Court takes over Discord community? A brief recap of the Fei team’s collective lawsuit event.

Court takes over Discord community? Recap of Fei team's lawsuit event.Original Text: “Fei team faces collective lawsuit, didn’t expect to see court account on Discord”

Author: jk

What is Fei and what happened recently?

Fei is a once-promising decentralized stablecoin project aimed at providing dollar-pegged value. Launched in the spring of 2021, Fei Protocol was one of the few purely crypto-backed algorithmic stablecoins at the time. The project introduced the concept of “protocol-controlled value,” which means that deep liquidity is owned and managed by the protocol and cannot be removed at any time, unlike other systems.

Recently, Fei Protocol released a settlement plan for a class-action lawsuit, and the San Francisco Superior Court personally announced on the Fei Protocol Discord channel that wallet users who participated in the Fei Protocol genesis event can fill out a form to claim settlement compensation, which is still an industry first in the crypto world.

- Cregis Research: The Value of Ethereum Account Construction Archaeology and Account Abstraction

- Understanding MEV and opportunities for Oracle extractable value

- Ethereum 2023 Q2 Data Research: Gross Profit of $700 million, ETH Burn Rate Accelerated to 0.8%

Background: 2022 hack and voting controversy

Fei suffered several hacks in 2022, leading to community suspicion of the protocol and technical ability.

The most severe hack directly caused a split in the Fei community in 2022. In mid-2022, the organization behind Fei, TribeDAO, merged with Rari Capital and suffered a re-entry attack, resulting in $80 million worth of crypto assets being stolen. After the theft, two completely different voices emerged, leading to community unrest and almost a split, and the entire Fei Protocol gradually came to an end in this dispute.

So what were the two different voices?

One plan was to fully compensate the victims of the hack through the TRIBE (Fei’s governance token) token pool, which is a common practice by project parties after an attack, which amounts to using project funds to offset the losses of relevant parties. However, this proposal was later rejected in the vote, mainly because the Fei team believed that the hacker primarily attacked the other party in the merger, Rari, and that TribeDAO was also a victim of the hack and should not be responsible for compensation, at least not in full. They supported another proposal that suggested keeping the FEI stablecoin pegged to the dollar and using 57 million TRIBE tokens to compensate the hack victims. This proposal is not a full compensation and has been criticized by many. Some critics claim that the partial compensation plan proposed by the Fei team retains most of the project’s funds.

Class Action Lawsuit for 2023

After the chaotic events of 2022, Fei Protocol and its three founders are facing a class action lawsuit this year for one of the most familiar reasons in the cryptocurrency project: that the Fei tokens FEI and TRIBE are accused of being unregistered securities.

On July 9th of this year, the San Francisco court took over Fei Protocol’s Discord server and issued an authorization notice announcing a proposed settlement agreement that would pay out a total of $17.85 million in claims to individuals and entities who purchased FEI or TRIBE tokens during the Genesis Genesis Genesis is the only big bulk broker full-service provider in the crypto industry and is a signature of DCG (Digital Currency Group). It is used to make large institutions encounter and manage risk. Its asset liquidity was insufficient due to the FTX event, and it filed for bankruptcy protection in January 2023. See more. event.

According to court documents, the main violation was the sale of unregistered securities, and during a period of time “the FEI token failed to maintain its peg, trading as low as $0.7128 per FEI. Investors quickly sought to exit their positions, but were penalized by Fei Protocol’s “direct incentive” for doing so. Anyone attempting to sell FEI during this time period suffered losses. The TRIBE token also failed to maintain its value, dropping over 80% from its Genesis Event opening price.” In summary, the plaintiffs in the class action are claiming that Fei sold unregistered securities and caused them losses.

This reason for the lawsuit is intriguing – if Fei sold unregistered securities, then whether the plaintiffs were aware of this when they made their purchases is a question. The entire lawsuit does not mention whether the plaintiffs were deceived or bought without knowing whether they were registered securities. If the reason for the lawsuit is the sale of unregistered securities causing losses to users, then this sounds very unfair to the project side: if they make money, there is no problem, but if the price drops, users who participated in the ICO can use “unregistered securities” as a reason to sue and demand compensation, then who would want to be a project side?

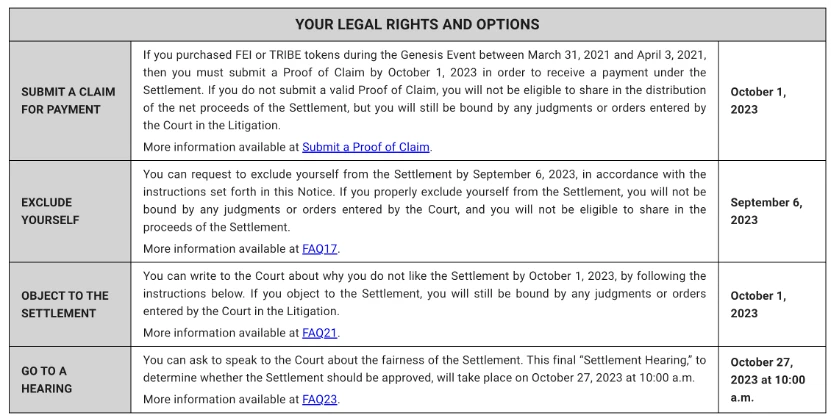

According to the settlement agreement, the net settlement fund will be distributed proportionally to the class members who submit claims, after deduction of attorney’s fees and court costs. The fund is expected to be worth $13 million and requires approval. Qualified individuals and entities can submit claim forms to receive a portion of the settlement amount, object, or choose to opt out and preserve their right to bring a separate lawsuit against Fei Protocol.

The website offered four options for Genesis members

The Fei Protocol team denied any wrongdoing. However, the entire incident has raised concerns and uncertainties about the future development of Fei Protocol.

The court will hold a hearing in the future to consider whether to approve the settlement agreement. Odaily Star Daily will also keep an eye on the development of this event.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Mint Ventures: Concerns about MakerDao go beyond RWA exposure

- Introduction to Words3, the Full-Chain Game: A Word Chain Game Developed Based on MUD.

- Arbitrum and the Dawn of a New Era: Exploring Ethereum’s Cancun Upgrade and the Future of $ARB

- Founder of Folius Ventures: 8 Insights on the Development of the Cryptocurrency Field

- LD Capital: Summary of NFT Lending Platform Updates

- Decoding Ambient Finance: An Efficient Two-Way AMM Protocol Combining CEX and DEX Advantages

- Interpreting Entangle Protocol: Convert any asset into LSD to solve the liquidity problem across the chain