DigiFT Research Report: Two Paths for MakerDAO to Implement RWA – Offline Trust and On-Chain RWA

DigiFT Research Report: Two Approaches for MakerDAO to Implement Real-World Assets - Offline Trust and On-Chain RWATLDRThe first Web3 products to explode were fixed-income products, driven by the treasury management of DAOs and Web3 companies. The RWA track that tops the TVL list is also occupied by national debt tokenization projects. Combined with RWA, it allows DAO organizations to retain high liquidity of assets while bringing in stable income that is sufficiently stable and less correlated with on-chain activities, achieving better quality income while diversifying risks. The governance and operations of DAOs are not more efficient than traditional corporate structures. MakerDAO can only buy national debt ETFs through a complex and trust structure, which is costly. By contrast, it is more efficient and feasible for professional/compliant asset issuers to tokenize RWA and for DAO organizations to purchase them.RWA enters the mainstream of CryptoAgainst the backdrop of the crypto winter and the US dollar’s interest rate hike, a new round of DeFi innovation is imminent, and the native DeFi protocol’s returns have plummeted, with stable returns even lower than the US bond yield—the so-called “risk-free rate of return.” Many DeFi projects are turning their attention to real-world assets (real-world assets, “RWA”) outside the crypto world. In mainstream DeFi protocols, MakerDAO was the first to rush into the RWA race. As early as 2020, MakerDAO built an RWA vault with 6s capital, a real estate development collateralized loan project, and cooperated with the RWA-based lending platform Centrifuge to tokenize collateral. MakerDAO classifies this type of token as one of the collateral for the stablecoin Dai, achieving collateral diversification. In the Endgame plan released by MakerDAO in May 2022, MakerDAO emphasized that one of the key parts of building a decentralized stable currency is to use RWA as collateral.Recently, major DeFi protocols have been laying out the RWA track. In June 2023, Robert Leshner, the founder of Compound, founded a new company called Superstate and submitted an application to the SEC, hoping to create a short-term US Treasury bond fund on Ethereum. MakerDAO’s MIP65 (MakerDAO Improvement Proposal, “MIP”, MIP65 is a proposal to deploy part of MakerDAO’s funds to invest in short-term bond ETFs) passed a new proposal in May this year, increasing the upper limit of the vault from $500 million to $1.25 billion and purchasing the corresponding number of bond ETFs in the coming months. In addition, many traditional financial giants, including Goldman Sachs and Citigroup, have expressed close attention to the RWA track, and many have already entered the game.

Why now?

As early as 2018, STO (Security Token Offering) as a subset of RWA had caused a craze in the market, but it ended up going nowhere. Today, the narrative of RWA is heating up. Why is it at this time? What is the driving force behind the development of the track?

– From the perspective of infrastructure: DeFi infrastructure is gradually improving. Related token standards, oracles, and peripheral development tools are more complete and capable of bridging on-chain and off-chain.

- Q2 2023 Polkadot Research Report: Revenue Decline by 32% Quarter-on-Quarter

- Binance Research Report: 88% of institutional-grade users are optimistic about the long-term development of cryptocurrency assets.

- Consensys: Global Cryptocurrency and Web3 Survey

– From the perspective of assets and income: Web3 native assets have reached a bottleneck, and the assets are basically homogeneous. In the bear market, on-chain activities are low, and there is a lack of Web3 native stable sources of income.

– From the perspective of narrative: After the explosion of CeFi, investors pay more attention to risk control and compliance. Traditional financial fields are highly compliant, and RWA assets provide more protection for investors compared to Web3 native assets.

– From the perspective of regulation and laws: Regulation is constantly expanding its boundaries, and at the same time, laws and regulations related to cryptocurrencies are gradually improving.

In the previous round of bull market, RWA platforms with similar models began to take shape, such as Maple Finance, Clearpool, TrueFi, etc. The basic model of such platforms is to open up lending funds to some institutions through community governance. Users invest in the fund pool to obtain a pre-agreed yield, and institutions can use the funds for related investment operations and pay interest and repay principal in accordance with the agreement. However, early RWA platforms lacked compliance processes and risk management. After the Luna and FTX explosions, some borrowers went bankrupt and were unable to repay the loan assets, resulting in serious losses to investors.

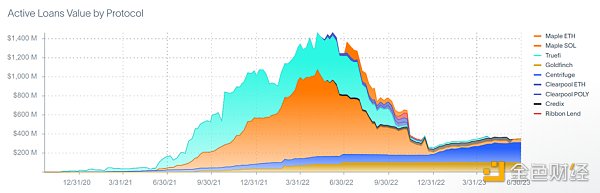

Figure 1: Active lending amount of RWA lending agreement, source: rwa.xyz data as of 2023.07.06

From the above chart, it can be seen that before the Luna explosion in 2022, the amount of borrowing reached its peak, and the amount of borrowing decreased sharply thereafter. In the second half of 2022, due to the Luna and FTX incidents, Clearpool and TPS Capital suffered the most serious losses, both of which had major mistakes in compliance processes.

TPS Capital and Clearpool started to cooperate in the second quarter of 2022 and opened a lending fund pool on Clearpool. TPS Capital claimed to be independent of Three Arrows Capital (which went bankrupt after the Luna incident). However, the court documents prepared by the liquidator of Three Arrows Capital showed that the relationship between the two was quite close and complex. Three Arrows Capital was actually the guarantor of TPS Capital and provided guarantees for the loans defaulted by TPS Capital later.

In June 2022, Clearpool removed TPS Capital’s lending pool, while Clearpool’s data partner X-Margin downgraded TPS Capital’s rating to B and reduced the lending limit to $0. Clearpool and X-Margin announced that they would work together to ensure that TPS Capital repaid the borrowed funds and that users did not suffer losses.

Before the avalanche, the world was silent until the last snowflake fell. These tens of millions of dollars in losses are a tragic warning for those who want to participate in the RWA track, and have made developers who want to participate in the RWA track pay more attention to risk control, compliance processes, and legal frameworks.

What is RWA?

RWA refers to various assets that exist outside of the blockchain, but can be tokenized and combined with existing DeFi protocols in a certain way. Currently, the main RWA projects are mainly concentrated in the following types:

– Bonds, including private bonds, corporate bonds, and government bonds

– Equity

– Real estate

– High-value collectibles

– Carbon credit points

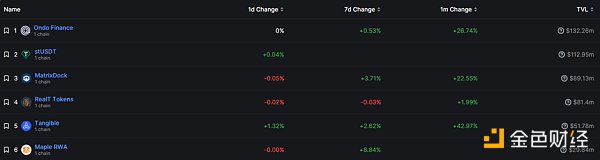

We believe that the earliest products to enter DeFi are bond products, including government bonds and corporate bond products. The demand side is mainly the adoption of RWA by DeFi protocols and Web3 protocol treasury management. According to DefiLlama data, the top two TVLs in RWA projects are US bond tokenization platforms (OpenEden and MatrixDock), followed by real estate-related RWA platforms (Tangible and RealT). However, the total volume of tens of billions of dollars is still relatively small compared to both the DeFi and the entire Tradfi field, and there is huge room for growth.

Figure 2: RWA project TVL, source: DefiLlama, data as of 2023.07.10

The driving force behind RWA

In general, existing DeFi protocols mainly use RWA assets in three ways: 1) treasury fund management, some of MakerDAO’s RWA demand comes from this; 2) used as collateral, such as MakerDAO and Solana ecological stablecoin protocol UXD Protocol; 3) Introducing new asset types for DeFi scenes, such as Curve (MatrixDock STBT) and Flux Finance (Ondo Finance OUSG).

DeFi protocols introduce RWA from multiple sources of motivation, including:

– On-chain asset management needs

– On-chain asset management seeks stable income and good liquidity. Real-world products such as government bonds are widely recognized investment targets because of their relatively stable returns and high liquidity, making them one of the asset classes that can reach trillions of dollars in market value.

– Alternative sources of income

– On-chain native income mainly comes from Staking/Trading/Lending. When the cryptocurrency market is highly volatile, the decline in on-chain financial activities will lead to a decrease in income. In the current market state, the returns on mainstream on-chain platforms are even lower than those of US Treasury bonds. If seeking alternative income with low correlation to on-chain native assets, introducing RWA-related assets is undoubtedly a good choice.

– Diversified investment portfolio

– On-chain assets are relatively single and highly correlated with high volatility. Introducing more stable RWA assets with low correlation to on-chain native assets can achieve hedging purposes and form more diversified and effective investment portfolio strategies.

– Introduction of diversified collateral

– The high correlation of on-chain assets makes it easy for loan agreements to be redeemed or liquidated on a large scale, further exacerbating market volatility. Introducing RWA assets with low correlation to on-chain assets can effectively alleviate such problems.

Below, we take MakerDAO as an example to analyze in detail how DeFi protocols apply RWA (as collateral).

Deep Analysis of MakerDAO RWA Application

MakerDAO is a decentralized autonomous organization (DAO) aiming to create and manage a Dai stablecoin based on Ethereum. Users lock Ethereum (ETH) as collateral to generate Dai stablecoin. The goal of Dai is to anchor the value of 1:1 with the US dollar through smart contracts and algorithms. Due to the high volatility of the cryptocurrency market, a single collateral can easily lead to large-scale liquidation, so MakerDAO has been trying to diversify its collateral, and introducing RWA is one of the important means, even written into MakerDAO Co-founder Rune Christensen’s Endgame plan.

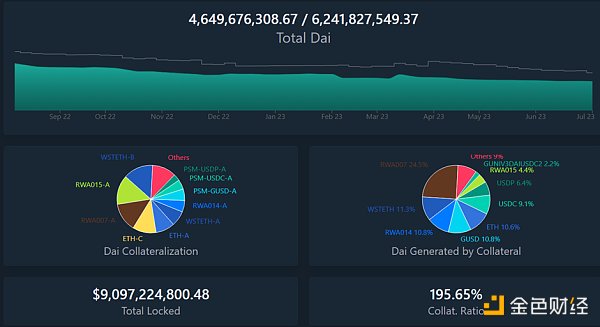

Figure 3: Current status of Dai, source: daistats.com, data as of July 10, 2023

The above figure shows the total amount of Dai currently (about 4.65 billion), and the upper limit set by MakerDAO is 6.2 billion. The composition of Dai collateral has achieved relatively diversified inclusion of RWA and various stablecoins.

– Dove state (current state): No restrictions on RWA as collateral, stablecoin Dai anchored to the US dollar

– Hawkish state: Dai target interest rate is negative, freely floating

– Phoenix state: In addition to RWA with physical elasticity, there are no other types of RWA in the collateral of stablecoin Dai

The specific plan designs the specific proportion of collateral corresponding to each stage, which can be referred to the original text and will not be repeated here.

Endgame Plan v3 complete overview – Legacy / Governance – The Maker Forum (makerdao.com)

Current composition of MakerDAO RWA

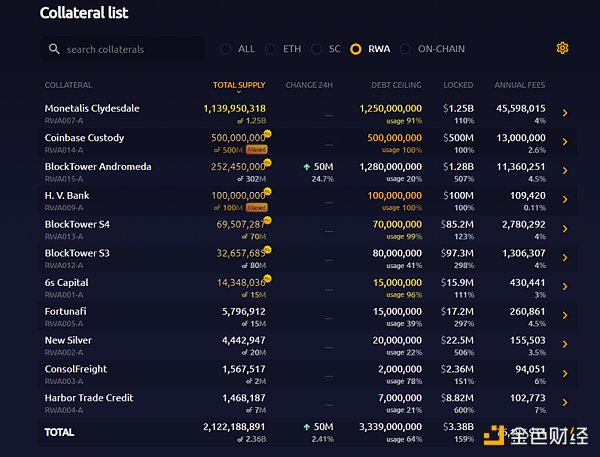

Throughout monetary history, the currency adopted by humans has evolved from commodity currency, using a scarce resource agreed upon by consensus as an equivalent, such as shells, gold, etc., to later issue paper money with scarce resources with consensus as collateral, such as gold reserves issuing paper gold, and development to credit currency issued based on military power, such as the US dollar. Although MakerDAO’s Dai has a volume of tens of billions, it is still a drop in the bucket from a larger perspective, and it needs to borrow the credit of other assets to highlight its advantages and gradually consolidate its position. In the Endgame plan proposed by the co-founders of MakerDAO, RWA is also introduced as a transition: in a situation where the cryptocurrency asset world is not yet solid enough, real-world assets are needed as anchors. According to data from MakerBurn, there are currently a total of 11 RWA projects, with US$2.12 billion in assets as collateral for MakerDAO.

Figure 5: MakerDAO RWA collateral data, source: MakerBurn.com, data as of 2023.07.10

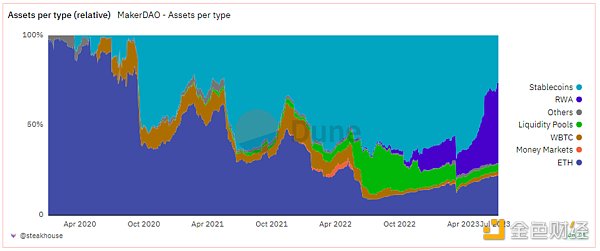

According to the Dune data panel, the income brought by these RWA assets has greatly increased MakerDAO’s profit. Currently, RWA accounts for about 40% of MakerDAO’s total assets and contributes more than 50% of the profit.

Figure 6: MakerDAO asset composition, source: Dune.com, data as of 2023.07.10

The blue part in the middle right is the proportion of RWA, which currently accounts for 41.5%.

Figure 7: MakerDAO protocol profit, source: Dune.com, data as of 2023.07.10

In the composition of MakerDAO’s protocol profit, the profit from RWA in the upper right corner accounts for 51.1%. Therefore, in June 2023, MakerDAO proposed to raise the Dai Saving Rate (the risk-free interest rate of Dai) from 1% to 3.49%, providing attractive returns for Dai holders.

In terms of type, MakerDAO’s RWA mainly includes four parts:

– RWA 001, 6s capital, providing real estate loans.

– MIP81, RWA014, a proposal submitted by Coinbase Institutional in September 2022, which invests part of the USDC held by MakerDAO in Coinbase USDC Institutional Rewards, providing 1.5% APY based on USDC.

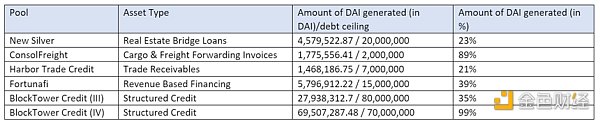

– Digitized assets realized by decentralized lending platform Centrifuge, purchased by MakerDAO-related tokens, including New Silver (real estate lending), BlockTower (structured credit), etc.

– MIP65, named Monetalis Clydesdale, No. RWA007, proposed by Monetalis, uses stablecoins held by MakerDAO to purchase short-term bond ETFs. It was first passed in October 2022 (500 million US dollars), and the debt ceiling was raised through subsequent proposals in May 2023 (to 1.25 billion US dollars).

6s capital and Coinbase are separate cooperation cases, and this article will focus on the Centrifuge and Monetalis Clydesdale parts to explore how DeFi protocols combine with RWA. The related issues involved are not only technical solutions and business models, but also governance architecture, legal framework, and asset ownership.

How does the DAO buy government bonds? MakerDAO’s Monetalis Clydesdale project

MIP65, named Monetalis Clydesdale, was proposed by Monetalis founder Allan Pedersen in January 2022, and was passed and executed in October 2022. The goal is to invest some of the stablecoins held by MakerDAO in high-liquidity, low-risk bond ETFs. The initial debt ceiling is 500 million U.S. dollars, and the ceiling will be raised to 1.25 billion U.S. dollars through subsequent proposals in May 2023.

In the discussion of the community in MIP13 proposed in February 2022, about 60% of MakerDAO’s balance sheet at that time were various stablecoins (using the Peg Stability Module (“PSM”) mechanism to ensure the value stability of Dai, and the reserve is mainly USDC), and more than 50% of the assets have been stablecoins for the past 18 months, but they have not created profits for MakerDAO. The counterparty risk mainly comes from Circle (the issuer of USDC). The community hopes to invest stablecoins in some way to obtain profits and diversify risks, including the idea of investing in short-term US government bonds.

Subsequently, 71.19% of MKR token holders who participated in the MIP65 proposal vote supported the proposal, which was ultimately passed. MIP65 will launch an RWA-related vault, which will invest funds from the MakerDAO PSM mechanism in high-liquidity bond strategies in the form of trusts.

Monetalis is a consulting firm founded by Allan Pedersen and Alessio Marinelli that provides consulting services and solutions to traditional finance and DeFi institutions. Both founders have extensive experience in traditional finance, consulting, and venture capital firms. Monetalis’ investors include UDHC, Dragonfly, and MakerDAO co-founder Rune Christensen.

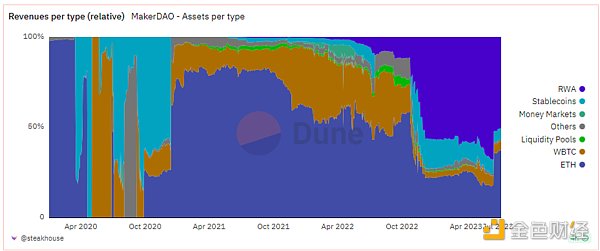

The overall business architecture of the proposal is as follows:

– MakerDAO delegates the design of the overall architecture to Monetalis through a voting process, and Monetalis needs to periodically report to MakerDAO

– Monetalis, as the project planner and executor, designs the overall trust architecture, which includes:

– Riverfront Capital (SHRM Trustee (BVI) Limited) as the only director.

– Hatstone (Fiduciary Group Limited) as the manager of the transactions. Transactions of the trust need to be approved by this company.

– Belvaux Management Ltd as the trust executor to ensure that the trust operates according to its objectives.

– MakerDAO MKR token holders are the overall beneficiaries and can direct the trust assets through governance instructions for purchase and disposal.

– James Asset (PTC) Limited (“JAL”) is the trustee.

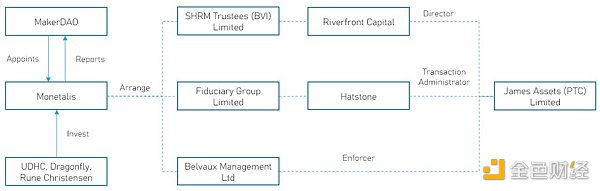

– Coinbase provides exchange services for USDC and USD.

– Sygnum Bank provides transaction and custody services for trust assets and sets up an account for trust operating expenses.

– Funds are invested in two types of ETF products: Blackrock’s iShares US$ Treasury Bond 0-1 yr UCITS ETF and Blackrock’s iShares US$ Treasury Bond 1-3 yr UCITS ETF.

Where:

– JAL is a shell company that holds the trust and is a newly established company in BVI.

– Riverfront Capital (SHRM Trustee (BVI) Limited) is a company established in the 1990s that provides professional trust services.

– Hatstone (Fiduciary Group Limited) has over $1 billion in total assets and provides fund management, corporate services, and fund investment services.

– Monetalis, under the delegation of MakerDAO, serves as the project manager and establishes the overall architecture. Monetalis’ situation will not affect MakerDAO’s assets. Monetalis receives a management fee of 0.15% per year, paid quarterly.

– Sygnum Bank is the world’s first regulated digital asset bank and a global digital asset expert headquartered in Switzerland and Singapore. Its products include regulated cryptocurrency trading. With Sygnum Bank AG’s banking license in Switzerland and Sygnum Pte Ltd’s Capital Markets Services (CMS) license in Singapore, Sygnum enables institutional investors, qualified private investors, corporations, banks, and other financial institutions to invest in the digital asset economy with full confidence.

Figure 8: Monetalis project trust structure, Source: DigiFT Research

The purchase process is as follows:

Figure 9: Trust operation process diagram, Source: DigiFT Research

JAL is the holder of each bank account, and each transaction is initiated online and requires approval from both Riverfront Capital (JAL’s sole director) and Hatstone (JAL’s transaction manager).

Under this legal framework design, the goals that MakerDAO MIP65 can achieve are:

– Third parties or Monetalis have no ability to change legal terms or access relevant funds

– Through the trust, MakerDAO MKR holders have the ability to trigger liquidation through community voting and governance

– No single third party has the ability to block MakerDAO’s governance of the trust or modify its terms

– There can be no obvious weaknesses or special circumstances that would result in the misappropriation of funds

– Determine that the trust structure can only purchase designated asset types and amounts

To realize DAO’s holding of RWA, MakerDAO has designed a complex trust structure and new legal regulations, which come with high costs, including an initial $950,000 for various expenses and ongoing payments to various institutions and project managers at Monetalis for trust-related expenses.

In addition, in the latest community proposal of MakerDAO, in late May, community members proposed Project Andromeda, which purchases short-term US Treasury bonds as Dai with a debt ceiling of $1.28 billion, further increasing MakerDAO’s investment in RWA. BlockTower has worked with Centrifuge and MakerDAO many times, and the team has rich experience in traditional finance. With the flow of Monetalis running ahead, if the MakerDAO community wants to increase its investment in RWA only, this proposal is likely to be adopted.

Tokenized Asset Integration with DeFi Protocol – MakerDAO <> Centrifuge

Centrifuge is a decentralized lending platform that provides a series of smart contracts to create a transparent market without unnecessary intermediaries, enabling decentralized financing of RWA assets. The ultimate goal of this protocol is to reduce the borrowing costs of enterprises while providing stable RWA collateral income for DeFi users.

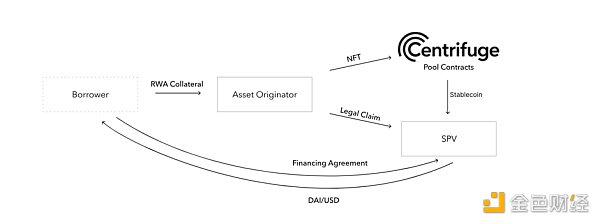

Figure 10: Centrifuge fund operation chart, source: Centrifuge document

In fact, the process of issuing assets on Centrifuge is similar to the process of issuing ABS (Asset-Backed Securities). The fund operation

The process is as follows:

– The asset initiator (asset originator, such as BlockTower) creates a special purpose entity (SPV, as the issuer) as an independent legal entity for each fund pool to keep each fund pool independent. Centrifuge’s contract will create a corresponding fund pool on Ethereum and associate it with the corresponding SPV;

– The borrower decides to finance some real-world assets as collateral, which can be invoices or real estate;

– The asset initiator issues the RWA tokens corresponding to the collateral, verifies them, and mints the corresponding NFT as the on-chain collateral;

– The borrower and the SPV agree on the financing terms; the asset initiator locks the NFT in the Centrifuge fund pool associated with the SPV and withdraws stablecoin Dai from the reserve of the pool; Dai can be directly transferred to the borrower’s wallet, or converted into USD by the SPV and transferred to the borrower’s corresponding bank account;

– The borrower repays the financing amount and fees on the NFT maturity date, either directly on-chain in Dai or by bank transfer, which is then converted into Dai and paid to the Centrifuge fund pool by the SPV; once all NFTs are fully repaid, they will be unlocked and returned to the asset initiator and can be destroyed.

The SPV is created by the asset initiator, and the borrower generally has business contacts with the asset initiator.

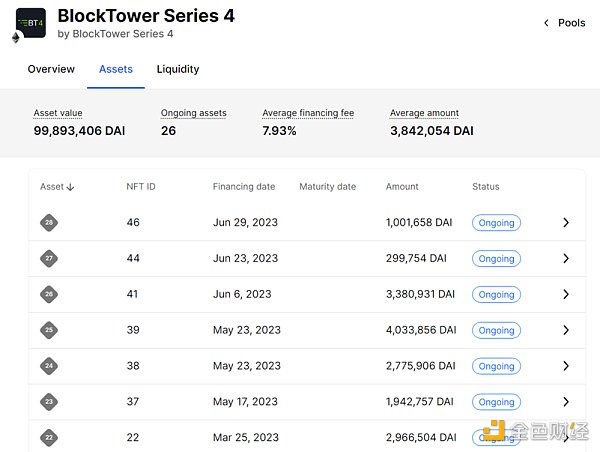

Figure 11: Centrifuge BlockTower series 4 part assets, source: Centrifuge

The figure shows the Centrifuge App page, with a screenshot of BlockTower Series 4 and a list below of NFTs that serve as on-chain collateral, with each NFT corresponding to a verified off-chain real-world asset from the asset initiator, in this case structured credit.

Centrifuge provides a tool and market for project owners/users who need to purchase RWA, which can embed assets into the DeFi world and provide higher returns than the general market stable interest rate, but there are also certain risks, which come from the borrower as the counterparty.

Data: MakerDAO’s purchased Centrifuge platform asset types and quantities, and the number of Dai issued based on this collateral, source: Daistats, data as of July 10, 2023

At present, several borrowing data from Centrifuge adopted by MakerDAO are shown above. Compared with national debt projects, RWA tokenized through Centrifuge has a relatively small relative volume, and the largest-size BlockTower is just over 100 million US dollars. Compared with MakerDAO’s direct purchase of national debt, the advantage of this plan lies in the simple process and no need for MakerDAO itself to build a complex legal structure. In recent community discussions, Centrifuge will extract 0.4% of the fee to help these projects obtain loans; MakerDAO does not need to bear additional fees in it. However, due to the higher risk of default for these projects compared to national debt, there is a greater counterparty risk as a whole; so far, Centrifuge has not experienced bad debts.

Conclusion

As one of the largest DeFi projects, MakerDAO has tried two forms in the operation of the RWA-related community for several years: directly purchasing and holding assets through DAO + trusts (MIP65) and purchasing tokenized RWAs (through Centrifuge), which is currently the best case of combining Tradfi and DeFi. Compared with smaller DeFi protocols, MakerDAO has sufficient financial strength to achieve DAO’s direct purchase of national debt, but the cost is high. MakerDAO established an innovative legal structure to ensure the safety of MakerDAO community assets through a complex trust structure, bringing RWA income to Dai and MKR token holders. For this, MakerDAO paid a pre-expense of 950,000 US dollars. In addition, Monetalis needs to charge 0.15% of the total amount as project management fees every year, and the other three companies participating in the trust also have corresponding expenses. Reported that MakerDAO’s project paid about 2.1 million US dollars in January 2023 for the purchase of the first phase of 500 million US dollars of national debt ETF. This is too expensive for ordinary DeFi projects.

The root cause is that the holders of MKR tokens cannot be fully mapped to the legal framework of the real world. The anonymity, lack of KYC, and different national and regional affiliations (which need to comply with different laws and regulations) make it incompatible with the existing legal framework of the real world, to ensure the security of token holders’ assets (especially off-chain assets). Therefore, a complex legal framework is designed to achieve the purchase of national debt ETFs. Whether this legal framework will have problems remains to be seen.

For most DeFi protocols and project parties, they do not have the energy, resources, and capabilities to build a complete system. The second way to purchase tokenized assets directly will be easier. If there are compliant asset issuers (traditional financial asset issuance requires holding relevant licenses or permits), only simple community voting is required. After the purchase, the assets are saved on-chain through multi-signature and the address is made public for community supervision. The risk is more on the counterparty risk of the issuer. As mentioned in the previous research report “Exploration of RWA Application Cases: 5 Attempts of Chain US Treasury Bonds”, OpenEden, MatrixDock, Maple Finance, Ondo Finance, etc. are all trying to tokenize national debt, and according to DefiLlama data, the two largest RWA TVL projects also belong to national debt projects.

In the case of DeFi development encountering bottlenecks, the DeFi community has also begun to further consider asset security issues, from only worrying about smart contract vulnerabilities to further focusing on compliant assets; traditional finance is highly regulated, asset isolation, governance role allocation and isolation, process standardization, and institutional restrictions are used to avoid small loopholes leading to large-scale systemic risks.

It is expected that in the future, we will see more protocols and projects include RWA in their asset-liability sheets to achieve diversified asset allocation. Here, compliant asset issuers will be indispensable, and better governance structures that combine on-chain and off-chain will also be gradually discovered and explored. Looking forward to the real-world application of the crypto world.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LD Weekly Report: ETH Staking Rate Rises to 19.43%, Layer2 TVL Total Locked Amount Reaches $9.68 Billion USD

- Decoding Chainalysis research report: How retail traders, veterans, and institutions contribute value to exchanges?

- Unrest and Consequences of Centralized Communities: Reddit Protests in Progress

- Game Article: Key Points in Designing Economic Systems

- Huang Licheng sues online detective ZachXBT for defamation

- How to effectively hedge USDT risk on the chain when unexpected events occur?

- OKX Ventures Latest Research Report: Rethinking Oracles, Seeing the Seen and the Unseen