Exclusive Interview with Connext Adopting a Points Mechanism to Determine the Number of User Airdrops, with Plans to Expand to 20 Chains by the End of the Year

Connext plans to expand to 20 chains by the end of the year, and will adopt a points mechanism to determine the number of user airdrops.The encryption project has recently ushered in the airdrop season. After Cyber and Sei announced their airdrops, the blockchain interoperability protocol Connext also announced the launch of its native token NEXT and will use 10% of the total supply for airdrops. The claim for NEXT tokens will start from September 5th, and early users will be eligible for the airdrop.

In fact, Connext is an “old-timer” in the encryption industry, established in 2017 as an early-stage blockchain project. Before founding Connext, co-founder Arjun Bhuptani had started a crowdfunding platform. According to Crunchbase data, Connext has gone through 8 rounds of financing and has received investments from organizations such as the Ethereum Foundation, ConSensys Ventures, Polychain, 1kx, Polygon Ventures, eGirl Capital, A.Capital Ventures, No Limit Capital, Coinbase Ventures, and Hashed.

Over the past 6 years, Connext has made multiple adjustments to its business due to changes in the market environment. In the early stages of Connext’s establishment, purchasing and using cryptocurrencies was difficult. From May 2017 to January 2018, Connext focused on how to use credit cards to purchase cryptocurrencies.

With the rise of ICOs and the surge in transaction volume brought by games such as CryptoKitties, the team realized that the key issue to address is the need for sufficient scalability in blockchain to meet user demands. Therefore, Connext’s focus shifted towards Ethereum layer 2 scaling solutions – state channels, which can also solve payment problems.

- LianGuai Daily | Grayscale Wins Lawsuit Against the US SEC; Ethereum Foundation Launches Ethereum Execution Layer Specification

- In-depth conversation with Sui, Chief Scientist of Mysten Labs How does Sui solve the problem of network scalability from theory to practice?

- Friend.Tech frenzy subsides daily trading volume drops by 90%, Base network returns to rationality

However, encrypted payments did not become widespread as expected during that time. Ethereum scaling solutions using Rollup technology came out on top in the competition, and there was little interest in state channel solutions. Subsequently, Connext shifted its business focus to the current interoperability protocol.

What has Connext been through over the years? What is the difference between it and other cross-chain protocols? When designing the airdrop rules, what factors were considered? In an interview with LianGuaiNews, Max, the growth lead of Connext, introduced that Connext is a layer that allows interaction with all Rollups and is the only cross-chain solution that does not add new trust assumptions on the connected blockchains. It enables developers and their xApps to access any smart contract, liquidity, and data on any chain, unifying the fragmented ecosystem. With Connext, users can interact with dApps on any chain, using any token, without leaving the dApp’s UI – regardless of where the dApp is deployed.

Regarding the airdrop mechanism, Connext stated that it uses a scoring system to determine the amount of NEXT that users can receive. This scoring criterion takes into account stableswap liquidity provision and cross-chain bridge usage, giving the highest scoring rewards to users who continue to use Connext stably.

After the DAO launch and token release, Connext will focus on expanding to 20 L2 chains by the end of the year to grow the protocol and ecosystem.

Here is the full interview:

LianGuaiNews: Connext was founded in 2017. Could you share the major milestones and development stages that Connext has gone through in these years? Why did you consider transitioning from state channels to the current interoperability protocol?

Max: Connext is the first bridge that connects Arbitrum and Optimism without trust.

Connext is a team that launched together with SLianGuainkchain on the mainnet. It is a trust-minimized L2 system built without specific use cases in mind.

State channels are very limited in functionality, and P2P encrypted payment space did not gain as much popularity as expected. Instead, the ecosystem shifted towards DeFi protocols like Uniswap that interface with contracts.

Therefore, our new architecture allows for the transfer of any type of message across chains. This enables developers to create cross-chain applications where dApps can interact with any smart contract on any chain.

LianGuaiNews: When we talk about cross-chain bridges and cross-chain message passing, there are already several important players in the market. What do you think is the core competitive advantage of Connext?

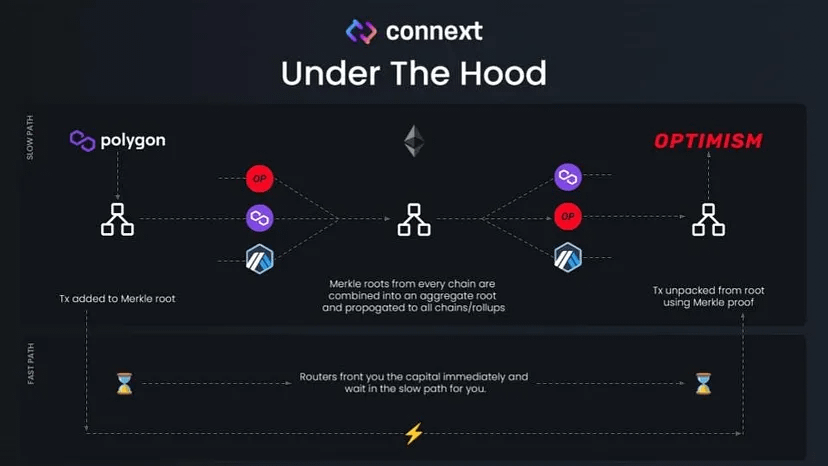

Max: Connext is the only solution that does not introduce new trust assumptions on the connected blockchains. By directly connecting to the native bridge of the chain (think Arbitrum-Ethereum bridge), Connext eliminates the need for any oracle or external validator set: these third parties are the weak link in communication when they exist, as they can be bribed, hacked, or compromised.

LianGuaiNews: There have been security incidents in the cross-chain field multiple times. How does Connext ensure the security of its protocol?

Max: In addition to our trust-minimized infrastructure, we have multiple teams managing and operating monitoring networks, as well as multiple audits and an open bug bounty program. When these monitors detect any potential malicious attempts, they can halt specific blockchains connected to Connext.

LianGuaiNews: How is the modular general message passing achieved in Connext?

Max: By creating a modular stack, we can plug in the most secure and trust-minimized transport and validation layers.

What this means now is that Connext can transfer assets across different chains (using the “NextAssets” open cross-chain standard), and developers can create any cross-chain application for any use case. For example, cross-chain lending (Fuji Finance) where assets can be deposited on one chain and borrowed on another.

LianGuaiNews: Could you explain what “chain abstraction” means in the context of Connext? How is it achieved, and what key role does it play?

Max: Chain abstraction, similar to account abstraction, is a pattern that improves the dApp user experience by minimizing the need for users to care about the chain they are on.

With Connext, users can interact with dApps from any chain, using any token, without leaving the UI of the dApp – regardless of where the dApp is deployed. This eliminates the need for users to switch networks, sign transactions on different chains, or spend gas on another chain. Users can now interact with dApps from any supported chain.

For web3 experience, this is a real revolution where users no longer need to consider the blockchain, effectively abstracting the technical stack. Similar to how users in web2 do not need to consider servers and storage when using websites, now users can do the same in web3 – they just need to focus on their experience in the dApp!

For example, Fjord (an LBP platform that enables decentralized auctions during token launches) allows its users to purchase tokens from any chain, and the bridging experience is completely abstracted for the users, so they never have to leave the Fjord website. Prode, a decentralized betting platform built on Gnosis Chain, can now accept bets from any other chain through integration with Connext.

LianGuaiNews: The Connext ecosystem has many xApps built on top of it. How does Connext help these ecosystem projects achieve unique functionalities? Can you provide specific examples?

Max: Connext enables developers and their xApps to access any smart contracts, liquidity, and data on any chain – this unifies the fragmented ecosystem. With 1000+ Rollups coming online, Connext is the layer that allows all these ecosystems to interact.

The simplest use case is cross-chain transactions (e.g., Metamask integrates Connext to allow token swaps between any tokens on any chain).

Another use case is the ability to create cross-chain assets: these assets can move seamlessly and instantly between any chains using the security of Connext, and Alchemix is the latest integrator.

More complex use cases involve the ability for Connext to pass any data to the target chain and receive callbacks on the source chain, enabling new types of interactions. For example, Keep3r Network uses Connext to create trust-minimized cross-chain oracles, Superfluid can create cross-chain token streams, and Fuji Finance is used for cross-chain lending. In collaboration with Gnosis Guild, we have created a tool for executing DAO governance proposals across any chain.

LianGuaiNews: Crunchbase data shows that Connext has gone through 8 rounds of financing and has received support from institutions such as the Ethereum Foundation. How have investment institutions helped and influenced your team?

Max: We have always received strong support from all investors and institutions (Polychain, 1kx, etc.) and angel investors. They are believers in our vision and values, and having them by our side is truly great.

LianGuaiNews: Connext recently announced the governance token. When formulating the airdrop rules, what considerations did your team primarily take into account to ensure fairness and effectiveness?

Max: NEXT, the Connext network’s xERC20 (cross-chain native) token, implements fair adoption and governance within the Connext network. At launch, NEXT is used to govern the Connext DAO, an organization responsible for allocating funds for the ongoing development of the protocol.

The true decentralization and permissionless operation of the Connext protocol are achieved by solidifying the repeatable governance process and directly embedding it into the underlying protocol. This process is referred to as “Ungovernance”.

The NEXT airdrop will be conducted through a groundbreaking mechanism that allows eligible recipients to claim NEXT tokens on the blockchain of their choice without the need for cross-chain bridges or unnecessary gas fees.

We have implemented a scoring system to determine the amount of NEXT tokens each recipient can receive. Our scoring criteria take into account stableswap liquidity provision and cross-chain bridge usage, with the highest score rewards given to users who demonstrate continuous and stable usage.

LianGuaiNews: What plans and arrangements does Connext have for the future in terms of technology and ecosystem development?

Max: After the launch of our DAO, we will focus on expanding to 20 L2 chains by the end of the year to grow the protocol and ecosystem, and support hundreds of builders who have already created revolutionary xApps. We have also established partnerships with key players in the field, which will drive exponential growth for Connext in the near future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Explaining Zeth, the Ethereum Block Validator The First Type 0 zkEVM

- No matter how much emphasis is placed on it (1) 10 steps to ensure the security of encrypted assets

- From now on, will OP and Base become ‘family’? Maybe not, discussing the variables and prospects of superchain cooperation.

- Binance Research In-depth Study of Decentralized Sorters

- Dida Chain The ‘AMM Moment’ of Full-chain Gaming

- Exploring THORChain’s lending module Revealing the hidden impact of Terra LUNA.

- Interpreting the Road to Web3 Gold Mining in the Central African Republic