Binance Research’s lengthy article: Bitcoin BRC-20 principles, current status, and future

Binance Research's article on Bitcoin's BRC-20 principles, status, and future.Original Title: “BRC-20 Tokens: A Primer”

Original Source: Binance Research

Translated by: Lynn, MarsBit

Table of Contents

What are Ordinals and Inscriptions?

- What is your opinion on the Democratic presidential candidates accepting Bitcoin as campaign donations?

- Emerging economies in Africa, South Asia, and Southeast Asia are leading the global trend of cryptocurrencies.

- Exploring the evolution of the stablecoin market structure: Why can USDT always dominate the first place?

What fields are BRC-20 tokens applicable to?

What is the market for BRC-20 like?

How does using BRC-20 tokens compare to using other standard tokens?

BRC-20’s Impact on the Bitcoin Market

Homogeneity and Non-Fungibility

Memory Pool

Transaction Fees

Community Responses

“Pro-Fee” Crowd

“Low-Fee” Camp

BUIDLer

Risks and Challenges

High risk of scams due to lack of infrastructure and actual utility

Future Prospects

Bitcoin Layer 2

Infrastructure

Innovations in Token Design

1. Key Points

BRC-20 tokens are the latest innovation from Ordinals Protocol and have taken over Crypto Twitter timelines in recent weeks.

BRC-20 is an experimental token standard that supports the deployment, minting, and transfer of non-fungible tokens on the Bitcoin blockchain. While the total market cap of these tokens has reached as high as $1 billion, the tokens themselves are relatively simple, with no smart contract functionality, unlike ERC-20 or BEP-20 tokens.

Due to the minting frenzy in early May, the Bitcoin memory pool became severely congested and network transaction fees skyrocketed.

While many in the ecosystem welcome higher fees given the importance of supplementing miner income as block rewards decline over time, others have been more critical in discussing the drawbacks of pricing out users in more price-sensitive regions.

At this early market stage, BRC-20 tokens bring significant risk and require more infrastructure support. As the founder has said, this is an experiment and potential risks should be scrutinized carefully.

Ordinal, Inscription, and BRC-20 tokens help demonstrate a clear organic demand for Bitcoin block space beyond traditional currency use cases. This may be a key factor for the long-term sustainability of the Bitcoin security model.

The development of Bitcoin Layer 2, infrastructure support for BRC-20, and further token design innovation may be the next step in this legend.

2. Introduction

Since the first launch of Ordinals Protocol earlier this year and the proliferation of Inscriptions (i.e. Bitcoin NFTs), innovation in the Bitcoin ecosystem has resurged. The latest result of this ordinal-driven innovation is the BRC-20 token, which has been all the rage in the past few weeks.

BRC-20 was first conceptualized in March 2023 as an experimental token standard that supports the deployment, minting, and transfer of non-fungible tokens on the Bitcoin blockchain. This latest innovation means that fungible and non-fungible tokens (inscriptions) have become part of the wider Bitcoin ecosystem. The total market capitalization of these tokens has been rising and even surpassed $1 billion in early May. In addition, the leading BRC-20 token $ORDI has been listed on multiple exchanges.

While many are excited about the increase in internal activity in Bitcoin and the apparent new energy resonating in the community, others believe that this deviates from Bitcoin’s “design purpose” and are not satisfied with the impact of these innovations on Bitcoin transaction fees.

In this report, we explore the origins of BRC-20, the current market outlook, their comparison to ERC-20 tokens, their impact on Bitcoin metrics, community divisions, potential risks, and our outlook for the future.

Disclaimer: BRC-20 tokens are extremely risky and in the early stages of price discovery. This material is not intended as a forecast or investment advice, nor is it a recommendation, offer, or solicitation to buy or sell any securities, cryptocurrencies, or adopt any investment strategy (see General Disclosures on page 26). The creator of the BRC-20 token standard, an anonymous Crypto Twitter user named domo, named the GitBook of this token standard “brc-20 experiment” and began the page with the following:

Keep this in mind when learning about the latest market developments through this Binance Research Institute report.

3. Background

What are Ordinals and Inscriptions?

ORD is an open-source software that can run on any Bitcoin full node [1], and it tracks individual Satoshis (sats) on Bitcoin according to founder Casey Rodarmor’s “ordinal theory.” Sats are the smallest unit of the Bitcoin network, with 1 Bitcoin equaling 100,000,000 sats. **Ordinal theory assigns a unique identifier to every individual on Bitcoin.** Additionally, these individual sats can be “inscribed” with arbitrary content (e.g. text, images, video) to create “inscriptions” (i.e. Bitcoin-native digital artifacts) [2], which can also be referred to as NFTs.

…… Individual sats can be “inscribed” with arbitrary content (e.g. text, images, video) to create “inscriptions” (i.e. Bitcoin-native digital artifacts), which can also be referred to as NFTs.

For a more in-depth look at Ordinals and Inscriptions, including their history, technical background, specifications, comparisons to other NFTs, and their impact on the market, please see our recent report: “A New Era for Bitcoin?”

What are BRC-20 tokens used for?

As inscriptions allow for non-fungible tokens (NFTs) to be used on Bitcoin, a natural question arises: “What about fungible tokens?” This is where BRC-20 comes in.

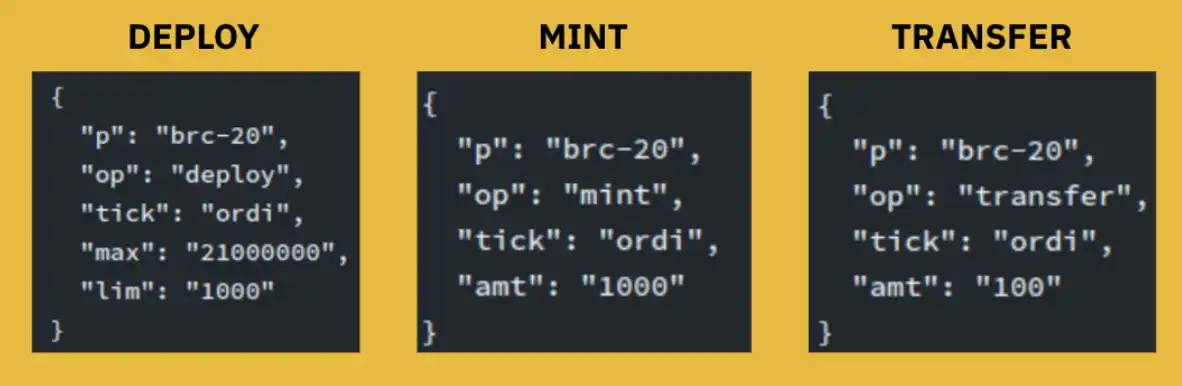

On March 9th, an anonymous Crypto Twitter user named domo theorized a method called BRC-20, which would create a fungible token standard on top of the Ordinals Protocol. **The idea is to inscribe JSON [3] data onto individual sats using Ordinals, to deploy, mint, and transfer fungible BRC-20 tokens.** JSON is essentially a text-based data format, so essentially, the method is writing text onto sats to create fungible tokens. The initial design only allows for three different operations: deploying tokens, minting tokens, and transferring tokens (we will explore this and other limitations later in this report).

**The first token contract to be deployed is the $ORDI token, limited to 1K tokens per minter and a maximum supply of 21 million (a nod to Bitcoin’s maximum supply).** This release caused a stir in a subsector of the Bitcoin community, and all 21 million ORDI tokens were minted in under a day. Other tokens soon followed, such as $MEME, $PEPE (not the wildly popular one uploaded to Ethereum), and $PUNK.

Figure 1: The humble beginnings of the BRC-20 token (domo’s first post on the topic)

Source: Twitter (@domodata)

Figure 2: Three possible initial operations for BRC-20 tokens (p = protocol name, op = operation, tick = stock code/identifier, max = maximum supply, lim = minting limit, amt = amount)

Source: https://domo-2.gitbook.io/brc-20-experiment/, Binance Research

What is the BRC-20 market like?

BRC-20 was only conceptualized a few months ago – and the history of ordinal and inscription is less than six months old – it can be fair to say that the market is still in its infancy. Nonetheless, developers and enthusiasts have been experimenting day and night. As of May 16, 2023, there are over 18,000 BRC-20 tokens with a total market capitalization of 500 million dollars. The market cap was close to 1 billion dollars in the days leading up to May, but as expected with any such frenzy, the market is self-correcting to find a more stable equilibrium point.

Figure 3: Top five BRC-20 tokens by market capitalization at present

Source: ordsBlockingce.org, as of May 16, 2023

The ordinal ($ORDI) token, the first BRC-20 token, is still the market leader to this day. This is evident in both market capitalization and trading volume and may have recently contributed to being listed on several different exchanges.

How does using BRC-20 tokens compare to using other standard tokens?

Although the name “BRC-20” is an imitation of the Ethereum “ERC-20” token standard, there are significant differences between them.

- Different blockchains

BRC-20 tokens exist on the Bitcoin blockchain, while ERC-20 exists on the Ethereum blockchain, and BEP-20 exists on the BNB smart chain, etc. Therefore, BRC-20 tokens rely on various features of the Bitcoin chain that are significantly different from ERC-20 or BEP-20, such as transaction speed and fees, just to name two key factors. This means that your experience using BRC-20 may be very different from your experience trading on other chains.

- Lack of smart contract functionality

ERC-20 tokens and BEP-20 tokens are created using smart contracts on the Ethereum and Binance Smart Chain blockchains, respectively, giving them a high degree of programmability and the ability to execute various operations and rules. This is in contrast to the relatively simple BRC-20 tokens, which are not based on smart contracts and have limited functionality (as shown in Figure 2).

- Market infrastructure

ERC-20 tokens and BEP-20 tokens are much more mature than BRC-20 tokens. While the former have been around for years and have led to the establishment of various types of infrastructure (such as DEXs, compatibility with centralized exchanges, fiat on-ramps, cross-chain capabilities, and more), the same cannot be said for BRC-20 tokens. Of course, BRC-20 tokens have only been around for a few months, so we cannot expect them to have a similar level of infrastructure. Nevertheless, this fact is worth keeping in mind as it highlights the significant differences in risk profile between them and more mature standards like ERC-20 and BEP-20.

4.Impact of BRC-20 on the Bitcoin market

Homogeneity vs. non-homogeneity

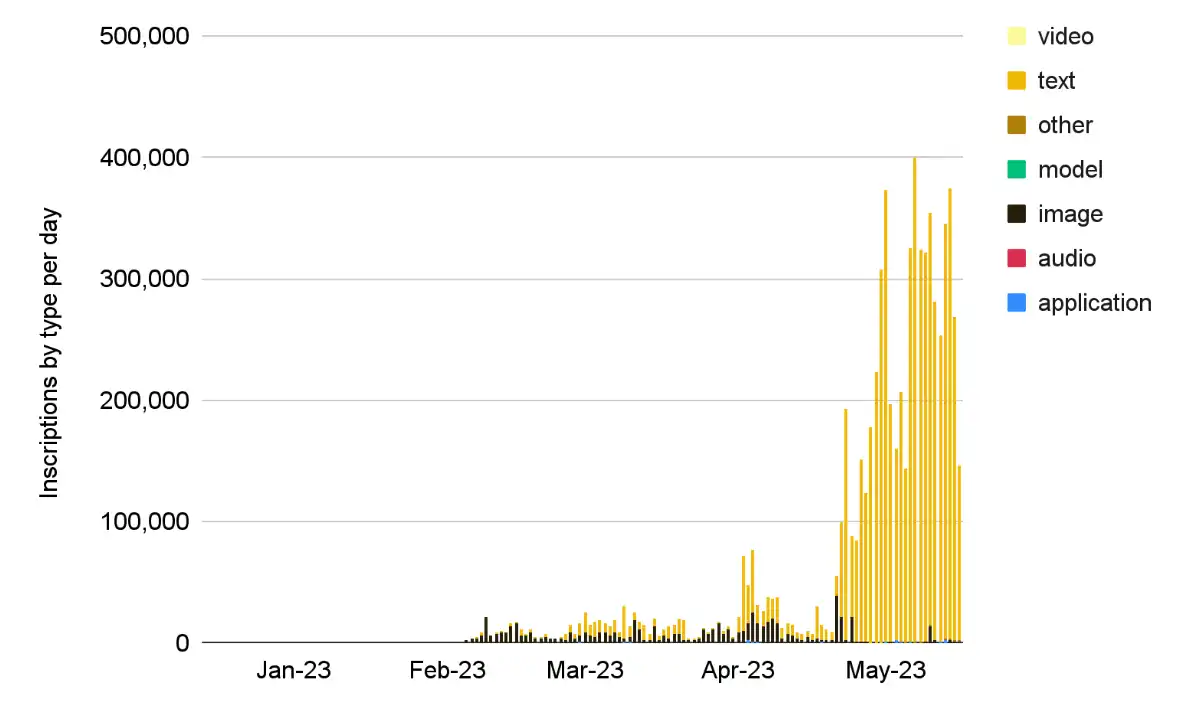

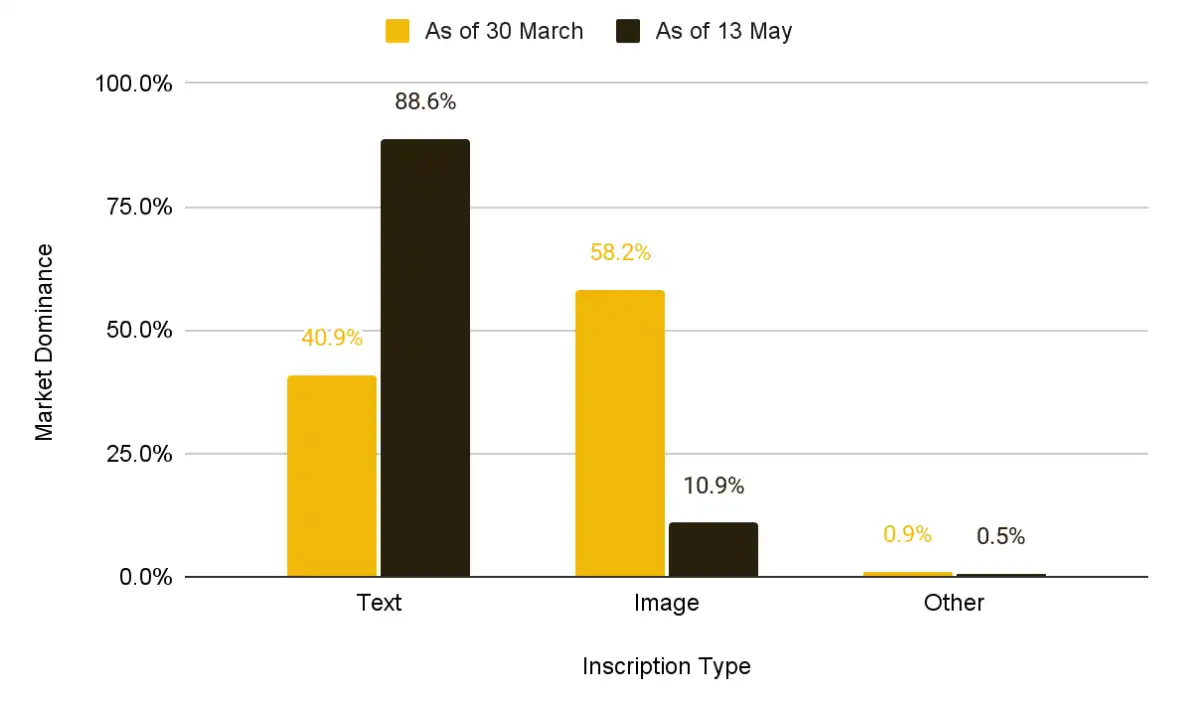

First, let us quickly review how the entire inscription market has changed since the emergence of BRC-20 tokens. Remember that BRC-20 tokens were first conceptualized on March 9, 2023, while inscriptions have been available since December 2022. As we can see, in February, images were the dominant inscription type in use in the market. This was when the ordinal craze began and Bitcoin NFT series started to emerge. Even from February to early April, though text inscriptions became more prevalent, there were still some days when images were the most widely used inscription medium.

Now, if we look at the latter half of April to May, we see a significant change. Text-based inscriptions (primarily associated with BRC-20 tokens) have been dominant, essentially pushing out any other media type. Additionally, the daily number of inscriptions (represented by the height of the bar graph) is several times the number we saw from January to early April. This demonstrates that BRC-20 tokens have been able to generate huge popularity since their conception, and are making waves.

Figure 4: Daily NFT minting has increased significantly, with most of it being text-based.

Source: Dune Analytics (@dgtl_assets), as of May 16th, 2023

In our report – “A New Era for Bitcoin?” – we provided a chart of the types of NFTs minted as of March 30th. Comparing these numbers to the current composition of the NFT market, we can see how BRC-20 tokens dominate the entire NFT market. As we can see below, text-based NFTs have doubled their lead over the past six weeks, while image-based NFTs have declined by over 5 times. In terms of the total number of NFTs, they have increased nearly 10 times from about 650,000 on March 30th to over 6.1 million as of May 13th.

Figure 5: Text-based NFTs have dominated the market in recent weeks

Source: Dune Analytics (@dgtl_assets), Binance Research, as of May 13th, 2023

Memory Pool

A reminder that the memory pool is essentially a waiting room for unconfirmed transactions that have not yet been put into blocks. These are ordered by attached fees, and a more crowded memory pool means more competition to get your transaction into the next available block.

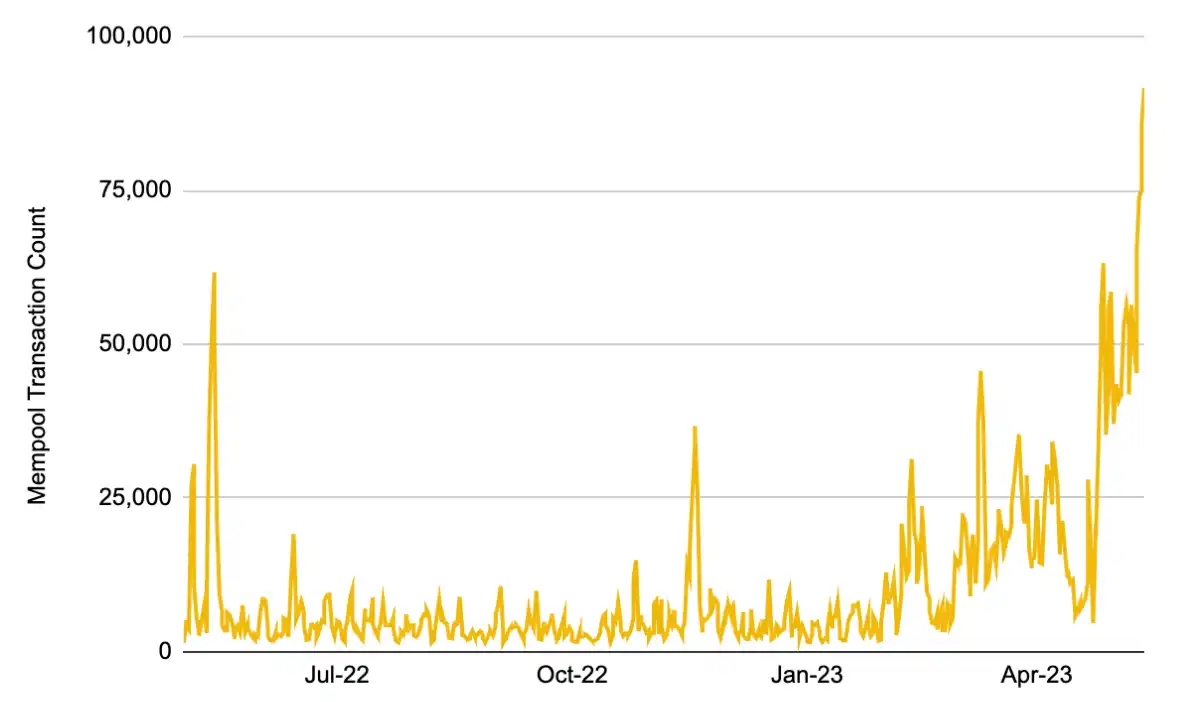

So far, the total number of unconfirmed transactions – i.e. memory pool transactions – for Bitcoin has been on the rise in 2023. **Recently, the interest generated by NFTs and BRC-20 tokens has meant that the number of memory pool transactions (relative to last year) has skyrocketed. This in turn has affected the cost of executing transactions on the Bitcoin blockchain (which will be further discussed below).

Figure 6: The number of memory pool transactions for Bitcoin has been steadily increasing this year, at least in part due to ordinal, NFT, and BRC-20 help

Source: Blockchain.com, Binance Research, as of May 14th, 2023

Transaction Fees

As perhaps the most discussed metric in the Bitcoin community, fees have been a focal point of debate dating back to the 2015-17 block size war [4].

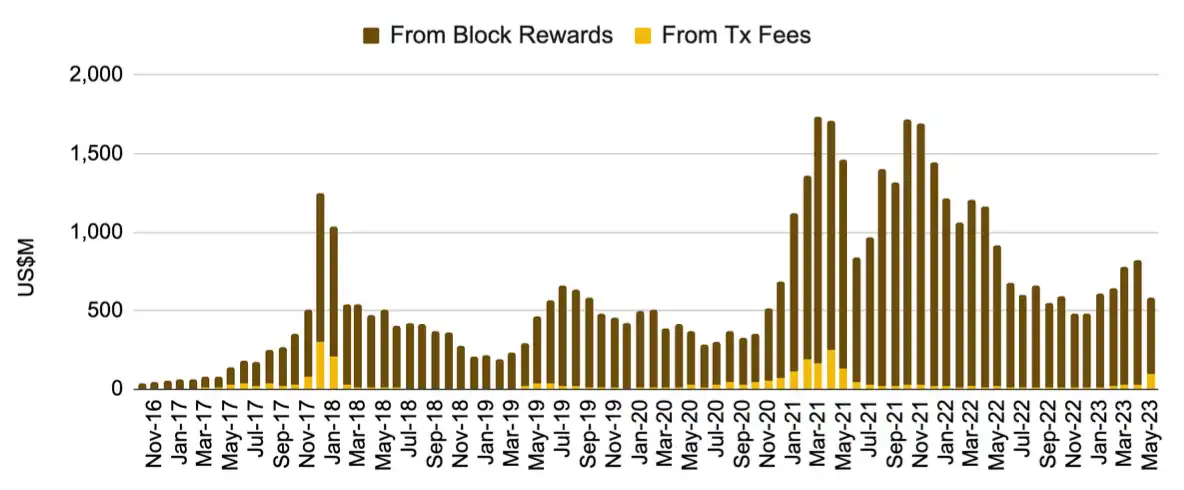

As a brief overview of the situation, let’s review how Bitcoin’s model incentivizes miners to secure the network via two economic measures: block rewards and transaction fees. Block rewards halve roughly every four years and will eventually taper off to zero in the long run. As such, eventually Bitcoin’s transaction fees will be the only compensation to miners, i.e. the security budget of the chain. Given that up until this year Bitcoin’s use cases have been relatively limited (primarily asset transfers), these fees have historically only made up a small portion of miner revenue and have been a point of concern for many in the Bitcoin community.

Figure 7: Bitcoin’s annual security budget (block rewards + transaction fees) is primarily composed of block rewards, which halve every four years and taper off to zero

Source: Dune Analytics (@niftytable), Binance Research, as of May 16, 2023

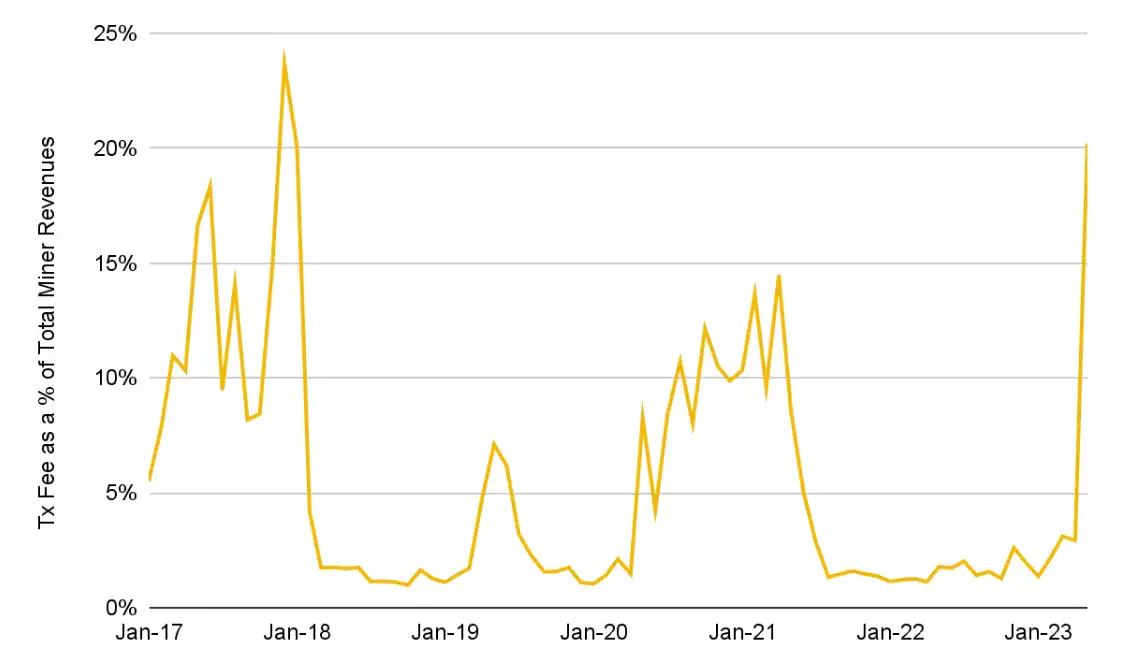

However, upon closer examination of the latest data from last year, we can see that transaction fees have increased from 1-2% of total miner rewards to 2-3% at the start of the year and surged to over 20% in May. While we can’t say for certain that this is solely due to Inscriptions and BRC-20, we have relatively strong reasons to believe that a large part of this move is due to these innovations within Bitcoin.

Figure 8: Transaction fees as a percentage of miner revenue approach all-time highs (note that the previous peak occurred in Dec 2017 during Bitcoin’s historic bull run)

Source: The Block Data, Binance Research, as of May 14, 2023

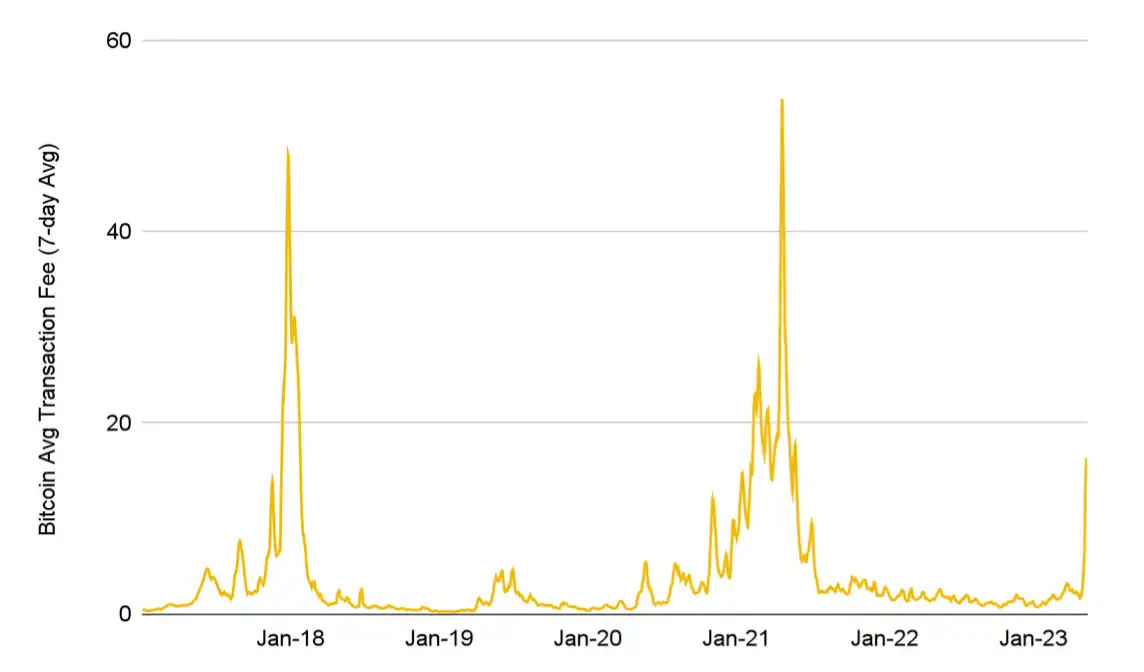

Of course, not everyone is thrilled about the steadily increasing transaction fees on the Bitcoin blockchain. Another impact of doing so is that fees required to send Bitcoin to another party correspondingly increase (which many argue is Bitcoin’s “true” utility – more on that later).

The Bitcoin transaction fee has soared before, especially in December 2017 and April 2021. However, both of these times were during strong bull markets in Bitcoin and the crypto space. This is the first time the fees have significantly increased in what many consider to be the middle of a bear market.

Figure 9: Average fee for trading on Bitcoin has recently soared

Source: The Block Data, Binance Research, as of May 14, 2023

However, it is worth remembering that Bitcoin transaction fees have risen before; this is not a unique or extreme event. Even the recent spike can be seen as a kind of warning, indicating that Bitcoin needs to innovate and prepare for further upward movement in the future.

Ultimately, the surge in demand for the Bitcoin blockchain was unleashed by tokens such as Sats, OP_Return, and BRC-20. They created a demand for block space that Bitcoin has not seen in some time. Many have thought that Bitcoin has lost attention to games like Ethereum, but the creation of OP_Return and BRC-20 seems to be changing that. From a financial standpoint, Bitcoin miners need to continue to be rewarded, and fees will have to make up for this income loss as the block reward continues to decrease until it becomes zero, just like any company that might expect core income to continue to decrease.

Many have thought that Bitcoin has lost attention to games like Ethereum, but the creation of OP_Return and BRC-20 seems to be changing that.

5. Community Response

The initial innovation that followed the use of the Satoshis ordinal theory to track individual sats and further engrave them with data to create OP_Return sparked a heated debate within the Bitcoin community. As you might expect, the creation of BRC-20 tokens has taken this debate to a new level.

“Fee Payers” Community

As discussed above, the sustainability of the Bitcoin security model has long been a major concern for many in the community [5]. How will miners be rewarded in the future as block rewards continue to decrease? What does it mean for the long-term health of Bitcoin if miners are not adequately compensated for securing the chain? It is inevitable that miners need to be compensated for providing security, and for this reason, Bitcoin transaction fees need to be higher. For this reason, many in the community were surprised by the attention that OP_Return and BRC-20 have received and the impact that this has had on the relatively sluggish Bitcoin fee market.

Figure 10: Many prominent figures in the cryptocurrency industry are optimistic about this new unlock.

Source: Twitter (@danheld, @nic_carter)

The fact that miners need to be compensated for providing security is inevitable, and for this reason, bitcoin transaction fees need to be higher.

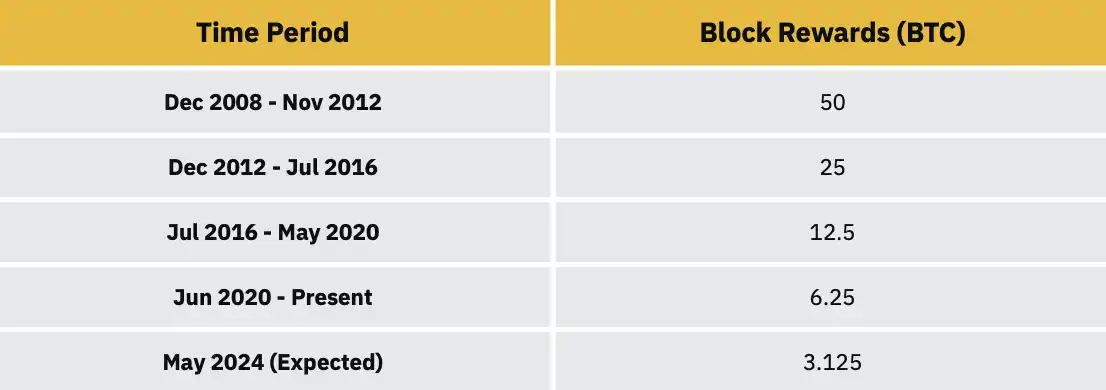

One specific sub-sector of the community that has benefited greatly from bitcoin’s recent developments is the mining community. For more background information on the above discussion, see Figure 11 to learn about the bitcoin block reward halving cycles that have occurred so far.

Figure 11: Bitcoin block rewards per successful block

Source: Bitcoin Visuals, Binance Research

Although the price of bitcoin has risen significantly since the days of the 50 BTC block reward, this table illustrates the tricky nature of the bitcoin miner business model. As transaction fees supplement their income and potentially signal a bright future for block space demand, the equation looks more favorable for miners and may attract more people to the network. Remember, the more independent miners there are, the better for decentralization, and ultimately the better for the security of the bitcoin blockchain.

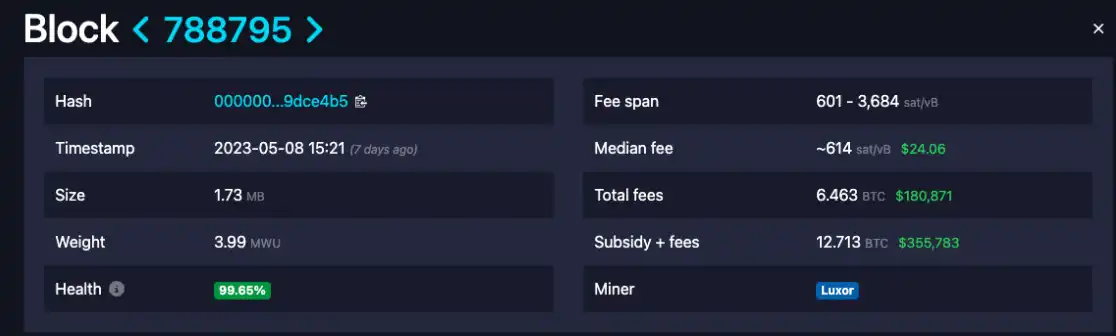

It is worth noting that there were even bitcoin blocks in early May with transaction fees exceeding the 6.25 BTC block reward. This is a remarkable achievement considering that for most of 2022, transaction fees have averaged 1-2% of miner revenue and were not much higher in earlier years (see Figure 8). This demonstrates how NFTs and BRC-20s are helping to introduce a growing demand for block space — even without a major bull market backdrop.

Figure 12: Total fees for Block 788795 were 6.46 BTC, while the block reward was 6.25 BTC

Source: mempool.space

Low-Fee Camp

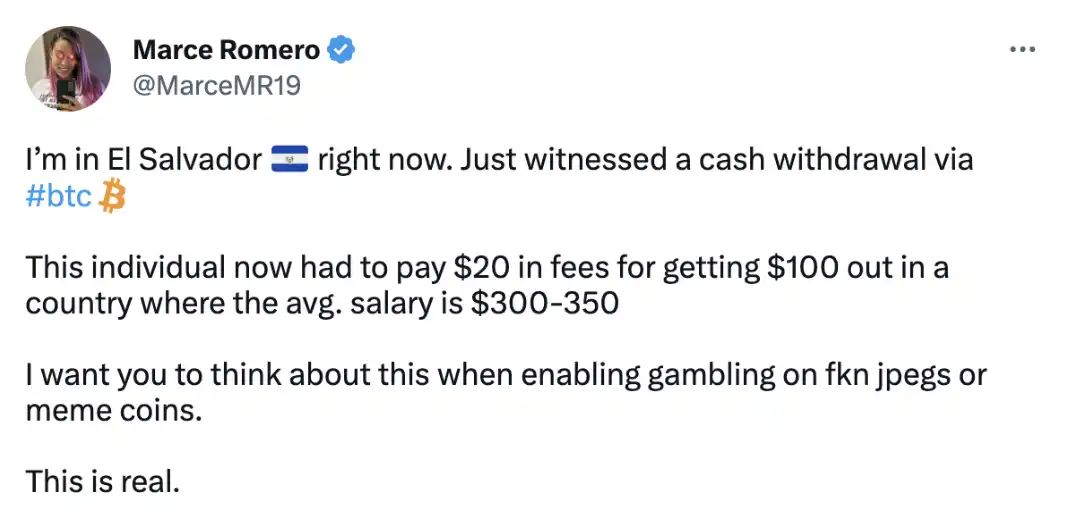

While many are excited about the increase in activity and buzz around the bitcoin ecosystem and are encouraged by the increased fees from a sustainability standpoint, others are more critical. **This camp is more interested in what they see as bitcoin’s “real purpose” as a hard, non-fiat currency, and the chain should be dedicated to facilitating peer-to-peer transactions.** This group believes that data-intensive transactions associated with NFTs, i.e. inscriptions and BRC-20s, primarily cause bitcoin network congestion and drive up fees, ultimately impeding peer-to-peer transactions.

While some argue that increasing fees are causing users in countries relying on Bitcoin as a substitute for their local fiat system to be priced out, others have extreme views, even suggesting that SegWit and BRC-20 are attacks on the chain.

Figure 13: Some are worried about Bitcoin user pricing being too high

Source: Twitter (@MarceMR19)

Figure 14: Others hold more extreme views

Source: Twitter (@proofofjogi)

Some in the community have even suggested that Bitcoin core developers should review transactions related to SegWit. We don’t need to explain why such a review would be completely contrary to the spirit of Bitcoin, as it is incredibly focused on decentralization.

While transaction fees on the Bitcoin network are indeed rising, which will inevitably cause some consumers around the world to pay a price, is this really a problem? The question we need to ask is whether a user must use the underlying Bitcoin L1 to transfer $10 to their friend. This is the purpose of creating the Lightning Network, and it is why Bitcoin chose to be a fast, secure peer-to-peer payment solution. In fact, as you can see in our recent report “A New Era for Bitcoin?”, Lightning Network capacity continues to grow year by year, and fees remain affordable.

The question we need to ask is whether a user must use the underlying Bitcoin L1 to transfer $10 to their friend. This is the purpose of creating the Lightning Network, and it is why Bitcoin chose to be a fast, secure peer-to-peer payment solution.

Trading on the basic L1 has never guaranteed to remain very cheap.

Even if Bitcoin’s popularity increases significantly, attracting millions of new users to use it for peer-to-peer transactions, it will have the same effect on transaction fees. So the idea that more Bitcoin usage is bad because it makes consumers lose out on price is not valid, especially considering the future growth prospects of the network. In fact, the focus should be on making it more efficient and easier to join the Lightning Network, and doing further work on Bitcoin’s L2 solutions so that transactions can occur on layers beyond the underlying Bitcoin L1.

BUIDLer

Before we dive in, we want to remind readers to read the disclaimer on page 3 and the general disclosures on page 26. As mentioned before, we are discussing the cutting-edge of the cryptocurrency market here and reporting on it to better educate and inform our readers. These technologies are very new and come with extreme risk. Please exercise extreme caution when interacting with any of these projects or builders.

Perhaps the most important group – the ones building the tools and infrastructure to take these innovations to the next level. Key builders include, of course, Ordinals Protocol founder Casey Rodarmor and BRC-20 token standard creator domo. Trevor.btc and Leonidas.og have also done extensive reporting on the story of Ordinals and BRC-20 and help host the Ordinals Show podcast, which covers the latest in cryptocurrency.

In terms of key projects, the UniSat wallet has been a participant in the early stages of the Ordinals/BRC-20 story. While initially offering a wallet for Ordinals and then BRC-20, UniSat now also helps users subscribe to sats and recently released a BRC-20 marketplace (currently marked as “experimental testing”). Notably, at the start of the marketplace, in order to trade on UniSat, you needed to have done a certain amount of trading before you were allowed to trade. This meant that early traders were extremely crypto-native (i.e. DeFi degens). These restrictions were later lifted and other trading venues have emerged. UniSat has also been developing a BRC-20 index and has released some preliminary functionality related to this (more on this to come). The website further notes that UniSat is in testing stages, so exercise caution when interacting with the protocol.

Another notable participant is ALEX. ALEX is a project built on Bitcoin L2 and Stack that aims to develop DeFi on Bitcoin while using Bitcoin as a settlement layer and Stack as a smart contract layer. Prior to BRC-20, they focused on swaps, liquidity pools, staking, farming, and bridging (classic DeFi primitives). They recently entered the BRC-20 token space and launched a test version of a decentralized exchange (“DEX”) for trading B20. To trade BRC-20, users can bridge from USDT on Ethereum or BNB chain to Stack USDT (“sUSDT”), and then they use sUSDT to trade BRC-20. As mentioned before, the DEX is currently in testing and was just recently established, so exercise extreme caution if you’re considering checking it out.

The last project we’ll mention here is doing something a little different. The Rare Satoshi Society’s business is finding the rarest Bitcoins on the market and connecting them with collectors. They use Casey Rodarmor’s descriptions of different rarity levels to define these Bitcoins, taking a novel approach to collecting Bitcoins and using software to scan for uncommon and rare Bitcoins in each one. As anyone in the collector’s market knows, people will collect just about anything – from first edition newspapers to stamps to sports cars – so it’s no surprise this group has decided to enter the sats collecting market. Some are looking for a rare Bitcoin to engrave a specific image on, while others are seeking Bitcoins from specific blocks, such as the famous 10,000 BTC pizza transaction from 2010.

Figure 15: Casey Rodarmor’s ordinal scarcity index

Source: rodarmor.com/blog/ordinal-theory

6. Risks and Challenges

As previously mentioned, ordinality, engravings, and BRC-20 tokens are recent innovations and are at the forefront of cryptocurrency at this early stage, with significant risks. These are not the same tools and do not occupy the same market as Ethereum, BNB, or Bitcoin itself. This is at the cutting edge of cryptocurrency work today. Accordingly, there are several key risks that all readers need to be aware of.

Limited infrastructure

Put plainly, BRC-20 tokens are just an experimental token standard created by a Twitter user with a fake name. While we say this not to diminish the innovation and potential of this idea, we must first state it to illustrate just how early we are in this story.

The token standard has been in existence for a few months, only seeing significant activity in the past few weeks. While builders are working fast and we emphasize that some project teams are working hard to ship relevant tools and infrastructure, there’s not much around at this stage. Yes, we’ve seen prototypes of market platforms and DEXs, but most trading is still happening OTC (over-the-counter) via Discord servers. Tracking tokens and holders without a mature indexer is a tricky process.

In fact, the risk of centralized indexing is quite significant because theoretically, if an exchange does not use the same indexer, they may not recognize something you purchased on another exchange. These tools are not native to the Bitcoin blockchain, but rather come from ordinal theory, which basically “associates” certain sats with certain features. If we do not reach social consensus on this method, some aspects may not recognize certain ordinals and therefore not recognize specific BRC-20 tokens.

If we are to see a market with over a few thousand holders, there is still a lot of work to be done, and although we remain optimistic about what BRC-20 tokens unlock and what they can offer, the infrastructure has a long way to go.

No Practical Utility

Currently, most (if not all) BRC-20 tokens being exchanged are Meme tokens. Almost by definition, these tokens have no utility and are primarily driven by social media and community sentiment. While this brings attention and creates hype, the lack of practicality means that there is a lack of serious holder base, which means that these tokens may collapse suddenly and without warning.

This risk should be kept in mind by every reader, and at the same time, if you see a new token offering some form of utility, you should dig deep and question whether this is real or just a marketing gimmick.

High Risk of Fraud

In keeping with how new the entire experiment is, we should remember that this means there is a high risk of fraud. For example, OTC token trading on Discord servers is naturally a very high-risk activity and has led to many people being scammed out of money. Projects that build infrastructure for ordinals or BRC-20s are also uncertain, and in this early stage, may bring potential security risks. While we are not trying to scare off readers, it is important to take the high risk of fraud seriously, given that we are in the early stages of these tokens and this new technology.

7. Future Outlook

Bitcoin Layer 2

This whole frenzy is a reminder that the scale of Bitcoin does not match its grand goal, and if it is not ordinals, inscriptions, or BRC-20s, it will be something else. **As long as a few million more people decide to use Bitcoin for peer-to-peer transactions, we will have the same result, skyrocketing transaction fees; this skyrocketing is caused by BRC-20s, which is irrelevant.** If anything, we should take this as a warning for the future and understand that there is still a lot of work to be done if Bitcoin is to truly become a global peer-to-peer payment system for millions or even billions of people.

This further underscores the importance of the scaling methods that other chains are using compared to Bitcoin. Do we need to send a $5 transaction on Bitcoin L1, or can it be done at the L2 level? Many people would argue that underlying transactions are a scarce commodity and if the chain is to develop, they cannot be expected to remain cheap forever. The conclusion to be drawn here is simple: the use case for Bitcoin L2 is clear, and that is where developers should focus. If Bitcoin is to become a technology that millions of people can use regularly, scalability solutions will be the next critical step it takes.

In our report, “A New Era for Bitcoin?”, we take a close look at potential solutions including the Lightning Network, Stack and Rootstock, as well as quick primers on the Liquid Network and Rollkit. Stack’s upcoming sBTC[6] looks particularly interesting and could provide a distinctly more decentralized way of using BTC on L2 than is currently possible. Use of the Lightning Network continues to rise, with Binance recently announcing they are looking to integrate it and startups like Lightning Labs[7] creating “enterprise-grade” network gateways to enable businesses to join. Bitcoin open-source development platform Spiral, backed by Jack Dorsey, recently released an ambitious new roadmap[8] for its Lightning Development Kit (“LDK”) project.

The future of the Bitcoin secondary market looks promising as more users and developers see clear use cases for Bitcoin scalability, and we remain optimistic about the developments in this field next year.

Infrastructure

As mentioned in the “Risks and Challenges” section above, infrastructure around BRC-20 tokens is very limited at this early stage. While many different aspects, such as Unisat and ALEX, have released test versions or are researching solutions, we are still at a very early and experimental stage.

The transaction process must clearly become smoother, and peer-to-peer Discord server transactions should gradually be phased out over the coming weeks and months. Fully deploying a fully functional and efficient DEX is a key step in taking BRC-20 to a new level and should be closely monitored.

Additionally, as BRC-20 token standard founder domo recently stated in a Twitter Spaces, his top priority is to have a fully on-chain and trustless indexer released. An indexer is software that reads the Bitcoin chain and can compile all transactions to create an agreed-upon global balance state. UniSat and ALEX are both researching solutions in this area, and an effective indexer will be critical as it will further increase the legitimacy of BRC-20.

We expect significant developments in the relevant infrastructure over the next few months. For example, the Bitcoin Frontiers Fund recently announced [9] that their accelerator program has accepted eight new start-ups. These start-ups are researching various solutions, from ordinal lending to development toolkits for Bitcoin Web3 games, to cross-chain bridging for ordinals. Developers’ interest in the Bitcoin ecosystem is clearly benefiting from this recent wave of enthusiasm, and we are excited to see what kind of innovation can emerge from it.

Innovation in Token Design

Finally, in terms of specific BRC-20 innovations, we should note again that this is a very simple token standard with limited flexibility.

A key feature is that all BRC-20 token minting is fair, meaning you cannot take team allocations or have traditional “whitelist” functions that allow some users to mint tokens ahead of others. While the initial design used this feature to reduce the prevalence of rug pulls and scams, there are certainly legitimate reasons to have “whitelists” and tokens with team allocations, etc. Builders are working to address this issue, and whether a solution appears in BRC-20 or perhaps in another token standard remains to be seen.

Similarly, builders are also attempting to find a solution to “burn” tokens. Given BRC-20’s lack of smart contract functionality, this is currently impossible, and there may be some very real and legitimate use cases, especially when considering adding different utilities to these tokens.

Outside of BRC-20, builders have been innovating rapidly. The ORC-20 token recently appeared on the timeline, aiming to address some of the limitations of BRC-20. For example, BRC-20 tokens are currently limited to a four-letter naming convention. ORC-20 does not have this limitation, adding a degree of flexibility for developers. We have also seen the embryonic form of SRC-20 tokens, which are related to “Bitcoin stamps.” SRC-20 tokens store data differently than BRC-20 tokens, and due to some technical specifications, may be more secure than BRC-20, but this also means they can store far less data than BRC-20.

These are just a few examples of the symbolic design features that builders are attempting to innovate. We believe there is much more to come, and we will closely monitor the progress of developments.

8. Conclusion

Ordinal, Inscriptions, and BRC-20 tokens have helped prove to the world that there is indeed a demand for Bitcoin block space beyond the classic peer-to-peer payment model. Users want to do the same things on Ethereum and BNB chains as they do on Bitcoin. While Casey and domo helped stimulate innovation with their unlocks, it is now up to the community and developers to take it to the next level.

The lack of income from transaction fees for miners has been a key concern for many Bitcoin supporters, and this recent wave of activity demonstrates the possibilities that exist outside. Recent developments are encouraging and contribute to potential avenues for Bitcoin’s sustainable long-term development.

Scalable Layer 2 solutions for Bitcoin will be critical and we expect to see growth in this area. Further infrastructure development and token innovation are also on the menu.

Before we conclude, we want to remind readers that growth in the crypto space tends to be exponential. For example, it took over a month to reach 100 after the first Inscription on December 14, 2022. However, between February 2 and February 15, the number of Inscriptions went from 1K to 100K. By April, we had reached 1 million, and now we are well over 7 million. The market grows slowly at first and then suddenly. While we cannot say how big this market will be, we can predict that we will soon surpass the milestone of 10 million Inscriptions. Please keep a close eye on this space.

Figure 16: Exponential growth of Inscriptions so far

Source: Dune Analytics (@dgtl_assets) Binance Research, as of May 16, 2023

References

https://github.com/casey/ord#readme

https://docs.ordinals.com/digital-artifacts.html

https://en.wikipedia.org/wiki/JSON

https://www.bitrawr.com/bitcoin-block-size-debate-explained

https://medium.com/@hasufly/research-blockingper-a-model-for-bitcoins-security-and-the-declining-

https://www.stacks.co/learn/sbtc

https://twitter.com/lightsblockingrk

https://lightningdevkit.org/blog/ldk-roadmap/

We're excited to introduce 📣

Eight new startups in Bitcoin Frontier Fund's Accelerator Program

Ordinals Lending, DLCs, Institutional BTC & Consumer NFT Bridges, Bitcoin GameFi, and an Incubator for the Next Generation of BTC Builders!

👇🧵

— Bitcoin Frontier Fund (@BTCFrontierFund) May 15, 2023

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Evolution of demand, yield, and products in the ETH Staking market after Shanghai upgrade

- How to search and join some popular events, using Bitcoin Pizza Day as an example?

- Exclusive Interview with Arbitrum Founder: One Whiteboard, Three “Zhuge Liangs”, Creating the King of Billions in Layer2

- The RWA vision is promising, but it requires a joint effort from the encrypted market, traditional finance, and regulation.

- Financing Weekly Report | 24 public financing events; Bitcoin financial services provider River completes $35 million Series B financing, led by Kingsway Capital.

- Overview of BTC NFT Ecology: Development Status, Trading Market and Value Analysis

- One year after Terra’s Black Swan event: Market is on the mend, but still struggles to shake off the gloom