The New Narrative of Cryptocurrency Investment in a Bear Market Unibot Project Analysis

Cryptocurrency Investment in Bear Market Unibot Project AnalysisAuthor: Jake LianGuaihor

Translation: Biteye Core Contributor Crush

Unibot is currently a very hot project that will unlock the next wave of cryptocurrency investment.

Today’s article is my detailed analysis of this project, please make sure to read it to the end to understand my overall rating of the project!

- Cosmos ecosystem’s living water Entangle and Tenet, the dual heroes of the whole chain LSD.

- Reddit Avatar One-Year Anniversary Layout and Insights Behind the NFT Project with the Largest User Scale

- Worldcoin in the Polkadot ecosystem? Another money-spreading project Encointer analysis

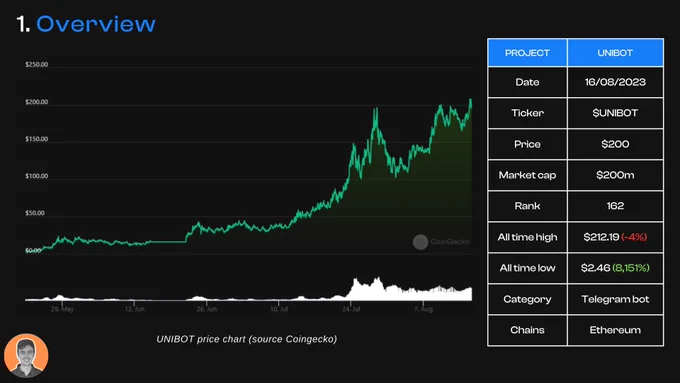

01. Project Overview

Unibot is a trading bot that allows you to automate DEX trading on Telegram.

It simplifies the trading experience on Uniswap by providing the following features:

- Clearer user interface

- MEV protection

- Reduced transaction failure risk

- Faster transactions (6 times faster than Uniswap)

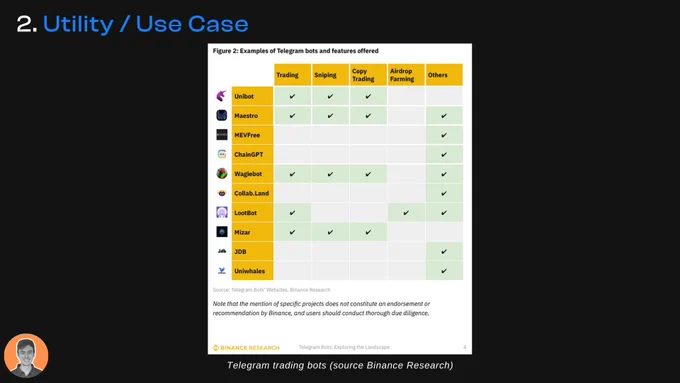

02. Use Cases

If you have used Uniswap before, you know that the experience is average.

Telegram trading bots are popular in the cryptocurrency community because they provide a more streamlined and faster way of trading, especially for new users.

They have the following advantages:

- Faster transaction speed

- Improved user experience

- Automation

- Easier for new users to use

- Security (MEV protection and RUG protection)

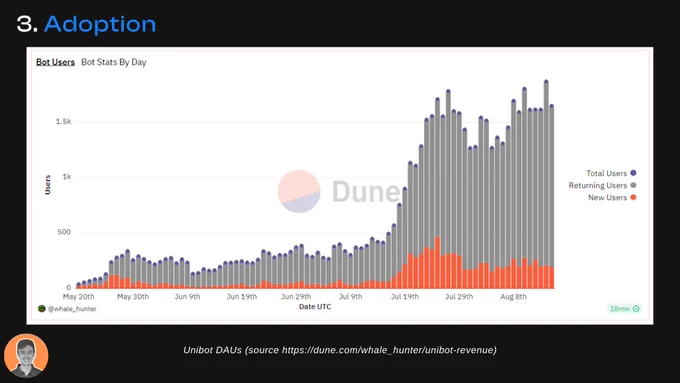

03. User Adoption

Unibot has dominated the market and currently holds about 71% of the market share.

I believe this is just the beginning in this field, as Telegram bots will help more users and investors enter the web3 space.

Since its launch in May 2023, Unibot’s user base has been growing steadily, with daily active users now stable at 1500 and the total number of users just surpassing 10,000.

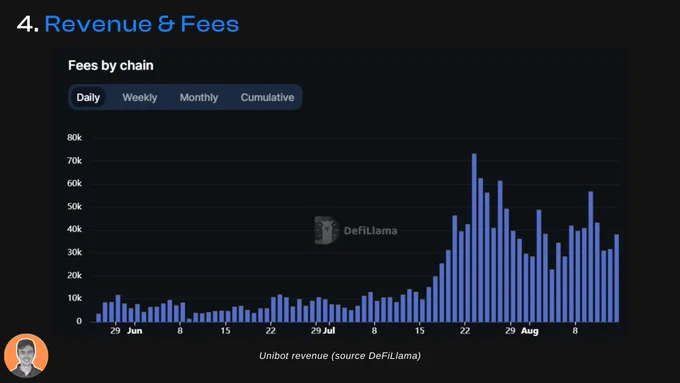

04. Project Revenue

Unibot distributes revenue shares to token holders through its protocol. As long as you hold at least 10 $UNIBOT tokens, you will receive ETH rewards (no staking or locking required).

The income allocated to token holders includes:

- 40% of all robot trading fees

- 1% of UNIBOT trading volume (2% for those who participated in token migration before September)

According to data from DeFi Llama, Unibot ranks 26th in terms of revenue among all protocols and generates $40,000 in revenue daily.

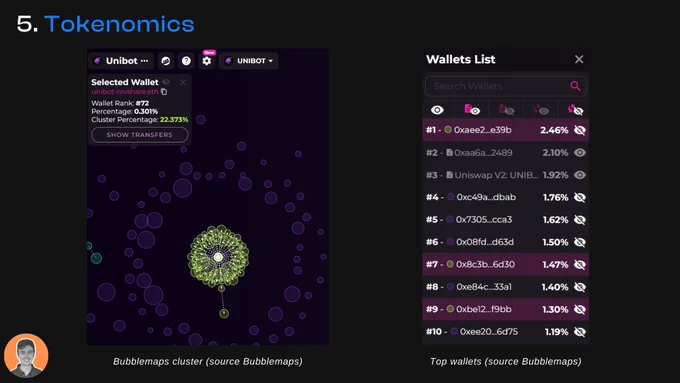

05. Economic Model

The token economic model of Unibot is quite simple:

- Fair launch on May 17, 2023;

- Issuance of 1 million tokens, fully circulating;

- A 5% tax is levied on each $UNIBOT transaction (1% goes into LP, 1-2% is returned to holders, 2% goes to the team).

Here is the current token supply data:

- Circulating supply and max supply = 1 million;

- Market cap = $200 million;

- FDV = $200 million;

- Market cap / FDV = 1.

The green bubbles in the image reflect the distribution of share of earnings. It can be seen that the largest wallet holds only 2.46% of the tokens (24.7k UNIBOT = $4.7 million).

For more detailed analysis, you can refer to Bubblemaps’ tweet.

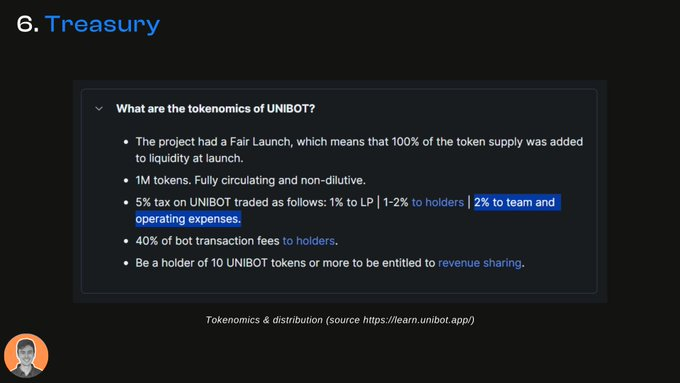

06. Treasury

There is no mention of the protocol’s treasury in any of Unibot’s documents. However, they did mention that 2% of the tax revenue from UNIBOT goes to the team and operations.

Since the project is still relatively early, I expect they may consider this issue as it grows.

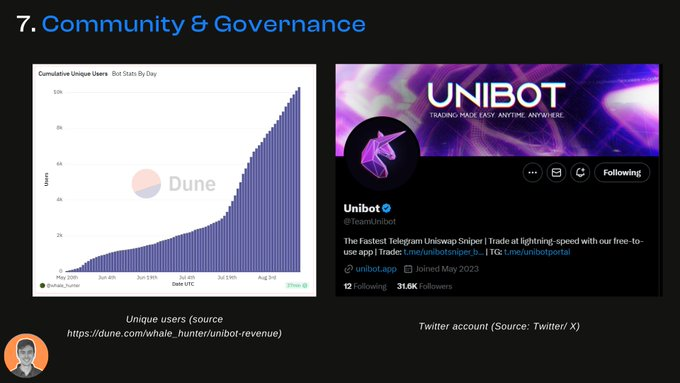

07. Community and Governance

Although there is no formal decentralized governance forum, as long as you hold 10 UNIBOT tokens, you can access Unibot’s private Telegram holder channel.

Here are some social and user data related to Unibot:

- Twitter – 31.6k followers;

- Telegram – 8,700 members;

- Independent users – 10.3k.

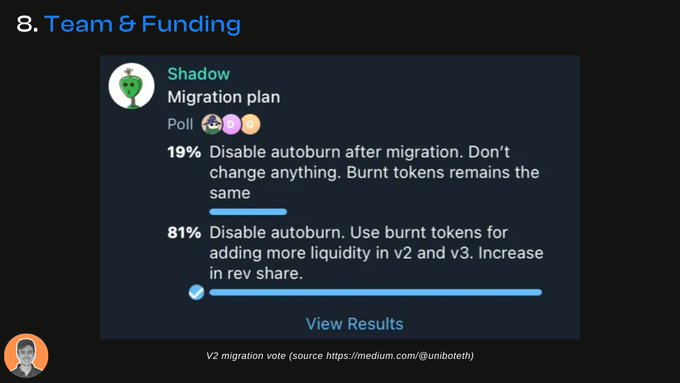

08. Team and Funding

Unibot was “fair launched” in May 2023, but there is very limited information about the anonymous team behind the project.

The project recently underwent a migration from V1 to V2 (upgrade of the token economic model, adding previously burned tokens to its liquidity pool), with a vote in the holders’ Telegram channel passing with 81% approval (not an official DAO vote).

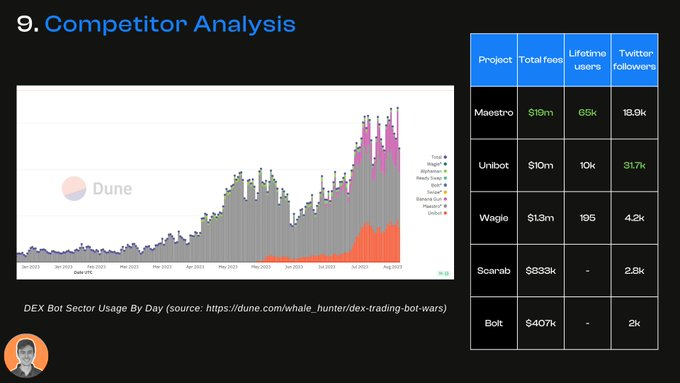

09. Competitive Analysis

There are actually many competitors in the field of Telegram bots, among which Maestro has been around the longest, which is why it leads Unibot in terms of transaction fees and cumulative user count.

However, since the launch of Unibot, it has been dominant, and now Unibot has captured about 71% of the market value share in the robotics field (data from Coingecko).

It is believed that it won’t be long before Unibot surpasses Maestro in various data aspects.

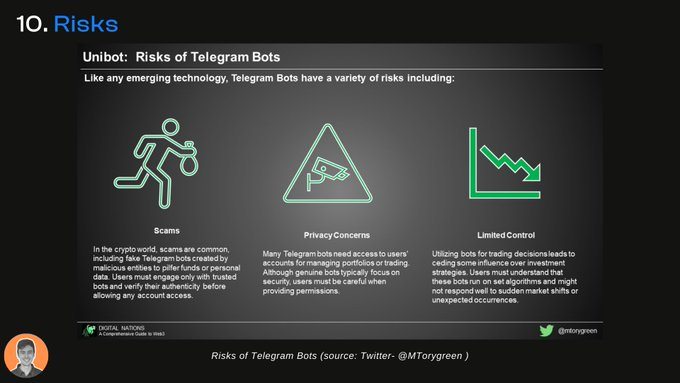

10. Risks

My biggest concern about Telegram trading robots is privacy and the security of wallet private keys.

Unibot pointed out in its documentation:

- The private keys are encrypted or decrypted using industry-standard symmetric keys (no one can access your keys);

- Unlike centralized exchanges, users can access the private keys of the trading wallets generated by Unibot;

- You can import the keys into Metamask and have full control over the funds in Unibot at any time;

- Users can always consider the wallet as a hot wallet;

- Other risks include smart contract vulnerabilities, exploits, and hacker attacks.

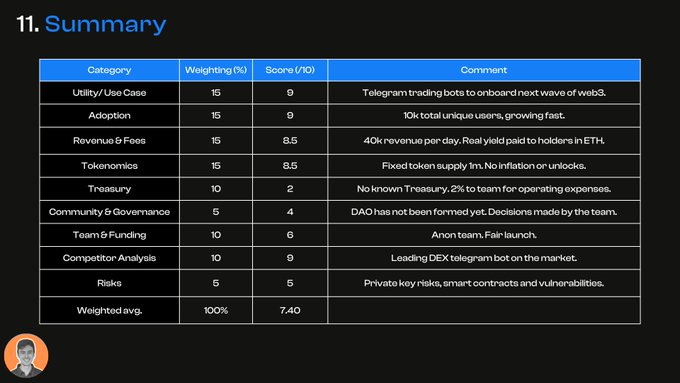

11. Summary

Overall, Unibot has left me with a great impression. It has unique use cases and simplifies DEX trading in an innovative way.

However, it needs improvement in governance and treasury and further clarification on privacy issues. As shown in the above figure, I would give it a weighted score of about 7.4, which is my evaluation of the project.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Quick Overview of Recent Popular DeFi Narratives and Innovative Projects

- Inventory of the 8 old projects of the transformation LSD

- Crossing the Bull and Bear The LSD Battle of the Project Party

- Crossing the Bull and Bear The LSD Battle of Project Parties

- A summary of 10 projects worth paying attention to recently DeFi, DEX, games, and on-chain tools

- Full-chain gaming becomes the market focus, in-depth analysis of the pioneering project Dark Forest.

- Using Tornado.Cash as an example to expose the scalability attacks on zkp projects.