DeFi Narrative Losing Popularity: How Can Outdated Blue Chips Regain Market Attention?

DeFi Narrative Losing Popularity: How Can Blue Chips Regain Attention?The crypto world is no stranger to narratives, especially with the recent succession of Shanghai upgrades, BRC 20, meme, and even the retelling of the halving story, each of which has sparked new market attention.

However, before all these narratives, the “DeFi Summer” that began in 2020 is rarely mentioned today. As a key milestone event in the rotation of narratives in the crypto world, three years have passed and DeFi narratives are beginning to show some new changes worth noting.

Unpopular DeFi Narrative

Since the “DeFi Summer” in 2020, the entire DeFi track has made significant progress, and the market has created many sub-sectors such as decentralized trading, lending, derivatives, fixed income, algorithmic stable coins, asset synthesis, aggregators, etc.

However, with the decline of traditional DeFi blue-chips such as UNI, LINK, SUSHI, and SNX, which has been evident since the historical peak on May 19, 2021, it seems that neither the old DeFi leaders like Uniswap or Synthetix nor the new “DeFi 2.0” rookies like OHM can escape the gradually forgotten embarrassing situation of being a market hot spot.

- Story behind the sudden rise of PulseChain, which excavated 500 million TVL in a week

- Hong Kong to open cryptocurrency trading to retail investors, bitcoin rebound may be weak or unsustainable

- Introducing BTC Warp: A Proof of Concept solution for Bitcoin Light Node Synchronization Issue

Especially in the development of the crypto world in 2022, after experiencing the successive prosperity of narratives such as NFT, DAO, Metaverse, Web3, etc., DeFi has been forgotten by most market participants and has become an unpopular market narrative.

The fundamental reason is that apart from the brand and stickiness of some leading products, the services provided by most products are very similar, most of them only barely maintaining themselves through the token incentive plans they launched:

When there is ample liquidity incentive, the asset scale (TVL) of new DeFi platforms will indeed expand rapidly, but this is unsustainable because the funds themselves are not truly “locked”. Once new high-yield opportunities emerge or the incentives of the original protocol cannot be maintained after a certain TVL scale, the funds will quickly and flexibly shift.

This is also the reason why DeFi products, especially their tokens, have opened high and fallen low in the secondary market since 2020 – relying solely on token incentives to retain users in the short term is bound to be unsustainable.

Old DeFi launches new flowers

However, if we temporarily put aside the poor performance of DeFi protocol tokens in the secondary market, there are still some interesting variables happening within the DeFi race track. Among them, Curve, MakerDAO and other leading blue-chip projects have the most obvious actions, and the most direct signal is that the boundary between DeFi giants is becoming blurred.

MakerDAO enters the lending race with SBlockingrk Protocol

First of all, MakerDAO, which started with stablecoins, began to lay out the lending race track and launched the lending protocol SBlockingrk Protocol based on Aave V3 smart contracts at the beginning of this month, which is open to all DeFi users. This product is centered on DAI and has lending functions for ETH, stETH, DAI and sDAI.

SBlockingrk Lend supports MakerDAO’s PSM and DSR, and USDC holders can also convert USDC to DAI by PSM through the SBlockingrk Protocol official website homepage and earn deposit interest through DSR.

In addition, another function of SBlockingrk Lend is to guide the liquidity pledge derivative product EtherDAI that MakerDAO will launch in the future. The overall mechanism will be similar to Frax Finance, and when it is launched, it will also provide MKR or DAI for liquidity block production.

Aave lays out GHO stablecoin

Interestingly, Aave, which has lending as its basic plate, coincides with MakerDAO and plans to launch the Aave DAO-native stablecoin GHO that is decentralized, collateralized, and pegged to the US dollar.

Its logic is similar to that of DAI-it is an over-collateralized stablecoin cast using aTokens as collateral, the only difference is that since all collateral is productive capital, it will generate a certain amount of interest (aTokens), which depends on the demand for lending.

Last month, Aave founder and CEO Stani Kulechov released an update on the progress of stablecoin GHO, stating that the GHO code has been publicly released and audited, and GHO has been released on the Goerli test network and is undergoing a bug bounty program.

Actually, this is also a great comparison test group: as the two major DeFi blue chips whose businesses are infiltrating each other, the stablecoins of MakerDAO and Aave are similar in mechanism design, and the lending mechanism is also based on Aave V3 smart contracts. The only difference is that one is based on the stablecoin’s own token casting rights to enter the lending market, and the other is based on the lending scenario to build stablecoin usage as an extension foundation.

It can be seen to some extent which is easier to penetrate into the lending field, whether it is based on native stablecoins or based on lending protocol to expand the use cases of stablecoins. However, currently both sides are still in the testing phase, and the actual effect needs to be observed later.

Curve launches crvUSD

In addition, Curve, which mainly focuses on large asset exchanges, also recently launched its own stablecoin crvUSD, which has deployed its UI and officially launched recently, and currently supports sfrxETH, the Ethereum liquidity collateral product under Frax Finance, for mortgage casting, and will further support stETH later.

However, the total amount of crvUSD is still relatively small, but relying on Curve’s natural liquidity incentives, crvUSD can be said to have been born with a golden spoon.

The rapid development of frxETH

In fact, MakerDAO, Aave, and Curve are all laying out liquidity collateral in this big cake outside of their respective new tracks-MakerDAO and Aave’s lending can directly expand LSDfi business.

However, among all DeFi blue chips, Frax Finance has the deepest layout in the LSD field, which can be seen from the growth data of frxETH alone:

On October 21, 2022, Frax Finance launched the Ethereum liquidity collateral product frxETH. As of today, in about 200 days, frxETH has grown from 0 to nearly 220,000, worth about US$400 million.

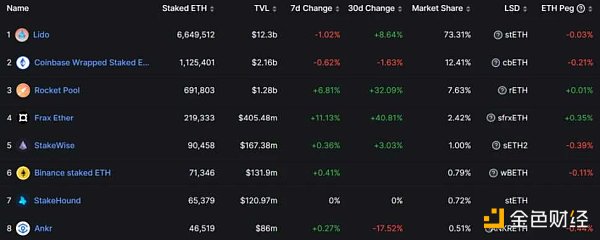

According to DefiLlama data, the current number of frxETH pledges is second only to Lido, Coinbase, and Rocket Pool, and the growth rate in the past 30 days exceeds 40%, and the growth rate after the Shanghai upgrade is even more impressive.

In a sense, Frax Finance’s yearning for change over the past year is a typical example of our observation of DeFi blue chips breaking through:

In 2022, the change in algorithmic stablecoins once put Frax Finance in a crisis. At the critical moment, on the one hand, for the original stablecoin layout, Frax chose to increase reserves to completely remove its own algorithmic stability (becoming a fully collateralized stablecoin).

At the same time, it further expands the new narrative, especially accurately hitting the LSD wind-there was originally Convex governance Token CVX held for the purpose of forming a 4 pool with UST, which gave Frax the possibility of creating higher returns (around 6%) by using huge exchange rate impacts to reward Curve’s emission, and thus to create higher returns.

This is also the key to frxETH’s ability to quickly enter the LSD market and establish a foothold, while quickly seizing the market.

Summary

In fact, the prosperity of most DeFi projects in 2020 and the difficulties encountered since 2021 were destined from the beginning-the rich liquidity incentives are unsustainable.

That’s why the try-everything approach of current DeFi blue chips is a microcosm of many DeFi protocols starting from different channels and launching self-redemption. Whether they can achieve their own breakthroughs or give birth to new narratives remains to be seen, but it is worth paying attention to.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Risks and Opportunities in the Bitcoin Ecosystem (Part 1)

- Binance Research’s lengthy article: Bitcoin BRC-20 principles, current status, and future

- What is your opinion on the Democratic presidential candidates accepting Bitcoin as campaign donations?

- Emerging economies in Africa, South Asia, and Southeast Asia are leading the global trend of cryptocurrencies.

- Exploring the evolution of the stablecoin market structure: Why can USDT always dominate the first place?

- Evolution of demand, yield, and products in the ETH Staking market after Shanghai upgrade

- How to search and join some popular events, using Bitcoin Pizza Day as an example?