Understanding the Ordinals family on Bitcoin in one article

Explaining Ordinals family in Bitcoin in one articleWhat is the Ordinals protocol?

The Ordinals protocol can be simply understood as a system for numbering SATS. By assigning a sequential number to each SATS, and then attaching additional data (text, images, code, etc.), also known as “metadata” in NFTs, each SATS becomes a unique NFT. This process is called “engraving”.

“SATS” is a unit named after Satoshi, the inventor of Bitcoin, representing the smallest denomination of Bitcoin, with one Bitcoin being divisible into 100 million SATS. Individual SATS were originally interchangeable, but once they are numbered by the Ordinals protocol, they become non-interchangeable tokens (NFTs).

According to the Ordinals protocol, SATS numbers are based on the order in which they were mined. Therefore, numbering can also be used to define scarcity for each SATS. In an article on the Ordinals theory, founder Casey Rodarmot proposed a rarity table for Bitcoin NFTs, classified as follows:

- CoinGecko: How to discover “smart money” and track them?

- Bitcoin supply trend is changing, with a shift towards the East already taking shape.

- Current Status of Data Analysis in NFT Lending: Blend Takes 80% Market Share in First Month, Three Major NFT Loans Exceed Half the Total Amount

-

Common: Any SATS except the first SATS in a block (total supply of about 21 trillion)

-

Uncommon: The first SATS in each block (total supply of 6,929,999)

-

Rare: The first SATS in each difficulty adjustment period (total supply of 3,437)

-

Epic: The first SATS after each halving (total supply of 32)

-

Legendary: The first SATS of each epoch (total supply of 5)

-

Mythic: The first SATS of the genesis block (total supply of 1)

The introduction of the Ordinals protocol allows Bitcoin to break out of the limitations of being solely a store of value and payment function, helping to break the homogenization of the Bitcoin ecosystem. Therefore, despite being proposed less than half a year ago, the Ordinals “family” has developed rapidly. Currently, multiple derivative protocols have emerged around Ordinals, each with its own characteristics, enriching the connotation of the Ordinals protocol and providing more new ways to develop projects on it.

BRC-20

BRC-20 is a standard for issuing homogeneous tokens on the Bitcoin network that defines a series of functions, such as the name, issuance, and transfer of tokens.

BRC-20 is based on the Ordinals protocol. When the data written into SAT is cast according to a unified JSON format, homogeneous tokens can be generated. Therefore, the inscriptions on BRC-20 that identify sub-tokens are text data (Text) in a unified JSON format.

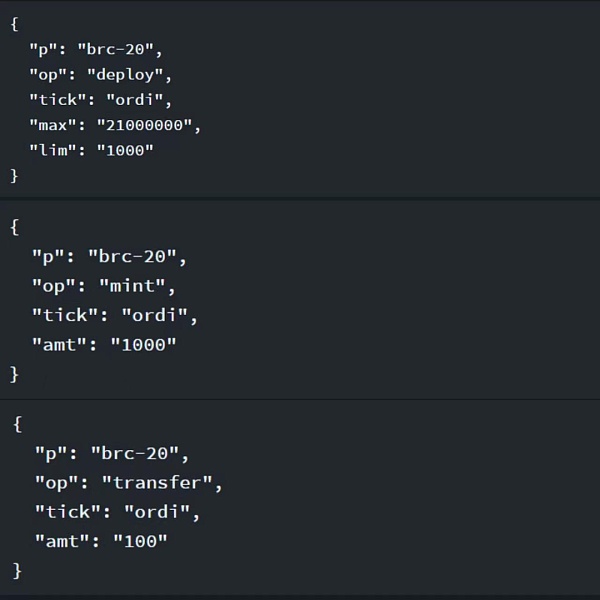

Taking the ORDI token in the figure below as an example, the deploy, mint, and transfer fields in the op field respectively represent the operations of token deployment, casting, and transfer. The tick represents the name of the token being executed, max represents the total issuance of the token, lim represents the maximum limit for a single coin casting, and amt represents the number of tokens executed during casting or transfer operations.

ORC-20

ORC-20 is an optimized version of BRC-20.

ORC-20 aims to enhance the functions of the BRC-20 protocol. ORC-20 is backward compatible with BRC-20, extends the functions of BRC-20, and cancels some restrictions, making it better suited to the needs of projects.

For example, ORC-20 cancels the restriction of a 4-character name for BRC-20 tokens; adds the function of token upgradability, allowing project parties to do more empowerment based on tokens (reduce supply and increase scarcity, etc.); adds some advanced functions (casting whitelist, royalty, etc.), and reduces the double-spending risk of BRC-20 through UTXO reduction, etc.

In short, the ORC-20 protocol is more flexible than BRC-20, and its application scenarios are more abundant. Its user experience is closer to ERC-20 tokens on Ethereum.

BRC-21 and BRC-42

BRC-21 and BRC-42 are cross-chain versions of BRC-20.

BRC-21 and BRC-42 are cross-chain solutions for BRC-20 tokens proposed by Alexei Zamyatin, the founder of the cross-chain project Interlay, aiming to connect BRC-20 tokens to external smart contract chains such as Ethereum, Solana, Polkadot, Interlay, etc. in a fully decentralized manner, thus unlocking the DeFi use cases of BRC-20 tokens.

BRC-21 and BRC-42 have the same function but different directions. In short, BRC-21 deploys assets from external blockchains to the Bitcoin network, while BRC-42 deploys BRC-20 tokens to other chains.

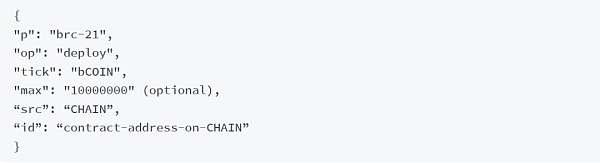

BRC-21 and BRC-42 have deployment formats similar to BRC-20, with only some specific functional differences. Taking BRC-21 as an example, BRC-21 adds the src and id fields on the basis of BRC-20, where src is used to specify the “source chain” of the asset (such as Ethereum), and id is used to specify the contract address of the target token on that chain. In addition, BRC-21 changed the max field of the total issuance to optional, because the total issuance is generally already specified on the “source chain”, and the limit on the single minting amount field lim is cancelled, because there is no need to make restrictions here when following strict minting and redemption rules.

Non-Fungible TokensBRC-721

BRC-721 is an experimental standard for issuing non-fungible tokens (NFTs) on the Bitcoin network, which has richer functions and higher flexibility than native Ordinals NFTs.

The BRC-721 standard defines a series of operations, such as deployment, minting, transfer of NFTs, updating metadata, etc. Each token is assigned a unique identifier to ensure the uniqueness of each NFT, making it impossible to exchange one-to-one with other NFTs.

Using the BRC-721 standard, users can easily create, mint, transfer, and update unique digital assets, suitable for a wide range of applications, including digital art, collectibles, and virtual goods.

BRC-721 can support saving images in IPFS and other chain-based services, which can not only save space on the Bitcoin network, but also provide flexible attribute information for each NFT. BRC-721 can support fields such as Trait to define NFT properties and rarity information.

In addition, the Token URI and Metadata specifications used by BRC-721 are consistent with ERC-721, with higher compatibility with the existing NFT ecosystem.

Therefore, compared with native Ordinals NFTs, using the BRC-721 protocol can achieve more complex functions, introduce external resources into Ordinals, have stronger scalability, richer application scenarios, and be more friendly to developers.

Generative BRC-721

Generative BRC-721 is an NFT protocol aimed at reducing the cost of issuing and minting NFTs for project parties and users.

Since the Bitcoin network itself does not support smart contracts and has a limit on the upper block capacity, the cost is very high for project and users to issue NFTs by directly uploading pictures like native Ordinals NFTs, and storing data on off-chain servers violates the original intention of decentralization. Generative BRC-721 proposes a completely decentralized way to solve this problem.

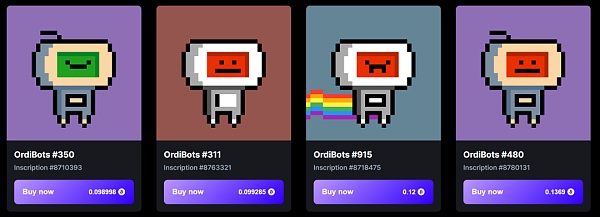

For example, OrdiBots, the first NFT series issued by Generative BRC-721. Although each NFT appears to be a normal image from the front end, the project does not upload complete images to the Bitcoin network during issuance. Instead, the features of this series of NFT images are broken down, such as background color, head style, facial expression, etc., and these features are numbered, for example, purple background is #1, gray background is #2. Finally, these “parts” and “index instructions” are uploaded to the Bitcoin network to complete the issuance.

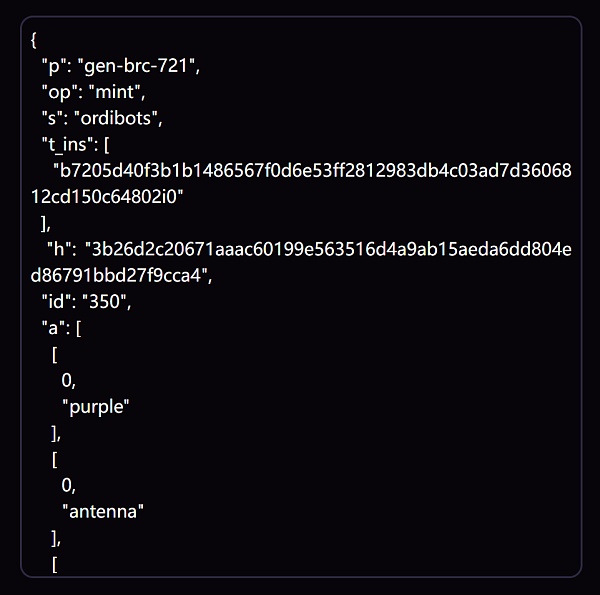

For users, what is minted is also the “index instructions” corresponding to the NFT (the figure below), not the complete image. According to this “instruction manual”, all the features of the NFT can be found, and then a normal image can be formed (the figure above).

Through this “uploading features and then combining them” method, Generative BRC-721 can greatly reduce the use of the Bitcoin network throughout the issuance and minting processes, thus reducing the costs for project parties and users when using it.

Derivation SRC-20

SRC-20 is a token issuance standard based on the STAMPS protocol.

In addition to issuing homogeneous SRC-20 tokens, the STAMPS protocol can also issue non-homogeneous tokens, which are called Bitcoin stamps.

BRC-20 is based on the Ordinals protocol, which writes arbitrary files in the witness data of Bitcoin transactions. However, this process node can be pruned or eliminated, and not all nodes must retain or propagate witness data. As for the STAMPS protocol, since the information is stored in UTXO, each full node must store them, so it is more “blockchain-native” than Ordinals.

Simply put, the biggest difference between the two is that ORC-20 stores data in witness data, while SRC-20 stores data directly in transaction data. Technically speaking, SRC-20 is more secure.

However, the disadvantages of SRC-20 are also obvious. It has a smaller space for storing data, and currently can only accept images with a maximum of 24×24 pixels or 8 colors.

In terms of code format, the text used to deploy, cast, and transfer SRC-20 tokens is also in JSON format, which is almost the same as BRC-20.

Fork LTC-20 and DRC-20

LTC-20 and DRC-20 are community-initiated “forked versions” of BRC-20 on the Litecoin network and the Dogecoin network, respectively.

Just like the original concept of BRC-20, LTC-20 and DRC-20 also provide users with the function of “engraving” data such as text, pictures, and code into the minimum unit tokens based on the Ordinals protocol.

Compared with BRC-20, the biggest advantage of LTC-20 and DRC-20 is that they can process a large number of transaction demands at a lower cost and faster transaction speed. Apart from that, they are essentially the same as BRC-20.

Another advantage of LTC-20 is its halving narrative. Litecoin is expected to halve in August. With the wealth effect and halving narrative of BRC-20, LTC-20 may have a better chance of attracting attention and funds from the market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opportunity and risk, BRC-20 brings Bitcoin into the “smart era”

- Reflections on the .sats domain: Current development status and value analysis

- News Weekly | Hong Kong’s “Guideline on Virtual Asset Trading Platform Operators” will take effect on June 1, 2023.

- Glassnode Data Research: A Review of the “Crazy Week” of Bitcoin Scripting Outbreak

- Why is DigiFinex Coin considered as the “backbone” and pillar between fiat currency and virtual assets, even though it is not a stablecoin pegged to the Hong Kong dollar?

- Ark Introduction: A Layer 2 Protocol for Anonymous Bitcoin Payments Off-Chain

- BXB Capital: Made fortune from kimchi premium, once co-founded Korean market with Binance