Friend.Tech frenzy subsides daily trading volume drops by 90%, Base network returns to rationality

Friend.Tech frenzy subsides, daily trading volume drops 90%, Base network returns to rationality.Author: BeInCrypto

Translation: Felix, LianGuaiNews

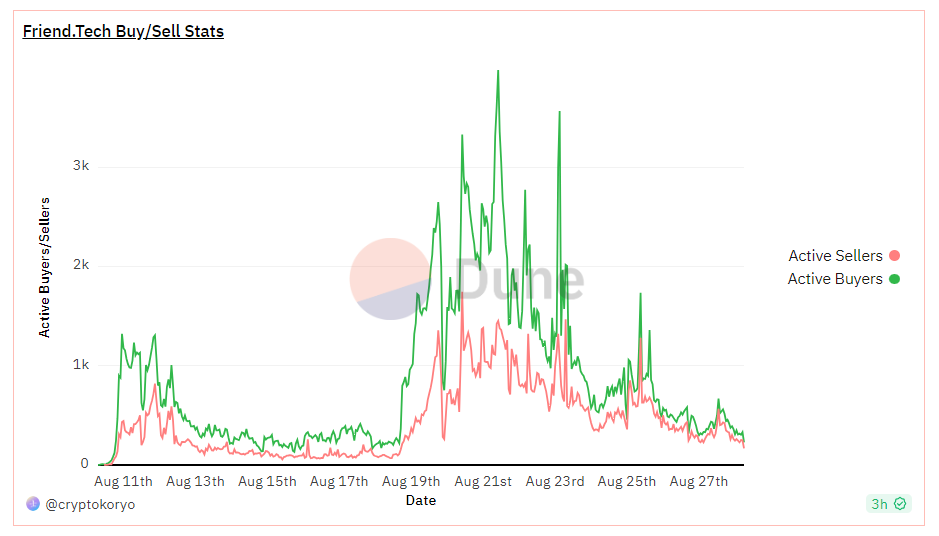

Just as several cryptocurrency industry analysts predicted, the rise and fall of the social protocol Friend.Tech has been just as rapid. After dominating the headlines of the crypto media for a consecutive week, Friend.Tech’s network activity has significantly declined.

- Explaining Zeth, the Ethereum Block Validator The First Type 0 zkEVM

- No matter how much emphasis is placed on it (1) 10 steps to ensure the security of encrypted assets

- From now on, will OP and Base become ‘family’? Maybe not, discussing the variables and prospects of superchain cooperation.

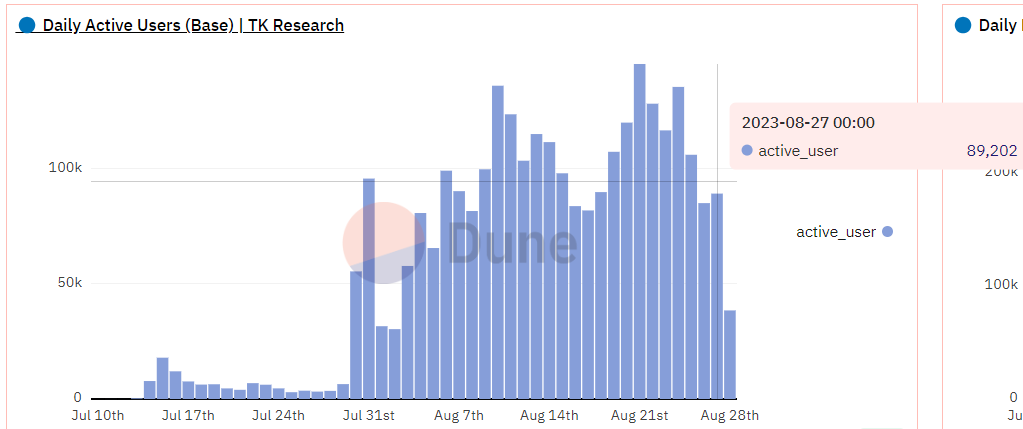

Data source (as of August 28th): Dune

Friend.Tech Daily Transaction Volume Drops by 77%

Although the idea of “SocialFi” or “DeSo” platforms allowing users to buy and sell certain X (formerly Twitter) accounts and social media shares is novel, it seems that the protocol is declaring failure as Friend.Tech buyers and sellers are leaving the platform, and share sales have plummeted.

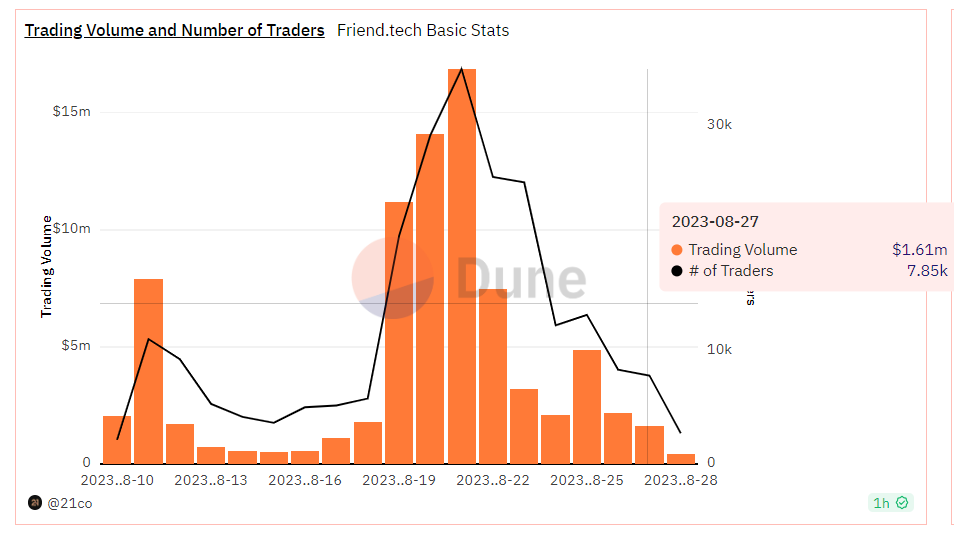

According to data from Dune Analytics, Friend.Tech’s daily trading volume has dropped by 90.4% since reaching its peak of $16.9 million on August 21st, with the daily trading volume on August 27th plummeting to only $1.61 million. Additionally, the number of daily traders has dropped from a peak of 35,000 to only 7,850 on August 27th, a decrease of approximately 77.57%.

(As of August 28th)

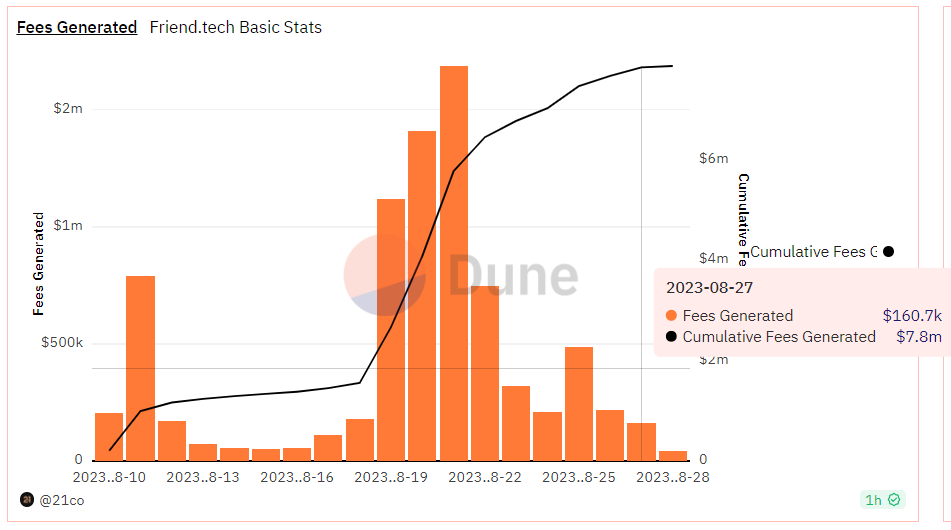

Friend.Tech’s network fees have also decreased from $1.7 million on August 21st to $160,000 on August 27th.

(As of August 28th)

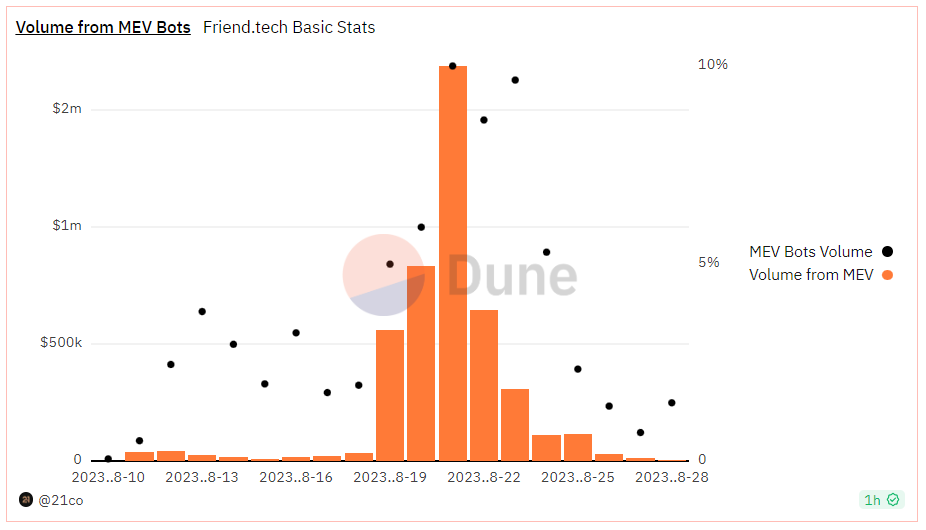

In fact, since last week, all metrics of the platform, from trading to MEV bots to new traders, have decreased by over 80%.

(As of August 28th)

In addition, industry research company Messari has reported the downsides of Friend.Tech, including high transaction fees, slow loading times, and steep pricing curves.

Impact on Base

The bots have also infiltrated the Base network, causing a surge in transaction volume and front-running. This platform has been a huge driver for Base, with TVL and activity on the Base network surging last week. According to L2beat data, Base network activity briefly surpassed that of the Ethereum network on August 21st.

However, the downward trend of Friend.Tech has led to a significant drop in Base transactions and activity, with daily active users dropping to 89,202 on August 27th.

(Data Source: Dune)

Ryan Wyatt, former president of Polygon Labs, said last week that in its current form, Friend.Tech is basically seen as an unexpected Ponzi scheme with no product features to create user stickiness.

In addition, it appears that someone is creating fake accounts to revive Friend.Tech. Cryptocurrency KOL icebergy said, “It’s sad to see developers attracting newcomers to this field through speculation.”

Most of the newcomers attracted by Friend.Tech come from the adult social media platform OnlyFans (note: most creators on OnlyFans are amateur and professional adult models). According to Decrypt, as Friend.Tech launches new photo features, more and more content creators from OnlyFans are flocking to the encrypted application Friend.Tech. Among the popular accounts on Friend.Tech, JenfoxxUwU ranks 13th and is priced at 0.87 ETH, while JenfoxxUwU’s monthly subscription fee on OnlyFans is only $3.75.

In addition, according to OnlyFans’ financial report, OnlyFans has been investing in Ethereum (note: according to OnlyFans’ financial report, OnlyFans has invested $19.889 million in ETH). As OnlyFans continues to delve deeper into the crypto field, it seems that more OnlyFans creators may enter the crypto field, increasing the speculative nature of Friend.Tech.

Related reading: Understanding friend.tech’s data: its impact on Base, MEV activities, and profitability.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Binance Research In-depth Study of Decentralized Sorters

- Dida Chain The ‘AMM Moment’ of Full-chain Gaming

- Exploring THORChain’s lending module Revealing the hidden impact of Terra LUNA.

- Interpreting the Road to Web3 Gold Mining in the Central African Republic

- Quick look at the Jackson Hole annual meeting Powell maintains possibility of raising interest rates, Lagarde says rates will be kept at necessary high levels to control inflation.

- LianGuai Daily | Hong Kong police take action against money laundering activities, including cryptocurrencies; Social platform OnlyFans has purchased about $20 million worth of ETH.

- Weekly Preview | Hong Kong Exchange HashKeyExchange begins to serve retail investors; Optimism and Hedera will unlock tokens worth tens of millions of dollars