Ethereum DApp king returned: stable currency "Zhanshan is king", DeFi is not expected

The launch of EOS and TRON has promoted the development of DApp. Now, “ecological prosperity” has become one of the new standards for measuring the public chain. Since January this year, the DApp ecosystem on EOS and TRON has been leading the “king of the public chain” Ethereum in terms of quantity, daily activity and daily average transaction volume. But recently, Ethereum has gone against it.

According to the latest data from DAppTotal, the total number of users in Ethereum was about 184,000 from August 12 to 18, which was more than 20,000 more than the second EOS. The total transaction volume was about $109 million. The second-ranked TRON was $12.07 million, but the number of transactions was still the least among the three public chains, with only about 850,000. This means that Ethereum is not only the most user-rich, the largest transaction, and the user's single transaction amount is much higher than other ecosystems.

Why did Ethereum suddenly surpass EOS and TRON? The general consensus of the market is that the prosperity of DeFi this year has boosted the overall ecological prosperity of Ethereum. Is it really the truth? PAData will use the EPC's overall data and DeFi segmentation data from January to August this year to observe how DeFi is used and to what extent it promotes Ethereum's ecological prosperity.

o 1

- Interview with Gong Xinbao Huang Minqiang: At the beginning of the year, the heart will remain unchanged, and the chain business will introduce live water for the blockchain industry.

- People's Daily: The online invoice of blockchain is no less than a reform of tax collection and management

- Cycle observation | market, economy and cycle (below)

Stabilizing coins provide maximum power

In the recent news about Ethereum, DeFi projects such as lending, DEX, and forecasting are not the most concerned. The most concerned is that USDT has frequently issued additional shares in Ethereum this year, which has led to a new high level of congestion in the Ethereum network. Stabilizing coins has become an important part of the Ethereum that cannot be ignored, and it is becoming more and more important.

In fact, in a broad sense, stable currency is part of DeFi, and even the extent to which DeFi can be expanded in the future is closely related to the application of stable currency. But for now, the main use case for counter currency, such as USDT, is still to act as a trading medium to meet the trading needs of users who cannot directly invest in French currency.

Because the importance of stable currency can not be ignored, and it is not widely used in decentralized financial applications in Ethereum, the statistical dimension of this article considers a single stable currency as a DApp to be included in the overall ecology of Ethereum, but It does not count the statistics of the DeFi-like DApp. In other words, the DeFi-like DApp discussed in this article is a decentralized financial application such as lending, DEX, and forecasting.

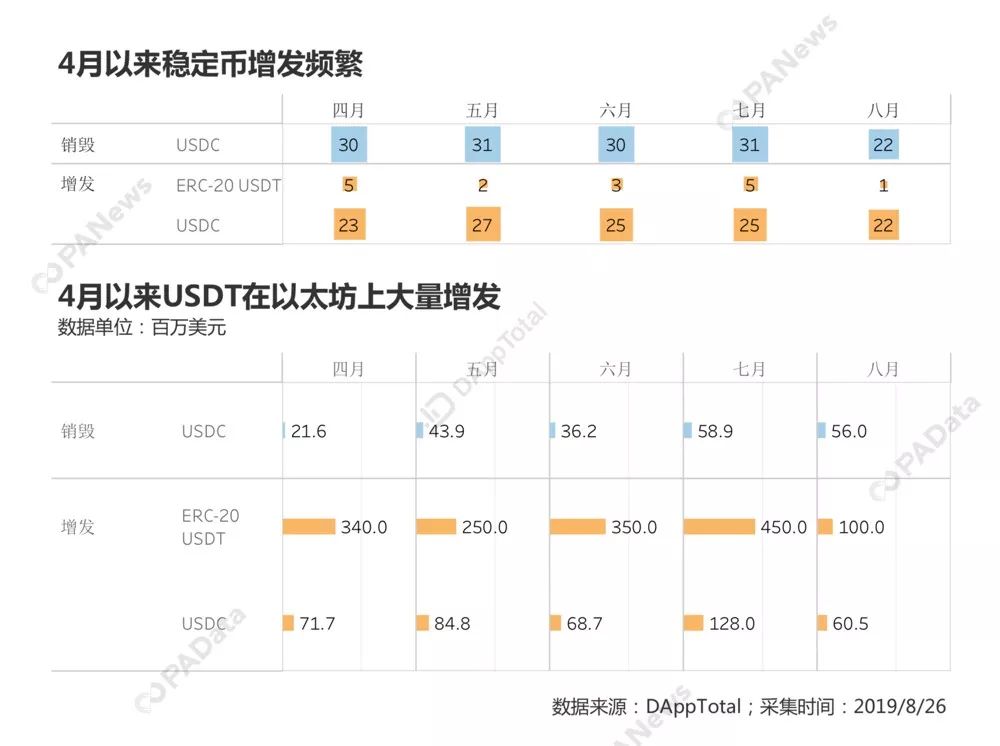

In April, the issue of stable currency increased frequently. Only USDT was issued five times in Ethereum, totaling 340 million US dollars (assuming 1 USDT = 1 US dollar). The second-largest stable currency in terms of market capitalization, and the few stable currency USDC that became a borrowing asset, were issued 23 times in April, totaling 71.7 million US dollars. As of August 26, both USDT and USDC maintained a high number of additional issuances and additional issuances. USDT issued 16 additional instalments within 5 months, with an additional amount of approximately US$1.49 billion, and USDC issued 122 additional instalments, with an additional amount of approximately 4.13. One hundred million U.S. dollars.

The issuance of stable currency also brings active chain trading. According to Etherscan data, ERC20-USDT has continued to increase since April this year, from $6.15 million on April 1 to 4.75 on August 27. In the US$100 million, the increase was as high as 7627%. The number of transactions in the same period rose from 539 to 129,000, an increase of 2,3835%.

Although the stable currency provided the greatest motivation for the reversal of the overall ecology of Ethereum, the DeFi Dapp did not develop in the same month, monthly transaction volume and number of transactions, which means that the stable currency issuance promotion transaction A large part of it has not flowed into the DeFi market, and the issuance may be largely related to transactions in the secondary market. If the stable currency is now classified as part of DeFi, the over-optimistic estimation of DeFi applications due to the stability of the stable currency is not a good thing for the long-term development of DeFi.

o 2

DeFi power is not expected

Ethereum relies on DeFi? According to PAData's earlier analysis of the ecological structure of the public chain, DeFi , including exchanges and financial DApps, has surpassed the game and become the dominant DApp type in Ethereum (refer to "All in 9102, you know the public chain." What are you busy with?").

The DeFi that has been opened in the Ethereum does not directly trigger the eruption of the overall ecology of Ethereum. So, what role does DeFi play in this process?

The monthly activity, the monthly transaction volume, and the monthly transaction amount are not always applicable to observe the performance of each DApp, but this is still a mature and unified observation scale. According to the average monthly activity [1], the average monthly activity of the DeFi-like DApp in the first eight months of this year is about 43,800 (assuming an address is considered a person).

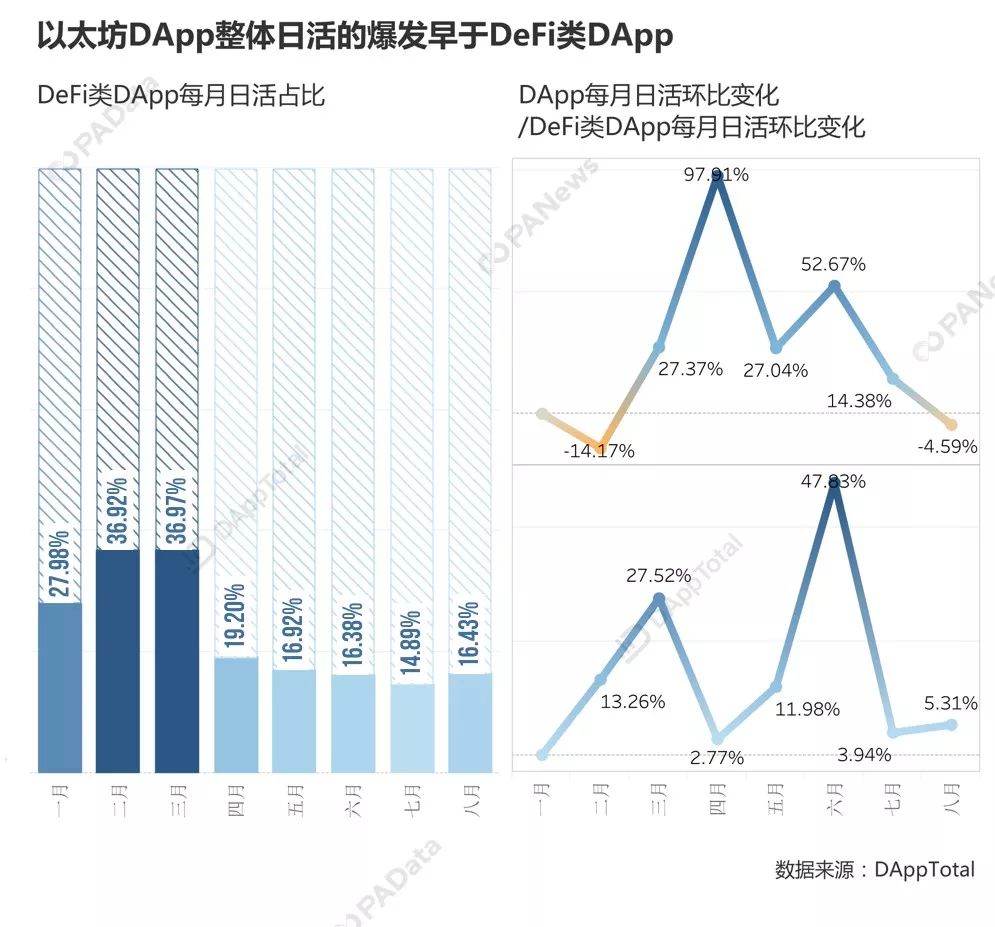

Among them, in February and March of this year, DeFi-type DApp active users accounted for the highest proportion of all DApp active users in Ethereum, reaching about 36.9%, but then from April onwards, DeFi-like DApps accounted for a month. There is a significant drop in the ratio.

Looking at the changes in the overall ecology of Ethereum and the monthly life-cycle change of DeFi-like DApp, it will be found that the DApp ecology showed a significant increase of 97.91% in April, while the monthly growth of DeFi-like DApp was only 2.77%. Basically unchanged from last month. The increase in the stability of the currency led to the expansion of the denominator, and the numerator was basically unchanged, which caused a sudden drop in the monthly share of the DeFi-like DApp. The monthly expiration of the DeFi-like DApp was delayed by nearly two months compared with the overall ecology. According to statistics, the monthly activity of the DeFi-like DApp increased by about 47.83% in the month, reaching 59,700. Since July and August, DeFi-like DApps have continued to grow, with year-on-year growth of 3.9% and 5.3%, respectively.

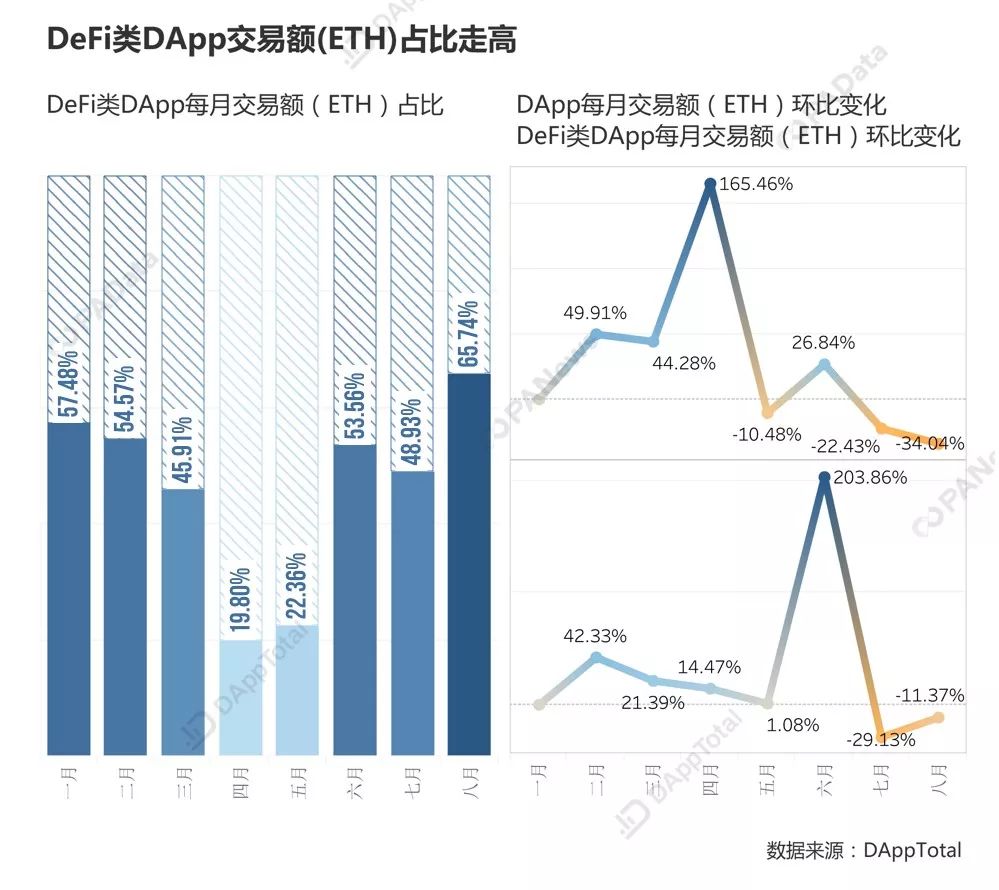

As with the monthly activity, the transaction amount of all DApps on the Ethereum and the transaction amount of the DeFi-type DApp are similar. In the first eight months of this year, the average monthly transaction amount of the DeFi-like DApp [2] was about 43,800 ETHs, which was converted to the price of 200 US dollars, equivalent to 8,762,300 US dollars.

According to PAData's report "DApp" AARRR published in conjunction with DAppTotal: ETH/EOS/TRON User Behavior Portrait Study shows that Ethereum has the highest net user value, especially for financial and financial DApp users, per person per day per transaction. The amount is about 709.3 US dollars. This situation continues to this day. Although the monthly average of DeFi DApps only accounts for 23.21% of the total, the average monthly transaction volume has reached an overall 46.43%.

Among them, the monthly average transaction volume of DeFi Dapps in April and May accounted for only 19.8% and 22.3%, which was mainly due to the overall monthly transaction volume of Ethereum, which showed a 165.46% growth in April, while the amount of DeFi transactions was basically Flat impact. In June, the monthly transaction volume of DeFi-like DApp broke out, and the transaction volume increased by 203.86%. However, the monthly transaction volume of DeFi-type DApps in July and August showed a decline , which was approximately 983,000 ETH and 871,000 ETH, respectively, with a decrease of 29.13% and 11.37% respectively.

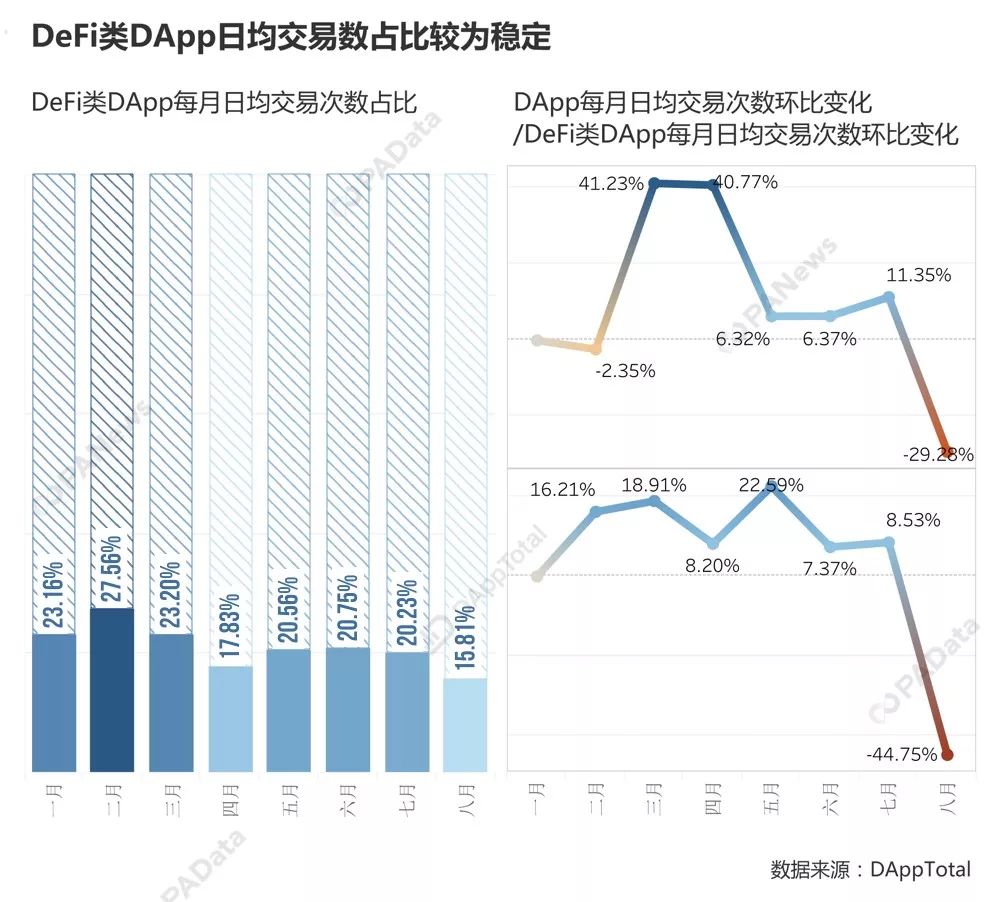

Judging from the number of transactions per month [3], the proportion of monthly transactions in the first eight months of DeFi-like DApp remained stable at around 21.14%. However, from a micro perspective, the number of transactions in Ethereum in March and April has continued to increase significantly, while the growth rate of DeFi transactions has not been synchronized with the overall. The month-on-month decline in August transactions may be related to only 23 days in August, but the lower 8 days of the month may reverse the negative growth.

The month-on-month increase in monthly activity, monthly transaction volume and monthly transaction volume actually point to a possibility that even the DeFi-like DApp has become the dominant type of DApp in Ethereum, and it maintains a good growth trend itself, but It does not have a decisive role in promoting the overall ecology of Ethereum. It is even worth noting that the transaction volume and number of transactions in the DeFi-like DApp have dropped significantly from the peak in June.

o 3

DeFi becomes the main "supply source" for new users

So what does DeFi mean for the Ethereum ecosystem?

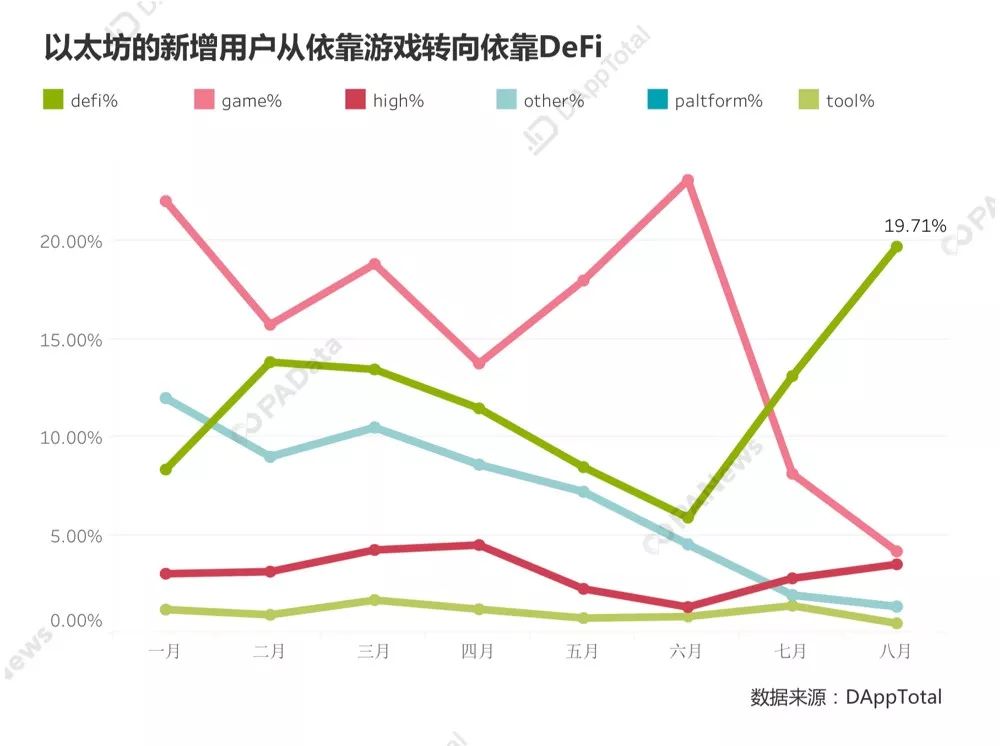

From the data point of view, DeFi's biggest contribution is to provide new users for Ethereum Ecology. At present, in the first 8 months, the average monthly user of DeFi DApp [4] is about 25,500 person-times. In August, the number of new users in incomplete statistics (as of August 23) has reached 81,900. The address is regarded as a new person), accounting for 19.71% of the total ecological new users. It is the largest “supply source” for the new Ethereum eco-users and far ahead of other types of DApps.

Before DeFi, the game has always been the competitive advantage of Ethereum's ecological differences, and dominated the ecology of Ethereum, but in August, incomplete statistics (as of August 23), the number of new users of the game was only 17,300. It accounts for about 4.16% of the total, and the newly added volume is only about 68% of DeFi. Other types of DApps in the Ethereum ecosystem have lower number of new users. For example, the high-risk DApp August incomplete statistics (as of August 23) has about 14,500 new users, accounting for about 3.5%. There are about 0.56 million new users, accounting for about 1.35%.

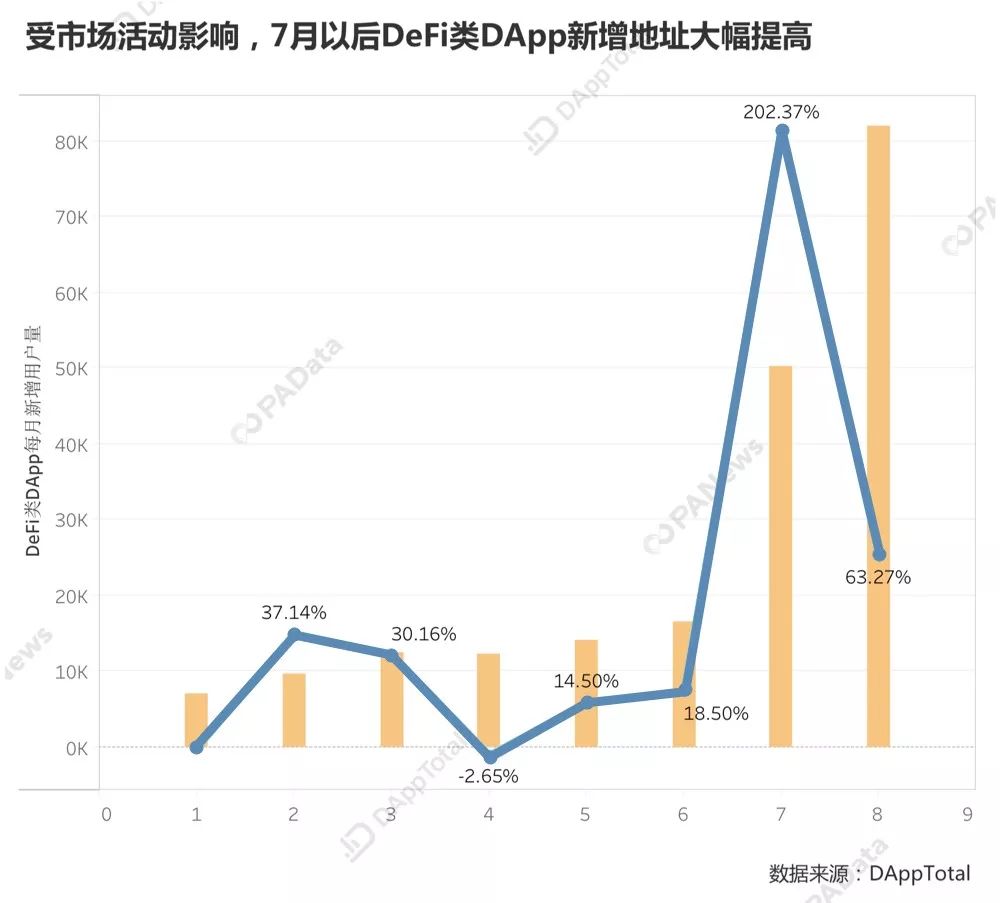

Nearly 20% of new users in Ethereum are from DeF-like DApps, but a more important trend is that DeFi's popularity has changed the pattern of new users in Ethereum. From July, DeFi has become an etheric game. The largest new user "source". However, before July, the concept of DeFi has been heated up. The number of new users has not ushered in explosive growth. The average month-on-month increase in May and June was only 16.5%. The month-on-month increase in July suddenly broke out. Amazing 202.37%, why is this?

According to PAData's earlier observations, this change may be related to Coinbase's activities. According to the Block's earlier reports, the DAI campaign launched by Coinbase Earn on July 26 has promoted the creation of more than 14,000 CDPs. 40% (refer to the "Ethernet DeFi loan status: Maker into the "Central Bank" user financial needs are booming).

The data proves that marketing activities can effectively promote the growth of new users, and this impact may be sustained and diffuse. According to statistics, in August, incomplete statistics (as of August 23), the increase in new users has reached 63.27%, which means that either the activity is still going on, or other applications have also launched to attract new users. Activities, DeFi's new user base continues to expand.

[1] The monthly activity is equal to the average of the daily daily activities of the whole month, and the average monthly activity can be regarded as the average daily daily activity within the statistical time range.

[2] The monthly transaction amount is equal to the arithmetic mean of the daily trading amount of the whole month, and the average monthly transaction amount can be regarded as the average daily transaction amount within the statistical time range.

[3] The number of transactions per month is equal to the average number of daily transactions per month.

The new user in [4] month is equal to the average of the number of users added daily for the whole month.

Text & Data | Carol ; Design | Tina ; Editorial | Tong

Data Support | DAppTotal ;Source | PANews.io

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- To save $1.7 billion, Telegram will release the TON blockchain code on September 1.

- Is the development of Ethereum opening a new direction? Hyperledger announces the acceptance of the first public Ethereum blockchain project Pantheon

- Recommend a "back door" wallet software, stealing nearly 200 bitcoin, he was sentenced to 5 years

- $8.5 million! US Securities and Exchange Commission fines fraud

- PNC, the eighth largest banking company in the US, began using RippleNet for cross-border payments

- Opinion: Why is the price of Bitcoin not important?

- ConsenSys latest report: 2019 Stabilization currency status