Binance Research Report: 88% of institutional-grade users are optimistic about the long-term development of cryptocurrency assets.

Binance Research: 88% of institutional users are optimistic about crypto's long-term growth.Binance Research Institute and Binance VIP & Institutional announced their survey report on institutional-grade cryptocurrency users. The survey results show that 63.5% of Binance VIP users and institutional users are optimistic about the future development of cryptocurrencies in the next year. The vast majority (88%) of respondents also expressed optimism about the development of cryptocurrencies over the next decade.

In addition, many institutional users believe that more real-world use cases (26.9%) and improved regulatory clarity (25.3%) will drive the popularization of cryptocurrencies, a proportion that is much higher than price factors (3.4%). This clearly indicates that institutional users are more likely to adopt a long-term strategy and therefore have lower sensitivity to short-term market cycles.

From March 31, 2023 to May 15, 2023, Binance conducted a comprehensive survey of 208 VIP and institutional users, covering demographics, attitudes, preferences, popularity, and motivations for cryptocurrency investment. The main survey findings include:

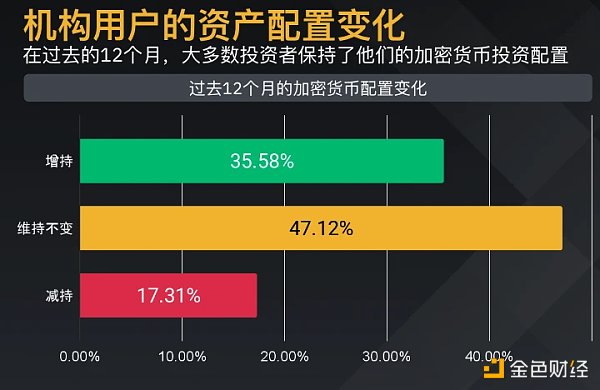

● Asset allocation of institutional users: Although the market situation was average last year, most investors (47.1%) still retained cryptocurrency assets in their portfolios, and more than one-third of investors (35.6%) increased their cryptocurrency assets. Only a few investors (17.3%) reduced their cryptocurrency assets.

- Consensys: Global Cryptocurrency and Web3 Survey

- LD Weekly Report: ETH Staking Rate Rises to 19.43%, Layer2 TVL Total Locked Amount Reaches $9.68 Billion USD

- Decoding Chainalysis research report: How retail traders, veterans, and institutions contribute value to exchanges?

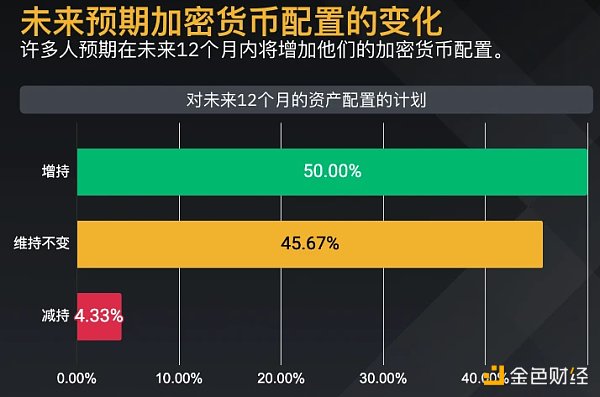

● Future allocation intentions: Most users believe that they will increase (50.0%) or maintain (45.7%) their cryptocurrency holdings in the next 12 months. Only 4.3% of investors believe they will reduce their cryptocurrency holdings.

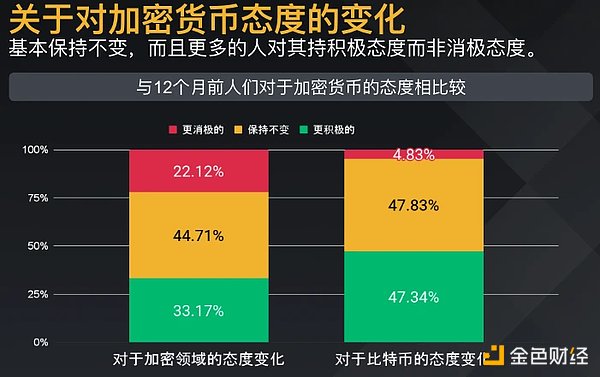

● More bullish on Bitcoin: In the past year, people’s market sentiment towards Bitcoin and the entire cryptocurrency industry has remained basically unchanged (47.8% and 44.7%, respectively), but users are more bullish on Bitcoin (47.3% vs. 33.2%) compared to the overall cryptocurrency market. At the same time, 22.1% of investors are pessimistic about the overall cryptocurrency market trend, while only 4.8% are pessimistic about Bitcoin.

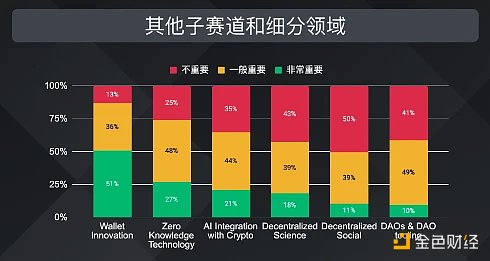

Infrastructure and Innovation: 53.9% of investors indicate that infrastructure projects are their top priority, followed by Layer 1 and Layer 2 technologies (48.1% and 43.8%, respectively). When asked about specific areas, 51.0% of users indicate that innovation in the wallet field (such as self-custody and UX/UI improvements) is also important.

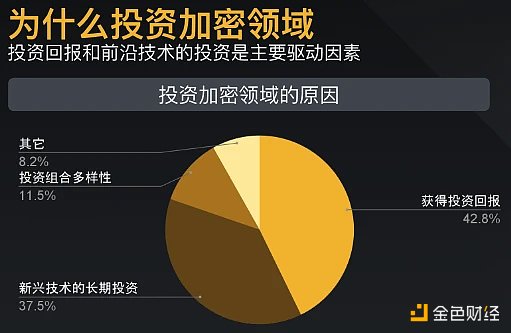

Investment Motivations: 42.8% of investors indicate that the potential for high returns is the biggest attraction of cryptocurrency investments. Additionally, 37.5% of investors indicate that long-term investment in emerging technologies is their primary motivation.

Trading Platforms: Centralized trading platforms are still the preferred platforms for institutional users for trading (90.5%) and custody activities (58.2%). Liquidity (28.0%), security (26.0%), and reputation (22.5%) are the three major factors that users consider when choosing a trading platform.

Catherine Chen, VIP and Institutional Business Director at Binance, said: “Institutional users usually adopt a long-term strategy when entering new markets. According to our survey, these users are optimistic about cryptocurrency in the long term and believe that use cases are more important than price in driving adoption. Therefore, we believe that they will adopt the same strategy for cryptocurrency. These survey findings are also consistent with Binance’s steady growth in institutional accounts (the number of institutional users has increased by 89% since the peak of the bull market in Q4 2021). We will work with our users to study this survey report and apply the research results to our products.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Unrest and Consequences of Centralized Communities: Reddit Protests in Progress

- Game Article: Key Points in Designing Economic Systems

- Huang Licheng sues online detective ZachXBT for defamation

- How to effectively hedge USDT risk on the chain when unexpected events occur?

- OKX Ventures Latest Research Report: Rethinking Oracles, Seeing the Seen and the Unseen

- Deep Experience Report: How to Layout Web3 Social Protocol Lens Protocol in Advance?

- glassnode | DeFi Industry Status Report: How to Deal with the Downtrend