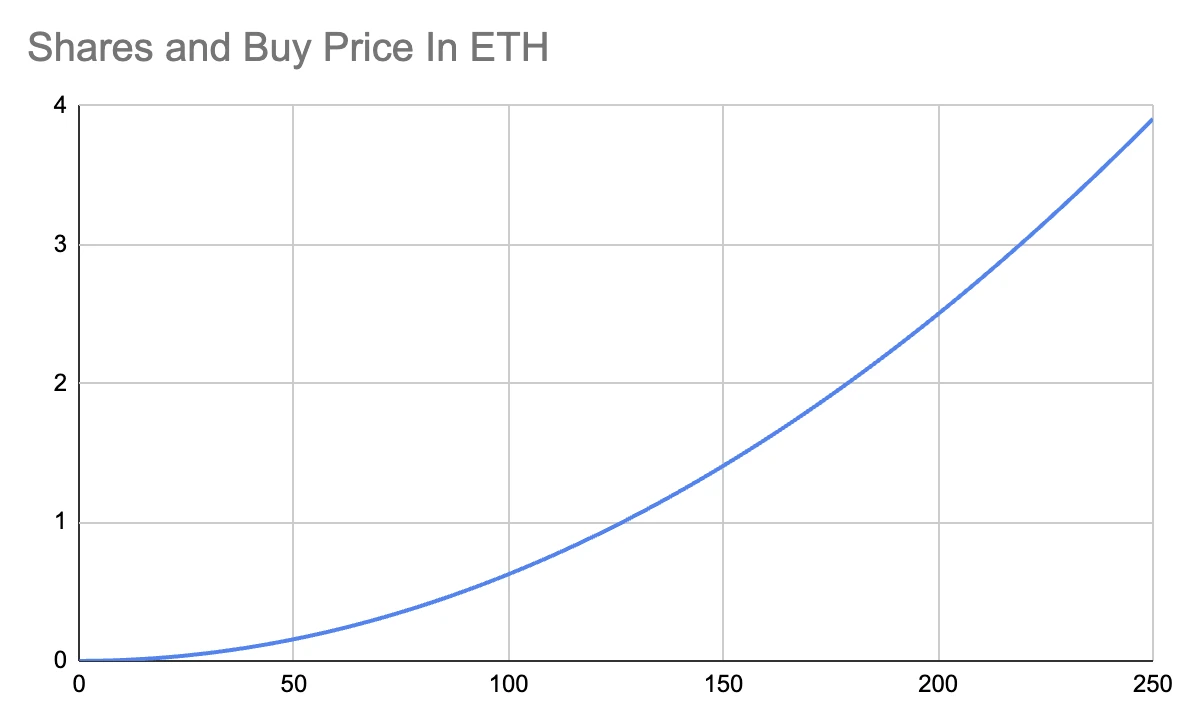

So, specifically, how is the stock price determined? Twitter user @functi0nZer0 has compiled the pricing model of this product.

With the growth of stock sales, the price has also significantly increased. The more shares of a person’s stock people buy, the more valuable their stock becomes.

And 5% of each transaction is earned by the original “issuer” (the subject of the stock naming). This also leads to a very strong network effect. The more transactions and speculation there are on a person, the more money they can earn.

Although this product is not a platform for issuing KOL fan tokens, its product design inevitably reminds people of traditional fan tokens.

Prior to this, the category of “fan tokens” had a significant impact in the SocialFi track. It is generally believed that issuing fan tokens to individuals with social influence and empowering fan tokens is a combination of social and encryption.

However, as fan token products mature, we can easily see the various problems that exist in such products. On the one hand, it is difficult for fan tokens to have a deeper connection (or binding) with influencers. Often, apart from the name, fan tokens no longer have much connection with the influencers they represent.

And the problem this brings is that fan tokens are difficult to have liquidity in the market. These projects are difficult to trade and, in most cases, do not have investment or speculative value.

What friend.tech brings to social tokens is that it gives trading value to the “stock” of influencers through the setting of a price curve in the mechanism. Just as DEX has abandoned the “order book” that requires higher immediacy and chosen the AMM mechanism. The change in the price of a person’s stock does not require constant trading. Even with few buying and selling activities, individual stocks will still generate sufficient volatility based on a pre-set price curve.

Invitation code farce reappears, different paths lead to the same destination?

friend.tech is currently in the testing phase and can only be used by users with invitation codes.

In addition, when the invitation code is used, users can also receive “points”. Due to the expectation of receiving airdrops for “points”, this further attracts people’s enthusiasm for its “CX”.

But when we look back at history, it is not difficult to find that such social products that became popular overnight and had scarce invitation codes appear in every cycle.

In 2021, the social product Monaco became popular overnight, and because the product also used an invitation mechanism, registration was only possible with an invitation code. This also caused the platform’s invitation codes to be traded for hundreds of dollars.

Earlier this year, Nostr, promoted by Twitter founder Jack Dorsey, became popular in the crypto world and was even repeatedly discussed as a possible replacement for Twitter.

Social networks are one of the most core and fundamental application scenarios on the Internet, and they can reach the most common and widespread C-end users. This also makes it a popular entrepreneurial field in the crypto industry.

But as concepts like SocialFi and DeSocial rise and fall, users looking back will inevitably find that encrypted social products seem to have the same fate – a rapid “rise to fame” followed by silence. Of course, the same goes for Web2, and I believe everyone still remembers the popularity of Clubhouse.

In the early stages of a product, by using admission mechanisms to limit the massive influx of ordinary users, artificially raising the threshold for users and creating scarcity is a common practice for social products to attract attention. However, without the accumulation of real demand and relationship networks, the initial novelty cannot determine user retention and conversion.

In the Web3 world, despite the emergence of new social protocols and applications like DID and SBT, there is no one that has truly accumulated a large number of active users after the hype, how long can the hotness of friend.tech last?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Is the highly touted concept of a fully integrated blockchain gaming system really feasible?

- Interview with Animoca’s Director of Investment Where is the next wave of application scenarios for NFT?

- Performance art or hidden motives? Bold speculation on the reasons and identity behind the consecutive burning of significant assets by nd4.eth.

- LianGuai Daily|The Federal Reserve launches a new plan to regulate banks’ cryptocurrency activities; Founder of MakerDAO proposes to change the maximum value of EDSR to 5%.

- In-depth Research Can Algorand, a public chain focusing on developer and marketing, stage a comeback?

- Leading Ethereum-based project ETHS launches virtual machine, innovation seems to return to its origins.

- EigenLayer in-depth research report Ethereum’s middleware protocol leading the narrative of re-staking