Mining myself, mining out a 50% annualized return? Interpreting the Ve (3.3) game hidden behind the emerging star RDNT in the borrowing and lending market

Mining myself, achieving a 50% annualized return? Unveiling the Ve (3.3) game in the emerging star RDNT in the borrowing and lending market1. Leveraged TVL

First of all, there is a large amount of liquidity in RDNT’s TVL. RDNT has heavily skewed mining subsidies, with the RDNT subsidy to borrowers being 5 times that of depositors, thus providing space for the circular borrowing.

Based on this, RDNT has legitimized the circular borrowing. Essentially, circular borrowing is a form of “transaction mining” that stimulates borrowing with high mining subsidies, creating false demand. In the past, borrowing platforms engaged in circular borrowing to exchange their own worthless tokens for users’ real money, but RDNT is more focused on leveraging its TVL and APY.

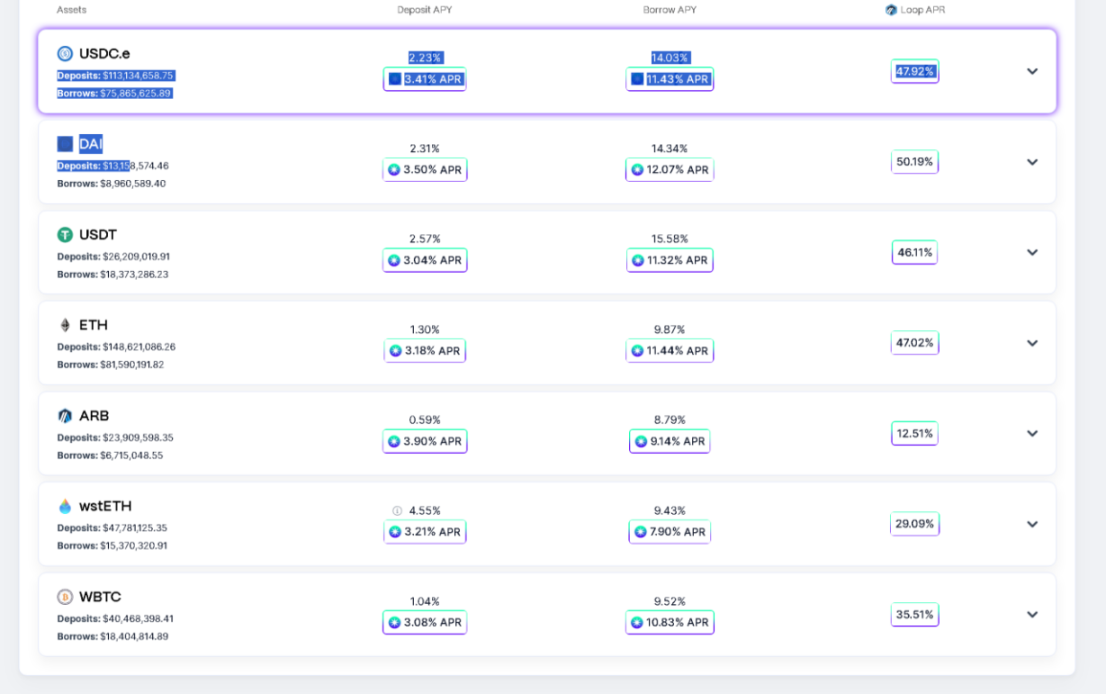

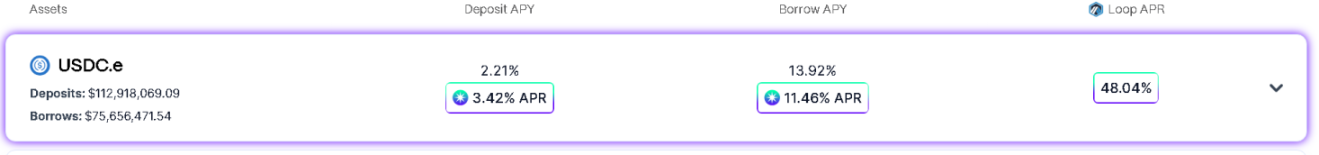

From the data, it can be seen that the utilization rate of most tokens is above 60%. Calculated according to a 4x leverage for stablecoins and a 3.3x leverage for non-stablecoins, a minimum of only $76 million in real TVL is needed, which can be increased to the current TVL of $280 million (Arb chain) after leverage. Of course, the actual situation may be higher than $76 million, but not much higher. The reason is simple: who would borrow USDC at an interest rate of 14.03%?

- Cryptocurrency Track Weekly Report [2023/08/14]

- Deep analysis of ARB on-chain chips Users continue to increase their holdings, and most large holders are at a loss.

- Exclusive|Interpreting the draft guidance principles of Taiwan’s Financial Supervisory Commission Can’t use the slogan To The Moon anymore?

If we capture ten borrowers of RDNT, all of whom are arbitrageurs engaged in circular borrowing, there may be some false positives, but if we assume there are only nine, there is a high probability of missing some.

2. The APY the Protocol Tells You and the APY You Can Earn

“Secondly, there are also some issues with RDNT’s nominal APY.” A 50% interest rate on USDT through circular borrowing? Are you tempted? But if you are tempted, you have been deceived, because what RDNT refers to here is only the deposit interest rate, without taking into account borrowing costs.

Suppose you deposit 100 USDC, which is equivalent to a deposit of 400 USDC and a loan of 300 USDC with 4x leverage. The overall profit is calculated as follows: deposit interest + deposit mining output – borrowing interest + borrowing mining output. Plugging in the data above, we get:

APR = 4*2.23% + 4*3.41% – 3*14.03% – 3*11.43% = 14.76%

If you have read this far, you may think: Fine, 14.76% is also a sufficiently high APR.

Well, congratulations, you have been deceived again. There are two problems:

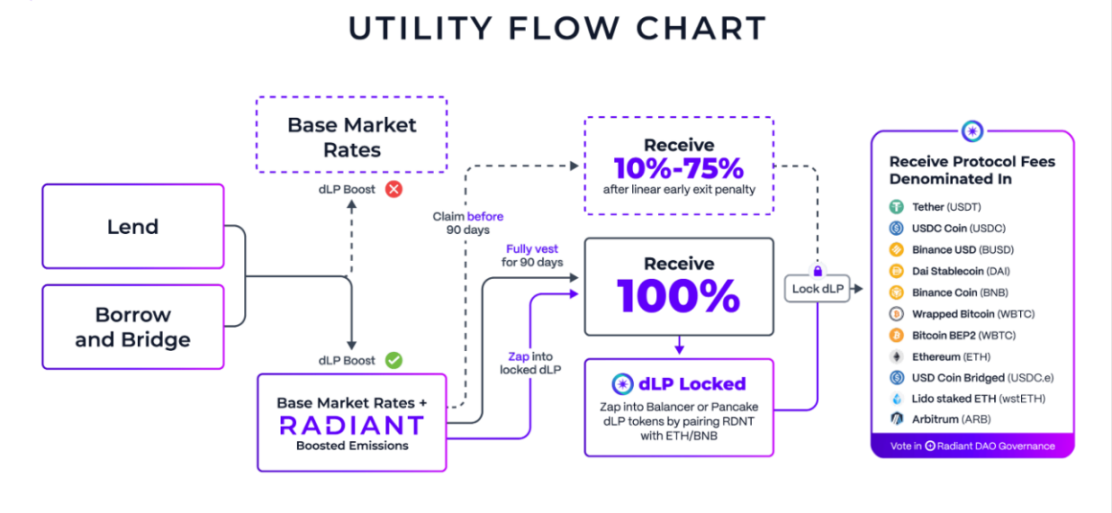

- In order to receive RDNT mining rewards, you need to hold 5% of the DLP mining volume, and this 5% is an underestimate because the mining volume is calculated based on the leveraged amount. This means that if you deposit $100, you need to hold 100*4*5% = 20U of LP, or 5%*4 = 20% of the principal LP. So the question is, with such a high proportion, plus the long lock-up period, can your mining rewards keep up with impermanent loss?

- The second problem needs to be looked at from the perspective of net income and cost. Income and costs are also divided by currency. Taking the example of depositing 100 USDC and mining for one year, you can ultimately receive 4*3.43% + 3*14.03% = 55.81U of RDNT, but you have to pay 11.3%*3 – 4*2.23% = 24.98U of USDC in real money. The problem is that your USDC interest needs to be paid immediately, but RDNT has a Vesting period. If you sell RDNT at an average price lower than the current price by 44.75%, you will be counter-rugged, and you will lose your money due to impermanent loss twice.

3. The Disappeared Reserve Factor

As mentioned earlier, the practice of marking up APY and disguised selling of tokens through yield farming is not uncommon in DeFi, especially in the lending sector. However, one point to note is that in general lending models, the following quantity relationship exists:

Deposit Rate = Borrowing Rate * Utilization Rate * (1 – Reserve Factor)

Implicit in this equation is that the interest earned from borrowing will be divided into two parts – one part will be distributed to depositors, while the other part will be extracted as protocol fees (the higher the Reserve Factor, the higher the protocol fee). As a result, if both the utilization rate and borrowing rate are high, the deposit rate will also be high. However, this rule does not apply to RDNT.

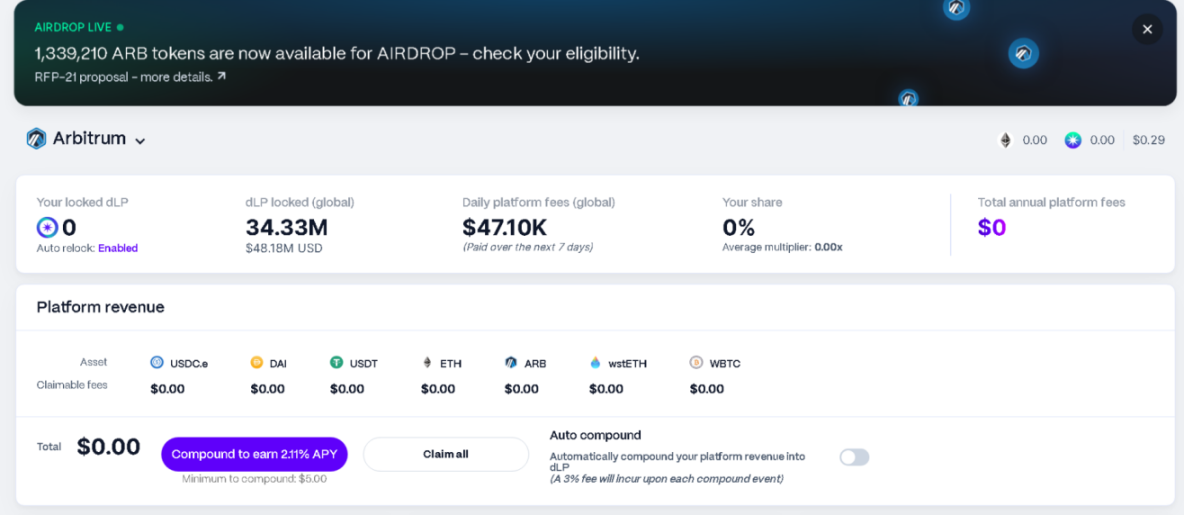

It can be seen that only 23.7% of the loan income is distributed to depositors, while the remaining 72.3% is distributed to the DLP provider. The protocol’s average daily income in the past 7 days is approximately $47,000, which corresponds to an annual income of $17.155 million. This income is distributed in the form of USDC, ETH, ARB, and BTC.

Now, let’s address the previous question. If I deposit 100U and participate in RDNT mining with 4x leverage, although the protocol will charge me a borrowing fee of 24.98U per year, this fee will be allocated to the DLP pool. This leads to an interesting situation: I mine RDNT, RDNT mines my USDC, DLP mines RDNT’s USDC, and I mine DLP. So the result is: Am I mining myself?

The income from lending comes from borrowers. If the following formula is satisfied, borrowers can mine back all the fees they are charged, achieving the true meaning of “mining myself”.

Individual borrower’s loan amount / Total platform loan amount = Individual borrower’s provided DLP amount / Total platform DLP amount

Next, let’s look at the data. There is a total deposit amount of $280 million on Arbitrum, and the total DLP amount is $48.38 million. As mentioned earlier, due to leverage and circular borrowing, DLP equivalent to 5% * leverage ratio is actually required. Assuming a 20% estimate, the $48.38 million DLP can provide mining subsidies for $242 million, which means that at least $38 million cannot obtain RDNT income. (Of course, they may only hold deposits and not be “reversed”).

4. The Largest DeFi 2 Pool

Obviously, this mechanism has created an immensely large LP pool for RDNT, with $48.4 million on Arbitrum alone. Since the end of the narrative of the new public chain and the collapse of Luna, I haven’t seen such a large DeFi 2 pool for a long time. So what does such a large DeFi 2 pool bring?

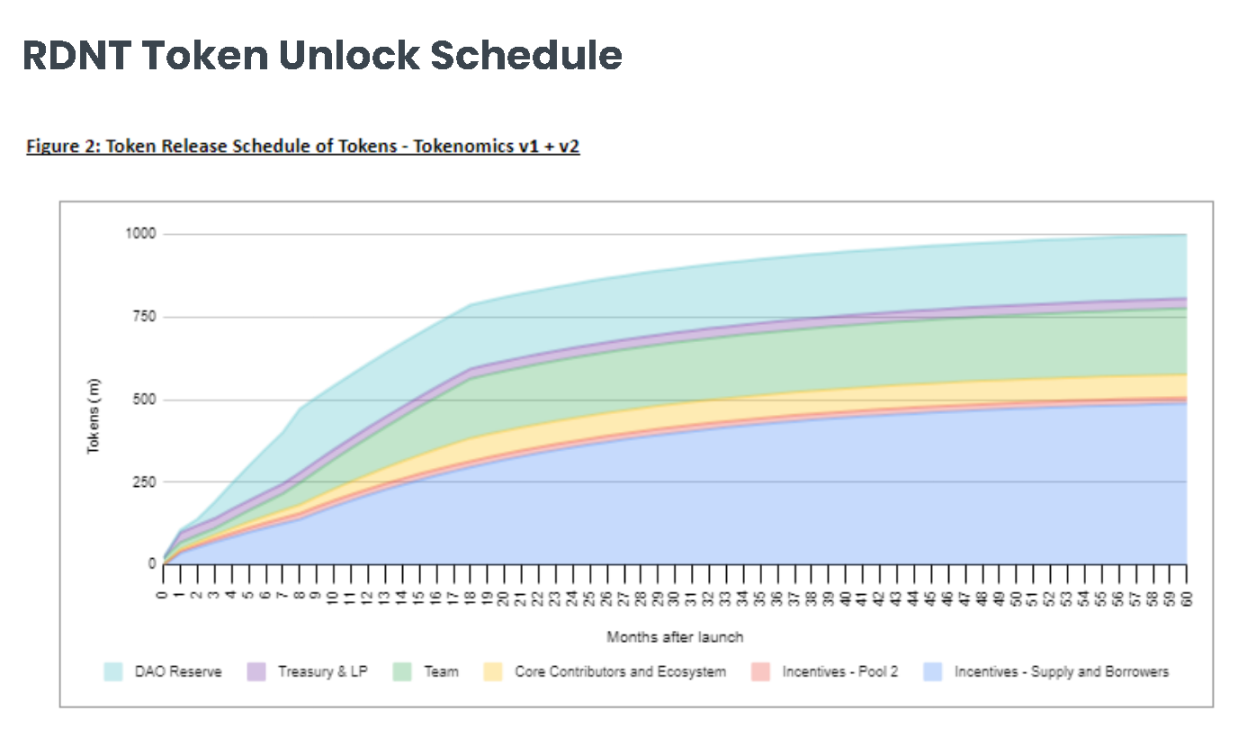

- Take on the selling pressure of mining output. * The biggest drawback of the loop lending is that it will generate a large number of tokens. If we estimate the cost of 44% interest rate / mining output, DLP will generate a selling pressure of $100,000 while earning $47,000 in daily income. However, the release mechanism of RDNT can delay this process, and with the huge secondary pool, the death spiral of the mining coins will be significantly postponed.

- Provide liquidity for withdrawal. We still need to consider that the team and core contributors hold a large number of unlocked tokens, and good liquidity is a great opportunity for them. We hope they don’t do this.

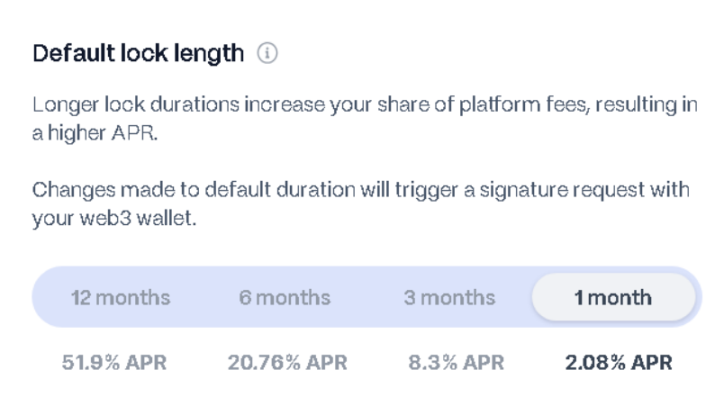

Another point we need to consider is that storing their own RDNT in DLP is a better choice for the team and core contributors than directly selling tokens, after all, the 50% APR and $17.155 million annual income are very attractive, and this income is distributed in highly liquid assets, complying with all laws and rules on the chain. It should be noted that the yield of DLP also depends on the lock-up period. To obtain a 51.9% APR, a lock-up period of 12 months is required, while a lock-up period of 1 month can only obtain a 2.08% APR.

This issue will once again reverse the previous “I mine myself” issue, and the answer becomes “I cannot mine myself” again, because the team and core contributors will deposit additional excessive DLP, diluting the profits belonging to users. However, objectively speaking, this dilution is also appropriate, after all, Compound and AAVE also charge around 20% Reserve Factor. The only problem is that if the team and core contributors invest too much DLP and choose to lock it for the longest time, they are likely to take away 50%, 60%, or even higher DLP returns.

5. Invisible Ve(3,3) Game

The team and core contributors participate in DLP mining to obtain the “tax” while also stirring up the water. Let’s imagine that if the arbitrageurs reach a consensus and all deposit for 1 month, then everyone can achieve a high enough yield and bear as little impermanent loss as possible. But if the team and core contributors deposit a large amount of DLP locked for 1 year, the yield of the DLP locked for 1 month will quickly decrease; of course, even without the team and core contributors, there is a high probability that there will be a “traitor” among the arbitrageurs.

So the final result is very clear: locking for 1 month will not be a viable option from the beginning. From the data, we can also see that based on the income of $57,000 and $48 million TVL, the average annualized APY is 35.3%. The actual return of the DLP locked for 1 year is 51.9%. The specific proportions are not known, but it is obvious that many DLPs have chosen to lock for 1 year. This also means that if you choose not to lock for 1 year, your borrowing costs will be shared by other players who lock for 1 year.

Of course, this is ultimately a multiple-choice question. Choosing a longer lock-up period can indeed allow you to share the profits of others, but it also comes with higher impermanent loss risks. Players who choose a 1-month lock-up period may have sufficient reasons, but choosing a 3-month or 6-month lock-up period may not have as high a cost-effectiveness.

Sixth, the final question: Will RDNT go into a death spiral?

In theory, it is possible. The current mining model is a process of a left foot stepping on a right foot spiral to success. It amplifies the APR and TVL by 3-4 times and uses the miner’s cost to subsidize the miners, attracting them to keep mining, and locks the liquidity with DLP and Vesting. That’s why RDNT has not experienced a “mining collapse” in the past few months.

However, it cannot be ignored that RDNT’s APR has already decreased to a sufficiently low level, 14.76%. With a long unlocking period, it also needs to bear the impermanent loss of DLP. Now, RDNT doesn’t seem as attractive. If the number of miners in the loop decreases, the yield of DLP will also significantly decrease. The increase in impermanent loss risk will require a higher necessary APR. At the same time, the demand for reinvesting in DLP will also decrease. Unilateral selling pressure will further lower the price of RDNT and mining yield, and the death spiral will accelerate from here…

Of course, this is just a possibility. Currently, the capacity of the two pools is still worth tens of millions of dollars, while the daily trading volume of RDNT on BN is only a few million dollars, and the FDV is only 300 million dollars, with a circulating market value of less than 100 million dollars. In addition to the death spiral, the same method can also create a “reverse death spiral” for RDNT: RDNT price rises → mining APR rises → accommodate more loop lending funds → DLP income increases → reinvestment demand grows, bringing more buying pressure for RDNT → price continues to rise. Combined with multiple concepts such as Bn investment and Arb, the situation is not so bad.

At this stage, the cost-effectiveness of participating in loop lending mining doesn’t seem so good. If you are not optimistic about the future of RDNT, using the interest cost generated by loop lending to purchase and hold or do DLP may bring higher capital utilization efficiency. And if you don’t have confidence in RDNT, not participating will always be the best choice (as always, not investment advice). But regardless of whether RDNT will go into a death spiral at some point in time, the DLP mechanism itself provides a very meaningful economic model construction idea, which is worth further exploration.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Depth Latest analysis of asset risk assessment for stablecoin TrueUSD (TUSD)

- Analyzing the Unique Aspects of Puffer Finance’s Design from the Perspective of Node Validation Rights

- In-depth Analysis of Base Standing on the shoulders of giants, emerging in the fiercely competitive Layer2 race.

- How can Base chain without tokens start Onchain Summer?

- Interpreting US Cryptocurrency Taxes General Taxation, Cryptocurrency Taxation, and Future Development Trends

- Outlier Ventures What pain points does the Web3 marketing model solve?

- Ketacoin collides with All In and soars a thousand times, who will be the next Wang Dalu?