OKX Ventures Latest Research Report: Rethinking Oracles, Seeing the Seen and the Unseen

OKX Ventures' Latest Research Report: Rethinking Oracles and Seeing the UnseenIntroduction

With Vitalik recently mentioning the issue of the ultimate oracle in his article, “oracle” has re-entered the focus of the crypto community. Currently, oracles have irreplaceable value in many fields and sectors such as insurance, finance, random prediction, and the Internet of Things. The core view of OKX Ventures is that as long as off-chain data still has value, middlewares such as oracles will continue to play a key role in the narrative of the entire Web3. Specifically, in the following aspects:

- In the context of the continuous development of the Web3 ecosystem, it is foreseeable that the increasing number of dapps and platforms will drive the demand for calling data sources and APIs through oracles. In the future, dapps, especially defi exchanges, are likely to integrate more than one oracle (usually with one as the main data source and 1-2 as backup for cross-validation) to obtain off-chain metadata, thereby avoiding delays or attacks on a single oracle, which can cause the protocol to suffer from unbearable losses (similar to protocol accidents such as Venus).

- In terms of investment opportunities, although traditional defi focuses on oracle directions with data feed functions, it is difficult to see who will break Chainlink’s monopoly in the short term, but there may still be competition space for the second place in the remaining 10% or so of the market. In addition, there are innovative protocols and narratives worth noting in segmented areas of oracles, such as L2, credit, NFT, DID, etc.

- Based on the experience of DEX and L1, from the perspective of incremental market demand and L2/ZK and segmented emerging scenarios, the oracle track cannot be monopolized by a single winner in the long run. There is still a greater potential for development and market space worth exploring, such as off-chain computing scenarios, non-standard on-chain asset pricing such as NFT, and the deep integration of AI/ML.

In the following sections, we will provide in-depth explanations of the concept, classification, application scenarios, and investment opportunities of oracles.

Background

According to Vitalik’s recent article, he believes that there will definitely be a more effective trust mechanism oracle protocol in the future. He mentioned his two solutions in the article:

- Deep Experience Report: How to Layout Web3 Social Protocol Lens Protocol in Advance?

- glassnode | DeFi Industry Status Report: How to Deal with the Downtrend

- VanEck Ethereum Valuation Report: ETH to Approach $12,000 by 2030

- Price Oracle : One is a decentralized oracle for incomplete encrypted economy, and the other is a oracle based on validator voting.

- The latter mainly recovers through emergency recovery strategies rather than resorting to L1 consensus. For example, the price predictor relies on the trust assumption that voting participants may be bribed and corrupted, and users can receive attack warnings in advance and withdraw from any system dependent on the oracle. Such oracles can intentionally delay rewards for a long time, so if the protocol fails, participants will not receive rewards.

- The proposal for a price oracle is mainly based on the previously proposed schellingcoin/point mechanism, envisioning a reverse prisoner’s dilemma-style game theory.

- Its core idea is still to maintain the simplicity of the chain, avoid direct hard forks caused by the failure of a single oracle.

- More complex truth oracles: used to report more subjective facts than prices.

- Similar to a decentralized court system built on an imperfectly encrypted economic DAO.

- The Rocket Pool Oracle DAO, which consists of nodes forming a DAO, should also meet Ethereum’s expectations for the development of oracles.

- But according to Vitalik’s ideas, he seems to prefer the first voting validator scheme based on complex game theory.

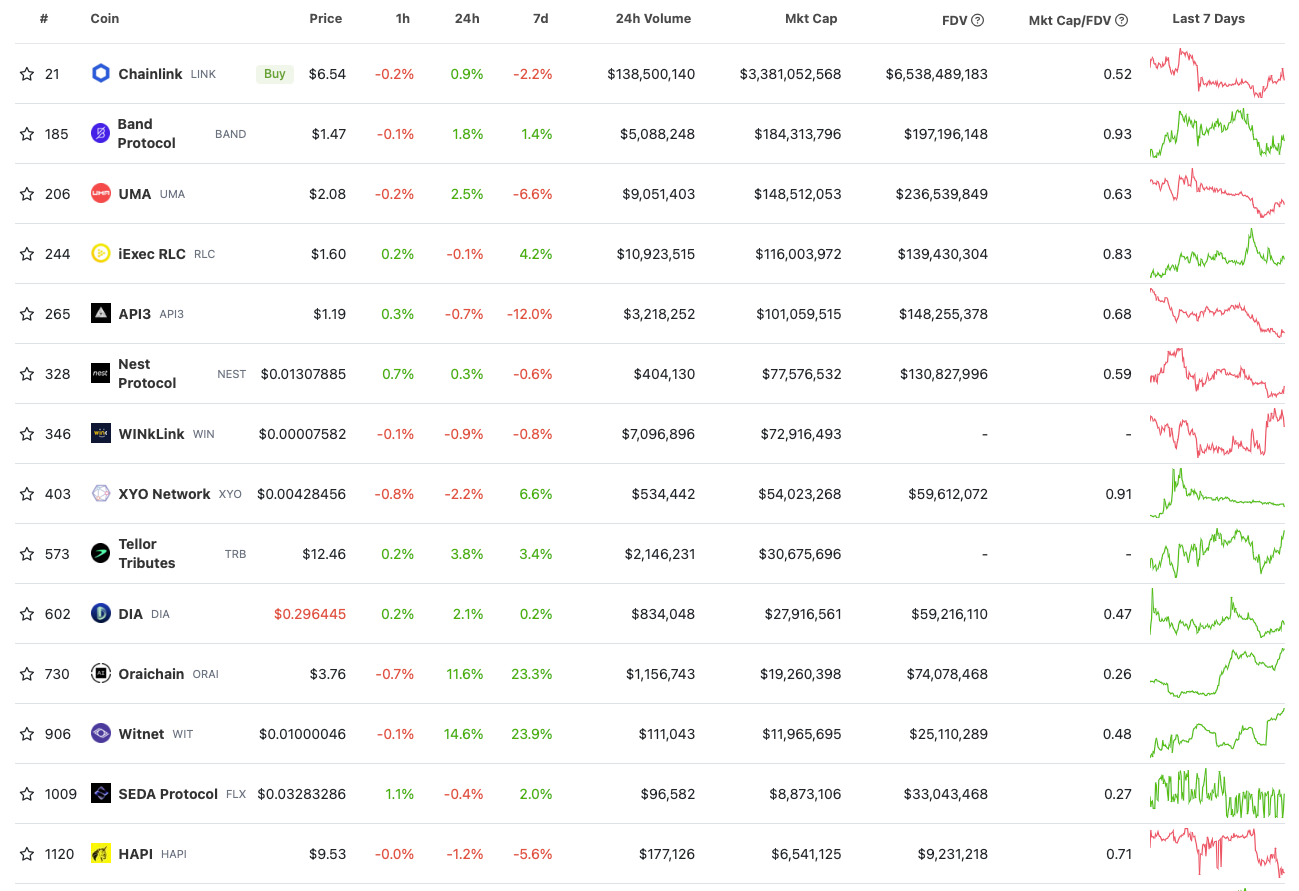

Track data

Observing the overall oracle track data, Chainlink is still in a leading position in the market. As middleware with oracles as the core in the entire Defi track, it has not received much attention. On the one hand, this is due to the lack of practical use cases for most protocol tokens, and on the other hand, it is also because ordinary market users lack awareness and motivation to learn.

- However, it is worth noting that the coin price of the last few places in the track, such as Band and UMA, has also performed well in history.

- In addition, protocols such as Gelato that provide automation, cross-chain and off-chain computing services are expected to have a lot of imagination space as they have good fundamentals and gradually start to increase utility for tokens.

- With more developers joining and dapps appearing in the next cycle, the demand for oracle call data sources and APIs cannot reverse shrink. A large amount of unexcited market increment may drive the sector to take off.

In summary, we believe that oracle, especially the vertical oracle category in the subdivision track, can still be regarded as an investment direction worth paying attention to in the medium to long term.

Interpreting Oracles

1.1 Concept

Oracles are generally considered to be the bridge that connects on-chain and off-chain data. In short, the oracle is an intermediary that provides trustworthy off-chain data services for blockchain projects.

The biggest reason we need oracles is that the trust generated by the current blockchain itself is not enough to support all the needs of upper-layer applications , so we need oracles to inject more trust:

- Currently, the amount of off-chain and on-chain data is still unequal. Compared with the real world off-chain with rich data types and huge data volumes, the amount of on-chain data is far from enough to support its complete independent development without relying on off-chain data. Most protocols currently cannot survive without connecting to oracles.

- This is why many people say that oracles are a “necessary evil” for blockchain . Until the richness of on-chain data surpasses off-chain data and becomes thick enough, we will no longer need to rely on oracles or similar relay agents. This is also the fundamental reason why many DEX and DeFi protocols are so persistent in the oracleless on-chain native design .

Blockchain is a closed system that cannot be directly connected to the Internet. Smart contracts cannot directly access deterministic information from the Internet and the real world, including stock prices, exchange rates, and the final results of presidential elections. And because of the consensus mechanism, it also needs a trusted third party to verify the data. Therefore, the role played by oracles is more like a broker that matches on-chain and off-chain trust.

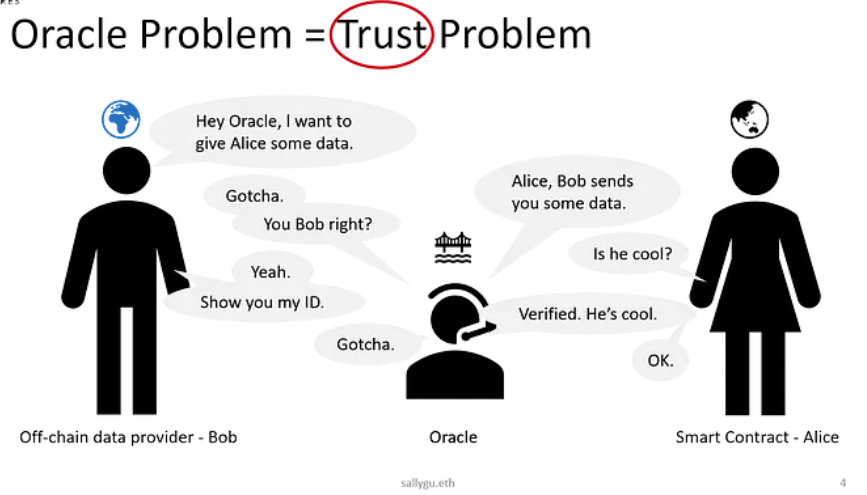

It is worth noting that the key problem that oracle solves is not how to obtain information from the real world (in fact, anyone, including you and me, can upload off-chain data to the chain), but how to help the blockchain trust the information from the real world (even if you and I upload off-chain data to the chain, no one will believe it, and therefore no one will adopt it, which of course involves the problem of honest nodes).

Trust is generated through communication, not just connection. Therefore, the intrinsic value of the oracle depends on its ability to bridge the communication channel between on-chain and off-chain, that is, its function of injecting trust into data from the real world off the chain by forwarding, verifying, and filtering information. Therefore, the key point to judge the quality of an oracle is to figure out how “trustworthy” it is.

1.2 Classification

According to the form, we can divide oracles into software oracles and hardware oracles based on their form:

- Software oracles: Provide API/SDK and other services to help protocols access and transmit third-party server data, such as commodity prices, weather indices, flight numbers, etc.

- Hardware oracles: Hardware oracles are widely used in IoT, such as electronic sensors and data collectors.

According to the data source, oracles can be divided into centralized oracles and decentralized oracles:

- Centralized oracles: Usually only integrate single trusted third parties such as government departments, official organizations, and reputable companies to provide data. Its advantage is that it separates data from untrusted operating systems of local devices to prevent data tampering and loss. The disadvantage is that the single centralized data brings the risk of single point failure.

- Decentralized oracles: Decentralized oracles refer to oracles with a distributed consensus mechanism, also known as consensus oracles. It obtains data from multiple external sources rather than a single one, so it is more reliable and does not require trust.

Centralized vs. Decentralized

Centralized oracles have the advantages of efficiency and feasibility. Decentralized oracles, on the other hand, are more reliable and secure due to their discrete multi-node and cross-reference processes.

When efficiency is not the main goal, a centralized solution is not the most advisable. Obviously, the information provided by a single node is likely to be biased and arbitrary, in which case authority comes from autocracy rather than credibility.

For the sake of trust risk control and concern, most DeFi applications basically adopt third-party decentralized oracles such as Chainlink instead of developing a simple centralized oracle or running nodes to carry chain data to the chain independently (again, project parties or individuals cannot gain community trust even if they upload data to the chain themselves).

| Indicator | Centralized Oracle | Decentralized Oracle |

| Data Feeding | Single Node | Multi-node |

| Feasibility | Higher | Lower |

| Time Efficiency | Higher | Lower |

| Credibility | Lower | Higher |

| Risk Tolerance | Low | High |

| Scalability | Low | High |

1.3 Application Scenarios

In 2021, Chainlink 2.0’s white paper introduced the concept of DON (Decentralized Oracle Network) for the first time. DON is a network maintained by a group of Chainlink nodes that allows Chainlink to provide external data to the blockchain through trustless off-chain computing. To achieve this vision, Chainlink has launched a series of products and services such as VRF, Keepers, CCIP, etc., further opening up the oracle’s application scenarios in web3. In the following figure, we list the application cases of oracles in several different scenarios such as DeFi, NFT, GameFi, Social, DAO, and cross-chain for reference:

| Scenario | Specific Requirement | Functional Service |

| DeFi | Price Feeding | VWAP |

| DeFi | Fair Sorting | anti-MEV |

| NFT | Community Airdrop | VFR |

| NFT | Price Feeding | TWAP |

| GameFi | Random Scene Generation within the game | VRF |

| Social | User Profile, User Side Writing | DID |

| DAO | Community Airdrop, Community Governance | DID |

| Cross-chain | Cross-chain Information, Asset Transfer | Cross-chain brige |

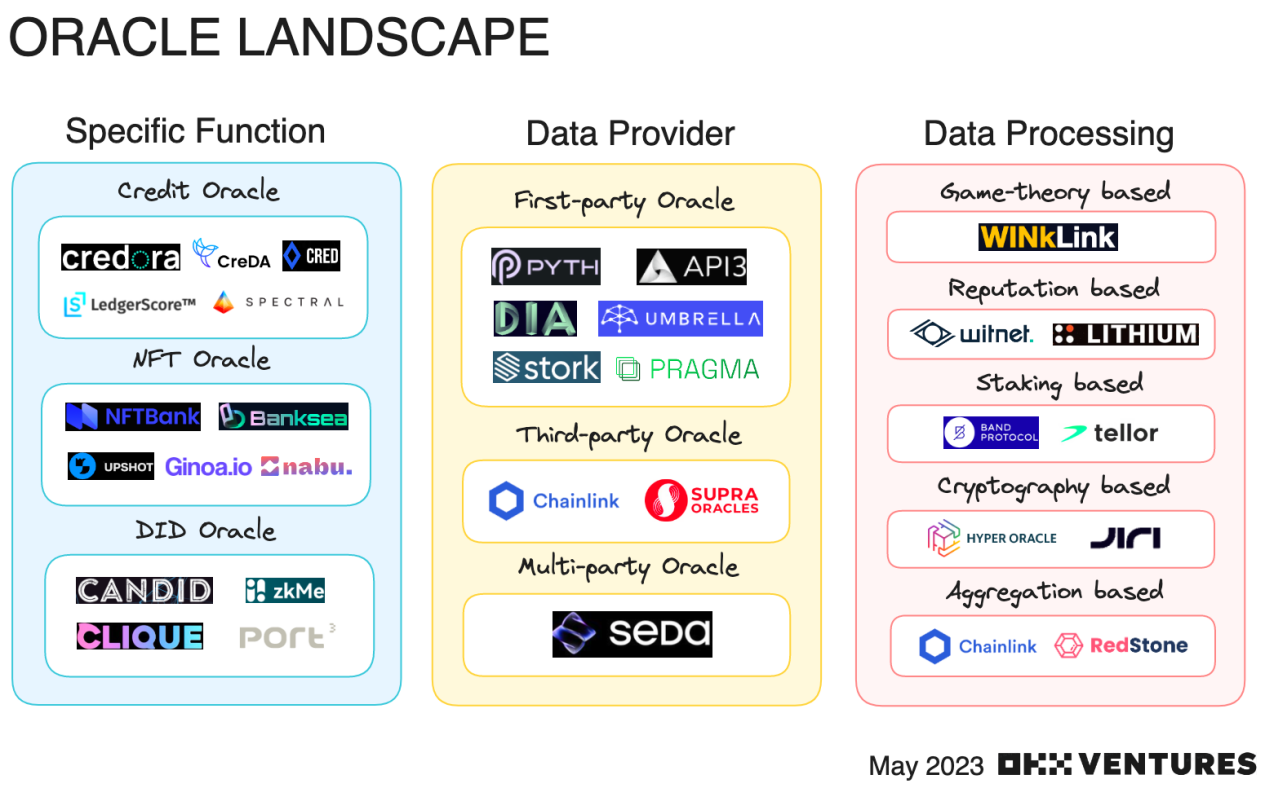

1.4 Industry Map

We believe that three dimensions can be used to classify oracle:

According to specific functions, data sources, and data processing methods.

- Based on the specific function , in addition to the common defi oracle, three common types are listed here: credit oracle, NFT oracle and identity (DID) oracle .

- According to the data source , it can be divided into three types: first-party oracle, third-party oracle and multi-party oracle.

- According to the data processing method , it can be divided into five types: game-based oracle, reputation-based oracle, pledge-based oracle, cryptographic-based oracle and aggregation-based oracle.

Investment Opportunity Expectations

2.1 Viewpoints

- Traditional defi oracles, with data feeding as the main function, is currently dominated by Chainlink (market share of 80-90%). However, there may still be second-place competition in the remaining 10% market :

- One is the consensus mechanism innovation of this project, and Vitalik gave two possible solutions for future projects that may have theoretical landing

- Combining game-theory with PoS/PoW

- The form of DAO committee/decentralized court

- Another is a significant improvement in functional cost-effectiveness, where the price feeding or random number generation is more cost-effective than Chainlink, such as Redstone, Ontropy, etc., which claim that their price feeding can be 80-100 times cheaper than traditional solutions like Chainlink. Generally speaking, only when the call cost is significantly reduced, defi or gaming projects may consider replacing the original service provider with it due to economic considerations.

B. Oracles in specific fields, L2, credit, NFT, DID and other directions all have potential opportunities:

- L2 oracles are mainly the native solutions of the op/zk ecology, where low latency and security should be the core concerns, and cheap price feeding is relatively secondary

- The expansion progress of Chainlink on various non-EVM chains should be taken into account. If the price feeding on a certain chain has been basically monopolized by Chainlink, the competition difficulty will be greatly increased.

- L2 oracles should largely meet the high-frequency trading demand of derivative exchanges (L2 can provide higher TPS support, thus supporting on-chain decentralized derivative trading), similar to oracle protocols such as pyth and empiric, which have more precise price feeding or more robust data integration process (such as directly doing on-chain first Blockingrty data integration + verification, which eliminates the need for off-chain nodes)

- If tokenomics design is reasonable and more utility is added (Chainlink’s tokenomics design was once criticized for lack of utility, but LinkPool-like liquidity staking + yield protocols emerged later, which to some extent activated liquidity), we believe that the token price of the oracle protocol can be expected to have a relatively stable performance.

- Combining credit prediction machines with on-chain credit expansion theory may detonate in the next cycle

- The improvement and soundness of on-chain credit rating systems are prerequisites for building on-chain insurance and claims mechanisms, so they play an important role in the development and evolution of the entire defi. In the previous racing map and other documents, we have given several cases of credit prediction machines such as: CreDA \ Cred Protocol \ LedgerScore \ Spectral \ Credora: Infrastructure for Institutional Credit, etc.

- As far as this specific subdivision is concerned, we believe that more attention should be paid to the differences in data verification and integration of similar products on the chain (such as the coverage, cleaning ability, and credit rating accuracy of on-chain data). In addition, having strong financial engineering or actuarial capabilities would be a plus for the team.

- At the same time, we also noticed that the entire project of on-chain credit system on-chain is more complicated than expected:

- On the one hand, it is difficult for a single project to directly interact with a certain country’s social credit system. A key issue may be: Can off-chain economic behavior activities really endorse on-chain credit capabilities? However, a strong BD capability like Spectral Finance may cooperate directly with large credit rating agencies in the United States, which may be a good solution.

- On the other hand, the barrier to integrating on-chain public credit data is not high (cloud teams of traditional Internet companies theoretically have the ability to develop and land relevant functions).

- NFT prediction machine can be divided into two main ideas:

- One is twap time-weighted average price, of course, there are also moving averages

- Currently, it is not possible to achieve vwap because the trading volume is not enough. Considering the non-liquidity and non-homogeneity of NFT itself, we are unlikely to foresee the implementation of NFT vwap in the short term.

- Chainlink and DIA, several traditional defi prediction machines, have provided NFT twap feeding price services, and many will directly adopt Chainlink’s twap solution.

- After communicating with the relevant technical team, we tend to believe that most NFT twap feeding price functions are still in the preliminary stage, and there is room for optimization in the integration method, but overall, the development prospects of this direction are not great.

- One is a valuation pricing scheme that combines AI/ML with off-chain computing, which we believe is relatively more promising.

- In the later stage, some horizontal integration can be carried out to transform into a full-stack NFT data analysis + purchase + evaluation application (the traffic entry and liquidity activation plan for NFT spot) is a good potential scenario.

- However, such schemes are basically black boxes because the algorithm is not open source, and it is difficult to obtain cooperation agreement trust (such as upshot, banksea, although they have achieved good results in financing, they are difficult to create income sources or issue coins in a short period of time, and profits rely on other derivative businesses, such as wallet data analysis and market integration services to collect fees).

- An open-source ML similar to Nabu may be a good transparent solution, but its future profitability is still difficult to predict. However, if similar protocols can be transformed into an open-source ML model DAO + issuance of coins, with reference to commercial ideas such as Forta/Go+ in the security track, there is theoretically good imagination space for development prospects.

- DID identity oracle is a protocol service that combines user off-chain data on-chain for identity verification and social graph drawing. This segmentation field has high value in the long run.

- The CanDID (DECO) team under Chainlink is trying to build a decentralized on-chain identity infrastructure based on highly optimized multi-party computation and zero-knowledge proof technology. Similar zkDID projects such as legalDAO and Intuition also provide similar solutions through DAO committee-type identity verification services.

- However, most of the identity oracles currently seen are basically centralized and have low barriers (although most of them plan to transform into a decentralized form in the future, it is difficult to verify their feasibility without actual landing).

- At the same time, it is necessary to focus on its verification process (such as node quality, whether the verification is trustworthy) and storage what is used and how it is implemented.

2.2 Case Study

According to the investment point of view given above, we have selected a case study for each sub-segment direction for simple analysis for reference.

| 名称 | 细分 | 链 | 推特 | 商业模式 | 数据源 | 融资 | 亮点 |

| Redstone | Defi Oracle | EVM-compatible L1s & L2s + Starknet + Fuel Network | 9606 | 2B | 50+

链上及链下 CEX/DEX + 数据集第三方(CoinmarketCap, Coingecko, Kaiko). |

2022 – $7M

Lemniscap, coinbase. Blockchain, Maven11, etc. |

|

| HyperOracle | L2/ZK Oracle | EVM-compatible | 2091 | 2B | On-chain (original blockchain data from data analysis platforms, CEXs, and DEXs) and off-chain (data indexed by zkGraph). | 2023 – 3M@30M val led by Sequoia & dao5 |

|

| CanDID (DECO) | DID Oracle | EVM-compatible | N/A | 2B/2C | Off-chain data from authoritative sources, social media platforms, online bank accounts, email accounts, etc. | Unfinanced |

Making Decentralized Identity Possible with CanDID |

| CreDA | Credit Oracle | Ethereum, Arbitrum, BSC, Fantom, Polygon, HECO, and OEC | 9167 | B2C/2C | On-chain data (assets, activities, interaction behaviors, lending participation), other DID networks (Elastos DID), off-chain data | Unfinanced |

|

| Upshot | NFT Oracle | Chain-agnostic | 27.5k | B2B/2C | On-chain and off-chain data, such as miner, sale, bid, inquiry, and asset metadata. | Mar 2022 – Series A2 – 22M – Polychain, Framework, CoinFund, Blockchain Capital, Slow Ventures, Mechanism Capital, and Delphi Digital, etc. |

|

Overall, OKX Ventures believes that with the continuous development of blockchain technology, oracle will still play an indispensable and important role in the encrypted track in the next cycle, and there is still a greater development potential and market space to be explored, such as off-chain computing scenarios, pricing of non-standard on-chain assets such as NFT, and the deep integration of AI/ML. We will also keep a close eye on innovative protocols and investment opportunities in the oracle track.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Non-farm payroll report is mixed, there is still a possibility that the Fed may pause the rate hike in June.

- Token Analysis Framework: Identifying the Potential and Returns of Low Market Cap Tokens

- Research on the major wallet risks of Binance, KuCoin, and Jump: Are assets stored in large institutions 100% safe?

- IOSG Weekly Report: An Analysis of Full-Stack Game Engines

- Report on the Development of Zksync Ecosystem Two Months after the Mainnet Launch

- Interpretation of the 2023 DeFi Status Survey Report

- Report on the Development of the Zksync Ecosystem Two Months after Mainnet Launch