Bitcoin Position Weekly | The largest such account has begun to “prompt risk”

Source: Scallion blockchain

On November 9, the CFTC announced the latest issue of the CME Bitcoin Futures Weekly (October 30-November 5). In this statistical range, the Bitcoin market has remained stable, so the current position weekly report also showed The change in market sentiment during the correction period after the last round of violent fluctuations.

The total number of positions (total open positions) showed obvious signs of recovery. The latest data from 3,155 sheets further rose to 3,520 sheets, setting a new high since the beginning of October, indicating that after a sustained decline in the previous period, The price level has stabilized, and the market tension has gradually eased. The rebound in the number of positions indicates that market participation is gradually returning.

- Bitcoin version 0.19.0 Core client will be officially released, the bech32 address format is enabled by default and BIP70 is disabled.

- Viewpoint | Why decentralized banks will take over the traditional financial ecology?

- Speed reading | Marketers must read: Introduce the concept of decentralized branding; why is it important to adopt large-scale?

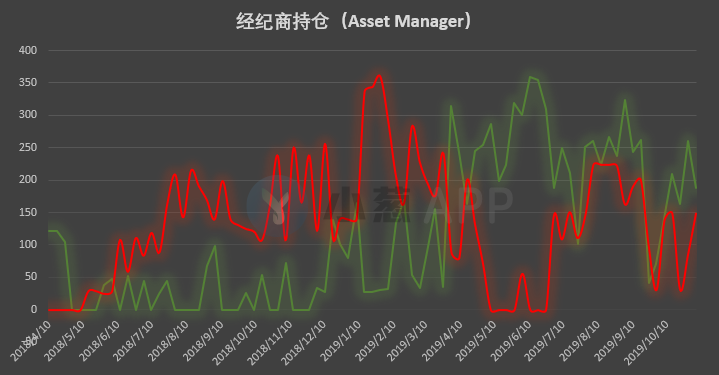

According to the sub-item data, there is a clear tendency to change the position of the larger brokers. The long positions have dropped from 260 to 188, and the short positions have risen from 86 to 149, compared to the positions of the previous week. In terms of the situation, the advantage of multi-position holdings is almost wiped out. This kind of performance in which the position of the short-term positions has dropped sharply while the positions of the parties have increased significantly has not been seen in the classified data of broker positions in the past period of time. Investors should pay attention to the risk of market callbacks behind the broker's adjustment.

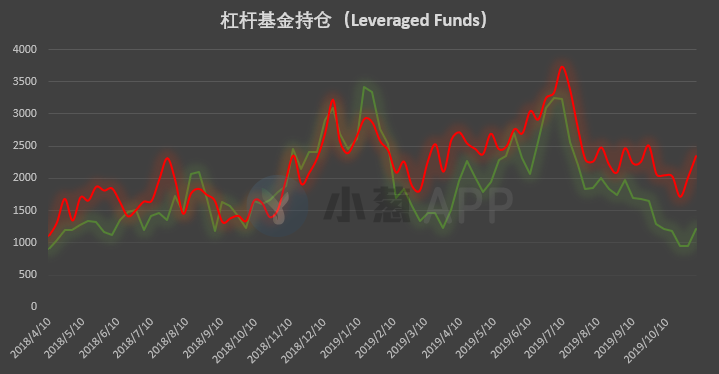

In terms of leveraged funds, there has been a long-term two-way simultaneous increase in the latest data. The number of long positions has risen sharply from 956 to 1221, and short positions have risen sharply from 2016 to 2,345. The situation for the leveraged funds is also the first time since mid-June this year, but it should be noted that after the latest adjustments, the change in the long-short position ratio is not obvious, although such accounts have been significantly garnered. However, for the market outlook, there is no clear and long-term unilateral tendency.

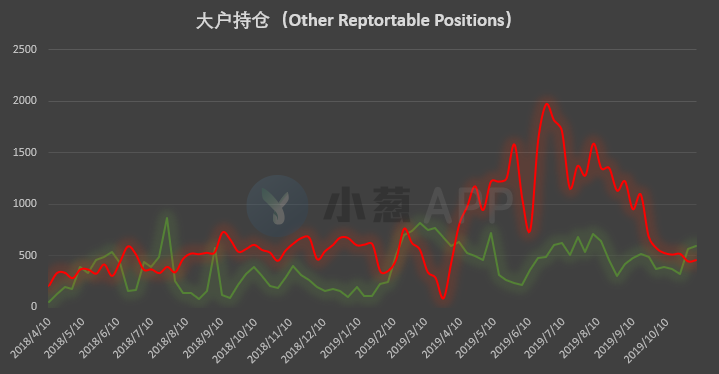

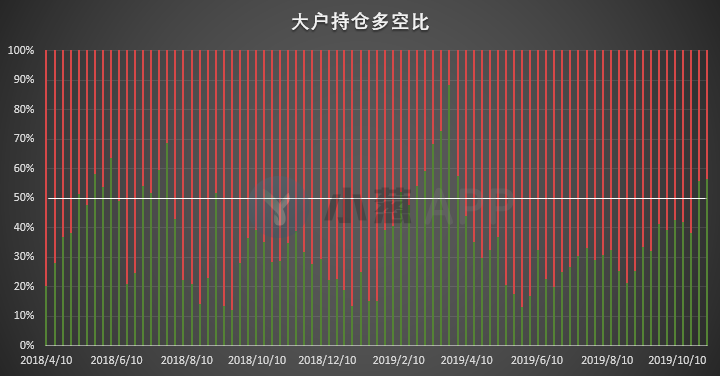

In terms of large positions, long positions have risen slightly from 569 to 595, with a continuation of nearly 12 weeks, and short positions have risen from 445 to 457. In the last statistical cycle, after the large-scale positions appeared in the multi-position positions and the anti-empty positions were changed, the advantages established by the various parties in the current period were maintained. Although the change in long and short positions was not large, considering that this was early April this year. For the first time since the first two weeks, it has remained net-rich. Therefore, this relatively modest adjustment of the position actually shows that such accounts are relatively optimistic about the market outlook.

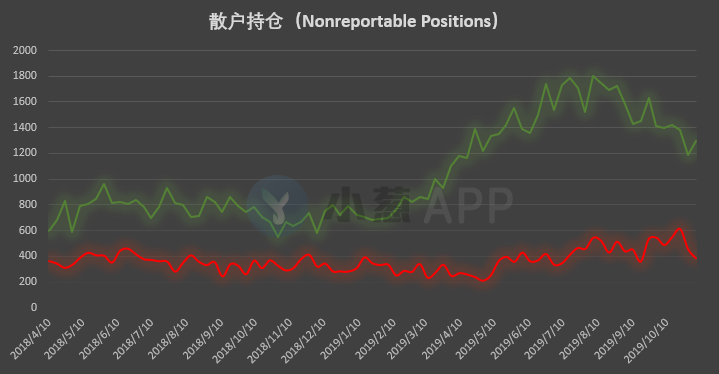

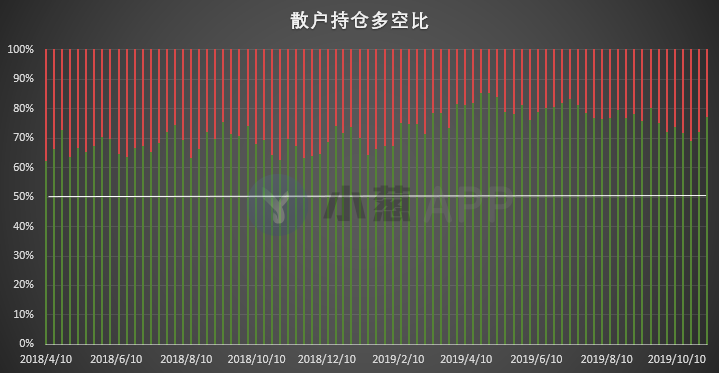

In terms of retail positions, the number of positions increased from 1,185 to 1,297, and the number of positions was further reduced from 456 to 382. After this type of account showed signs of a rare bullish sentiment in the past few data, in the latest data, retail sentiment has clearly begun to tilt towards multiple parties. The number of open positions in such accounts has arrived this week. The new low level in the past seven weeks.

Bitfinex Exchange Bitcoin Position

Bitfinex Bitcoin contract long and short position data is updated by the exchange in real time, so compared with the weekly CFTC position report, the Bitfinex exchange position data can better reflect the immediate market retail market long-term emotional changes.

The Bitfinex exchange's bitcoin contract position has not fluctuated much in the past week. The more noteworthy point is that the number of long positions held by contract investors in the exchange has dropped significantly in the second half of last week. The change in the position of the single open position is relatively limited. Although this is inconsistent with the price reduction process in the past period, it is not unrelated to the small change in the previous period, but it also shows that the market is in the process of continuous sideways. On the contrary, the previous period of bullish positions showed signs of loosening in the first step, reflecting that the exchange contract participants of the exchange still seem to be mainly short-term trading.

OKEx Exchange Bitcoin Position

OKEx official data shows that the exchange's bitcoin contract investors have a very significant decline in the long-term than in the past week. In the second half of last week, the data once fell back below 1.40, hitting a new low in the past two weeks. Similar to the change in the position data of the Bitfinex exchange contract mentioned above, in the process of horizontal volatility of the market, these exchanges are more “less patience” than the single position, and with a small dip on Friday. As the market went out, the situation of multiple escapes concentrated, and the results of the following figures were presented in terms of the ratio of positions to positions. However, the rapid rebound of the long-short position ratio of the OKEx exchange during the weekend shows that this wave of retracement in the short-term has attracted some investors to try to enter the market, which is consistent with the market itself or there are some lags in the same direction. This indicator is still a bit passive, and the forward-looking value of the market trend is not high.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- BCH protocol upgrade countdown: More than 68% of BCH nodes support upgrade

- Zhejiang Provincial Party Committee Secretary: Strive to become the leader of the development of blockchain

- QKL123 market analysis | Bitcoin halved, history will not simply repeat (1111)

- Ethereum co-founder Joseph Lubin: I hope that the public chain such as Ethereum can interact with the central bank's digital currency

- One of Silicon Valley's top VCs, a16z, announced a free start! Dedicated to cryptocurrency and blockchain entrepreneurs

- Legal tender, gold and bitcoin: Three PKs in the form of three currencies, which is the most ideal?

- Chief analyst of the financial industry of Guosen Securities Economic Research Institute: Will the central bank's digital currency shake the banking business logic?