In-Depth Analysis of Coinbase’s Proposal for Flatcoin How to Design an Inflation-Adjusted Stablecoin?

Coinbase's Proposal for Flatcoin Designing an Inflation-Adjusted Stablecoin - In-Depth AnalysisOriginal Title: “Flatcoins: Inflation-Adjusted Stablecoins”

Written by: Jeff Emmett, Danilo Lessa Bernardineli, Jamsheed Shorish, Michael Zargham

Translated by: Leia

Introduction: What is Flatcoin?

Flatcoin is a emerging concept in token economics that serves as a value storage token and adjusts its value with inflation. The clear goal of Flatcoin is to maintain the purchasing power of token holders and/or specific interest groups (such as platform users).

- Why should MakerDAO choose Cosmos instead of Solana?

- An Instrument for Observation, Decision-making, and Trading – Friend Tech Tools.

- Interpreting Arweave Atomic Assets and Its Ecosystem A New NFT Paradigm Paving the Way for Creators’ Migration

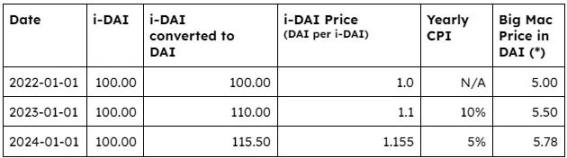

Let’s take a simple example – a fictional “i-DAI,” which is an Inflation-Corrected DAI that removes the inflation factor. The anchoring of i-DAI will be attached to a reference time point, and its price will be adjusted in real-time with inflation changes to maintain the purchasing power of i-DAI holders. The table below illustrates this typical behavior. As we will see in this article, although i-DAI is currently just a fictional concept, it can be realized through a controller-based stablecoin (referred to as “CBS” for short), and there are already examples like RAI (a new algorithmic stablecoin introduced by Reflexer Labs) that have been implemented in practice.

The table shows the value difference between DAI and the fictional i-DAI. (*) The giant price index in DAI is a fictional example used to illustrate the impact of CPI on goods.

What is inflation?

In economics, inflation refers to a general rise in prices, resulting in a decrease in the purchasing power of currency (used to represent prices) holders. In the web3 field, the definition of inflation is somewhat different and is often (quite confusingly) used to describe the impact of token supply growth, although in terms of traditional economic terms, this phenomenon should more accurately be called “dilution.” In this article, we will stick to the traditional definition of inflation.

In an inflationary environment, currency holders may experience a decrease in purchasing power, which weakens people’s trust in the currency and the entire economic system. For this reason, inflation is considered a key indicator for measuring any economic system, and central banks around the world have a clear mandate to set a low annual inflation rate (usually between 2% and 4%) for the fiat currency they manage. However, as recent experiences in the global economy have shown, this is not a simple task.

In light of the high inflationary pressures faced by the global economy in recent times, Coinbase proposes the design of an inflation-adjusted “Flatcoin.” The clear goal of Flatcoin is to “maintain stable purchasing power while also having a certain degree of flexibility to withstand economic uncertainties caused by the traditional financial system.” However, it needs to be emphasized again that this is not an easy task – let’s explore some of the inherent challenges in Flatcoin design.

Flatcoin Design Challenges

Flatcoin is a unique design proposition that encompasses several challenges that need to be addressed. These challenges can be solved independently or simultaneously. We will delve into the details of these challenges in the following text. The most core challenge lies in accurately perceiving inflation and creating appropriate incentive mechanisms.

Specifically, inflation, like many concepts in economics, operates within a complex adaptive system. This means that there are dynamic interactions involving numerous different factors and variables, including unpredictable human behavior, which can impact the causes and outcomes of inflation. This poses challenges in the design of Flatcoin, and any implementation of the design needs to consider and focus on many aspects, including but not limited to:

- Low time granularity of inflation indices

- The difficulty of spatial and temporal adjustments in sensor measurements

- The complexity of sensor fusion and effective controller design

- The challenge of achieving Flatcoin’s economic changes through appropriate incentive mechanisms

A Viable Flatcoin Design: Controller-Based Stablecoin

For building Flatcoin, there is a promising approach to draw inspiration from and adopt the ideas and technologies of the most successful stablecoins currently available. These successful stablecoins utilize the concept of a controller, which can “perceive” price changes and readjust the incentive mechanisms for participants to ensure that the value of the held tokens tends to track the reference value.

This type of controller-based stablecoin is known as Controller-Based Stablecoins (CBS), and RAI is an example that has already been implemented. RAI draws inspiration from similar theoretical and practical considerations. One of the reasons for adopting a controller in RAI is that it has been proven that the historical behavior of central banks in controlling inflation can be well described by a PID controller (composed of proportional unit P, integral unit I, and derivative unit D). This has been demonstrated in theoretical research by Hawking et al. in 2014 and empirical research by Shepherd et al. in 2019.

Given the stability demonstrated by RAI as a CBS, we will use RAI as a case study and introduce a viable structure for Flatcoin based on CBS.

RAI as a Case Study

RAI is a controller-based stablecoin that maintains its value in line with the value of USD through the use of an unsupervised PI controller-guided economic incentive and an oracle that can “perceive” the RAI/USD price at any given time.

From a user experience perspective, RAI allows users to use ETH as collateral to obtain overcollateralized loans denominated in RAI. The outstanding debt is measured in RAI, and the interest rate of that debt (or redemption rate within the RAI ecosystem) is defined by the implemented PI controller. The amount of loan available is determined by the so-called redemption price, which is closely related to the RAI market price—typically differing by around 1%.

The logic of interest rate adjustment is based on the difference between the RAI market price (priced in RAI/USD) and the RAI redemption price (also priced in RAI/USD). When the redemption price is higher than the market price, the interest rate tends to rise. When it is lower than the market price, the interest rate tends to decrease (even become negative!).

Why can the RAI price remain relatively stable? This is because RAI has a countercyclical incentive mechanism, even without anchoring and even when using highly volatile assets (ETH) as collateral. The market price is determined by the secondary market of RAI buyers and sellers, so it fluctuates greatly. On the other hand, the redemption price is controlled by the PI controller, so it is more controllable and stable. Therefore, when there is a significant difference between the two, rational users will have the motivation to arbitrage.

Specifically, when the market price is higher than the redemption price, it is profitable to obtain RAI loans and sell them to the secondary market until the two prices converge. Then, buy RAI from the secondary market to repay the debt and achieve a neutral position. This practice is especially convenient when the market price remains higher than the redemption price for a long time, as the redemption rate may become very low, resulting in arbitrage profits and interest rate profits. In any case, profiting from the system helps maintain the stability of the RAI token market price.

As for the opposite case (i.e., when the redemption price is higher than the market price), the profitable behavior is to buy as much RAI as possible from the secondary market and hold it until the price converges, or use it to close any open RAI positions. The first behavior tends to reduce the circulating supply of RAI tokens in the market, while the second behavior destroys RAI. Both of these behaviors encourage the system to converge to the market price.

The beauty of the RAI controller is that all these incentives guided by the controller are driven by external benchmarks, i.e., the RAI/USD price obtained through external oracles. RAI does not directly rely on holding any USD inventory or liquidity pool to achieve price stability.

For the design of Flatcoins, the design of RAI represents a natural starting point for building an MVP (Minimum Viable Product) and requires two elements:

1) An inflation oracle;

2) A moderately adjusted controller to measure inflation.

If you need more resources about RAI, you can refer to the following links:

- Reflexer Finance: https://reflexer.finance/

- https://medium.com/reflexer-labs/summoning-the-money-god-2a3f3564a5f2

- https://www.youtube.com/watch?v=dQRvDV5IILw

- https://github.com/BlockScience/reflexer

- https://github.com/BlockScience/reflexer-digital-twin

Distributed Control Challenges

As mentioned earlier, building a Flatcoin requires a moderately adjusted controller and an inflation oracle. Now, let’s take a look at the challenges faced by these two aspects.

Due to the involvement of space, time, and compositional attributes (which will be elaborated on later), comprehensive measurement of inflation is a fundamental challenge in the design of distributed control systems.

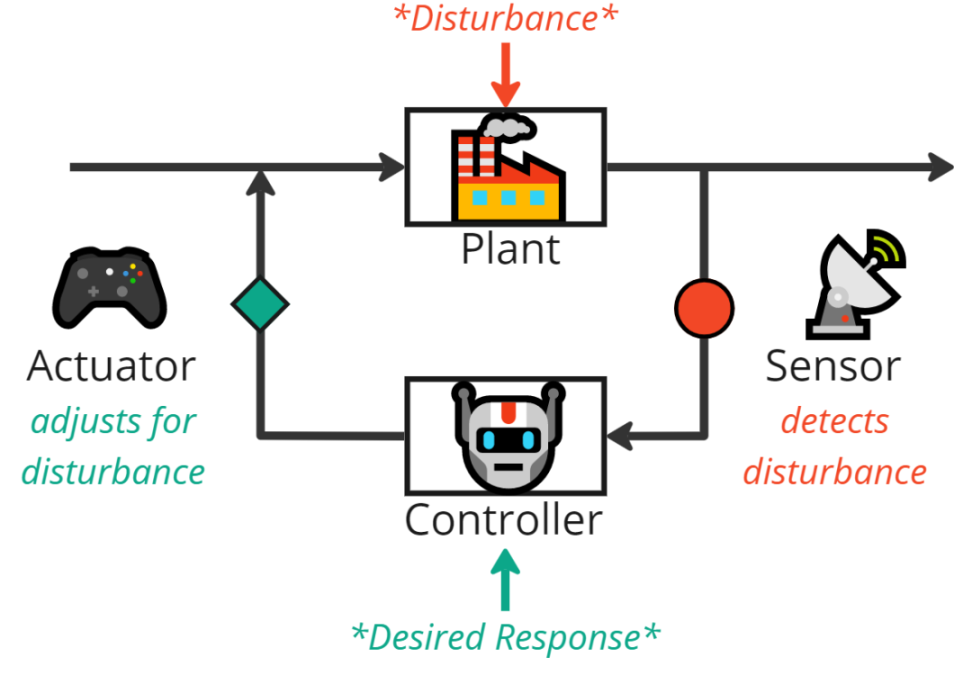

From the perspective of control theory, the design challenge of Flatcoin can be understood as:

(1) There is a geographically widespread “plant” (i.e., the market for goods and services) that sends price signals to different commodities at different times and locations.

(2) The first step is to design a set of sensors to collect relevant signals (at the correct frequency and appropriate location) and combine them at the appropriate time and spatial scale.

(3) These signals can then be input into a controller, which processes them into a rich world model to estimate the market intervention needed by the system, thereby ensuring that the value of Flatcoin evolves as expected.

(4) Finally, the system needs actuators that provide incentives to drive the adjustment of Flatcoin value in the secondary market, keeping it consistent with inflation.

In the next section, we will explore some basic knowledge of control theory to further analyze design issues.

Understanding Control Theory in Complex Adaptive Systems

Defining the Environment

In control theory, it is necessary to clearly define the “boundary” or environment of the system. A model can be established to sufficiently understand the world within that boundary and make controllable decisions within the system. Below, we will discuss the various parts of a control system.

- Plants refer to controlled physical or mathematical systems. This can be mechanical systems, circuit systems, or even biological systems. Plants originally referred to factories and production plants equipped with thermostats and other sensors for temperature control.

- Sensors are devices that measure aspects of system behavior or the environment, such as temperature, pressure, or component position. In this case, sensors need to capture changes in the prices of relevant goods and services to calculate and adjust for changes in inflation.

- Actuators are devices that influence the future behavior of the system, such as motors, valves, heaters, or economic incentives, to ensure that the price of the token is appropriately adjusted with inflation.

- Controllers are the brains of the control system, processing information from sensors and using that information to adjust the behavior of actuators to achieve the desired outcome. Controllers calculate appropriate actions based on the current state of the system and the expected outcome, using algorithms and mathematical models to help manage the performance of the system.

Sensors, actuators, and controllers together form the basic building blocks of a control system, which can be used to regulate and automate various processes, even in systems with unpredictable human interactions.

Understanding the Challenges of Flatcoin

The Difficulty of Inflation Adjustment

Any token that aims to track inflation rates to mitigate its impact on purchasing power must answer some tricky questions about which “sensors” and sources of information to use, such as “Where does inflation occur?”, “Who is affected by it?”, and “Which goods and services are affected?”.

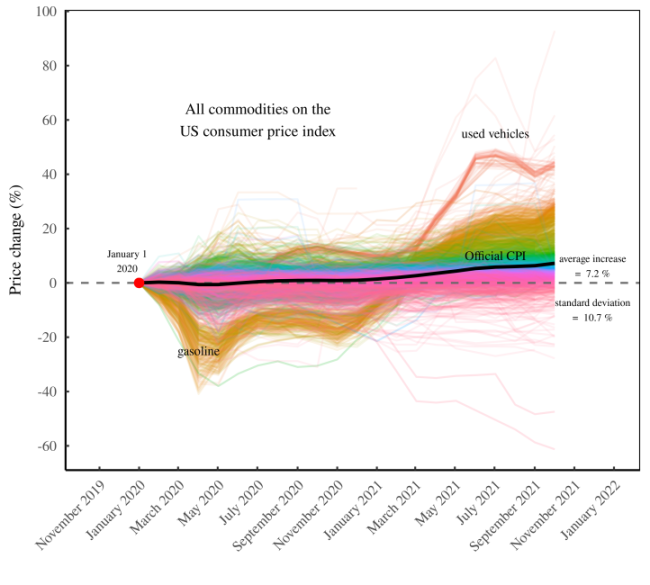

An illustration of the price changes of different goods listed in the U.S. Consumer Price Index (CPI), compared to the official CPI index (black line) (source: Blair Fix)

As economist Blair Fix vividly describes, inflation is not just “one” phenomenon. Of course, there are inflation indices, such as the GDP deflator or the Consumer Price Index (CPI) and the Producer Price Index (PPI), but there are significant differences between these indicators and other standards, such as geography, industry, or sector. In addition, these indices have a low time granularity, with most of them being updated only once a month, while changes in purchasing power can have an immediate impact in daily life (e.g., grocery shopping or gasoline purchases).

As the name suggests, Flatcoin is a token that aims to maintain “stability” in purchasing power. When designing Flatcoin, careful consideration must be given to the expected scope and coverage of its use. A token adjusted based on the inflation rate may face high price volatility, such as high inflation in certain regions or industries, which may persist for a long time. At the same time, this token also needs to adapt to situations where price volatility is low or even nonexistent in other regions or industries.

In addition, choosing the appropriate inflation measure poses certain challenges, as inflation can vary significantly even at the national, regional, or metropolitan level. Standardized inflation measures, such as the CPI, do not take into account the differences in purchasing power between different occupations, investments, or socioeconomic or demographic groups.

Finally, from an implementation perspective, accurately and timely measuring inflation increases the complexity of the design, as this token is susceptible to potential manipulation. Since the execution of the Flatcoin system will depend on the reliability (and “trustworthiness”) of the oracle subsystem, their design is not an easy task either.

Next Steps: Advancing the Implementation of Flatcoin

This issue presents significant challenges in terms of time and space, and from the perspective of control theory, there are many interesting open design problems to tackle to create a token economy regulated by appropriately incentivized algorithms.

In the spirit of agile methods, we suggest adopting a proof of concept (PoC) design and pilot implementation with minimal functionality to achieve the design goals that meet the initial requirements. The PoC can be designed to be upgradable to gradually address more specific and prioritized design challenges in iterations.

One starting point is to limit the spatial components of inflation first. A simple and recommended PoC design is to start with a regional index, Flatcoin, and a scalar price index within a single currency market, but this simple design may face various arbitrage challenges.

On a longer design time scale, a global composite index inflation token will be able to address these arbitrage issues, and therefore have more robust use cases, but this clearly requires more conceptualization and design to address the various challenges presented in this paper. With the deployment and evaluation of the first PoC, additional requirements and feasibility can be proposed to gradually conduct research and development of sensors, controllers, and actuators to achieve a truly effective global-scale Flatcoin, which will cover diverse and spatial indices.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Dark version of Friend.tech? A quick look at nofriend.tech, a social platform that converts friendship into rewards.

- What are the legal risks of NFT digital collectibles playing lottery?

- The Wonderful Use of Tokens in the Web3 Gaming Sector Incentivizing Community Engagement and Enhancing Network Effects

- TaxDAO Writes to the U.S. Senate Finance Committee Addressing the 9 Key Issues of Digital Asset Taxation

- Connext has made another mistake? Learn about the Connext airdrop claim incident in one article.

- The roller coaster trend behind Cyber explosive long liquidation, short selling, and a carefully planned hunting game by market makers.

- Revisiting EIP-1559 Is Ethereum safer two years after the proposal has been implemented?