Bitcoin supply trend is changing, with a shift towards the East already taking shape.

Bitcoin supply trend is shifting towards the East.Original: “Web3 finance trading center shifts eastward, Hong Kong’s new policy sparks a new round of crypto competition”

Author: BlockingBitpushNews Asher Zhang

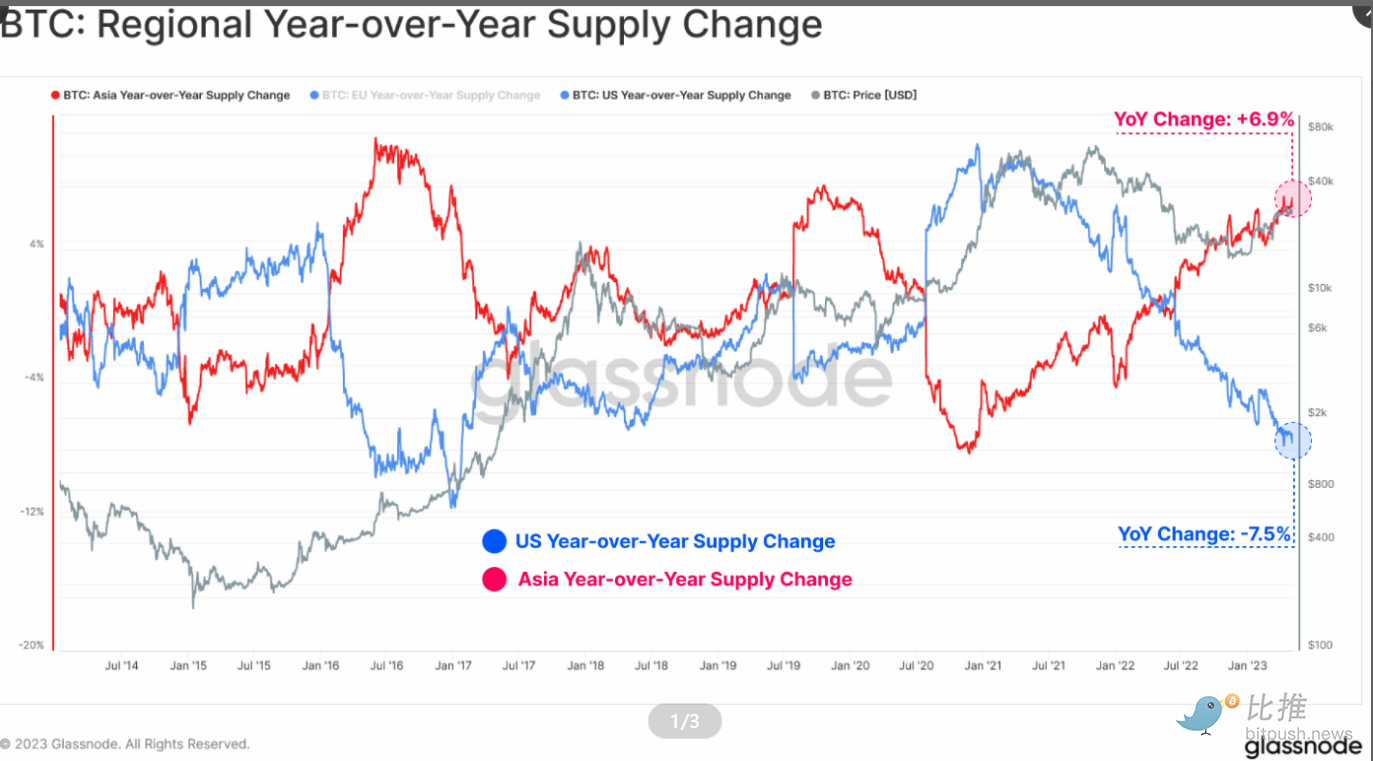

Bitcoin’s year-on-year regional supply changes show that bitcoin is beginning to shift from the US to Asian wallets. What does this reflect about changes in the crypto market? What is the future of the Web3 world behind US regulation and Hong Kong’s new policies, and what huge opportunities for development will the future bring? This article will discuss these questions.

- Current Status of Data Analysis in NFT Lending: Blend Takes 80% Market Share in First Month, Three Major NFT Loans Exceed Half the Total Amount

- Opportunity and risk, BRC-20 brings Bitcoin into the “smart era”

- Reflections on the .sats domain: Current development status and value analysis

Change in Bitcoin supply trend, unstoppable eastward shift

Since the US tightened cryptocurrency market regulation earlier this year, cryptocurrencies have also undergone some significant changes, with bitcoin wallets previously located in the US continuing to shift to wallets in Asia. Glassnode recently released a set of bitcoin year-on-year regional supply change charts, which show the changes in BTC supply held during US and Asian trading hours. In this chart, it can be observed that there is almost equal but opposite supply change, indicating that previously US-based tokens continue to migrate to wallets in Asia. (US year-on-year supply change: -7.5%; Asian year-on-year supply change: +6.9%).

Yassine Elmandjra, an analyst at Ark Invest, wrote in a report on Monday that the US could lose its lead in the global cryptocurrency ecosystem to countries such as the United Arab Emirates, South Korea, Australia, and Switzerland. The report stated that cryptocurrency liquidity in the United States has significantly decreased, and the country’s cryptocurrency ecosystem was once dominated by mature and reliable institutions, but now faces a void that could temporarily stall the interest of other institutional investors. For example, trading firms Jane Street and Jump Trading have reduced their participation in the US domestic market. CoinMetrics data show that the country’s bitcoin transaction volume has fallen from around US$20 billion per day in March to around US$4 billion last week, a 75% decrease. In the US, regulatory uncertainty appears to be impeding existing and new entrants in the cryptocurrency field.

Strict Cryptocurrency Regulation in the US Draws Attention to Hong Kong’s New Policies

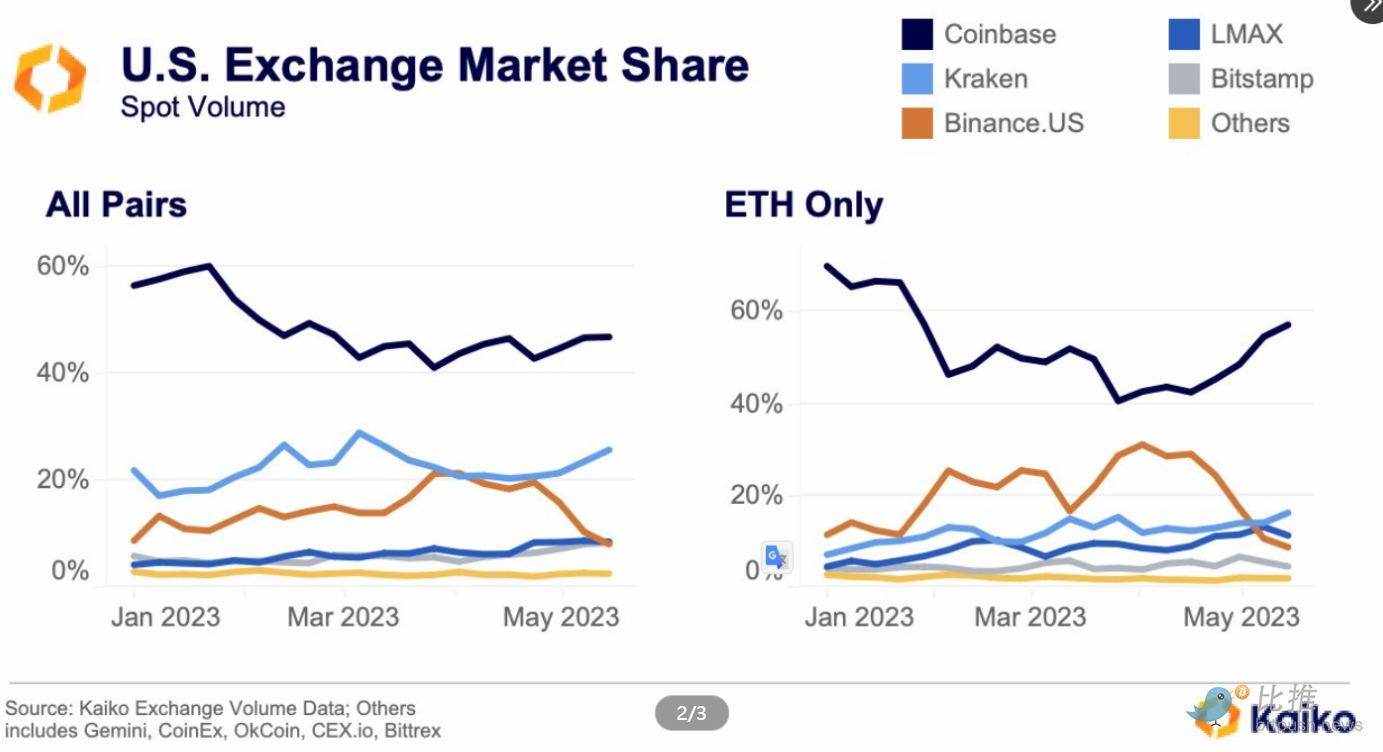

Recent cryptocurrency regulations in the US have become increasingly strict, while Hong Kong’s new policies have attracted attention. The most representative example of the impact of these new policies is on cryptocurrency exchanges, with Binance.US being the most affected. According to Blocking, the US CFTC sued Binance in late March, accusing it of violating trading and derivative rules. Subsequently, Binance announced that it had decided to terminate its asset purchase agreement with Voyager Digital, citing a “hostile and uncertain regulatory environment in the United States.” Kaiko tweeted on May 17 that Binance.US’ market share on US exchanges had halved in the past few weeks, with the ETH trading volume seeing a particularly large drop. Both LMAX and Bitstamp have doubled their respective market shares since the beginning of the year.

According to a Bernstein research report, as part of a potential settlement, the US Commodity Futures Trading Commission (CFTC) may require Binance to cease operations in the US. The report states that Binance US is a small part of Binance’s entire business, accounting for less than 5% of the exchange’s global business. The report also states that this latest enforcement action is not “a significant blow to the entire cryptocurrency market” like it was to Binance. As US business is not important, the company expects this news to not trigger a large-scale market sell-off, as the “regulatory narrative” has shifted from the US to the expected flow of funds from Hong Kong and mainland China.

The US’s regulatory reach is not limited to its own territory, but extends overseas. According to Blocking, the US Internal Revenue Service (IRS) has warned in the US that cryptocurrency crackdowns are imminent in relation to digital assets and tax evasion measures. It is expected that the IRS will update tax regulations under sections 6045 and 6045A, both of which cover broker reporting of digital asset information. In addition, the IRS plans to send commissioners to countries such as Singapore to investigate cryptocurrency taxation and financial crime, and plans to establish a pilot program in June to strengthen supervision of “tax and financial crimes related to the use of cryptocurrencies, DeFi, peer-to-peer payments, and mixers.”

Overall, the US’s continued efforts to increase domestic regulation have forced many cryptocurrency exchanges to choose to exit the US market. The US’s long-arm jurisdiction has also made many institutions in the cryptocurrency market more strongly willing to comply with regulations, which has become the main reason for the shift of the cryptocurrency financial market to the East. Based on current trends, this shift is expected to accelerate in June.

Hong Kong’s new crypto regulations to be implemented on June 1, major exchanges eagerly await

According to Blocking, in February of this year, the Hong Kong Securities and Futures Commission launched a consultation on proposed regulations applicable to virtual asset trading platform operators. The latest news on the Hong Kong Securities and Futures Commission website states that the consultation period on proposed regulatory requirements for licensed virtual asset trading platform operators issued by the Securities and Futures Commission will end on March 31, 2023, and respondents generally support the proposed regulatory requirements for licensed virtual asset trading platforms. The revised proposed regulatory requirements will take effect on June 1, 2023. The Hong Kong Securities and Futures Commission stated that it has noted that respondents strongly support allowing licensed virtual asset trading platforms to provide services to retail investors. The Commission will implement the recommendations on allowing licensed virtual asset trading platforms to provide services to retail investors.

Behind this news, the most notable thing is “the Commission will implement the recommendations on allowing licensed virtual asset trading platforms to provide services to retail investors,” and the cryptocurrency market has been influenced by this, with bulls ultimately gaining the upper hand and short-term downturns coming to an end. Some big V even expressed optimism that a bull market is coming. According to Blocking, Binance founder Zhao Changpeng (CZ) even said on social media that CCTV’s mention of Hong Kong accepting applications from virtual asset platforms had caused a strong reaction in the Chinese cryptocurrency community, “historically, such reports may trigger a bull market.”

In response to the new policy of the Hong Kong government, major exchanges are also rubbing their hands eagerly awaiting. BitMEX said that starting May 29, 2023, Hong Kong users will no longer be able to access the BitMEX website or API, and all account balances will be transferred to BitMEX Hong Kong accounts, which users will need to access through the new BitMEX Hong Kong mobile app. In addition, from May 29, 2023, the existing BitMEX trading platform will no longer accept any new Hong Kong users, and Hong Kong users will only be able to open accounts through the dedicated BitMEX Hong Kong mobile app. On May 26, according to official information from Huobi’s Twitter, Huobi will officially launch Huobi HK, and is ready to provide users with a variety of cryptocurrency trading services. Starting from June 1, users can purchase, sell, and hold mainstream cryptocurrencies such as BTC and ETH, as well as other major cryptocurrencies listed in independent indexes through Huobi HK. Others like OKX and Binance have also made positive moves, and a new crypto competition is about to begin.

Outlook

In addition to the new regulations on June 1st, the most important thing this year is the Hong Kong Monetary Authority’s public launch of the Digital Currency Pilot Program in Cyberport. 16 financial, payment, and technology industry leaders will conduct the first round of trials within this year, and will conduct in-depth research on the potential use cases of “digital Cyberport dollar” in six areas, covering comprehensive payment, programmable payment, offline payment, tokenized deposits, third-generation internet (Web3) transaction statistics, and tokenized asset statistics. If the Cyberport dollar progresses smoothly, it is likely to revive Hong Kong’s status as an international financial center and attract a large number of Web3 talents, projects, and RWA landing; blockchain technology will thus expand its use cases to a larger extent, and the encryption market may achieve true prosperity at that time.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- News Weekly | Hong Kong’s “Guideline on Virtual Asset Trading Platform Operators” will take effect on June 1, 2023.

- Glassnode Data Research: A Review of the “Crazy Week” of Bitcoin Scripting Outbreak

- Why is DigiFinex Coin considered as the “backbone” and pillar between fiat currency and virtual assets, even though it is not a stablecoin pegged to the Hong Kong dollar?

- Ark Introduction: A Layer 2 Protocol for Anonymous Bitcoin Payments Off-Chain

- BXB Capital: Made fortune from kimchi premium, once co-founded Korean market with Binance

- Multiple macroeconomic negative factors have hit the market, causing Bitcoin to drop below 26,000 US dollars in the short term.

- Macro negative factors continue to ferment, and Bitcoin may weaken in the short term and test $26,000.