LianGuai Daily | Grayscale Wins Lawsuit Against the US SEC; Ethereum Foundation Launches Ethereum Execution Layer Specification

Grayscale wins lawsuit against US SEC; Ethereum Foundation launches Ethereum Execution Layer SpecificationToday’s headlines:

Grayscale wins lawsuit against the US SEC

Shanxi police dismantle a “money laundering” criminal gang that used gold and virtual currency for fencing, involving a total of 135 million yuan

OpenSea announces the “redeemable NFT” open standard and plans to launch other products based on this standard

- In-depth conversation with Sui, Chief Scientist of Mysten Labs How does Sui solve the problem of network scalability from theory to practice?

- Friend.Tech frenzy subsides daily trading volume drops by 90%, Base network returns to rationality

- Explaining Zeth, the Ethereum Block Validator The First Type 0 zkEVM

Twitter obtains Currency Transmitter license in Rhode Island, USA

Ethereum Foundation officially launches Ethereum Execution Layer Specification (EELS)

BNB Smart Chain has completed network upgrade and hard fork, and deposit and withdrawal functions have been restored

EOS tokens approved in Japan, will be able to trade with the yen on locally regulated exchanges

Grayscale GBTC daily trading volume reaches the highest level since the cryptocurrency market crash in June 2022

Regulatory News

The US SEC accuses Los Angeles entertainment company ImLianGuaict Theory of issuing NFTs without registration

The US Securities and Exchange Commission (SEC) today charged Los Angeles-based media and entertainment company ImLianGuaict Theory, LLC with conducting an unregistered offering of crypto asset securities in the form of so-called non-fungible tokens (NFTs). ImLianGuaict Theory raised approximately $30 million from hundreds of investors, including investors from across the United States, through this offering.

From October 2021 to December 2021, ImLianGuaict Theory offered and sold three tiers of NFTs, referred to as Founder’s Keys, which ImLianGuaict Theory described as “Legendary,” “Heroic,” and “Relentless.” ImLianGuaict Theory encouraged potential investors to view their purchase of Founder’s Keys as an investment in the company and stated that investors would profit from the purchase if ImLianGuaict Theory’s efforts were successful. The SEC determined that the NFTs offered and sold to investors were investment contracts and therefore securities.

Without admitting or denying the SEC’s findings, ImLianGuaict Theory agreed to the issuance of a cease-and-desist order finding that it violated the registration provisions of the Securities Act of 1933 and ordering it to pay disgorgement of over $6.1 million in ill-gotten gains, prejudgment interest, and civil penalties. The order also establishes a fair fund to return funds paid by harmed investors for the purchase of NFTs. ImLianGuaict Theory agreed to destroy all Founder’s Keys it owns or controls, to post order notices on its website and social media channels, and to eliminate any royalties it may receive from future secondary market transactions involving the Founder’s Keys.

Chair of the US House Financial Services Committee writes a letter to Powell, condemning the Federal Reserve for undermining the clarity of stablecoin payment legislation

Patrick McHenry, Chairman of the House Financial Services Committee, wrote a letter to Federal Reserve Chairman Jerome Powell, stating that the recent supervisory and regulatory letters (SR 23-7 and SR 23-8) from the Federal Reserve undermine the progress made by Congress in establishing a regulatory framework for stablecoin payments, and will undoubtedly prevent financial institutions from participating in the digital asset ecosystem. Representatives French Hill and Bill Huizenga wrote in the letter, “By issuing these regulatory letters, the Federal Reserve is preventing banks from issuing stablecoins or participating in the stablecoin ecosystem. The regulatory framework established by Congress will better protect consumers and provide certainty for market participants, and this understanding led to the introduction of the Clarity for Payment Stablecoins Act. However, less than two weeks later, the Federal Reserve issued SR 23-7 and SR 23-8 without collaborating with Congress to establish a viable mechanism.”

Later, news came that Hester Peirce, a commissioner of the U.S. Securities and Exchange Commission (SEC), opposed the SEC’s enforcement actions against NFTs.

The SEC has filed a sealed motion against Binance

The U.S. Securities and Exchange Commission (SEC) has submitted a sealed motion to the District Court for the District of Columbia, requesting the court to allow it to submit certain sealed documents. Although the specific content of the documents is not disclosed, this may indicate that the SEC is preparing to further disclose its charges and evidence against Binance.

Earlier, on June 5th, the SEC sued Binance and Changpeng Zhao for violating U.S. securities rules.

The U.S. Department of Justice: All expert witnesses proposed by SBF should be banned from testifying

According to CoinDesk, U.S. prosecutors stated in a document submitted on Monday evening that all witnesses proposed by FTX founder Sam Bankman-Fried (SBF) should be disqualified from testifying because their disclosure documents are insufficient, their expertise may be misleading, or their planned testimony may be irrelevant. The expert witnesses proposed by SBF and opposed by U.S. prosecutors include British lawyer Lawrence Akk, Thomas Bishop and Joseph Pimbley from different consulting companies, data analysis and forensic expert Brian Kim, law professor Bradley Smith from Capital University Law School, and assistant professor Andrew Di Wu from the University of Michigan. These witnesses disclosed their fees for providing testimony, stating that their time and services are billed hourly, ranging from $400 to $1,200 per hour.

SBF’s team hopes to exclude the financial analyst Peter Easton proposed by the Department of Justice, as his proposed testimony may not be allowed according to the rules. These documents are part of the so-called Daubert motion (motion for expert witness evidence) submitted on Monday, which lists the views of both teams on why certain witnesses cannot be summoned to testify when SBF is to be tried for various fraud and conspiracy charges in over a month.

NFT

The multi-chain NFT marketplace BlueMove will cease operations on the Sei network on August 31st.

The multi-chain NFT marketplace BlueMove on the Aptos and Sui blockchains has announced that due to lower than expected trading volume on Sei, BlueMove will cease operations on the Sei network 72 hours from now (12:00 Beijing time on August 31st). During this time, all users are advised to remove their NFTs to prevent any potential asset loss.

JJ Lin has used a newly customized Stellar NFT as his digital identity and has also used it as his X account avatar.

JJ Lin posted on the X platform, stating, “I am very excited to launch my brand new custom Stellar NFT, which is a digital identity that resonates with me on a whole new level.” In addition, he has changed his X account avatar to this NFT image.

Earlier in July last year, JJ Lin joined the Singapore “Web2.5” NFT community ARC as a co-founder.

Artificial Intelligence

OpenAI releases ChatGPT Enterprise Edition: Unlimited access to GPT-4, enhanced security and privacy

According to IT Home, OpenAI has released a new product called ChatGPT Enterprise Edition, specifically designed for the needs of enterprise users, providing enhanced security and privacy. In their blog post, OpenAI states that ChatGPT Enterprise Edition not only offers unlimited and rapid access to the powerful GPT-4 model but also enables deeper data analysis to help enterprises quickly understand information and pose more complex questions to ChatGPT.

Many enterprises are concerned about their data being used to train the GPT-4 model or accidentally leaking sensitive customer information when using this tool. To address these concerns, OpenAI states that users of ChatGPT Enterprise Edition have full control and ownership of their own data, which will not be used to train the GPT-4 model. Additionally, OpenAI plans to introduce more features, such as allowing users to customize ChatGPT’s knowledge of enterprise data and providing more advanced analysis tools. The company will also offer pricing plans for ChatGPT Enterprise Edition suitable for small teams.

OpenAI states that this is the first enterprise-oriented product of ChatGPT, separate from ChatGPT and ChatGPT Plus. Enterprises already using ChatGPT can choose to continue using the current product or switch to ChatGPT Enterprise Edition to enjoy the new features. OpenAI aims to onboard as many enterprise users as possible in the coming weeks.

Project Updates

Caixin: Hong Kong virtual asset exchange HashKey Exchange supports compliant account opening for “Hong Kong drifters”

According to Caixin, even if “Hong Kong drifters” from mainland China do not possess permanent residency in Hong Kong, as long as they have a Hong Kong resident identity card, can provide proof of a fixed address in Hong Kong, and have a Hong Kong bank account, they are eligible to open an account on HashKey Exchange. The platform will detect IP addresses and VPNs of users, and for compliant users holding Hong Kong permanent resident identity cards who conduct transactions in mainland China, they will be placed under monitoring status after being detected through network surveillance. HashKey currently has hundreds of thousands of pre-registered users and is expected to officially provide trading services to registered retail investors in September. The goal is to have a registered user base of 500,000 to 1 million people by 2023 (including local and overseas users) and reach 10 to 15 million users by the end of 2025.

Currently, there are four partner banks that can provide this service, including a Hong Kong issuing bank, two Chinese-funded banks operating in Hong Kong, and virtual bank Zhongan Bank. 98% of the digital assets on the platform are stored in an independent cold wallet system, with only 2% stored in a hot wallet. KPMG, PwC, and EY respectively conduct external independent audits, internal audits, and code audits for HashKey Exchange. The exchange cooperates with ON Insurance (AIA Insurance) to provide insurance for user assets, with 50% of cold wallet assets and 100% of hot wallet assets being guaranteed. The initial insurance coverage is around 500 million US dollars.

Prior to this news, HashKey is about to launch two trading pairs, MATIC/USD and AVAX/USD, targeting professional investors.

DCG has reached a preliminary agreement with Genesis creditors, with an expected recovery rate of 70%-90% for creditors.

According to CoinDesk, Digital Currency Group (DCG) has reached a preliminary agreement with Genesis creditors to resolve the claims raised in the Genesis bankruptcy. Based on the face value of the digital assets, the plan can provide 70%-90% recovery in US dollars or equivalent for unsecured creditors, and physical recovery of 65%-90%. All estimated recovery rates are subject to market prices and final documents.

In order to meet the existing liabilities of DCG’s unsecured loans of approximately 630 million US dollars due in May 2023 and unsecured promissory notes of approximately 1.1 billion US dollars due in 2032, both parties have reached a new partial repayment agreement, divided into two parts: a two-year loan of approximately 328.8 million US dollars and a seven-year loan of 830 million US dollars. Considering the partial repayment agreement due in May 2023, DCG will also pay 275 million US dollars in four installments.

Mantle Network plans to allocate 238 million US dollars to promote ecosystem development.

According to the governance page of Mantle Network, the Mantle community recently initiated a proposal to use the Mantle Treasury to promote ecosystem development. The specific contents include providing up to 160 million US dollars in liquidity support for applications, providing up to 60 million US dollars in seed liquidity for RWA-backed stablecoins, and providing up to approximately 18 million US dollars in liquidity support for third-party cross-chain bridges.

Reuters: SBF appeals detention decision by the court.

According to Reuters, SBF’s lawyer has appealed the decision to detain him by the judge before the trial. The trial against SBF will take place on October 3 in the Southern District of New York federal court, and US District Court Judge Lewis Kaplan will oversee the entire trial. Kaplan previously revoked SBF’s bail, stating that he attempted to interfere with witnesses at least twice. SBF is currently being held at the Metropolitan Detention Center in Brooklyn, and his lawyer has argued multiple times that this has hindered his preparation for the trial and violated his constitutional rights. SBF will stand trial on charges of telecommunications fraud, commodity fraud, securities fraud, money laundering, and related conspiracies.

The Wall Street Journal: Binance considering a complete exit from the Russian market.

According to The Wall Street Journal, Binance is reevaluating its business in Russia, including the possibility of completely exiting the market. A spokesperson said, “All options are on the table, including a complete exit.” Earlier, Binance announced on its Telegram channel that Binance P2P has banned Russian residents from using currencies other than the Russian ruble. Binance customers in Russia who reside overseas are also prohibited from using currencies such as rubles, euros, dollars, and Ukrainian hryvnias.

Optimism will transfer the initial OP tokens to Base on August 30th

According to official sources, Optimism announced that it will transfer the initial OP tokens to Base on August 30th. This is a planned transaction. Last week, Base and Optimism developers jointly announced a revenue sharing and governance sharing agreement. Base will pay 2.5% of its revenue or 15% of its profits to the Optimism Collective, whichever is higher. In return, it will receive “up to 118 million OP tokens.”

Founder of friend.tech apologizes for measures restricting users from switching to the clone version

Racer, the founder of the decentralized social protocol friend.tech, issued an apology statement, stating that the plan to restrict users from using the clone version of the application was based on “fear” and “zero-sum thinking.” Racer said, “I’m sorry. Fear made me tell you not to use other products, which is foolish. This is contrary to the crypto culture I interact with online every day. I know I have disappointed many of you. Live the way you want.”

Earlier, friend.tech announced that users who use the clone version of the application will automatically choose to opt out of earning points and lose existing points. This decision has sparked strong criticism from the community.

Coinbase: Fix implemented for some wallet assets showing a balance of 0, user funds are safe

Some Coinbase users reported on social media that their wallet Bitcoin balances showed 0. Coinbase later stated that some Coinbase wallet users may encounter errors when trying to create a new wallet or import an existing wallet. The cause of the problem has been identified and fixes have been implemented, and the team is monitoring the results. User funds are safe. Coinbase’s latest tweet states that the wallet error has been resolved, and balances can now be displayed correctly.

Web3 credential data network Galxe launches decentralized identity protocol Galxe Protocol

Web3 credential data network Galxe announced the launch of the decentralized identity protocol Galxe Protocol. Galxe Protocol is developed based on zero-knowledge proofs, providing developers with the opportunity to establish Sybil prevention algorithms, reputation systems, credit systems, personal data markets, and decentralized censorship systems. The core of Galxe Protocol consists of a series of smart contracts and SDK tools deployed on the chain, allowing developers to build and use these contracts to issue or verify off-chain credentials.

Velodrome to launch new DEX Aerodrome on Base network

According to The Block, decentralized exchange Velodrome will launch Aerodrome on Coinbase’s Layer 2 Base network. The newly launched DEX plans to incentivize users by airdropping its native Aero tokens. This airdrop will target existing users who have locked (or staked) Velodrome (VELO) tokens in exchange for project governance token veVELO. When Aerodrome is launched, 40% of the Aero token supply will be allocated as veAERO to veVELO holders.

Boba Network: BobaAvax will cease operation starting from October 31st, and users need to transfer their funds before then.

Boba Network, an Ethereum Layer 2 scaling solution, announced that BobaAvax on Avalanche will be shutting down and will no longer be available starting from October 31st. Users of BobaAvax or the BobaAvax application are required to transfer all their funds to the Avalanche mainnet before October 31st, otherwise they will risk permanently losing access to their assets on BobaAvax.

Sushi also released an announcement regarding this matter. Liquidity providers of BobaAvax on Sushi are required to take the following actions before October 31st: 1. Remove all existing liquidity from BobaAvax; 2. Transfer funds out of BobaAvax to ensure safety. Additionally, Sushi strongly advises against adding any new liquidity to BobaAvax. Failure to remove liquidity or transfer assets before the specified date may result in permanent loss of access to their assets on BobaAvax.

The Uniswap community has proposed the “Deploy V2 on all chains where a V3 specification instance exists” and is currently conducting a temperature check vote.

The Uniswap community has proposed the “Deploy V2 on all chains where a V3 specification instance exists” and is conducting a temperature check vote on this proposal. The proposal states that currently, the only specification deployment of Uniswap V2 is on the Ethereum mainnet, and there is demand for V2-style AMM on chains other than Ethereum. Many V2 forks have been deployed with varying degrees of modifications, and in terms of the extent to which these forks have been modified, they may be unsafe for users. If these forks have liquidity, this liquidity is likely to accumulate in Uniswap V2. In addition, integrating Uniswap V2 pools into a general router will help gradually improve the execution quality of applications that already use the router, allowing their users to make trades.

According to the proposal, chains with V3 deployments have passed the community’s auditing process and are eligible for V2 deployments by default. V2 deployments should be owned by the same contracts that have V3 deployments on their respective chains, and should be subject to the same cross-chain governance mechanism. V2 deployments should be cataloged in the text records of the new ENS subdomain v2deployments.uniswap.eth, which includes the bridge sender contract address and the UniswapV2Factory contract address on the target chain.

Currently, the support rate for this proposal is 97.31%. The temperature check vote will end on August 31st. If the temperature check vote passes, the on-chain vote for this proposal will be released on September 1st. If the on-chain vote passes, the proposal will be executed on September 12th.

The Curve community has passed the proposal “Remove the ±1.5% safety restriction on Chainlink price in crvUSD oracle.”

According to the Curve governance platform, the proposal “Remove the ±1.5% safety restriction on Chainlink price in crvUSD oracle,” initiated by Curve founder Michael Egorov, has passed the on-chain vote. In the proposal, Egorov stated that if the Chainlink price deviates too much (1.5%) from the internal oracle EMA, the data source of Chainlink will be used directly. However, when the market is extremely volatile, using the market spot price can lead to unnecessary losses.

Mining News

Canaan’s Q2 financial report: Total revenue of $73 million, mining revenue of $15.9 million

Jianan Yunzhi released its Q2 2023 financial report, which showed that the total revenue for Q2 was $73.9 million, a 33.7% increase compared to the $55.2 million in Q1 2023. Among them, mining machine sales revenue was $57.8 million, and mining revenue was $15.9 million. The company’s costs in Q2 were $143.9 million. The company holds 1,125 bitcoins and cash and cash equivalents of $66.1 million. The company expects total revenue of approximately $30 million for Q3 2023. The company’s total sales hash rate for Q2 2023 was 6.1 million TH/s, a 44.2% increase compared to Q1 2023.

Argo Blockchain Financial Report: Debt and net loss halved compared to the same period last year

According to Cointelegraph, Argo Blockchain’s mid-year financial report showed a net loss of $18.8 million for the first half of 2023, a decrease of over 50% compared to the net loss of $39.6 million in the same period last year. Argo also noted that by mid-2023, the company’s debt had decreased by $4 million, bringing the total debt to $75 million. Compared to the debt of $143 million in June 2022, the company has reduced its debt by $68 million. Argo’s revenue decreased by 31% compared to the first half of 2022. By mid-2023, Argo’s net revenue was $24 million, which is related to the decrease in the value of Bitcoin and the increase in global hash rate and network difficulty. Argo reported that a total of 947 bitcoins were mined in the first half of this year, only a 1% increase compared to the same period in 2022. It is worth noting that the global hash rate in 2023 has increased by 78%. As of June 2023, Argo’s balance sheet reflects $9.1 million in cash holdings and 46 bitcoins.

Important Data

The founder of Curve Finance has sold 160 million CRV tokens through OTC transactions this month, earning $64.26 million.

According to Dune Analytics, Curve Finance founder Michael Egorov has sold a total of 160 million CRV tokens through OTC transactions since August 1st. Based on the previous trading price of $0.4 per token, it is estimated to have earned $64.26 million.

In addition, DefiLlama data shows that in the CRV lending of Aave V2, there are 118.9 million CRV tokens with a liquidation price of $0.249 USDT, with a value of approximately $30 million. Coingecko data shows that the current price of CRV is $0.4879, with a 24-hour increase of 6.4%.

It is reported that Michael Egorov, in order to save his loans and possibly prevent a cascade liquidation in the entire DeFi field, has reached a series of OTC transactions with more than a dozen counterparties, selling a large amount of CRV in exchange for stablecoins to repay his debts. Egorov confirmed in a statement that buyers who violate the cooperation agreement will not be negatively affected, but he “believes they will” comply with the commitment of a 6-month lock-up period.

PeckShield: The fifth largest whale address holding over 94,000 bitcoins is controlled by the US government.

The blockchain security organization PeckShield stated in a post that the fifth largest whale address on the Bitcoin blockchain holds 94,643 BTC (worth about $2.46 billion). The seized address is believed to be under the control of the US government and is directly linked to the 2016 Bitfinex hack. On February 1, 2022, the address starting with 1CGA4 (controlled by the US Department of Justice) transferred approximately 567.5 BTC (worth about $21.88 million) to the seized address.

Earlier today, news broke that the deceased Prigozhin may have been the holder of the fifth largest Bitcoin wallet.

CoinShares: Net outflow of $168 million from digital asset investment products last week

According to CoinShares’ weekly report, there was a total net outflow of $168 million from digital asset investment products last week, marking the largest capital outflow since the US regulatory crackdown on exchanges in March 2023. The net outflow of Bitcoin investment products reached $149 million, and the outflow of Ethereum investment products was $16.8 million.

LianGuaiNews APP Points Mall officially launched

Hardcore prizes for free redemption: imKeyPro hardware wallet, First Class Research Report monthly card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research reports. First come, first served, experience now!

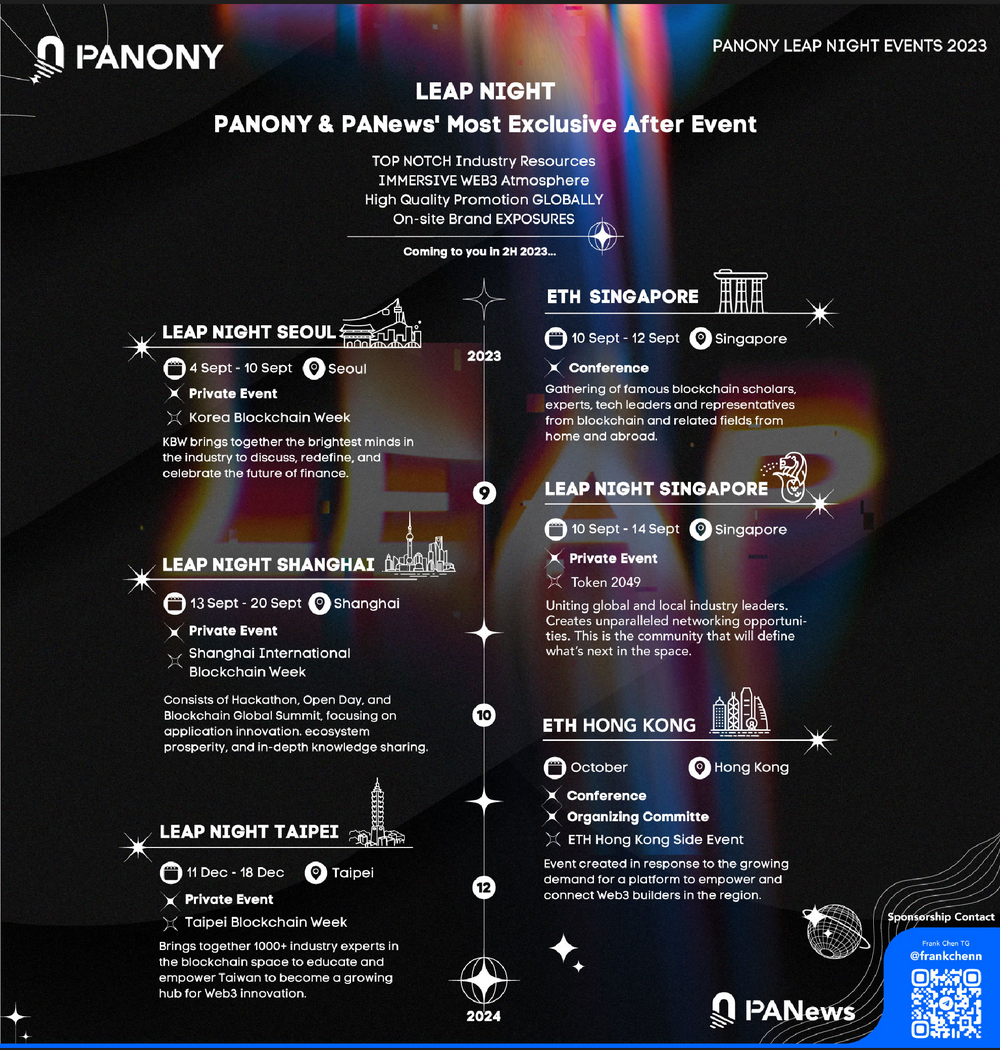

LianGuaiNews launches the global LEAP tour!

South Korea, Singapore, Shanghai, Taipei, multiple locations gathering from September to December, witnessing a new chapter in globalization!

📥Collaboration for events in multiple locations, welcome to communicate!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- No matter how much emphasis is placed on it (1) 10 steps to ensure the security of encrypted assets

- From now on, will OP and Base become ‘family’? Maybe not, discussing the variables and prospects of superchain cooperation.

- Binance Research In-depth Study of Decentralized Sorters

- Dida Chain The ‘AMM Moment’ of Full-chain Gaming

- Exploring THORChain’s lending module Revealing the hidden impact of Terra LUNA.

- Interpreting the Road to Web3 Gold Mining in the Central African Republic

- Quick look at the Jackson Hole annual meeting Powell maintains possibility of raising interest rates, Lagarde says rates will be kept at necessary high levels to control inflation.