Story behind the sudden rise of PulseChain, which excavated 500 million TVL in a week

The story of PulseChain's rapid rise, which generated $500 million in total value locked within a week.Since 2021, funds on the blockchain have been decreasing, and it has been difficult for new public chains to attract a large amount of capital. However, the recent launch of PulseChain and the on-chain decentralized exchange PulseX have been surprising. PulseX has attracted a TVL of $500 million for PulseChain in just one week, directly boosting PulseChain’s TVL to eighth place. In this article, BlockingNews will take you through the background and potential risks of PulseChain’s sudden rise.

Founder Richard Heart and controversial HEX

The success of PulseChain is closely related to its founder, Richard Heart, and his background. According to Twitter data, PulseChain’s official Twitter account has few updates, while founder Richard is actively marketing and has achieved good results. It can be said that the success of PulseChain is mainly due to the background of its founder, Richard, which can be traced back to the cryptocurrency he created, HEX.

HEX was issued on Ethereum through a Bitcoin UTXO snapshot in early December 2019, and Bitcoin holders could receive it for free. HEX is the world’s first high-interest blockchain certificate of deposit, also known as the encrypted version of traditional time deposits. Richard claims that HEX can monetize the time value of money in a better way. In the traditional world, the currency issuance continues to increase, and the value gradually decreases. The inflation rate of HEX is set and decreases to below 3.69% within a year.

HEX holders can stake their tokens for a period of time (1-5555 days) and receive the principal and interest upon reaching the specified deadline. Stakers can enjoy a considerable appreciation rate, while users holding HEX without locking it up will encounter inflation. If the staking is terminated prematurely, the staker will suffer a large loss. For example, with an inflation rate of 3.69% and a staking rate of 10%, the staker’s staking annualized return is 36.9%.

- Hong Kong to open cryptocurrency trading to retail investors, bitcoin rebound may be weak or unsustainable

- Introducing BTC Warp: A Proof of Concept solution for Bitcoin Light Node Synchronization Issue

- Risks and Opportunities in the Bitcoin Ecosystem (Part 1)

HEX received a lot of criticism when it was launched, including privacy issues in token collection and token structures similar to Ponzi schemes. Although Bitcoin holders could receive HEX tokens for free at the beginning, they also sacrificed their privacy. In addition to receiving free tokens, users could also send ETH to the fund pool to receive newly issued HEX tokens.

From worthless in 2019 to peaking in 2021, HEX gained over 10,000 times in value, making its founder Richard famous. The rags-to-riches myth of HEX changed the fate of many losers, and Richard, the founder, shares a similar background of failure.

This has attracted countless followers for HEX’s Richard, and some people have worked with Richard to build PulseChain and promote it actively. Prominent figures, including XEN founder Jack Levin, are supporters of HEX, working actively to cooperate with marketing.

Richard himself is also a “marketing expert” (many people think it is a scam), and is always passionate about his projects. According to public information, Richard has 324,500 followers on Twitter and 152,000 subscribers on YouTube. He has uploaded 264 videos, and multiple HEX-related videos have been viewed over 100,000 times. In addition, the HEX official website shows that Richard bought the largest cut diamond in the world, weighing 555.55 carats, with 55 facets. Heard renamed it “The HEX.COM Diamond.” HEX.com also sponsored the Daytona 500 racing event, in which one of the three Triple Crown winners, JJ Yeley, participated.

PulseChain’s Airdrop Plan

After HEX’s peak, Richard started another cryptocurrency project, PulseChain, which is a forked chain of Ethereum that Richard built to reduce gas fees. PulseChain supports EVM and can be directly connected through MetaMask, with a block time of about 10 seconds.

Similar to the airdrop that HEX gave to Bitcoin holders, PulseChain’s marketing also started with an airdrop. PulseChain was once promoted as the “largest airdrop in history” worth $1 billion. Similar to forked chains such as ETHW, PulseChain plans to replicate Ethereum’s state. Therefore, users holding ETH on Ethereum can also receive an equal amount of PulseChain’s native token PLS airdrop, and other tokens can also be exchanged for PLS for profit in theory.

However, the situation after the launch is quite different. As of May 23, PLSburn.com shows that the supply of PLS is 135T, the price is $0.000256, and the market cap is $35 billion. If you hold 1 ETH worth $1,850 on Ethereum, you can only receive 1 PLS airdrop worth $0.000256 on PulseChain, which is almost negligible.

Unique “Sacrifice” Attracts Huge Financing

When designing PulseChain, Richard also laid out the on-chain DEX, PulseX, which is comparable to Uniswap on Ethereum.

Both PulseChain and PulseX have a financing method called “Sacrifice”, which means that investors “give up” their cryptocurrency while receiving free, worthless PulseChain and PulseX native token airdrops. From their own perspective, users who participate in Sacrifice are obviously hoping to profit from the airdrop, which can be seen as a financing method adopted by PulseChain to avoid legal risks.

Tokens that can participate in Sacrifice include HEX, USDC, ETH, and other mainstream currencies, and the earlier you participate, the more tokens you get. According to PulseX’s rules, before January 10, 2022, every token that Sacrifices $1 can receive 10,000 Sacrifice Points, and after that, the amount of funding required to receive 10,000 points every 24 hours increases by 5% until February 25, when every token that Sacrifices $9.91 can receive 10,000 points.

Richard’s reputation, plus this FOMO financing method, has enabled PulseChain and PulseX to raise a lot of money. According to Footprint statistics, the Sacrifice fund in PulseChain is $500 million. As of January 10, 2022, when the first stage of Sacrifice for PulseX ended, the participation funds had reached $940 million.

Sacrifice seems to have become a common financing method in PulseChain, and Hexpulse.info also lists several projects that have been financed using this method.

Liquidity Mining Frenzy after PulseChain Goes Live

Through the above financing method of Sacrifice, the native tokens PLS of PulseChain and PLSX of PulseX also have a very high basic market value. The $1 billion financing scale of decentralized exchange PulseX is also one of the largest in cryptocurrencies.

As of May 23rd, the only project on PulseChain listed on DeFiLlama is PulseX, with a TVL of $500 million, which makes PulseChain’s TVL directly rise to eighth place, surpassing old public chains such as Solana and Fantom, and even ten times that of emerging public chains Aptos and Sui.

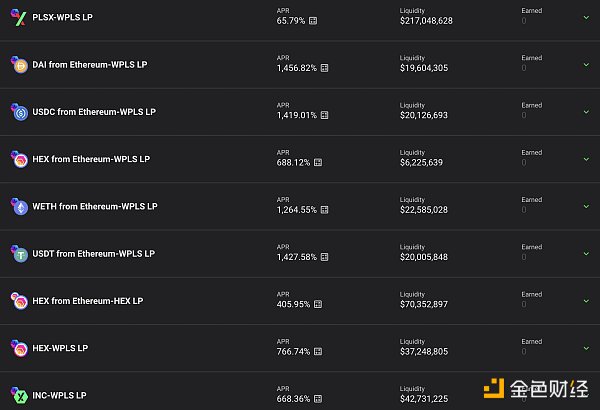

With the driving force of high market value of PLS and PLSX, the yield of liquidity mining on PulseX is almost above 1000%. Due to the excessive demand for cross-chain from Ethereum to PulseChain, the official cross-chain bridge was once paralyzed, and most of the funds were stuck on the cross-chain bridge and could not reach normally.

According to data from PLSburn.com, the current prices of PLS and PLSX correspond to 2.52 times and 1.13 times the sacrifice price, respectively, which may further enhance the cohesion of the HEX community. The once high-market-value HEX has been perfectly transferred to new projects in this way and has profited in the downward phase of the encryption market.

Risks in PulseChain

PulseChain has achieved rapid development, but also comes with great risks. The liquidity mining distributed in PulseX is represented by the INC token (Incentive Token). With the increase of liquidity in PulseX, the price of INC also continues to rise. According to data from GeckoTerminal, the price of INC has risen more than 10 times from May 19 to now. The liquidity of INC-WPLS and INC-PLSX is both over 40 million U.S. dollars.

The trading pair with the highest liquidity in PulseX is the internal ecological PLSX-WPLS. The liquidity of this trading pair is 213 million U.S. dollars, and the corresponding APR is only 65%. Mainstream coins such as USDC, USDT, and ETH do not have much corresponding liquidity. The highest liquidity of the relevant trading pair is WETH-WPLS, which is 22.44 million U.S. dollars. This indicates that the funds in PulseX mainly come from HEX and PulseChain ecology, and lack attractiveness to external funds.

Almost all mining in PulseX requires trading pairs with PLS, and the APR of PLSX-WPLS with the highest liquidity is relatively low. Once this part of funds starts to sell or INC starts to fall, it is easy to cause a death spiral, causing both liquidity and token prices to fall.

In short, PulseChain was built by Richard and his followers. Richard has extremely strong marketing capabilities, and the HEX community has a very strong consensus on this. PulseChain and PulseX have attracted a large amount of funds in the short term, but most of the funds come from HEX and PulseChain internals. Currently, the market value of PLS is 34 billion U.S. dollars, and the market value of PLSX is 160 million U.S. dollars, which is relatively high, and mining requires purchasing PLS, with high risks. Richard himself is also controversial, and many people think that the projects he has done are scams. Investment needs to pay attention to risks.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Binance Research’s lengthy article: Bitcoin BRC-20 principles, current status, and future

- What is your opinion on the Democratic presidential candidates accepting Bitcoin as campaign donations?

- Emerging economies in Africa, South Asia, and Southeast Asia are leading the global trend of cryptocurrencies.

- Exploring the evolution of the stablecoin market structure: Why can USDT always dominate the first place?

- Evolution of demand, yield, and products in the ETH Staking market after Shanghai upgrade

- How to search and join some popular events, using Bitcoin Pizza Day as an example?

- Exclusive Interview with Arbitrum Founder: One Whiteboard, Three “Zhuge Liangs”, Creating the King of Billions in Layer2