In-depth Analysis of Base Standing on the shoulders of giants, emerging in the fiercely competitive Layer2 race.

In-depth Analysis of Base Standing on giants' shoulders, emerging in the Layer2 race.1. Project Highlights

1. Project Advantages

1.1 Strong corporate background: With Coinbase as its backing, Base has strong user resources and financial support. In addition, Base can easily build decentralized applications that can access Coinbase products, users, and tools, seamlessly integrating with Coinbase’s product suite.

1.2 Integration into the Super Chain ecosystem: As a user of OP Stack, Base can seamlessly connect with all projects that have adopted this technology stack, while also enjoying the ecosystem support of other OP Stack projects, thereby enhancing the prosperity of the Base chain’s ecosystem.

1.3 Outstanding business performance: Base is still in its early stages, officially launching its mainnet on August 9, 2023. However, its business data far exceeds that of Linea, which launched on July 18, 2023. Its TVL even surpasses Starknet to become the fifth-ranked Layer2 TVL in the rankings. This shows that Base is more popular in the market.

1.4 High community heat: With users being able to enter the Base chain early through token contracts, a huge wealth effect has occurred in the Base chain. The appearance of the thousand-fold coin “$BALD” has sparked a frenzy in the Base chain, attracting the attention of many community members.

- How can Base chain without tokens start Onchain Summer?

- Interpreting US Cryptocurrency Taxes General Taxation, Cryptocurrency Taxation, and Future Development Trends

- Outlier Ventures What pain points does the Web3 marketing model solve?

2. Potential Risks

2.1 Lack of core competitive advantage in technology: The emergence of Base does not seem to bring significant importance. It seems to be just an ordinary member among many Layer2 projects. Although it has strong support, it is not enough to make it stand out. Moreover, the impact of Base on the industry and this field is minimal. (Which aspect of the core competitive advantage is this referring to? Is it technology?)

2.2 Uncertain issuance prospects due to regulatory pressure: In the uncertain regulatory environment, it is difficult for Base to launch its token, and its mainnet release roadmap clearly states that there are currently no plans to issue tokens. Compared to other Layer2 projects that are expected to conduct token airdrops, Base has lower attractiveness to airdrop hunters.

However, its official whitepaper also mentions: “Decentralization will be gradually implemented in the future.” In the decentralization process of web3, common implementation methods include token issuance and the establishment of decentralized autonomous organizations (DAO). In addition, many projects in the past have claimed that they will not issue tokens, but later distributed tokens and conducted airdrops to users. Therefore, another viewpoint believes that as a public chain, Base is highly likely to issue governance tokens.

2. Project Overview

1. Project Introduction

Base is an Ethereum Layer2 incubated by Coinbase and built on the OP Stack. Base will return a portion of the transaction fee revenue to the Optimism Collective Treasury. The goal of Base is to bring the next billion users into the crypto world.

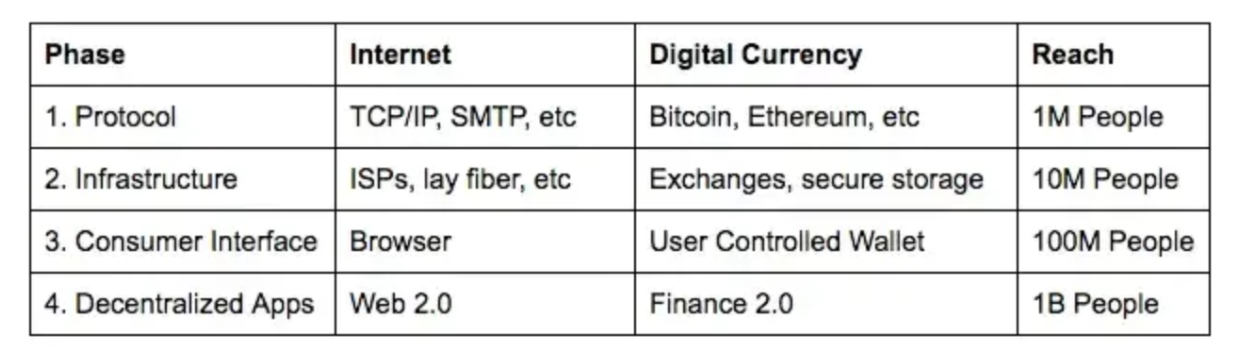

As shown in the above figure, the founder of the company, Brian Armstrong, proposed a general plan outlining the growth of cryptocurrencies in four stages. These stages include:

-

Developing new protocols such as Bitcoin and Ethereum. (Completed) – 1 million people

-

Establishing exchanges to facilitate trading. (Completed) – 10 million people

-

Building a mass-market interface for dApps. (Completed) – 100 million people

-

Building dApps to power an open financial system. – 1 billion people

The last step is hoped to be achieved through Base. The Coinbase team sees Base as the next step in achieving the mission of enhancing economic freedom in the world. Base will serve as the location for Coinbase’s on-chain products and an open ecosystem for anyone building Ethereum scaling solutions and dApps. The Coinbase team hopes that Base will become a seamless gateway for Coinbase users to access a wider range of the crypto economy, ultimately making it easier for more people to access web3.

Base is a branch of the OP codebase. The Base team chose Optimism because the EVM provides the “path of least resistance,” and the OP codebase provides a fast onramp.

Coinbase and the Optimism team have been collaborating for over a year and have made significant contributions to the development of EIP-4844 (also known as Proto-Danksharding, which will reduce L2 transaction costs by 10-100 times). Coinbase is now a core contributor to the OP stack and the second core project team to join.

2. Project Team

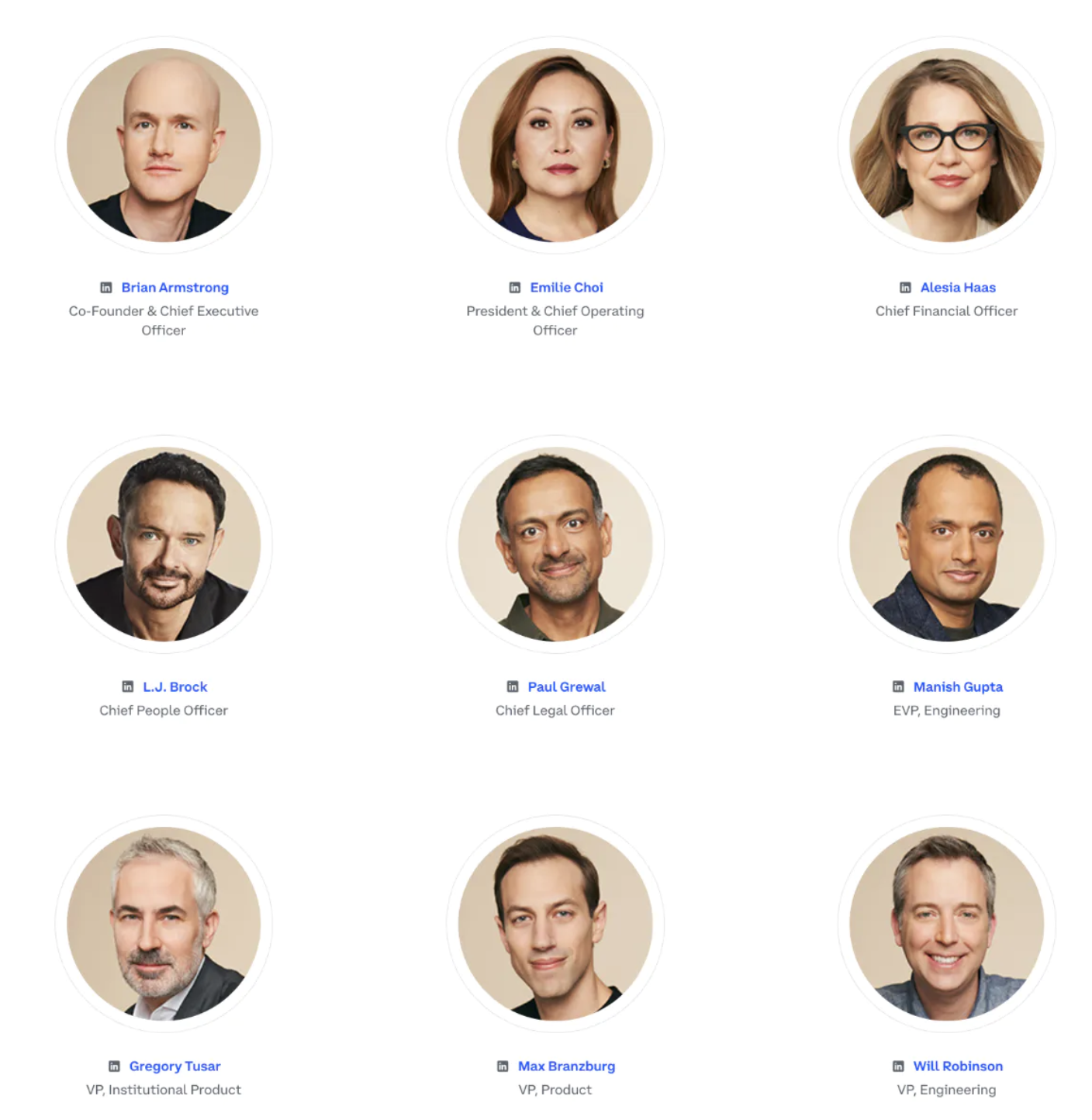

Base is incubated internally by Coinbase, one of the world’s largest cryptocurrency exchanges, founded by former Airbnb engineer Brian Armstrong in June 2012.

As of today, Coinbase has over 245,000 ecosystem partners in more than 100 countries/regions who believe in Coinbase’s ability to securely and easily invest, spend, save, earn, and use cryptocurrency. As shown in the above figure, Coinbase has assets on the platform totaling $128 billion, with a quarterly trading volume of $92 billion, and the company has over 3,400 employees.

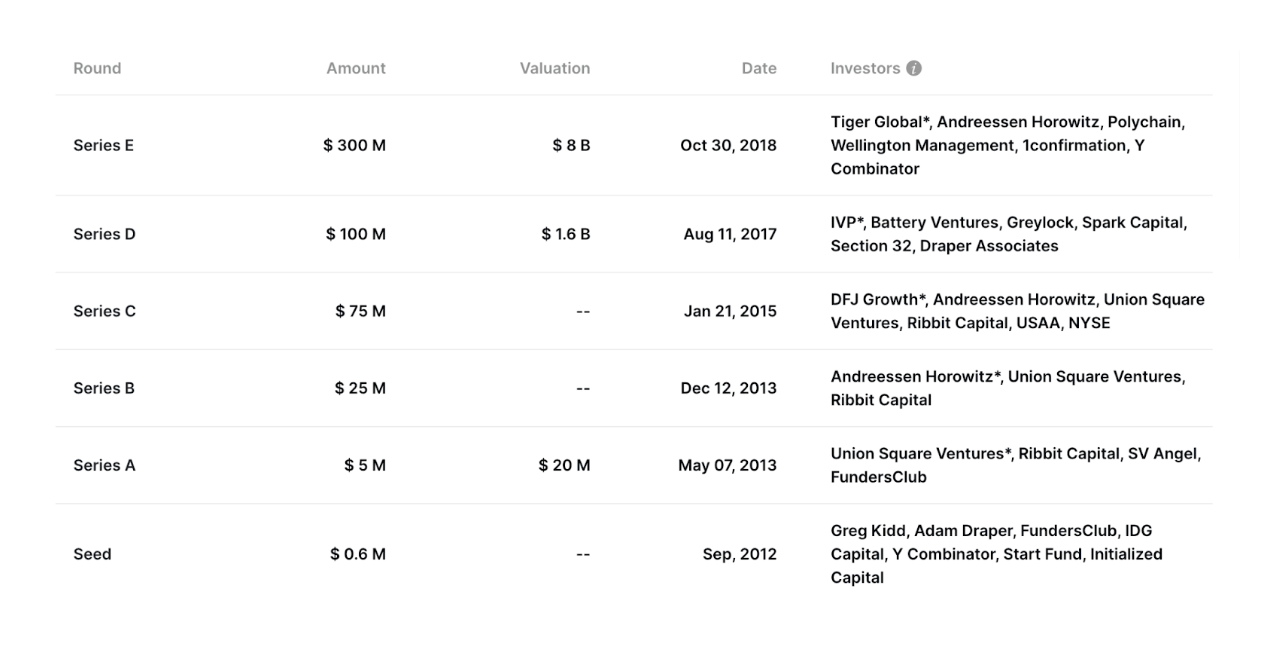

It is worth mentioning that Coinbase completed a $300 million Series E financing at a valuation of $8 billion on October 30, 2018, and went public on Nasdaq on April 14, 2021, with the stock code “COIN” and a current market value of $20.65 billion.

3. Project Financing

Currently, Base has not conducted independent fundraising activities, but its parent company Coinbase has successfully raised $505.6 million. Considering Coinbase’s position as one of the largest centralized exchanges and its strong financial resources and cash flows, Base is likely to receive funding support from Coinbase and will not face funding shortages.

4. Project Progress and Roadmap

Base launched the Base testnet on February 23, 2023. On March 4, 2023, it provided a bounty of $15,000 for infrastructure developers at ETHDenver. Afterwards, on May 24, 2023, the preparations required before the mainnet goes live were announced (all preparations have been completed):

-

Successfully completed the Regolith hard fork on the testnet

-

Successfully conducted infrastructure review with the OP Labs team

-

Successful upgrade of Optimism cornerstone

-

Successful completion of internal and external audits with no major issues

-

Demonstrated the stability of the testnet

After completing the above launch criteria, on July 13, 2023, Base officially announced that the Base mainnet is now open to builders. The first phase of the mainnet allows developers to deploy their products on Base.

On August 3, Base announced that the mainnet will be officially open to all users on August 9. Base also held an event called “OnChain Summer” to celebrate this, which is a month-long online event organized by 50 of the best builders, brands, products, artists, and creators. Every day in August, there will be some interesting online activities for users, including the following:

-

Onchain Summer – August 9 to 18: Create art, websites, or anything else inspired by Onchain Summer on Base.

-

Build on Base – August 12 to 23: Deploy protocols, build infrastructure, or new applications on Base.

-

Support Cryptocurrency – August 14 to 24: Create a one-minute video sharing stories about on-chain use cases or advocating for sensible legislation.

-

Based Accounts – August 16 to September 13: Use account abstractions to build something that unlocks new or improved user experiences on Base.

In addition to funding, Base also collaborates with other Superchain (OP Stack) members to hold the virtual hackathon Superhack from August 4 to 18, with a prize pool of $125,000.

3. Competitive Analysis

1. Funding:

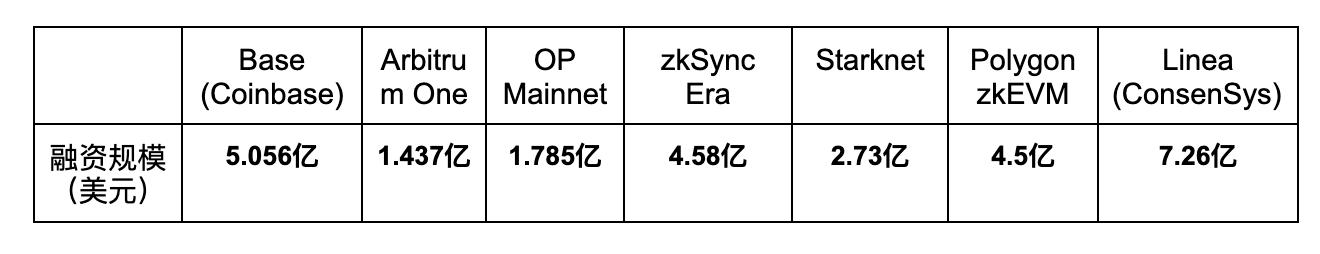

In terms of financing, Base did not raise funds separately for the project. However, as shown in the following figure, its parent company Coinbase has raised a total of $505.6 million in funding, so it has sufficient funds.

At the same time, Coinbase, as one of the top 5 leading centralized cryptocurrency exchanges, has strong financial resources and cash flow. It can provide a large number of user resources to Base while also offering strong financial support. As mentioned earlier, as the crucial role in Coinbase’s fourth step (10B+), Base will undoubtedly receive sufficient support.

In addition, other Layer2 projects have also received substantial financing: Arbitrum One has received $143.7 million, OP Mainnet has received $178.5 million, zkSync has received $458 million, StarkNet has received $273 million, Polygon zkEVM has received $450 million. It is worth noting that Linea, like Base, did not receive separate financing, but its parent company ConsenSys received $726 million in financing.

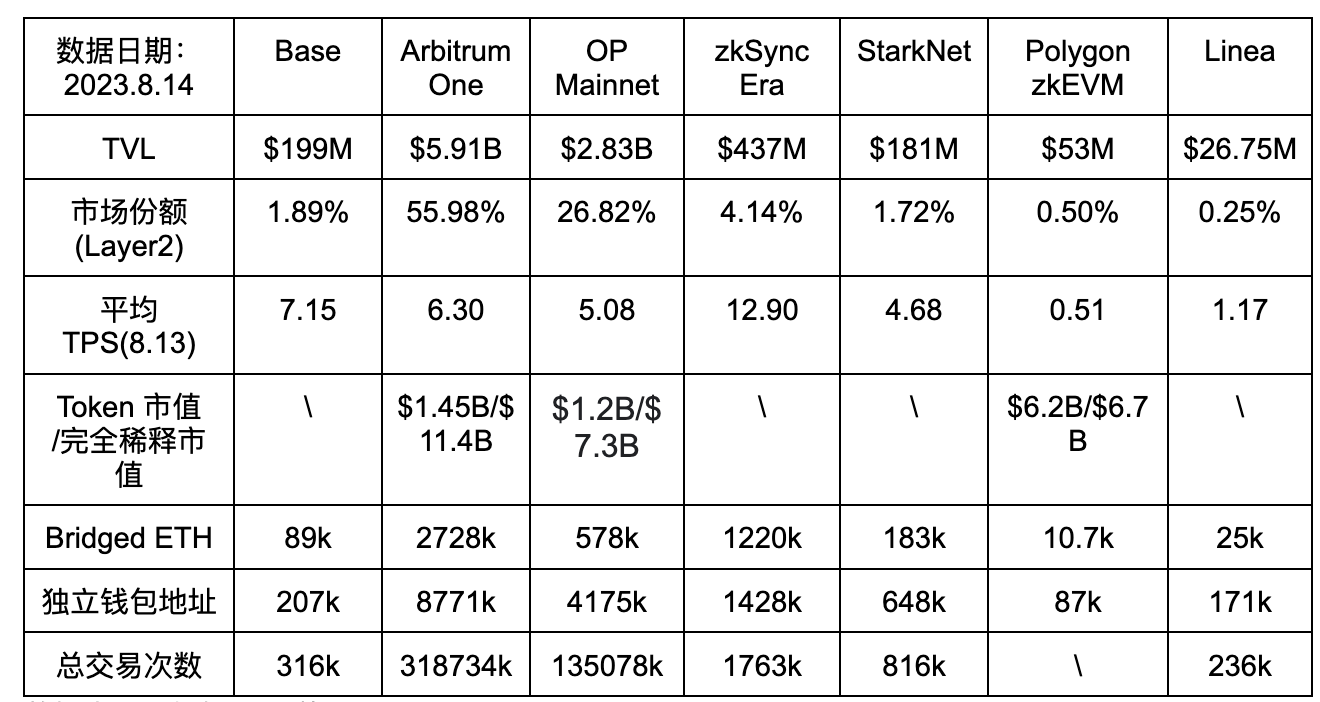

2. Business Data:

Data source: compiled according to dune

It should be noted that Base Mainnet was officially launched on August 9th, so the data is currently for reference only.

From the above data, it is obvious that Arbitrum One has an absolute leading position in terms of business in the current Layer2 field. In terms of Total Value Locked (TVL), Arbitrum One accounts for over 55% of the market share, followed by OP Mainnet, which accounts for over 26%. It is important to emphasize that these two projects together account for over 80% of the market share. Like Base, they belong to the category of Op Rollup technology.

In addition to TVL, it can be seen that Arbitrum One is also far ahead in other data, followed by OP Mainnet. Compared with the current Layer2 leader, Base still has a great room for development and improvement. Its TVL has a gap of more than 50 times compared to Arbitrum One, and the on-chain data is also far behind.

However, compared with Linea, another project that has been online for almost a month, although Base was launched on August 9th, it has already surpassed Linea in various aspects of business data and has achieved a significant leading position. The TVL is nearly three times that of Linea, and the on-chain data is also ahead of Linea. Therefore, it can be considered that the market holds a more optimistic attitude towards the development of Base, and more investors are willing to operate funds on the Base chain.

It is worth noting that before the official cross-chain bridge of Base was opened and the Mainnet was officially launched, some cross-chain bridges had already started to support cross-chain operations from other chains to Base, such as Orbiter Finance.

Moreover, before these cross-chain bridges support cross-chain of the Base chain, users can also deposit funds into the Base chain by manually transferring funds to the contract. At that time, it also caused a wave of meme coin frenzy, and even a token called $BALD, with a thousand-fold increase in value in one day, appeared. The specific situation can be referred to in this article.

IV. Highlights of Base and OP Stack Analysis

1. Backed by Coinbase

1.1 Financial and resource support

Coinbase has more than 100 million verified users and nearly billions of dollars in assets. As mentioned above, Coinbase is one of the top 5 exchanges in the cryptocurrency market, with strong user resources and abundant funds. Therefore, Base, backed by Coinbase, can obtain support in terms of funds and resources.

1.2 Seamless integration of Coinbase products:

Coinbase systematically eliminates the barriers that retail users may encounter when migrating from centralized finance (CeFi) to decentralized finance (DeFi) with its outstanding capabilities.

-

Coinbase Wallet is one of the most integrated wallets in the DeFi field, with over 1 million desktop users and over 10 million mobile users.

-

Coinbase has a close collaboration with Circle, jointly driving the market value of USDC stablecoin to over $25 billion.

-

Coinbase’s Liquid staking token cbETH is the second highest staking entity after Lido, with 2.33 million ETH staked on Coinbase, effectively securing the stability of the Beacon chain.

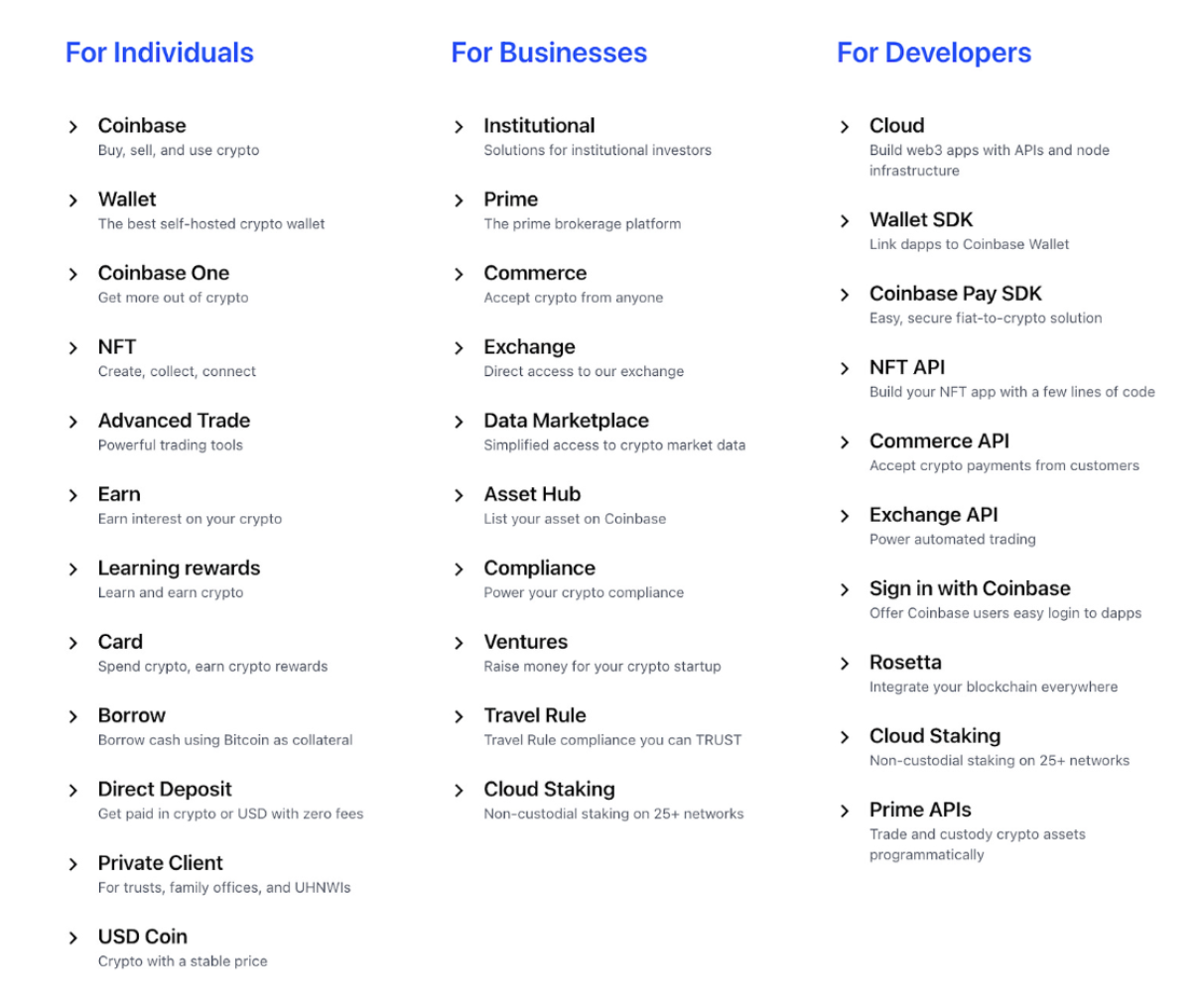

In addition, Base can easily build decentralized applications that can access Coinbase products, users, and tools, seamlessly integrating with Coinbase’s product suite. As shown in the figure below, just like Metamask automatically integrates the Linea mainnet, Base also automatically integrates the base mainnet in the Coinbase Wallet, so users do not need to add it themselves.

Furthermore, Coinbase is not just an exchange. Its product offerings include digital asset collateral solutions, liquidity collateral derivatives, institutional custody solutions, non-custodial wallet products, and DeFi accessibility within applications. Base is a natural extension of this product line, providing Coinbase users with a direct way to immerse themselves in the Web3 world.

1.3 Fund security support:

In the current stage, the cryptocurrency market is relatively limited in size, so many large investors and institutions may hesitate to invest a large amount of funds in the cryptocurrency field. They may also have reservations about holding assets on the blockchain for investment purposes.

However, it is worth noting that Base relies on Coinbase, a company listed on NASDAQ. Coinbase, as a mature market participant, has reliability in fiat on-ramps and is subject to stricter regulations. This makes Coinbase more trustworthy in terms of fund security and may attract more active participation from institutional investors.

2. OP Stack

As mentioned at the beginning of the article, Base is built on OP Stack, an Ethereum Layer2 solution, and Base will return a portion of the transaction fee revenue to the Optimism Collective treasury. So what is OP Stack? What benefits does Base bring by being built on OP Stack?

2.1 What is Optimism Collective

According to official introductions, Optimism Collective is composed of communities, companies, and citizens, governed by Citizens’ House and Token House. It aims to avoid the governance traps that other governance models on Ethereum may encounter, and the two entities’ mission is to balance short-term incentives with the project’s long-term vision. The purpose of Optimism Collective is to produce powerful public infrastructure for OP, increase the utility of L2, and create an efficient and comprehensive cryptographic economic foundation.

2.2 What is OP Stack?

According to the official introduction, OP Stack is a standardized, shared, and open-source development stack that supports Optimism and is maintained by the Optimism Collective. OP Stack consists of many different software components managed and maintained by the Optimism Collective, which together form the backbone of Optimism. OP Stack is built as a public product for the Ethereum and Optimism ecosystems.

In the second half of 2022, the Optimism team is breaking down their original development work into multiple modular levels (Data Availability Layer, Derivation Layer, Execution Layer, and Settlement Layer) and developing OP Stack. In short, OP Stack is a standardized open-source module developed by Optimism, which can be assembled into a custom chain. Any developer can innovate and create a new chain based on OP Stack.

With the OP Stack module, developers can directly plug in the data bits of OP Stack to create a Layer2, Layer3, or even Layer4. “Standardized” means that the module has a consensus and is recognized by the current market. “Open-source” means that it can be freely provided for iteration and requests by anyone.

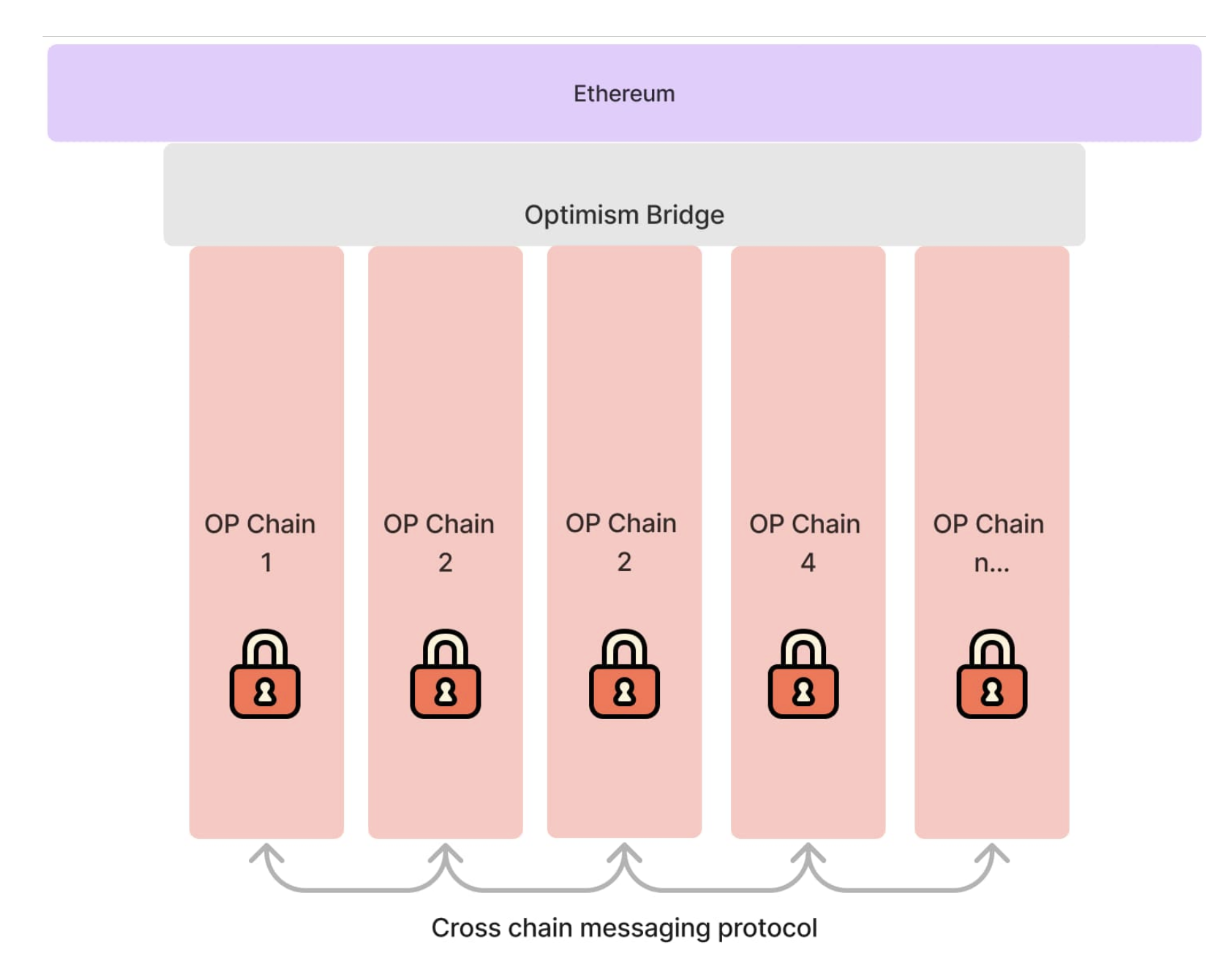

2.3 Superchain

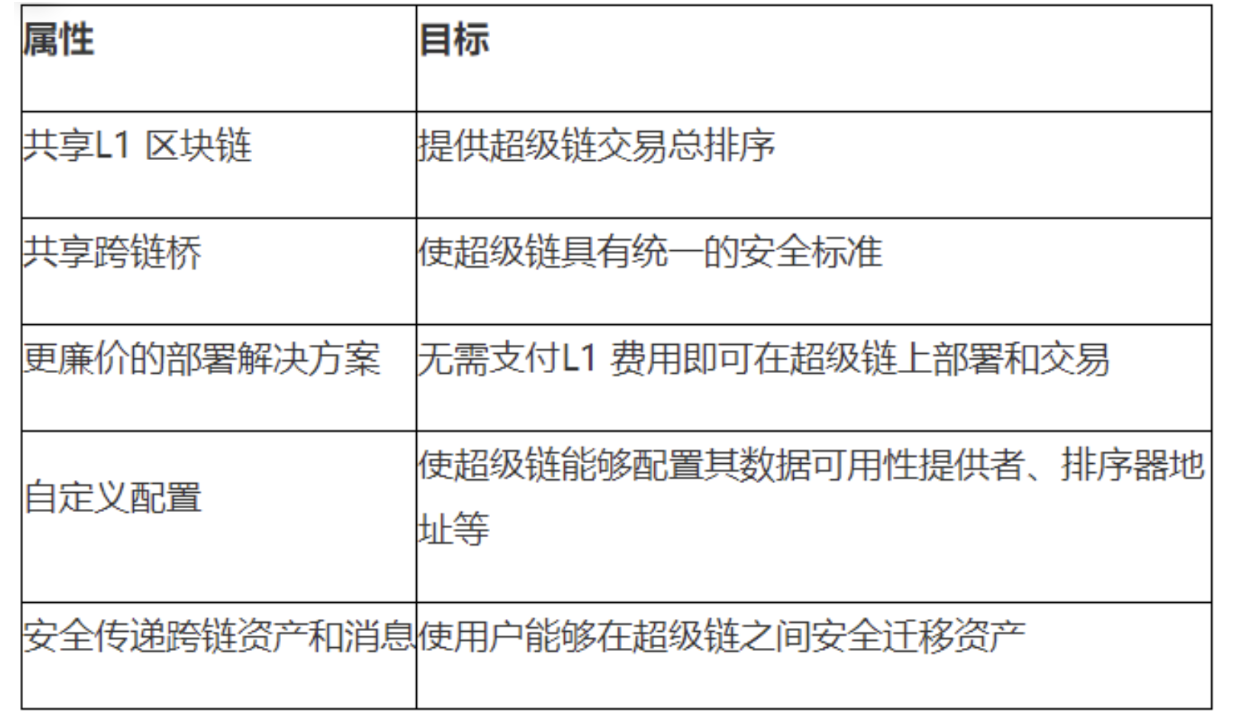

The goal of OP Stack is to integrate various isolated L2s into a single Superchain, integrating isolated L2s into a system with interoperability and composability, making launching L2 as simple as deploying smart contracts on Ethereum today.

Essentially, as shown in the above figure, the Superchain is a horizontally scalable blockchain network where the chains share security, communication layers, and development kits. OP Stack will be the modular development stack behind the Superchain, and within the Superchain are countless interconnected and communicable blockchains.

The Superchain based on OP Stack will have the following common attributes:

2.4 Collaboration between Base, OP Labs, and Optimism Collective

2.4.1 Accelerating Superchain Activities

Base is the second L2 deployed on OP Stack after Optimism’s mainnet and intends to be part of the Superchain. Base will bring Coinbase’s on-chain products and user base into the Superchain ecosystem, increase Superchain activities, and enable Coinbase users to seamlessly interact with dapps and transfer assets throughout the ecosystem.

2.4.2 Adding Value to the Superchain

Base will provide Optimism Collective with a certain percentage of fees earned from exchanges, making it part of the Superchain and providing funding for the core public product infrastructure of the Superchain and the broader crypto economy.

2.4.3 Advancing the Developer Ecosystem

Base will continue to work closely with OP Labs and Optimism Collective to make it easier for developers to build new L2s and Rollups and deploy their applications across the Superchain. For example, Base will collaborate with Optimism Collective to create primitives (such as identity) that can be used on L2s joining the Superchain, including Base and Optimism Mainnet.

2.4.4 Building an Interoperable Crypto Economy

In the short term, the Base mainnet and Optimism mainnet will operate as independent Layer 2 (L2) platforms, providing a range of products for the crypto economy, such as swaps and lending. However, in the long run, it is expected that more use cases will choose to deploy on Optimism mainnet or Base to achieve more meaningful applications. This will enable developers to flexibly deploy applications on the most suitable L2 platform based on the specific needs of their use cases.

3. What are other projects that use OP Stack?

3.1 Worldcoin

In May of this year, the Worldcoin Foundation and Tools for Humanity (TFH), early contributors to the protocol, announced their support for Optimism Collective to jointly build a scalable blockchain ecosystem based on OP Stack.

As the first step in entering Optimism Collective, Worldcoin’s decentralized privacy identity protocol, World ID, will go live on the OP mainnet. The native wallet of Worldcoin, World App, will also be migrated to the OP mainnet in the future.

In fact, as early as 2020, Worldcoin independently developed and launched an Optimistic Rollup application chain called Hubble, which was specifically designed for simple payments. They also released a test version of World App. However, after the release, the team found that the test results were not satisfactory. The users’ demand was not limited to simple payment functions, which far exceeded the capacity of Hubble. Therefore, it was migrated to Polygon PoS.

Now, Worldcoin has decided to rebuild the application chain using OP Stack. However, this collaboration will focus on building an on-chain identity system. For Optimism, an on-chain decentralized identity system is crucial to achieve its economic self-growth. It can unlock democratic governance and innovation, allowing individuals to better control their finances and participate in the global economy on their own terms. To achieve this, Optimism has deployed the identity primitive AttestationStation. This experimental identity system allows anyone to provide arbitrary attestations for other addresses, thus assigning a trust score to a specific on-chain address and measuring the real social relationship (influence) of that address.

For Worldcoin, the identity system is equally important. Since they want to distribute digital currency to the world’s 7.9 billion people for free and achieve fair distribution of wealth, they need a method to determine the user’s identity and prevent the same person from claiming tokens multiple times using different identities. To address this, the team has developed World ID as the underlying identity protocol for Worldcoin. It ensures that each person can only register one account using their iris. In addition, the team has also developed a set of biometric devices that verify a person’s uniqueness by scanning their iris and ensure the privacy of the verified individual using zero-knowledge proofs.

On July 13, 2023, during the testing phase, the number of World ID registrations exceeded 2 million.

Furthermore, on August 6, 2023, it was officially announced that in addition to the increase in the number of verified World ID holders, the World application (the first wallet built for the Worldcoin network) by Tools for Humanity also experienced a significant increase in global activity after its launch. Within 7 days of the release, the weekly active users of World App tripled, and the number of accounts created per week increased by more than 10 times.

3.2 BNB Chain Application Chain opBNB

In addition to Ethereum, other public chains can also use OP Stack to achieve their own “Layer2” scalability, such as the second-layer application chain opBNB built on OP Stack.

On June 19, BNB Chain launched the Layer 2 testnet based on Optimism OP Stack (expected to launch the mainnet in Q3 2023). By adopting OP Stack Rollup, opBNB can move computation and state storage off-chain to alleviate congestion and reduce transaction costs.

opBNB can further improve processing speed, with better performance than BNB Chain. According to official descriptions, opBNB has a block time of 1 second, with transfer gas fees as low as $0.005, and a transaction volume of over 4000 transactions per second (TPS). In comparison, the current processing speed of BNB Smart Chain on Layer 1 is 2000 transactions per second, with an average cost of approximately $0.109 per transaction. opBNB’s speed is almost twice that of the BNB Chain mainnet, with significantly reduced costs.

opBNB is a Layer 2 network (based on OP Stack) on the BSC. Similar to Optimism Rollup, opBNB calculates and packages transaction data off-chain and submits it to Layer 1 to improve network performance, ultimately achieving high TPS, low gas fees, and the same level of security as Layer 1.

So why does opBNB use OP Stack to build its own application chain?

In fact, L2 is not unique to Ethereum. With the surge in transaction volume from GameFi and other applications, even high-performance public chains like BNB Chain face the challenges of network congestion and high gas fees. The original design and architecture are no longer able to meet the scalability requirements. This is where opBNB comes in.

As early as September last year, BNB Chain launched the zkBNB testnet (a Layer 2 network that uses zero-knowledge proofs). However, zkBNB is not compatible with the EVM (incompatibility with the EVM means it cannot interact with applications on Ethereum). This is what prompted BNB Chain to develop the new Layer 2 solution, “opBNB”.

opBNB introduces improved data availability, batch transactions, and a gas limit of up to 100M for the BNB Chain ecosystem. At the same time, the EVM-compatible OP Stack simplifies the process of migrating Ethereum Virtual Machine (EVM) code from Ethereum to the BNB Chain, allowing developers to create open ecosystems faster and easier, thus expanding the user base.

Different from Optimism and Coinbase’s Layer 2 scaling solution Base, opBNB is built on BSC (not Ethereum). BSC is already faster than Ethereum in terms of speed, and opBNB will further improve performance, surpassing not only BSC but potentially also other scaling solutions like Optimism.

Most importantly, adopting OP Stack to build a Layer 2 application chain has strategic significance for BNB Chain. For the public chain BNB Chain, using OP Stack to build an application chain still allows BNB to be used as the gas fee payment token. This means that as more use cases emerge in the future, it can greatly expand the application scenarios for BNB, and these benefits can be captured by BNB. In the long run, BNB Chain may even become a strong competitor to Ethereum’s continuously developing L2 ecosystem.

3.3 Zora Network

Zora Network has launched a Layer 2 NFT minting platform based on OP Stack, targeting NFT creators, brands, and collectors, providing a range of tools for NFT creators, and reducing minting costs to below $3.

Around creators and collectors, Zora aims to create the best user experience by providing faster, cheaper, and better on-chain experiences. As Zora Engineering tweeted, “An interesting fact is that the cost of ‘bridging to L2’ + ‘minting’ is lower than the cost of minting alone on the mainnet.”

Zora Network will seamlessly integrate with the existing infrastructure of the Zora marketplace. This means that the current platform’s artists, brands, and collector users will seamlessly join the new Layer 2 network, including 35 Web3 project entities such as the music NFT platform Sound.XYZ, wallet application Rainbow Wallet, Web 3.0 innovation incubator Seed Club, and PleasrDAO, as well as the existing 130,000 users. To commemorate this release, Zora has issued an open edition NFT named Energy, which fans can mint in the next 10 days.

In addition, data shows that since its launch on the 21st, Zora Network has surpassed 164k bridging addresses and has a TVL (Total Value Locked) of 1706 ETH, equivalent to approximately $3.1 million.

Furthermore, Zora is currently deployed on Base.

3.4 a16z’s Rollup Client Magi

Magi is a Layer 2 Rollup client solution launched by a16z Crypto in April this year. It is written in the Rust language and is based on OP Stack, acting as a consensus client in the traditional execution/consensus split of Ethereum, providing new blocks to the execution clients to advance on-chain transactions. Magi has the same core functionality as the reference implementation (op-node) and works together with execution nodes (e.g. op-geth) to synchronize to any OP Stack chain.

The goal of Magi is to be an independently developed alternative to op-node to enhance the diversity of Rollup clients. A16z hopes to build a new Rust-based client that will encourage a more secure and active OP stack and bring more contributors to the ecosystem.

As one of the most well-known investors in the crypto field, A16z has over $7.6 billion (approximately RMB 50 billion) of funds for investments in the field (as of May last year). As one of the investors in the Ethereum scaling project Optimism, A16z Crypto is leading the development of the Magi client on OP Stack, not only as an investor but also as a developer. This is also a first step for a16z to enter the Optimism Collective.

3.5 On-chain Games

OPCraft, Keystone, and Loot are on-chain games that often have high-frequency interactive scenarios, so they have extremely high requirements for speed and cost. This means that on-chain games need customized blockchain infrastructure, and many scaling solutions have introduced scaling solutions specifically for on-chain games.

OP Stack is one of the most popular infrastructures for on-chain games, and one of the most representative on-chain game experiments, OPCraft, is built on Op stack.

OPCraft is an on-chain virtual world, a voxel game (fully on-chain game) built entirely on OP Stack. OPCraft is an autonomous world, a fully on-chain virtual space where every aspect of the world, including every river, every blade of grass, and the snow on the top of the mountains, exists on-chain, and every action in the world happens as an Ethereum transaction.

Keystone is another chain made with OP Stack, which uses custom pre-compilation to embed game tick and ECS into the chain. It can increase the game speed on-chain by 100 times and provide a more powerful gaming experience.

In addition, the Loot ecosystem project Adventure Gold DAO recently announced that it will adopt OP Stack to build a new Ethereum L2 network called Loot Chain specifically for the Loot community. This will reduce Gas fees and use their native token AGLD as a Gas Token. The chain also uses Polygon as a data availability layer, significantly reducing the construction, deployment, and operation costs of the Loot Chain.

3.6 DeBank Chain

On August 11, 2023, the all-in-one wallet DeBank announced the launch of the DeBank Chain based on OP Stack. The testnet is now live, and the mainnet will be launched next year. DeBank Chain aims to become a social asset layer and integrates a system similar to Account Abstraction at the chain level, allowing users to enjoy a near Web2 experience while remaining 100% compatible with the current EVM standard. The new account system supports dedicated L2 private key signature transactions, reducing the use of L1 private keys in social scenarios and enhancing the security of users’ L1 assets.

5. Ecosystem Development

1. Base Ecosystem Fund

On February 23, Coinbase announced the establishment of the Base ecosystem fund in conjunction with the establishment of Base. This is a fund pool for investing in early projects based on the Base network and is supported by the Base team to help projects succeed.

The Base ecosystem fund provides 4 suggestions for ecosystem builders (excerpt from Base):

Stablecoins that track inflation rates (flatcoins): Base is interested in “flatcoins” when deeply considering the design of decentralized stablecoins. These stablecoins can track inflation rates, allowing users to have stable purchasing power while also having flexibility to withstand economic uncertainties caused by the financial system.

Base also welcomes other forms of “flatcoins” that are not pegged to fiat currencies but fill the gap between fiat-pegged tokens and unstable crypto assets. Given the challenges faced by the global banking system in recent times, Base believes that these explorations are more important than ever before.

On-chain reputation platform: Base believes that blockchain is the next internet, and decentralized identity and reputation will play a key role in defining everyone’s on-chain roles. By supporting reputation protocols for native on-chain entities, there is an opportunity to create more trust on-chain.

This may look like FICO or Google page ranking type scores on ENS names, merchant ratings/reviews, and other measures that help establish trust on-chain. Base is pleased to see teams deeply thinking about what on-chain reputation and credit looks like and how to leverage these systems while protecting user privacy and autonomy.

On-chain limit order book (LOB) trading platform: While Base believes that existing exchange products (such as AMMs) are very useful and critical DeFi infrastructure, there is still a place for LOB, especially for professional traders and institutions.

The high throughput of Base provides new opportunities for designing spot trading, limit orders, options, perpetual rights, and other new mechanisms. Moreover, builders can use open-source tools like OP Stack to construct L3, which can increase liquidity depth while bringing faster speed and stronger control, and can be accessed through L2.

Safer DeFi: As the DeFi ecosystem continues to develop, Base believes that better tools are needed to enable users and developers to keep up with innovation while ensuring the security of funds.

These tools include those that can prevent smart contract code vulnerabilities or protocol logic errors (such as self-service security testing tools, audit services), tools that help mitigate the impact of ecosystem attacks (such as threat prevention, circuit breakers, and event response systems), as well as ultimate on-chain insurance and coverage protocols, or any other products that can provide critical support to users in the event of smart contract failures.

Builders are constructing systems, protocols, and tools to allow every user to store all of their funds on-chain. Base believes that this infrastructure is absolutely necessary to attract the next billion users.

2. Ecological Projects

Since the launch of the Base mainnet, it has received extensive response from the developer community. Currently, there are over 150 projects deployed on Base, including DeFi, social, gaming, NFT, infrastructure, developer tools, wallets, security, oracles, and more. This article will select some representative projects from these categories for introduction.

2.1 DeFi

In terms of DeFi, the ecosystem deployed on Base is already quite mature, including well-established projects such as Uniswap, iZUMi, SushiSwap, and others. In addition, there are some emerging native projects, such as DEX Baseswap, which tops the TVL list, and Pira Finance, which has launched the stablecoin aUSD.

iZUMi

iZUMi Finance is a liquidity optimization protocol built on the Ethereum network. It is a Uniswap V3 ecosystem project that provides “programmable liquidity-as-a-service” for blockchain projects based on Uniswap V3.

iZUMi’s LiquidBox program assists projects in attracting liquidity by planning effective incentive liquidity supply plans. It also provides a shared liquidity box that maps the liquidity of one token to multiple chains, allowing LPs to mine on multiple chains using liquidity from the original chain.

iZUMi Finance has also launched iZiswap on the BNB Chain and zkSync. This is an upgraded discrete liquidity AMM based on the centralized liquidity model of Uniswap V3. iZUMi is also developing iUSD, a stablecoin pegged to the US dollar supported by USDC. iUSD is used for iZUMi’s bond mining program.

Other user-centric decentralized financial products offered by iZUMi include impermanent loss insurance, which provides refunds for impermanent losses caused by LP tokens to liquidity providers. It also offers fixed-income opportunities with an annual interest rate of up to 10% and a term of 30 days.

iZUMi Finance has raised a total of $57.6 million in funding so far, with investors such as Mirana Ventures, Everest Ventures Group, IOSG, etc., providing strong financial support and powerful resources.

- BaseSwap

BaseSwap is the native DEX on the Base Chain. As of today (8.14), its TVL has reached $52.34 million, ranking first on the Base Chain TVL leaderboard.

In addition, the Token $BSWAP of Base Swap is one of the most liquid tokens on the Base Chain.

2.2 Bridge

- Orbiter

Orbiter Finance is a decentralized cross-aggregate bridge for transferring Ethereum native assets. It is the infrastructure of Layer 2, providing low-cost and almost instant transfers. Orbiter Finance is designed as a decentralized cross-aggregate bridge for transferring Ethereum native assets.

Currently, Orbiter Finance supports more than 10 Rollup networks, including zkSync, StarkNet, Polygon, Arbitrum, Arbitrum Nova, Optimism, Base, Linea, etc., almost meeting the cross-chain needs of all Optimistic Rollups and Zk Rollup networks, and enabling high flexibility cross-chain transactions such as from Loopring to Immutable X.

On November 29, 2022, Orbiter Finance completed its first round of financing with a valuation of $40 million and raised $3.2 million. Investors include Tiger Global, Matrixport, Starkware, Cobo Ventures, GGV, Mask Network, Zonff LianGuairtners, etc.

- Axelar Network

Axelar is a universal coverage network that securely connects all blockchain ecosystems, applications, assets, and users to provide interoperability for Web3.

Axelar consists of a decentralized validator network, secure gateway contracts, unified translation, routing architecture, and a set of software development kits (SDKs) and application programming interfaces (APIs) to achieve composability between blockchains. This enables developers to build the best platforms for their use cases while having access to users, assets, and applications in every other ecosystem. It relies on a network architecture that provides a unified codebase and governance structure instead of paired cross-chain bridges.

The Axelar SDK provides a comprehensive suite of tools for developing Web3 applications, ensuring that developers have the necessary tools to build. With these tools and APIs, developers can easily deploy dApps on the Axelar network and its connected ecosystems.

In other words, Axelar abstracts cross-chain interoperability into a set of simple API requests. This is absolutely the core that will be adopted, as the developer experience when deploying Web3 applications must be similar to that of current Web2 developers, thus eliminating the deployment details of underlying networks and specific ecosystems. In Web2, the deployment details of underlying networks and specific ecosystems have been greatly simplified.

On February 15, 2022, Axelar completed its Series B financing round with a valuation of $1 billion and raised $35 million. Combined with seed and Series A financing, the total amount raised exceeds $73 million.

2.3 GameFi

- LianGuairallel

LianGuairallel is a trading card game (TCG) based on the ETH chain and featuring science fiction NFT trading cards. Players can purchase and collect cards, and use different cards to form decks that comply with the rules of the game to earn rewards.

The team members of LianGuairallel come from AAA games such as “Assassin’s Creed” and “Valorant”, and YouTube co-founder Chad Hurley joined the team in March 2021.

On October 22, 2021, LianGuairallel announced that it had received a $50 million investment from LianGuairadigm with a valuation of $500 million. The foundation of the investment is Echelon. The royalty for NFT asset secondary market transactions in the game is 7,560 ETH, equivalent to a value of $11.94 million. LianGuairallel brings its ecosystem to the Base mainnet, allowing users to collect and participate in the game at a lower cost.

- Iskra

Iskra is a blockchain gaming center that brings together gamers and game studios. Iskra allows gamers to explore and enjoy high-quality blockchain games and create their own communities. Interested users will also have the opportunity to explore new game projects through Iskra’s LaunchLianGuaid.

Users can also freely trade in-game tokens and other in-game assets minted as non-fungible tokens (NFTs) outside of the game.

Game studios can leverage the various resources provided by Iskra to develop various types of games, including but not limited to TCG, strategy, collectible, and MMORPG.

Iskra provides comprehensive support for the development and operation of blockchain games, from funding and infrastructure to token economics and passionate communities.

2.4 DeSocial

- Farcaster

Farcaster is a decentralized protocol that enables developers to build novel social networks. Farcaster redefines identity, messaging, and social graph, and addresses the applicable scenarios of user social ownership at the fundamental levels of privacy, authenticity, portability, usability, and scalability.

Farcaster is the brainchild of former Coinbase executives Dan Romero and Varun Srinivasan. Dan once mentioned on his own website, “Our goal is to build a trusted, neutral protocol where users have a direct relationship with their audience and developers are free to build new clients.” friend.tech friend.tech is a fan economy product similar to BitClout, which recently announced its launch on the Base network. Due to its innovative conversion of personal influence into tradable shares, it suddenly became popular on August 11, attracting a large number of users and causing its servers to crash. The user social behavior generated by its invitation code system also gives it a strong topic and spread.

The product can be understood as each account being a token that can be bought and sold, and the price will correspondingly rise and fall. If other users purchase your account token, you can receive a share from the transaction. If you buy the account token of another user, you can enter their private chat room and communicate with the purchased account blogger. You can also communicate in the chat room composed of all the people who have bought and hold the account token.

- CyberConnect

CyberConnect is the first decentralized social graph protocol for Web3.0 social networks and metaverse services. Its mission is to return ownership and utility of social graph data to users, democratize social connections, and make social graph autonomous, portable, and composable, so that social graphs are not only related to blockchain, but also enable users to discover more social identity meanings through these associations.

CyberConnect is a developer-friendly protocol that provides an infrastructure for all Web3.0 developers to integrate with.

CyberConnect has raised a total of $25 million in two rounds of financing and raised $5.4 million in a public sale on May 19, 2023.

- Base Name Service

Base Name Service (BaseNS) is the ENS (Ethereum Name Service) on the Base chain. It held a domain name airdrop event on GALXE in conjunction with the Base official on August 2nd. During this period, each participant could obtain a special role (BaseNS Inception enthusiasts) on Discord.

BaseNS will also randomly select 100 participants to send domain names, each .base domain name is worth $100/year, and the winners can use them for free for one year).

2.5 NFT

- OpenSea

OpenSea’s website has now integrated with the Base mainnet.

- BakerySwap

BakerySwap announced the launch of an AI-based NFT series called Punk X on the Base network in August. The total supply is 10,000. At the beginning, tokens were used instead of NFTs to enhance the liquidity of NFTs. 40% of the total token supply associated with NFTs is used for fundraising, 40% for users to add liquidity, 10% for airdrops, marketing, etc., and 10% for advisors, etc.

As the first openly developed project on the Base network, it raised 1600 ETH in half an hour after fundraising, and the official ended the fundraising early due to high interest. According to official information, its NFTs will soon be available on NFTSwap, where users can exchange PUNK NFTs at a 1:1 ratio.

- mintfun

mintfun is an NFT minting aggregation platform that has also announced support for the Base network. Users can see a series of NFTs being minted on the Base network, allowing them to observe the latest NFT collections and popularity.

- Coca-Cola

According to official news, the well-known beverage brand Coca-Cola will release a series of NFTs on the Base chain on August 14, 2023. This NFT series combines world art works with the iconic Coca-Cola bottle. Currently, there are 5 NFTs in this series that can be minted, with minting prices ranging from 0.0011 ETH to 0.014 ETH.

2.6 Infra

- Thirdweb

Thirdweb is a UK-based Web3 software developer that offers free Web3 development tools, allowing developers to build, launch, and manage web3 projects without writing any code. With just a few clicks, developers can add features such as NFTs, social tokens and currencies, token trading markets, and NFT trading.

On August 25, 2022, Thirdweb completed a strategic financing round with a valuation of $160 million and raised $24 million. The round was led by Haun Ventures, with participation from Coinbase Ventures, Shopify, Protocol Labs, Polygon, Shrug VC, and others. Individual investors include Joseph Lacob, a partner at top Silicon Valley venture capital firm Kleiner Perkins and a major shareholder of the NBA’s Golden State Warriors.

In a previous seed funding round of $5 million, Thirdweb also received investments from Mark Cuban, owner of the NBA’s Dallas Mavericks, and well-known American entrepreneur Gary Vaynerchuk. The total funding raised by Thirdweb is now $29 million, providing strong financial support.

6. Summary

Like Linea, Base is backed by a strong company, with abundant user resources and financial support, which clears many obstacles for Base’s development. Currently, Base is still in the early stages and will officially launch its mainnet on August 9, 2023. However, its business data far exceeds that of Linea, which launched on July 18, 2023. Its TVL even surpasses Starknet and ranks fifth in the Layer2 TVL rankings. This indicates that Base is highly welcomed by the market.

In addition, after users were able to enter the Base chain early by transferring coins to the contract, there was a remarkable wealth effect with the emergence of the thousand-fold coin “$BALD,” which made the Base chain popular and attracted a large number of community members.

In this phenomenon of thousand-fold coins, Base gained significant attention, which may be attributed to the outstanding operation and execution capabilities of the Coinbase team, seizing market sentiment before the mainnet launch and creating a high level of enthusiasm for the Base chain. In addition, this may also indicate the entry of some large investors with substantial funds.

In addition, the recent launch of the Base mainnet will gradually reveal its impact and significance for the industry over time. Although it has strong background support and is a member of the Super Chain, it seems that this is not enough to make it stand out from the competition.

Therefore, in order to stand out among the many Layer2 projects, Coinbase needs to provide more powerful and effective support and work more closely with Optimism to promote the development of OP Stack. At the same time, Base itself should actively innovate on the basis of OP Stack and create more meaningful innovations for the entire field and industry.

Reference links:

[1] Optimistic about the future? A summary of projects using OP Stack

[2]Inventory of Layer 2 public chain Optimism’s killer moves. What highlights can be expected from OP Stack and Bedrock updates?

[3]In-depth explanation of cross-chain communication protocol Axelar: How to unlock cross-chain composability and liquidity?

[4]Exploring OP Stack: Optimism’s vision for modular scalability

[5]Optimistic outlook? An article summarizing projects using OP Stack

[6]The coming of the super chain: A deep dive into the OP Stack created by Coinbase and Optimism

[7]Detailed introduction to the gameplay and asset value of three blockbuster games: Bigtime, Illuvium, and LianGuairallel

[8]Inventory of projects and opportunities worth paying attention to in the BASE chain ecosystem

Data links:

[1]https://dune.com/gopimanchurian/arbitrum

[2]https://dune.com/gm365/L2

[3]https://dune.com/Marcov/Optimism-Ethereum

[4]https://dune.com/KARTOD/zk-evm-mega-dashboard

[5]https://dune.com/tk-research/linea

[6]https://dune.com/angry/linea-mainnet-dashboard

[7]https://dune.com/gm365/era

[8]https://dune.com/chaininsight/starknet-overview

[9]https://dune.com/angry/base-mainnet-dashboard

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ketacoin collides with All In and soars a thousand times, who will be the next Wang Dalu?

- Curve CEO Michael Egorov From Physicist to Cryptocurrency Pioneer

- Quick look at a16z’s new SNARK-based zero-knowledge proof tools Lasso and Jolt

- Social application Friend.tech is hot, how are individual stocks priced?

- A Brief Understanding of the Current Situation of CyberConnect

- Less than a week and it has absorbed $700 million, is MakerDAO’s 8% interest rate really that attractive?

- IMF Working Paper (Part II) How to Tax Cryptocurrencies?