DeFi: Ether Exodus?

Sharing people: Yang Mindao finishing: Uncle Red Army (Boundless Community)

Opening

Hello everyone, I am Yang Mindao, founder of dForce and Blockpower.

dForce is a blockchain-based decentralized financial (DeFi) and currency protocol platform that provides the underlying infrastructure for DeFi and open financial applications.

The USDx protocol has been launched, which is a highly scalable and stable index-type US dollar stable currency agreement using a basket of stable coins as a reserve. In addition, our community has developed a decentralized currency currency market such as lendf.me; I hope to create an open and highly scalable development finance ecosystem.

- Viewpoint | Data visualization of stable currency DAI

- Mosaic/Coinbase Joint Report: Development Status of Anonymous Coins

- Jianan listed plans to raise 100 million US dollars, the source: or due to the poor performance of the road show, the amount of funds raised

I have been in the currency circle since 13 years and ICO participated in the Ethereum ICO for 14 years. I have experienced many events in Ethereum, including the changes in the location of Ethereum. It is also a witness and witness of the development of Ethereum.

Therefore, when the host said that I would give a share a theme, I have turned over the various events that Ethereum has experienced over the years, confused, confused, crazy and repositioned .

These sufferings, struggles, and rebirths are like the Exodus, which tells the story of Moses leading the Israelites, experiencing hardships, leaving Egypt, and searching for the promised land of God.

Early Ethereum: Making the World Computer

I am not sure that Ethereum has completely found its own promised land, but going to Central Finance (Open Finance) Ethereum has found a very successful foothold after years of hardships. Whether it is a stable currency or a DeFi agreement, most of it is now built on Ethereum.

The earliest Ethereum is about this narrative: To be a world computer.

Have to mention TheDAO fork

The early development and drama of Ethereum, including the big fork caused by TheDAO, led to the advent of ETC, and Poloniex's on-line ETC without any indication, letting a forked coin that nobody cares, after giving financial attributes, changed overnight. It is worth the price.

Due to the effect of value, the political power of the "faction" was quickly condensed.

During the hard fork of Ethereum, many of the early investment in Ethereum were difficult for people to sleep for a few weeks. The highest point was ETC price 0.005 BTC. ETH was about 0.018 BTC at the time, and ETC was close to 30-40% of ETH's market value. Now this The ratio is 2.7%.

The ETH fork caused by ETH is the first time in the history of digital currency. The market behavior reversely affects the community consensus . I call it a kind of community protest driven by liquidity and marketization.

Then the various fork coins, including BCH, are textbooks that draw on ETC forks.

Through liquidity and market pricing, reverse access to community consensus and launching protest campaigns and liquidity attacks are a very low-cost way to get a new currency to get a liquidity consensus.

Bifurcation surprise: find the promised land

This is also the first time in the history of crypto to reverse the influence of social consensus through market behavior. From this point of view, in fact, Ethereum has been conducting various types of social experiments.

From the birth, the fork, and the ICO madness, Ethereum has never been looking for a good position, from the world computer to the AXO , until the beginning of this year, DeFi, Ethereum found its own Promised Land – Establish a global value and settlement network.

DeFi field, there are two levels, the first is the asset layer (layer 0 ) , mainly including ether, ERC20 assets, ERC20 stable currency, of which ERC20 stable currency is the most eye-catching type.

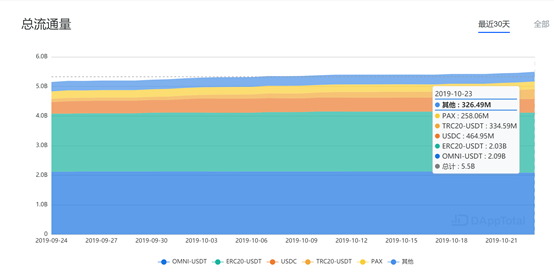

The figure below shows the circulation of stable currency in circulation now (the trading volume is 3-4 times the circulation)

Another picture, you can see, Ethereum's ERC20 stable currency (ERC USDT, PAX, TUSD, USDC, USDx, DAI) accounted for about 53% of the total market share of the stable currency, we expect Bitcoin Omni Most of the stable currency on the agreement will be transferred to Ethereum, and Ethereum may eventually account for more than 80% of the stable currency . Ethereum is at the asset end of DeFi's most important layer0 – the stable currency, which already accounts for most of the market.

DeFi is the blockchain of the Killer App

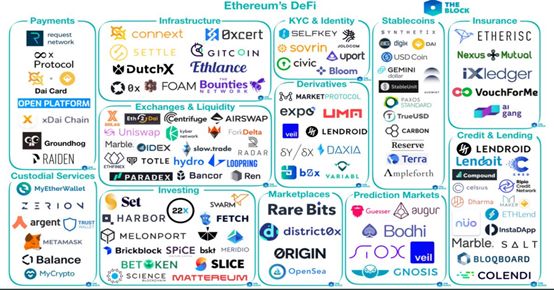

Ethereum DeFi already has a relatively complete ecology, covering all aspects of finance.

Different from traditional finance, the DeFi protocol has strong composability and interoperability. So it is easy to generate new applications generated by different protocol interactions (such as aggregators such as instadapp), or USDX like dForce, to create a stable, more stable and stable currency through combination.

This means that the DeFi ecosystem will evolve and expand at a geometric speed under the main force of composability and interoperability. Now we can see the new defi protocol/application on Ethereum every day.

Ethereum now has a DeFi ecosystem that is three to five times larger than this one.

The modularity and interoperability of the DeFI protocol will further strengthen the network effect of Ethereum itself. When all the "Lego" blocks are in Ethereum, it is very difficult for other public chains to re-establish such network effects. This requires a developer community, development tools, audit case accumulation, modular assets, and protocol templates.

A particularly successful part of Ethereum's DeFi is the establishment of a series of ERC standards that greatly reduce the friction between Ethereum assets and agreements.

If we look at DeFi from the perspective of Chinese chronicles, Bitshare should belong to Fuxi's Five Emperor era, which is also the mythological era; while MarkerDAO is probably a summer dynasty, China enters a verifiable era of historical records; now DeFi belongs to a hundred schools of thought, a hundred flowers Spring and Autumn Warring States .

If we say that we are always looking for the killer app of the blockchain, then DeFi as a whole or category, is in line with this feature.

Stabilize the currency, get the world

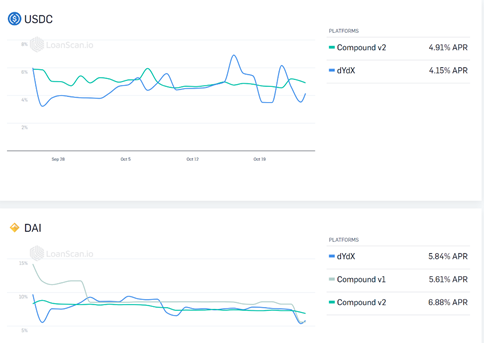

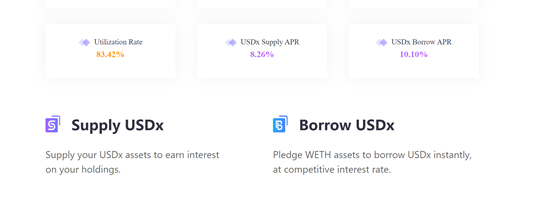

If you have a stable currency, you can also enter the interest-earning agreement to get interest above the balance. The following is the current interest rate of the stable currency, USDC is between 4.15 and 4.91%; DAI is between 5.8% and 6.8%; USDx is 8.26%.

Above is USDC, DAI's current interest

This is the current interest of USDx

The most important point is that these markets are interoperable. As long as you have access to the Internet, you can directly obtain these capital returns far above the balance , and you don't need to trust a central party. It is the most revolutionary application in the DeFi field by stabilizing the currency to open up the global capital market isolated by the region.

We have already seen a globally interoperable and unified capital market. The reason why there is a difference in interest rates between the US dollar stable currencies is because of the differences in their respective supply markets and frictions. With the deepening of DeFi development and the strengthening of liquidity, the averaging of capital costs will eventually be achieved through global arbitrage .

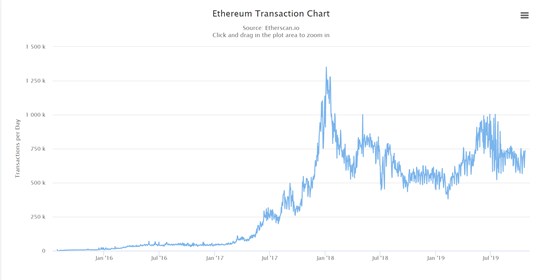

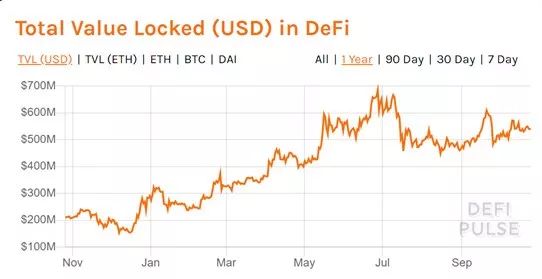

Ethereum data: all the way up

Speaking of the development of Ethereum itself, one of the most critical indicators is the number of transactions on the chain , which is very stable:

In addition, DeFi's Ethereum locks the value – all the way north:

Lonely: the value of the chain of assets outside the chain

Compared with the value of locking Ethereum, I think it is more important to lock the value of the assets outside the chain, such as the circulation of the French currency, and the circulation of the gold token.

When more and more out-of-chain assets are anchored in Ethereum, they will be completely separated from their own chain value, and the security value will be substantially improved. This will also make Ethereum completely different from other POS chains (other pos can only rely on its own token value to ensure its own security).

Since then, Ethereum does not need to rely on transcendental beliefs to determine its own network value, but to rely on extra-chain assets ($100 billion in extra-chain assets), until then, Ethereum may actually find its promised land.

Q & A session

Q1: Is the positioning of Ethereum's "World Computer" accurate? Are there other descriptions that are more suitable for the latest situation?

Yang Mindao : As I said, this is the idea that Vitalik is still 17 years old. The global value and settlement network should be a more reliable description.

Uncle Red Army: Need a catchy slogan, such as "world finance".

Yang Mindao: Although many people in the community are not willing to admit, financial agreements and applications are basically the mainstream discourse of Ethereum.

Q2 : Some people think that Ethereum currently has the effect of DeFi self-reinforcement, that is, based on the DeFi activity of Ethereum, will the development of Ethereum be more like DeFi tilt, and other non-DeFi applications may be relatively crowded? How do you think about this statement?

Yang Mindao:

Ethereum's gas market is a very good market regulation. One of the reasons why DeFi can be fired is that the DeFi protocol and application single transaction volume is relatively large, so it is not sensitive to the price of gas . This market will push applications and protocols that require higher tps to Layer 2 protocols. All of this is regulated through the market.

Of course, we expect ETH 2.0 to improve the throughput of layer1 and solve some problems, but this is far from meeting the needs of many applications, and can only be solved by centralized/semi-centralized or side-chain/chain-chain.

Uncle Red Army: So the application of DeFi does not belong to the "high frequency low" type?

Yang Mindao : High-value low-frequency trading. Now dex can also provide some high-frequency trading, through the chain.

Q3: What are the public chains that can be compared with Ethereum? Where are their opportunities?

Yang Mindao:

Not seen in the scope of the glasses, there should be a range of astronomical glasses. However, it is also the distance of light years.

I think that the opportunities of other public chains may be in the direction of more vertical or regional integration, using the market and landing advantages to accumulate potential energy. I am still optimistic about the Chinese market and the public chain and DeFi focusing on the Chinese market. The home advantage is the biggest advantage.

The biggest problem with other public chains is that, or the paradox is that all their money and technical investment may be more powerful in helping Ethereum to be free. Therefore, in fact, I have always suspected that Ethereum 2.0 is not coming out, it is in the "sucking star Dafa." More absorption of other public chain research and development and technology, and then integrated into 2.0/3.0. Taiji thief ~

Uncle Red Army: This V God and the team seem to have said that it will absorb the technology of other public chains. I remember who sent a reference form.

Yang Mindao: Yes, so the R&D expenses of Ethereum = the total amount of ICO in all public chains. (Other ICOs in the public chain are doing research for Ethereum)

Q4: In the statistics of dapp, it is often used in Taifang, wave field and EOS to compare, how do you see the wave field and EOS?

For example, if you send a chain with only 7 nodes, even if your DeFi is doing well, the code is safe, and you can't stand a kidney stone. DeFi needs a stronger foundation than kidney stones.

Q5: There are two voices in the Ethereum 2.0 segment. One is the industry's doubts. It feels technically difficult, and many of the public chain results that are tried in this area are not very good, so the implementation is very difficult; God also replied that the technical problems have basically been overcome. So what is the difficulty of achieving fragmentation? Is it only the team of V God?

Uncle Red Army:

Speaking of the team to talk a few more words. Most of V's team doesn't know. How do you feel about V's multiple development teams from the perspective of your knowledge?

Uncle Red Army:

Said the team continues to talk about the leader, I feel V God is a bit like Alibaba's Ma Yun? What do you think? How do you see the difference in leadership style between V God and Gavin from your perspective?

Q6: Do you think that 32ETH as the Validator is the threshold or the threshold is low?

Q7: staking of ETH2.0 seems to be able to achieve multi-person staking with the help of smart contract, and the total number of 32ETH can be started together. How do you see this way of looking a little decentralized staking? Does this method mean that there will be a big impact on the staking pool service?

Q8: DeFi currently looks very hot. If all kinds of applications can really land and be accepted by users, does it mean that the value of ETH will be better supported?

-

One is the lock of eth, which hedges the ico's selling pressure. -

The other is gas and transaction costs. But the greater support for the value of eth must rely on the ultimate lock-POS .

Q9 : ETH2.0's own staking requires ETH, and Ether based DeFi application also requires ETH. Is there a competitive relationship between the two?

Q11: Just mentioned Alipay, DeFi also allows users to make money than Alipay. Will Alipay be nervous?

Q12: Just mentioned the license of the public chain, can you mention what position the alliance chain will be?

Blockpunk:

There is a problem, I noticed that defi's derivatives and multi-layer nesting are now more and more than the sub-credit level. If there is a black swan event, will defi collapse collectively?

Q13: If there is ETH or DAI in the hands of ordinary users, what can be done in dForce?

Han Yuanzhang: What is the essential difference between Defi and p2p?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The hacker group Anonymous announced the establishment of a $75 million Bitcoin fund to boost privacy technology and cryptocurrency development

- Viewing the Governance and Game Theory under the Chain from the Merchant Law in the Middle Ages

- The Swiss Stock Exchange is based on the XTZ-based ETP, and investors can get XTZ staking income.

- Morgan Creek CEO: Every asset in the world will be tokenized, selling Amazon stock to buy bitcoin

- Getting started with blockchain | 10 common misconceptions about blockchain and cryptocurrency

- Do not blow black, a quick overview of the 2019 cryptocurrency 10 development trend

- Last year’s battle, this year’s cold and clear, BCH upgraded this year?