Why should MakerDAO choose Cosmos instead of Solana?

Why MakerDAO choose Cosmos over Solana?Written by: KODI

Compiled by: Deep Tide TechFlow

When even Vitalik starts selling, you know the bear market is really bad.

- An Instrument for Observation, Decision-making, and Trading – Friend Tech Tools.

- Interpreting Arweave Atomic Assets and Its Ecosystem A New NFT Paradigm Paving the Way for Creators’ Migration

- Dark version of Friend.tech? A quick look at nofriend.tech, a social platform that converts friendship into rewards.

Last week, the co-founder of Ethereum (ETH) sold about $580,000 worth of holdings.

But that’s not all. First of all, he didn’t sell ETH, but the governance token MKR of MakerDAO.

Why?

Because Maker co-founder Rune Christensen has recently caused a sensation in the crypto community.

We know that Maker’s team has been considering launching their own chain as the final step in their Endgame plan.

However, no one, including myself, expected that Rune would choose Solana, a fork of Ethereum, as the underlying infrastructure chosen by Maker.

This latest eye-catching idea is not uncommon for Rune. No one knows Rune’s intentions and actions. But it’s provocative, and it has attracted attention.

Don’t get me wrong, I like Solana and welcome more projects to launch new chains there.

But this decision is somewhat surprising, considering there are other choices that may be more suitable for the entire ecosystem.

In fact, Rune even mentioned that he also considered the Cosmos (ATOM) network.

The reason he chose Solana is mainly because “the core of Cosmos is not built around efficiency… it has higher maintenance and performance costs”.

Solana’s design philosophy is that hardware capacity should increase exponentially, and blockchain should scale with hardware. As hardware performance improves, Solana will also improve accordingly. Therefore, Solana is always superior to Cosmos in terms of efficiency and performance.

However, Cosmos has other advantages in building AppChains that other ecosystems cannot match.

Advantages of Cosmos

The goal of Cosmos is to build an interconnected network of blockchains. The network consists of CometBFT (formerly Tendermint), Inter-Blockchain Communication protocol (IBC), and Cosmos SDK.

CometBFT is a consensus algorithm that allows nodes to reach agreement on the network. Although it may not be the most advanced technology now, it is still the most widely used consensus algorithm in the cryptocurrency field, including some non-Cosmos chains such as Binance Smart Chain. Therefore, it has been thoroughly tested in practice.

And it can still perform well. Cosmos chain Sei, which focuses on transactions, has just been launched at a speed of 20,000 transactions per second and a final confirmation time of 50 milliseconds. In comparison, Solana is one of the fastest chains, with a maximum transaction volume of 10,000 per second and a final confirmation time of 2.5 seconds.

But the Cosmos SDK and IBC may be the most important features.

IBC can be said to be a revolutionary technology.

If you have ever tried to enter L2 (such as Arbitrum Optimism) from Ethereum, you will know that you need to cross-chain your assets from the mainnet to L2 for trading.

However, cross-chain bridges rely on centralized validators who must “respect” asset transfers. If attacked, these validators can put funds at risk, as seen in cases of vulnerability exploitation such as Wormhole and Nomad.

Building secure bridges is extremely difficult. It’s no wonder that four out of the top five hacker attacks on the rekt leaderboard are related to cross-chain bridges.

IBC eliminates all of these issues. IBC messages are trustless, meaning they can function without the need to trust intermediaries. The IBC protocol itself handles the verification of cross-chain messages.

This allows you to simply establish communication channels between different blockchains.

At the same time, the Cosmos SDK allows for easy and fast customization of blockchains that suit your application needs. It has various modules, each handling specific domains (such as governance or IBC connections).

This means that developers do not have to reinvent the wheel every time they want to launch a new chain. They can focus on the core application logic, while the SDK handles the heavy lifting in the background.

So why does Maker need to build a new chain on Cosmos (or Solana) when Ethereum is still the most popular DeFi chain?

Well, that’s also part of the problem.

Heavy Burden

The data clearly shows that Ethereum still dominates the cryptocurrency space. Its DeFi ecosystem leads the blockchain industry in terms of TVL, stablecoins, and overall ecosystem activity.

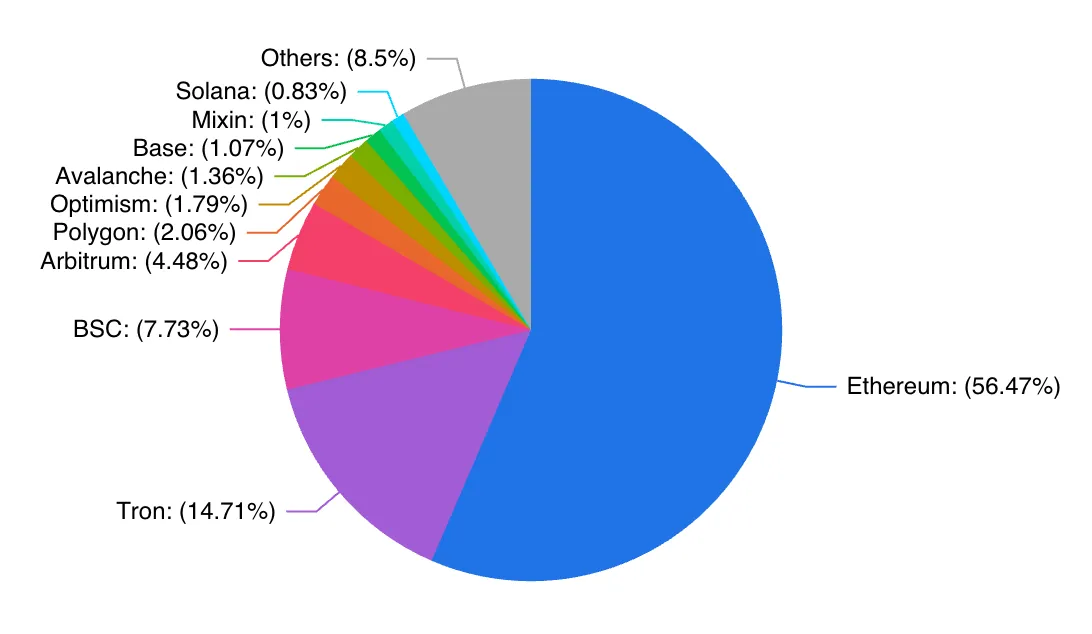

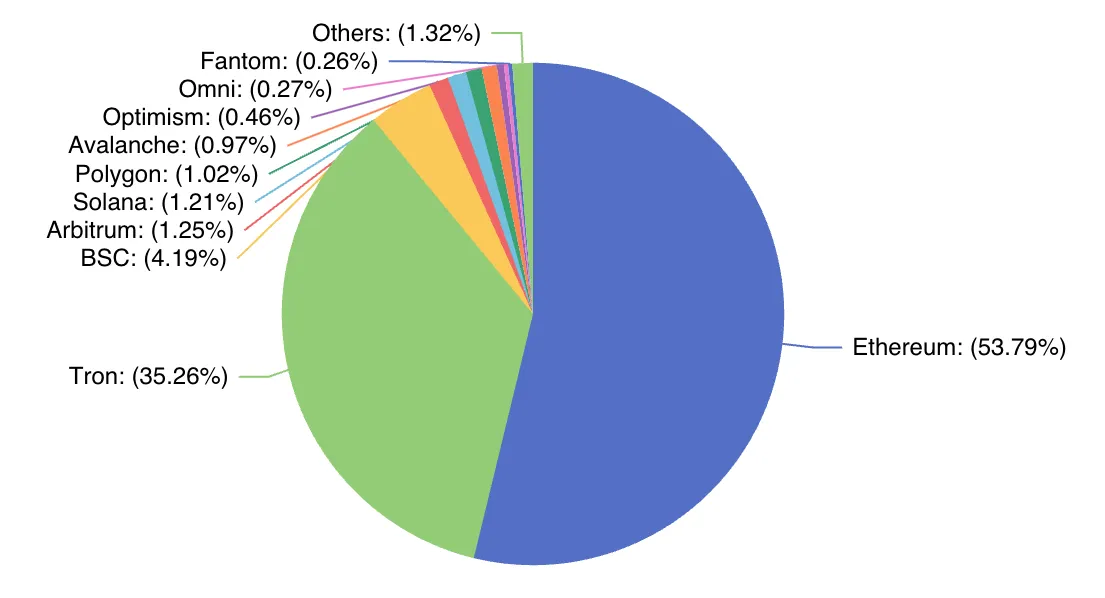

The total value locked (TVL) on Ethereum exceeds $21 billion, and if you calculate all of Ethereum’s L2 and Rollup solutions, this number will exceed $24 billion. This is far ahead of any other chain, including Binance Smart Chain ($5.5 billion), Polygon ($770 million), or Avalanche ($500 million).

In addition, Ethereum dominates the stablecoin market, with a total settlement value of over $69 billion, accounting for over half of the total stablecoin market cap of $130 billion. The only chain that comes close is Tron, with a total settlement value of stablecoins at $44 billion, of which 92% is Tether (USDT).

This solidifies Ethereum’s position as the settlement layer for crypto assets.

However, all of this activity also brings challenges. Congestion, gas fees, and scalability limitations hinder the improvement of the Ethereum user experience, especially as more applications are added.

In order to accommodate as many applications as possible on a single chain and maintain their functionality, we need to expand through methods such as Rollup, cross-chain bridges, and state channels. As we have seen on Ethereum, this is not easy.

This is where Cosmos comes in.

Cosmos is built around the topic of AppChains. The core question is: instead of trying to put all applications on a single blockchain, why don’t each application build its own chain?

Cosmos believes that applications should form numerous chains, each specifically designed to host that application, and all chains should be connected through shared communication standards.

Letting Cosmos handle the tedious and difficult parts (logic processing, security, governance) can provide you with a truly outstanding product experience on Ethereum.

A project can leverage the network effects and higher capitalization of Ethereum while using Cosmos for backend logic, interoperability with other IBC chains, faster transactions, etc.

This is a combination we may see more of in the future. The Cosmos chain acts as a “co-processor” for Ethereum, activating idle liquidity on Ethereum, reducing costs, and automating transactions.

Furthermore, there is already a project that has realized the vision of Rune, launching a product on Ethereum while putting the backend on a separate chain.

The best of both worlds

Sommelier Finance is a protocol built on the Cosmos blockchain, aiming to expand the capabilities of decentralized finance based on Ethereum.

Due to the expensive gas fees on Ethereum, Sommelier seeks to open opportunities for smaller investors.

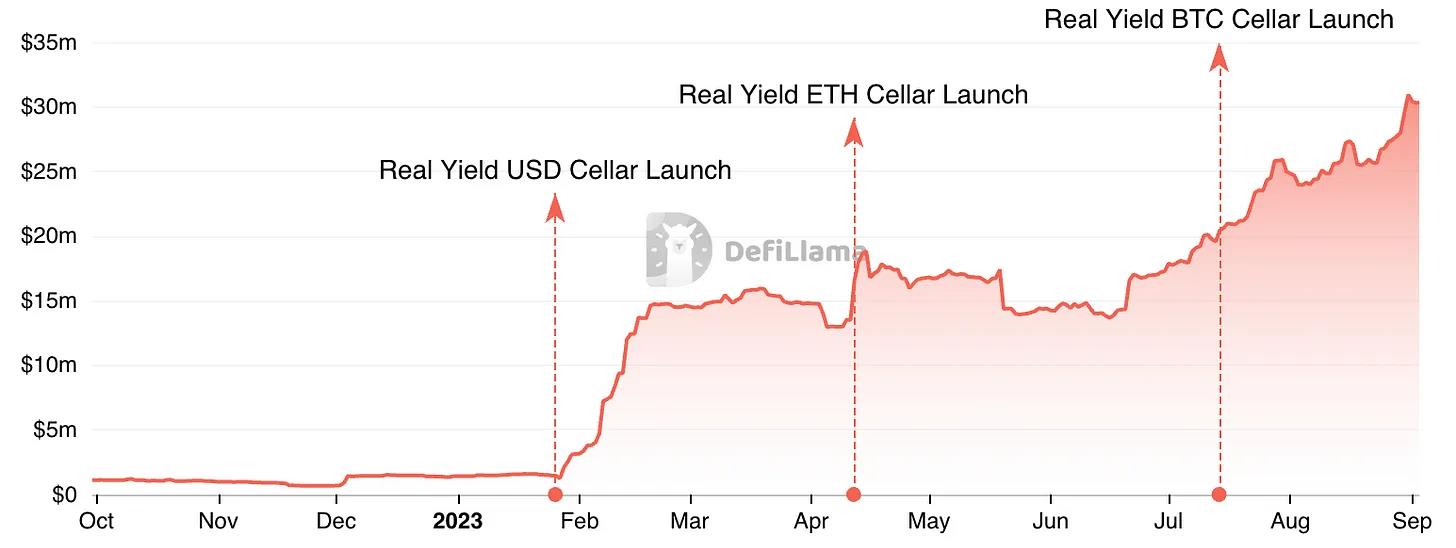

The project currently offers two main services: liquidity mining and algorithmic trading strategies. For users, all they need to do is choose one of them, lock their funds in the vault, and watch their beloved crypto assets grow gradually.

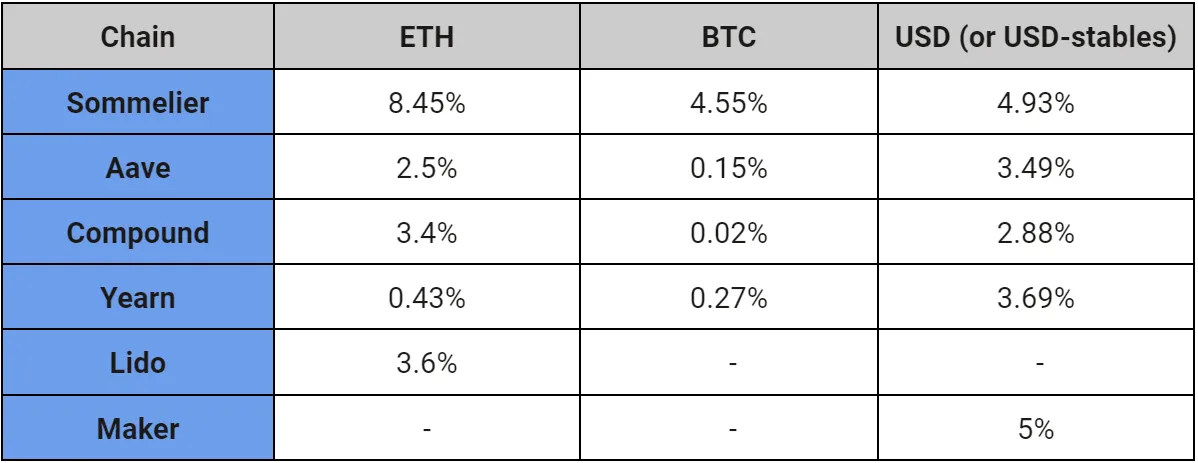

The algorithmic trading vault initially had some funds flowing in, but it wasn’t until the arrival of the main revenue vault that the total locked value (TVL) exploded. This is not surprising. Here is a comparison between Sommelier’s “real yield strategy” and blue-chip DeFi protocols:

Except for Maker, Sommelier outperforms any blue-chip protocol in terms of yield for ETH, BTC, and stablecoins. Even Maker’s 5% yield on DAI is only a temporary measure to attract TVL and will drop to 3.19% in the coming weeks.

To achieve higher yields, the only way is to participate in riskier and more exotic yield strategies, such as selling covered call options or providing liquidity (which may result in potential losses).

Therefore, it is not surprising that the income insurance vault of Sommelier dominates its total locked value, with over $30 million locked, while the algorithmic trading vault has only $200,000.

So what is Sommelier’s secret weapon?

One advantage is that its strategies run off-chain, allowing resource-intensive algorithms to operate while protecting privacy.

But I believe its main advantage lies in its ability to leverage the strengths of Ethereum and Cosmos.

The Cosmos backend provides a sovereign foundation for governance, security, and cross-chain communication. This reduces costs by decreasing Ethereum mainnet transactions. At the same time, the user-facing frontend taps into Ethereum’s vibrant ecosystem.

If more developers realize the synergistic effects between these networks, we may see a wave of innovative, Cosmos-based applications emerge that use Ethereum as the window for user interaction. Just as liquidity staking can inject much-needed liquidity into Cosmos, Ethereum-Cosmos hybrid products can also inject new vitality into this ecosystem.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What are the legal risks of NFT digital collectibles playing lottery?

- The Wonderful Use of Tokens in the Web3 Gaming Sector Incentivizing Community Engagement and Enhancing Network Effects

- TaxDAO Writes to the U.S. Senate Finance Committee Addressing the 9 Key Issues of Digital Asset Taxation

- Connext has made another mistake? Learn about the Connext airdrop claim incident in one article.

- The roller coaster trend behind Cyber explosive long liquidation, short selling, and a carefully planned hunting game by market makers.

- Revisiting EIP-1559 Is Ethereum safer two years after the proposal has been implemented?

- Asset management giant Fidelity report Where does the value of ETH come from? How to conduct valuation?