Cryptocurrency Track Weekly Report [2023/08/14]

Crypto Track Weekly Report [2023/08/14]

【Summary】

RWA: The utilization rate of DSR has exceeded 20%, and its interest rate may be lowered to 5%; SLianGuairk will establish traceable airdrops for users.

LSD: Last week, the ETH collateralization rate rose to 21.25%, an increase of 1.15% compared to the previous week. Last week, there were 25.55 million ETH locked in the beacon chain, corresponding to a collateralization rate of 21.25%, an increase of 0.1.15% compared to the previous week; among them, there were 727.5 thousand active validating nodes, an increase of 2.1% compared to the previous week, and 66.1 thousand validating nodes in the queue, a decrease of 8.53% compared to the previous week.

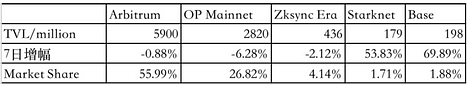

Ethereum L2: The total value locked (TVL) of Layer2 remained relatively stable compared to last week; the TVL of the Base chain continued to grow, rising by 69.89% this week to reach $198 million; Debank announced its cooperation with OP Stack and launched the DeBank Chain testnet; the next official test network Devnet 8 for the Cancun upgrade will be launched this week.

- Deep analysis of ARB on-chain chips Users continue to increase their holdings, and most large holders are at a loss.

- Exclusive|Interpreting the draft guidance principles of Taiwan’s Financial Supervisory Commission Can’t use the slogan To The Moon anymore?

- Depth Latest analysis of asset risk assessment for stablecoin TrueUSD (TUSD)

DEX: The combined TVL of DEX is 13.29 billion, which is basically unchanged from last week. The 24-hour trading volume of DEX is 1 billion, and the 7-day trading volume is 10.7 billion, a decrease of 3.7 billion compared to last week. The Ethereum DEX trading volume accounts for 52%. The inflation rate of Curve has decreased by 15.9%, and the daily emission has dropped from 532k to 448k.

Derivatives DEX: The overall trading volume of derivatives DEX continued to decline in the past week (August 7th to August 13th), with the weekly trading volume of the nine major derivatives DEX at only about 4.5 billion US dollars.

【RWA】

MakerDAO

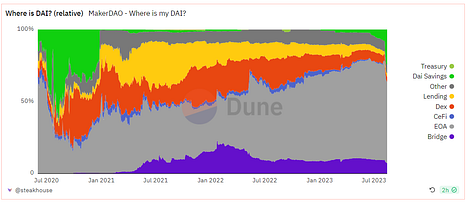

Currently, the DAI supply in DSR has reached 1.29 billion, with a weekly growth rate of 230%. The utilization rate has reached 25% (1.29/51), and the DSR interest rate is expected to be lowered to around 5% in the near future.

Both Sushi and Justin Sun have deposited DAI into DSR. Currently, Sun’s two addresses have accumulated 231,000 stETH, minting 176 million US dollars and depositing them into DSR, which means that Sun’s personal address accounts for as high as 17% of the DAI in DSR, accounting for 3.5% of the total DAI supply. The supply of sDAI (DAI wrapped in DSR) has reached 560 million.

From the distribution of DAI mentioned above, the share of DAI in DEX and Lending has been shrinking since November 2022, and the DAI holding rate in EOA accounts has reached 68.6%. After the adjustment of DSR, the share of Dai Saving has been increasing. Looking at the shrinkage of the three, EOA accounts decreased by 12%, DEX decreased by 2.2%, and Lending decreased by 1%.

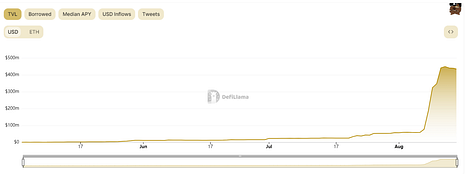

Maker’s TVL for its proprietary lending agreement SLianGuairk has reached 430 million, with a growth rate of 465%. After EDSR was adjusted to 5%, in order to allow users and arbitrage borrowers to continue using SLianGuairk, founder Rune proposed to establish a retrospective airdrop, rewarding users after the launch of the SLianGuairk protocol token SPK.

Because after the launch of Maker’s SubDAO, it is expected to launch 6 SubDAO token mining projects, with SPK being the first. Based on the disclosed information, SubDAO mining will be open to all stablecoin holders and MKR holders. In the first 10 years of Genesis Farming, a total of 2 billion SubDAO tokens will be distributed to each SubDAO participant: 500 million SubDAO tokens per year in the first two years; 250 million per year in the next two years; 125 million per year in the following two years; and 62.5 million per year in the last four years.

Aave

Aave governance forum has released a proposal to introduce sDAI as collateral into Aave V3, aiming to create new synergies with the MakerDAO ecosystem.

The proposal suggests adding the liquidity deposit token sDAI as collateral in the Ethereum pool of Aave V3 (sDAI cannot be lent out). Aave can provide users with DSR income while achieving amplified asset leverage. In the long run, it is also beneficial for the development of the Aave protocol. Of course, one of the current responsibilities of Aave is to increase the liquidity of the stablecoin GHO. The lending volume of GHO has exceeded 20 million.

【LSD】

Last week, the ETH staking rate rose to 21.25%, an increase of 1.15% compared to the previous period. Last week, there were 25.55 million ETH locked in the beacon chain, corresponding to a staking rate of 21.25%, an increase of 1.15% compared to the previous period. Among them, there were 727.5 thousand active validator nodes, an increase of 2.1% compared to the previous period, and 66.1 thousand validator nodes in the queue, a decrease of 8.53% compared to the previous period. Last week, the number of active validators on the beacon chain exceeded the threshold of 720,896, and the number of activated validators increased to 2,470 per day.

Pledge growth rate increased this week

ETH staking yield decreased to 4.10%

Among the three LSD protocols, in terms of price performance, LDO fell by 1.3% last week, RPL fell by 2.7%, and FXS rose by 0.9%; in terms of ETH staking volume, Lido rose by 1.42% last week, Rocket Pool rose by 1.35%, and Frax rose by 0.7%. Coinbase announced last week that it would invest in Rocket Pool by purchasing tokens from the team, but the specific amount and cost were not disclosed. Currently, the balance of the Rocket Pool deposit pool is 19,200 ETH, the Minipool queue has been cleared, the RPL staking rate is 47.34%, and the effective collateral is 88.95%. Frax RWA-related proposal FIP-277 has currently passed with full votes on Snapshot, and the voting will end tomorrow. In terms of funding, Brevan Howard Digital continues to sell FXS, with 100,000 tokens transferred to exchanges last week, and the current wallet balance is 661,300 tokens, accounting for 0.91% of the FXS circulation. In LSDFi, LBR rose by 64.7% last week, and attention is focused on the launch of the V2 version; ZERO rose by 38.9% last week, and the code audit has been completed, and the ZETH/ETH liquidity pool will be launched soon; USH rose by 34.7% last week and announced the completion of a $3.3 million financing.

【Ethereum L2】

TVL

The total value locked (TVL) in Layer 2 has decreased by $160 million compared to last week, with a total locked amount of $10.5 billion.

The base TVL continues to grow, and the on-chain application Friend.tech, also known as BALD, has once again sparked a community frenzy and attracted funds.

Friend.tech has already attracted over 20,000 users and has completed over 210,000 transactions with a total trading volume of 6,599 ETH. Friend.tech is similar to a paid private community. If you purchase someone else’s account token, you will enter their private chat room for communication. When your Twitter account token is purchased by others, you will share the transaction proceeds, and the price will also rise. Currently, only mobile products are available, and registration requires an invitation code.

On August 11th, DeBank announced that it will launch the DeBank Chain testnet on the same day and plans to launch the mainnet in 2024.

DeBank Chain is built on the OP Stack and has modified the consensus mechanism, reducing the gas fees for single transactions by 100 to 400 times. It also integrates a system similar to account abstraction on-chain to achieve a Web2 experience and is fully compatible with the current EVM standard. The new account system supports transactions signed with dedicated L2 private keys, reducing the use of L1 private keys in social scenarios and providing security for L1 assets.

On-chain Activity

Cancun Upgrade Progress

The 115th Ethereum Core Developers’ Meeting: The topics discussed in this meeting include the release time of Devnet 8, the deployment strategy of EIP-4788 code, and changes to the CL fork selection specification. Among them, developers agreed to launch the next official test network, Devnet 8, for the Cancun upgrade at the beginning of next week, and agreed to update EIP-4788 from a stateful precompile to a regular smart contract.

The next official test network, Devnet 8, for the Deneb/Cancun (Dencun) upgrade will be launched at the beginning of this week. Devnet 8 will activate all relevant Ethereum Improvement Proposals (EIPs) confirmed for the Dencun upgrade.

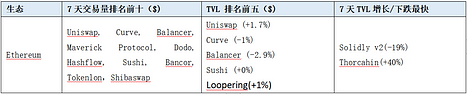

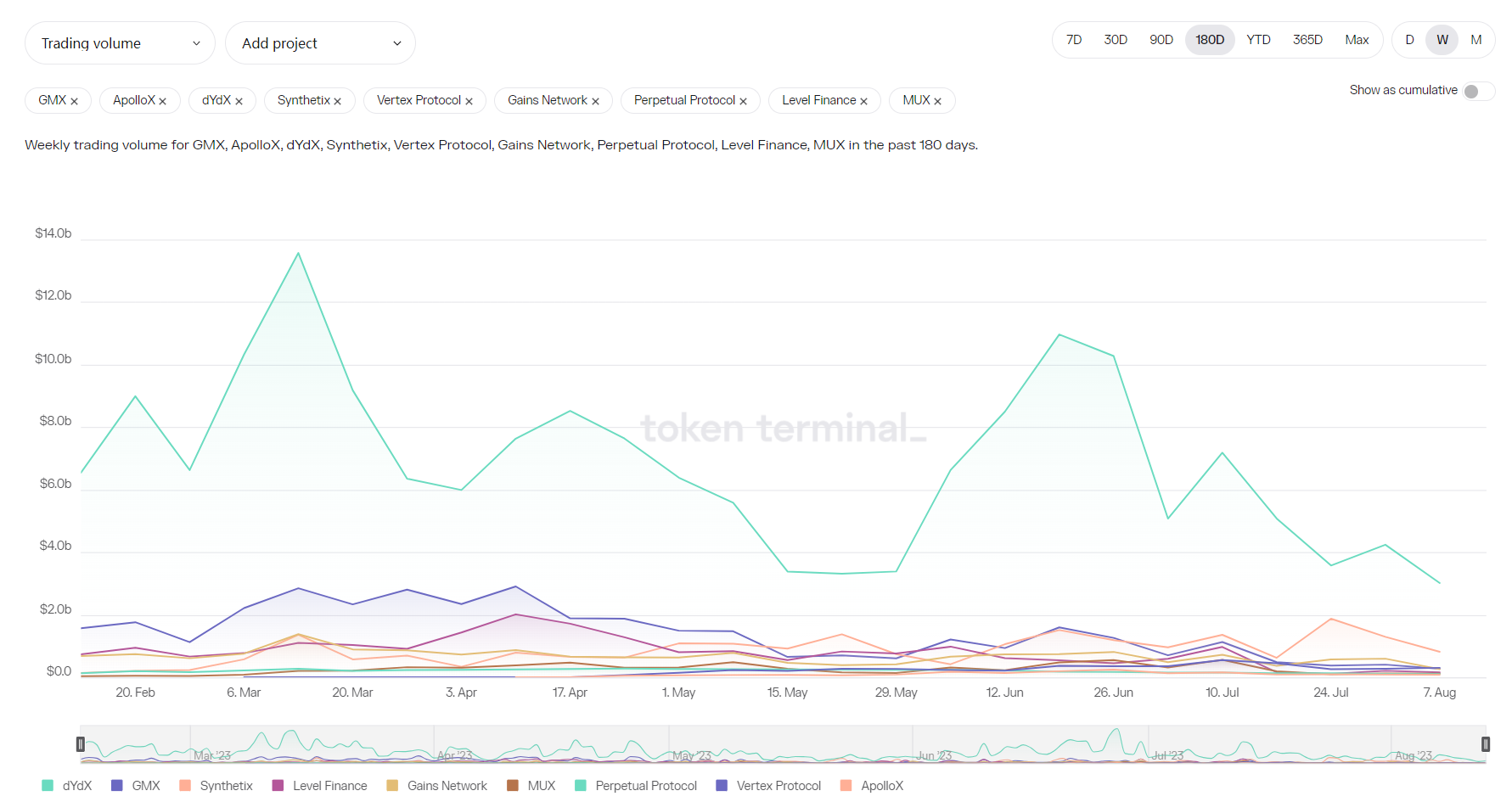

【DEX】

The combined total value locked (TVL) in DEX is $13.29 billion, which is basically unchanged from last week. The 24-hour trading volume of DEX is $1 billion, and the 7-day trading volume is $10.7 billion, a decrease of $3.7 billion compared to last week. Ethereum DEX accounts for 52% of the trading volume.

The inflation rate of Curve has decreased by 15.9%, with the daily emission decreasing from 532k to 448k. However, the annualized inflation rate is still around 18%.

Ethereum

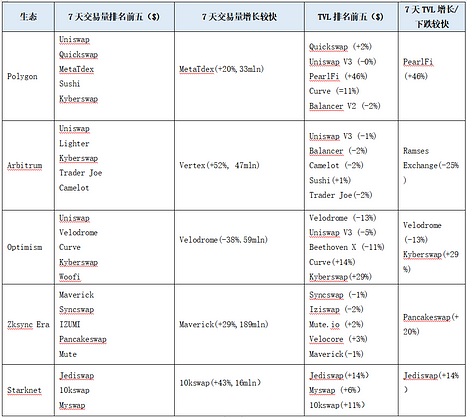

ETH L2/sidechain

L2 OP’s trading volume has dropped the most in the past week, down 30%. Arbitrum -16%, Zksync Era and Starknet’s trading volume is still growing, increasing by 17% and 18% respectively.

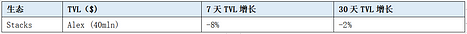

BTC L2/Sidechain

Alt L1

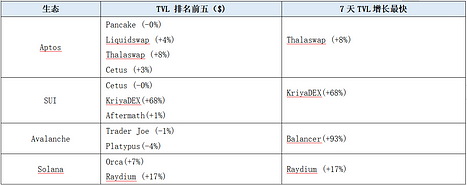

【Derivatives DEX】

In the past week (August 7th to August 13th), the overall trading volume of derivatives DEX continued to decline, with the weekly trading volume of the top 9 derivatives DEX at around $4.5 billion. Last week, the weekly trading volume of these 9 DEX was about $7 billion. Due to the volatility of Bitcoin and Ethereum reaching the lowest level in the past 5 years, the trading volume continues to shrink.

Source: tokenterminal

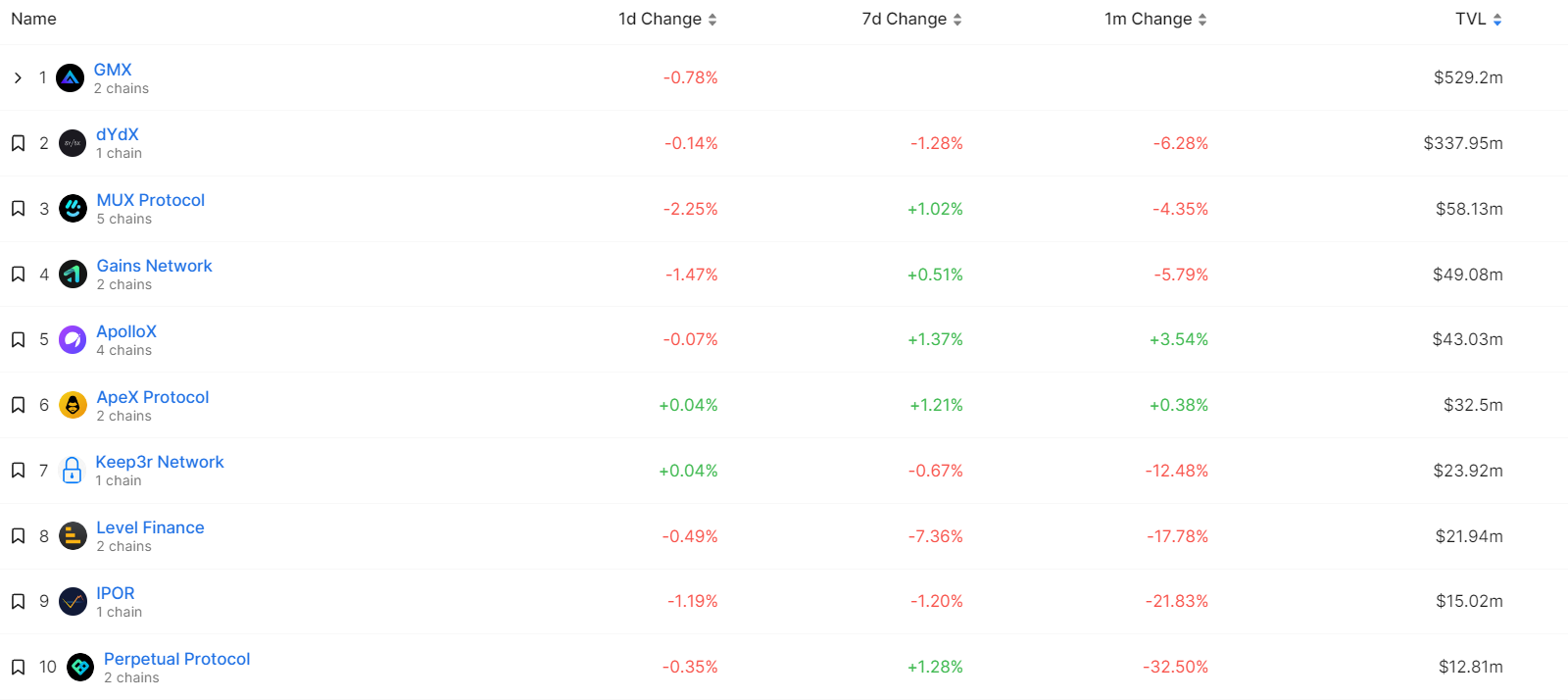

In terms of TVL, the overall TVL of derivatives DEX is also declining, with funds slowly flowing out in the past 7 days.

Source: Defillama

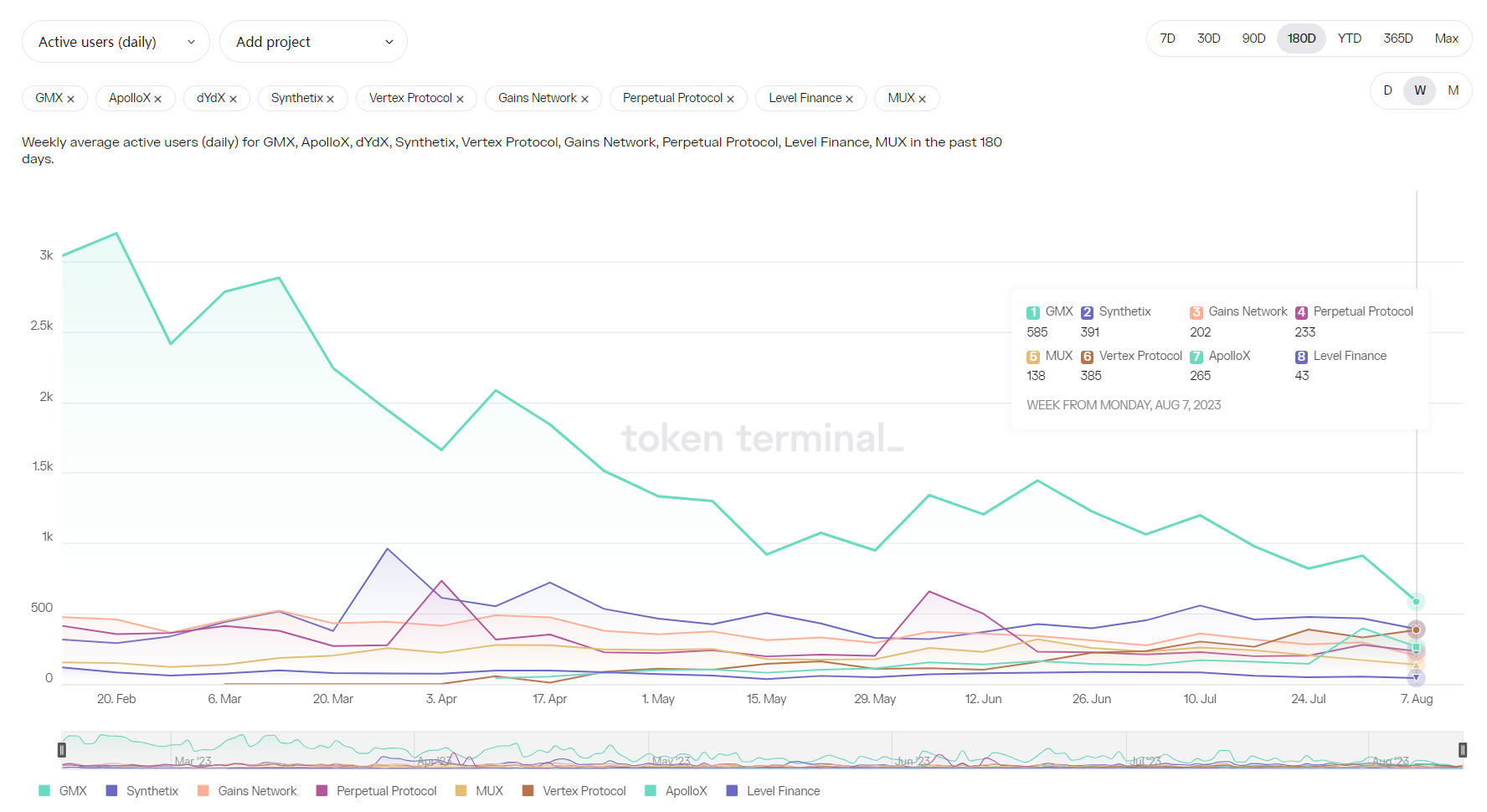

In terms of users, after reaching a peak in February and March, the number of daily active users is currently in a relatively low state. Currently, the number of GMX’s weekly active users has dropped below 1,000.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analyzing the Unique Aspects of Puffer Finance’s Design from the Perspective of Node Validation Rights

- In-depth Analysis of Base Standing on the shoulders of giants, emerging in the fiercely competitive Layer2 race.

- How can Base chain without tokens start Onchain Summer?

- Interpreting US Cryptocurrency Taxes General Taxation, Cryptocurrency Taxation, and Future Development Trends

- Outlier Ventures What pain points does the Web3 marketing model solve?

- Ketacoin collides with All In and soars a thousand times, who will be the next Wang Dalu?

- Curve CEO Michael Egorov From Physicist to Cryptocurrency Pioneer