Exploring the current development status of LSD stablecoins field

Exploring the current status of LSD stablecoinsAuthor: Ben Wee, medium Translation: Blocking, Good Europe

Today, we will explore LSD-backed stablecoins, which provide holders with the opportunity to avoid loss costs and earn income, while also preserving the key properties of stablecoins.

Stablecoins

Stablecoins are a type of cryptocurrency whose value is pegged to an external reference asset (such as another currency, commodity, or financial instrument). As a non-volatile asset, stablecoins are useful as a medium of exchange because their value fluctuates less relative to the reference asset.

- Opportunities and Reflections on Ethereum Block Space in the Future

- Introduction to Aave Cross-chain Communication Abstraction Layer a.DI

- Exploring the Complexity of the LSD Stablecoin Protocol: What are Its Characteristics and Risks?

Some well-known examples of stablecoins:

Dollar: Tether ($USDT), USD Coin ($USDC), Dai ($DAI), LUSD ($LUSD), Frax ($FRAX)

Euro: Euro Tether ($EURT), Euro Coin ($EUROC), Angle EUR ($AGEUR)

Gold: Blockingx Gold ($BlockingXG), Tether Gold ($XAUT)

Given the US dollar’s status as the world’s reserve currency, we naturally see that USD stablecoins occupy the majority of the stablecoin market share.

Stablecoin market overview

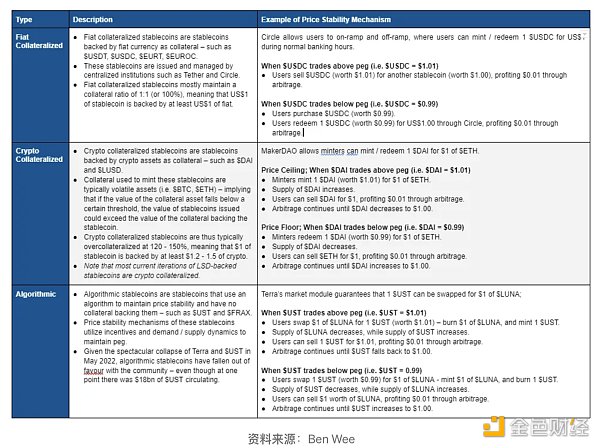

Stablecoins can be broadly divided into three categories: 1) fiat-backed stablecoins, 2) cryptocurrency-backed stablecoins, and 3) algorithmic stablecoins. These stablecoins differ in issuance method, collateral ratio, underlying assets supporting stablecoins, and price stabilization mechanisms.

How do stablecoin issuers handle collateral?

When users mint collateralized stablecoins by depositing fiat or cryptocurrency with the issuer, the issuer can use these collateral to generate revenue. Here are some of the major issuers’ approaches to these collaterals.

Circle / $USDC: $27 billion in reserve

Circle publishes the value confirmation of its collateral reserve every month, audited by Deloitte. According to the May 2023 value confirmation, we can see that most of the reserve is used for <3-month US Treasury bonds and US Treasury repurchase agreements, providing overnight cash lending to global financial institutions.

Tether / $USDT: $83 billion in reserves

Tether publishes the confirmation of the value of its collateral reserves quarterly, audited by BDO. According to the Q1 2023 value confirmation, it can be seen that the reserves are primarily invested in US treasury bonds and include some other less liquid assets, such as money market funds, corporate bonds, precious metals, Bitcoin, other investments, and secured loans.

Maker / $DAI: $4.5 billion in reserves

As part of Maker’s “Endgame” plan, Maker hopes to allocate its $4.5 billion in reserves to various yield-generating strategies, with guidance from external asset management firm Monetalis. They have taken some strategies:

-

Sell and buy up to $1.2 billion in US treasury bonds

-

Deposit up to $1.6 billion of $USDC into Coinbase Prime and earn 1.5% interest

Advantages of LSD-backed stablecoins

One common theme observed through the above examples is that the income generated by these yield-generating strategies is recorded as income for the issuer, benefiting the issuer’s equity or governance token holders. Stablecoin holders have no right to these earnings, meaning that holding stablecoins incurs an opportunity cost, as they could have put their funds into their own yield-generating tools. In today’s rising rate environment, this opportunity cost is around 5.5% for a 3-month US treasury bond.

Compared to Circle, this asset allocation seems to be more risky, as the reserves need to have high liquidity to fulfill redemption obligations in the event of a bank run. There have also been speculations about whether $USDT is truly backed and concerns about the quality of Tether’s asset composition.

As we see the upgrade of Ethereum Shanghai and the transition of Ethereum from PoW to PoS, we see an increased interest in Liquid Staking Derivatives (LSDs) — holding LSDs allows people to earn yield paid in Ethereum ($ETH) and have the ability to swap their LSDs for $ETH.

Introducing LSD-backed stablecoins provides holders with the opportunity to earn yield and avoid opportunity cost, while also preserving the key attributes of stablecoins.

# LSD-Supported Stablecoin Competition LandscapeBelow are the main competitors in the LSD stablecoin space. It should be noted that most LSD stablecoins are currently collateralized by cryptocurrencies.## Lybra Finance ($LBR/$eUSD) – launched- Developing $eUSD, an interest-bearing stablecoin backed by $stETH.- Current circulating supply of $eUSD is $176 million.- Minting: Mint using $ETH or $stETH collateral with a collateralization ratio of greater than 150%. Lybra will convert any $ETH collateral to $stETH.- Revenue stream: Collateral earns approximately 6% collateral yield per year in $stETH.- Price stability: Redemption mechanism creates a “price floor,” and a minimum collateralization ratio of 150% creates a “price ceiling.”- Other observations: Trading price of $eUSD consistently maintained a premium of approximately $1.05, meaning $eUSD holders do not redeem $eUSD even if arbitrage opportunities exist. This may be because $eUSD holders earn yield on holding $ETH.## Raft (n.a./$R) – launched- Developing $R, an interest-bearing stablecoin backed by $stETH and $rETH.- Current circulating supply of $R is $30 million.- Minting: Mint using $stETH or $rETH collateral with a collateralization ratio of greater than 120%.- Revenue stream: Collateral earns approximately 6% collateral yield per year in $stETH or $rETH.- Price stability: Redemption mechanism creates a “price floor,” and a minimum collateralization ratio of 120% creates a “price ceiling.”## Ethena – testnet- Implementing a risk-free stablecoin envisioned by Arthur Hayes in his March 2023 blog post “Dust on Crust.”- Ethena’s collateral assets are held in the form of Ethereum LSD, similar to long-term spot positions. Achieves delta neutrality by shorting $ETH perpetual contracts on centralized exchanges.- Minting: Mint using any Ethereum LSD with a collateralization ratio of 1:1.- Revenue stream: Collateral earns approximately 6% collateral yield per year in Ethereum LSD. Also earns revenue in the form of funding rate by shorting 1x $ETH perpetual contract on centralized exchanges.- Price stability: Achieves stability by holding long-term Ethereum LSD spot positions and shorting $ETH perpetual contracts on centralized exchanges to achieve delta neutrality.

Prisma Finance – Testnet

-

Prisma Finance is building $acUSD, an interest-bearing stablecoin backed by Ethereum LSD. The contract is based on Liquity and is immutable and upgradable.

-

Minting: overcollateralized minting using any of the 5 Ethereum LSDs authorized by the whitelist: $stETH, $cbETH, $rETH, $frxETH, $bETH.

-

Revenue source: collateral is held in the form of Ethereum LSD, generating approximately 6% collateral revenue per year.

-

Price stability: the redemption mechanism forms a “price floor” while the minimum collateralization ratio for each asset forms a “price ceiling”.

-

Other observations: has veTokenomics functionality where users can lock $PRISMA to obtain $vePRISMA, LSD issuers can incentivize users to use their LSD to mint $acUSD. Ultimately expected to build a Convex-like protocol on top of Prisma.

Summary

The LSD space is rapidly evolving, especially with new innovations in LSD stablecoins on the horizon. Expect to see new developments rolling out post-Shanghai upgrade.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- “Human flesh search” tool? Founder connected to CIA? Arkham accused of privacy breach.

- Exploring ZK/Optimistic Hybrid Rollup

- The Hidden Concerns of MakerDao, Not Just Exposures to RWA

- Ethereum 2023 Q2 Data Research: Gross Profit of $700 million, ETH Burn Rate Accelerates from 0.3% to 0.8%

- Fei team faces collective lawsuit, never expected to see a court account on Discord one day.

- Crash and Reshape: Drawing Lessons from the History of the Gaming Industry and Looking Forward to the Future of NFTs

- Court takes over Discord community? A brief recap of the Fei team’s collective lawsuit event.