Report on the Development of Zksync Ecosystem Two Months after the Mainnet Launch

Zksync Ecosystem Report, 2 Months Post-Mainnet LaunchAuthor: LD Capital

zkSync is an Ethereum layer-2 scaling solution based on ZK Rollups architecture. The Fair Onboarding Alpha mainnet was launched on February 16, 2023, which allows only registered projects to test without opening to end-users. The zkSync Era mainnet will be open to everyone on March 24, 2023, and zkSync 2.0 will be renamed zkSync Era, while zkSync 1.0 will be renamed zkSync Lite.

Currently, zksync has been online for 2 months. How has its network ecosystem developed? Let’s take a closer look.

- Interpretation of the 2023 DeFi Status Survey Report

- Report on the Development of the Zksync Ecosystem Two Months after Mainnet Launch

- LD Capital: Zksync Mainnet Goes Live for Two Months, Ecological Development Report

1. TVL

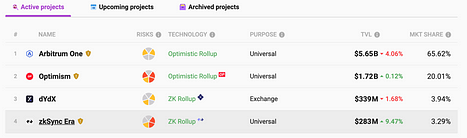

zkSync era TVL maintained steady growth in the first three weeks before the launch, stagnated growth in mid-April, and has recovered since mid-May. Currently, TVL is $283M, with a growth of 9.5% in the past week, accounting for 3.29% of the overall layer 2 TVL and ranking fourth.

2. On-chain Activity

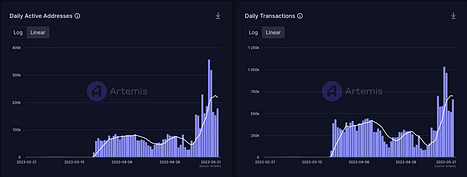

Browser data shows that since zkSync era went online, it has processed approximately 21 million on-chain transactions and has 1.7 million unique addresses. Due to the influence of the Arbitrum airdrop, zkSync received high on-chain activity at the beginning of the launch, with daily active addresses fluctuating in the range of 60-80k in the early days and dropping to around 30k in early May before rising significantly due to events and airdrops.

On May 11th, OKX Wallet launched a one-stop DApp exploration and airdrop interaction platform called Cryptopedia, with zkSync Era set as the theme for the first phase of launch and a zkSync Era interaction area created. Users who complete the interaction tasks can not only receive potential airdrop rewards but also draw five NFTs of different rarity co-designed by OKX Wallet and zkSync. As a result of this event, the on-chain activity of zksync era has increased significantly. At the same time, OKX opened the deposit and withdrawal of zkSync Era mainnet assets on May 20th.

zkApes, the metaverse project of zkSync Era, launched a $ZAT airdrop on May 10th and then shortened the time to claim the airdrop to one week. Before the May 17th deadline for claiming the airdrop, the on-chain activity of zkSync era reached a new high. On the day the airdrop ended, the number of $ZAT holders was 655,000, surpassing USDC and becoming the second-highest token in terms of holders in zkSync era, second only to ETH.

On May 21st, the ERA Name Service platform on zkSync ERA also conducted an ERA token airdrop, with a total of 43,500 addresses participating.

3. Cross-Chain Fund Situation

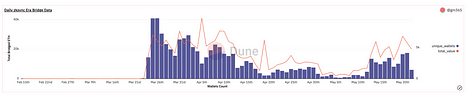

The official bridge data also shows similar activity. Stimulated by the arbitrum airdrop, the number of active addresses increased significantly in the three weeks before the mainnet launch, but decreased from mid-to-late April to early May. After mid-May, the data resumed growth and active addresses increased again.

4. Ecological Projects

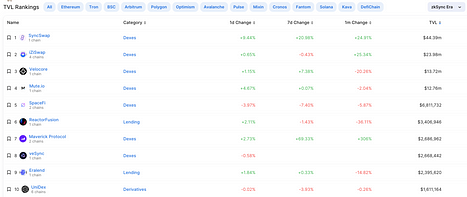

According to Defillama’s statistics, the top five TVLs in the zksync era ecosystem are all decentralized exchanges.

SyncSwap has trading, liquidity mining, and launchBlockingd (not yet started) functions, and currently 85% of TVL is concentrated in the USDC/ETH Pool, with an APR of 25%.

Syncswap plans to issue 100 million SYNC tokens (not yet online) and launched the “SyncSwap Loyalty Program” trading mining activity on April 10th, with a total of 900,000 SYNCs allocated for the genesis epoch. The genesis epoch lasts for 30 days and ends on May 10th. Users can receive 1 ySYNC for every $1 in transaction fees generated, and users in the genesis epoch minted a total of 1.18 million ySYNC (i.e., generated $1.18 million in fees), which will be distributed evenly among ySYNC holders to get about 0.76 SYNC per ySYNC. The activity is currently paused after the genesis epoch.

iZUMi Finance is a multi-chain one-stop Liquidity as a Service (LaaS) protocol that currently supports four chains: ETH, Arbitrum, Polygon, and zkSync ERA.

iZiswap uses the innovative Discretized Liquidity AMM (DL-AMM) mechanism, which is similar to the liquidity book mechanism used by Trader Joe. DL-AMM allocates liquidity to certain fixed prices to further improve capital efficiency. At the same time, iZiswap pro also provides a way to trade order books.

LiquidBox is a liquidity mining solution based on Uniswap V3 LP by iZUMi. Project owners can set incentives for LP within a specific value range through LiquidBox. Users who pledge V3 LP tokens to the iZUMi protocol can receive corresponding incentives within the specified range.

The relevant data of the protocol defilama differs greatly from that of its official website. The following figure shows the situation of TVL and trading volume displayed on the official website.

The platform token IZI was launched in December 2021 and has been listed on exchanges such as Bybit, Kucoin, and Gate. After a long period of decline, it rebounded significantly after being listed on zkSync in April of this year.

Mute is the first batch of DEX on zkSync Era. In addition to trading and providing liquidity, Mute also launched Yield Amplifier, Bonds, and DAO governance functions. Users can purchase MUTE tokens with Bonds at a discount using MUTE/ETH LP with a 7-day lock-in period. MUTE Token has been listed on Bitget, and the token price soared when it was launched on the zkync era mainnet, and then basically continued the trend of oscillating decline. The current main TVL is concentrated in the USDC/ETH Pool, with an APR of 28%.

Velocore is the first ve(3,3) DEX built on Solidly and Velodrome on zksync era. It conducted a private sale and public sale on its own launchBlockingd platform on April 3 and 4, 2023. The private sale hard cap was 90 ETH, and the public sale hard cap was 450 ETH. The oversold ratio was over 500% and 1814%, respectively, and the fundraising price was 0.0000207 ETH and 0.0000229 ETH, which is equivalent to about $0.037/$0.041. The price rose to about 6 times at the highest, and the current price is maintained at about 2 times the profit.

SBlockingceFi is a cross-chain platform that connects the Cosmos and Ethereum Layer 2 ecosystems. It currently integrates Evmos and ZkSync, and its products include DEX+NFT+LaunchBlockingd+SBlockingcebase. SBlockingcebase is an on-chain community, and creating and joining SBlockingcebase can increase mining rewards. Currently, there are a total of 18 sBlockingcebases created, and about 30,000 people have joined sBlockingce. On May 6th, SBlockingcefi adjusted the economic model of the platform token SBlockingCE, reducing the maximum supply from 600m to 100m, and burned 40M Initial Supply. Currently, the circulating market value of sBlockingce is only $780,000, and the trading volume is also low.

Zigzag is a decentralized order book exchange, the first dex on zkSync 1.0, currently supporting zksync lite and arbitrum. On March 3, 2023, over 100,000 users received a $zz token airdrop, which accounted for 34% of the total token supply. The Zigzag team also developed a decentralized betting platform, zkasico, with bet tokens including usdc, usdt, zz, and eth.

Nexon was one of the first lending protocols to go online with zkSync Era and has now been renamed Eralend. According to the announced token model, 61% will be used for community incentives, 10% for IDO, 15% allocated to DAO, 12% allocated to the team, and 2% allocated to advisors. The portions allocated to the team and advisors will have a 6-month lock-up period. Due to delays in token launch and activity diversion to other protocols, Eralend’s current TVL growth rate is slow, at only around $2.5 million.

Reactor Fusion is currently the largest lending protocol on zkSync Era and is one of the few projects that issue coins on zkSync. TVL is around $3.43 million and currently supports only ETH and USDC assets.

UniDex is a derivatives DEX protocol founded in April 2022, initially on the Fantom chain and subsequently expanding to other public chains and Layer 2 solutions such as Optimism and zkSync Era. Currently, TVL is $870,000, of which TVL on zkSync Era is about $1.6 million.

Onchain Trade is a spot and derivatives DEX protocol built on zkSync Era, with a small TVL of $670,000. Its token is OT, and it went through an IFO in March 2023 with a public offering price of $0.15. After listing, it briefly surged to around $1, but then fell back to around $0.18.

Cheems is a meme project on zkSync Era. From May 4th to 6th, holders on zkSync Era with a wallet balance greater than 0.01 ETH or $PEPE or $AIDOGE could claim $Cheems tokens. A total of 65,000 addresses participated in the claim, and the number of current holders is 51,000, with a circulating market capitalization of $27 million. The current price is still significantly higher than the opening price.

Reference:

https://l2beat.com/scaling/tvl

https://app.artemis.xyz/dashboard/zksync

https://zksync2-mainnet.zkscan.io/

https://www.okx.com/cn/help-center/okx-wallet-launches-cryptopedia-a-one-stop-dapp-exploration-and-airdrop

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Understanding Hong Kong’s Cryptocurrency Exchange Licensing System

- A set of data tells you why you shouldn’t ignore BTC NFT

- Can the United States really avoid a recession?

- Blocking Daily | OpenAI releases iOS version of ChatGPT app; Hashkey Group plans to raise $100 million to $200 million in funding with a valuation of over $1 billion

- Why did hardware wallet Ledger launch the Ledger Recover service, which has sparked criticism from the Web3 community?

- 3 Counterintuitive Experiences in Cryptocurrency Investment

- EigenLayer, which raised $64.5 million in financing: A new narrative in the collateralized track