Getting started with blockchain: Iceberg commission for big deals, find out

Produced|Baihua blockchain (ID: hellobtc)

In the case of large-scale trading of digital assets, market prices may be affected by the large amount of transactions, especially for digital assets with relatively poor liquidity. A large purchase order can be pulled.

Similarly, a large sell order can be sold. So, is there a way to complete large transactions without overly affecting market prices? In fact, the choice of iceberg commissioning can be achieved when trading.

01

What is the iceberg commission

- Network effects in blockchain games: content is still king

- All are talking about DCEP, what is the relationship between the central bank digital currency and you?

- Research: Five major effects of central bank digital currency

Iceberg entrustment is one of the types of orders. It refers to investors who split large bids/sell orders into multiple small buy/sell orders in order to avoid excessive impact on the market when making large-value transactions. The latest price fluctuations in the market adjust the entrusted price, and reduce the impact of large orders on market prices through continuous small orders.

Explain in vernacular: split a large purchase order or sell order into multiple small orders for batch trading, which can reduce the price shock caused to the market. However , there is no need to manually split. When the iceberg commission order type is set, the splitting process is automatic.

02

Application scope of iceberg commission

Iceberg is commissioned as one of the types of orders, which is suitable for splitting large orders, thus reducing the impact on market prices.

For example, when making a large-value sell-off transaction for digital currency, setting the order type to Iceberg Entrustment can reduce the impact of large-selling orders on market prices; similarly, when making large-value buy-in transactions for digital currencies, it can prevent large The purchase price caused an increase in the price and increased the cost of buying.

At present, iceberg commissions are available in the order types of many trading platforms.

03

Iceberg commissioning example

The following is an example of an iceberg commission-buy on a platform.

Xiao Wang hopes to purchase a total of 800,000 USDT BTC, but does not want to increase the cost of buying because of the large number of pending orders, thus increasing his own buying cost. At this time, he can set the order type to iceberg commission.

Xiao Wang sets the total amount of purchase orders to 800,000 USDT; the average number of purchases per order can be set to 8000 USDT (the actual number of orders will fluctuate between 90% and 110%); Depth control the position of the order in the depth of the order book transaction; set the maximum purchase price: 8100 USDT to control the upper limit of the purchase price.

Therefore, Xiao Wang’s iceberg commissioning is set as follows:

Total amount: 80000 USDT; Single amount: 8000 USDT; Depth of commitment: 0.1%; Maximum purchase price: 8000 USDT.

What does this iceberg commission mean?

Xiao Wang wants to buy 800,000 USDT BTC, in order to not affect the price of the disk, so use the iceberg to order the type of small batch transactions; each batch of orders to buy 8000 USDT (actual order will be 90% ~ 110% The floating BTC; and the commissioned purchase price is: the latest buy 1 price * (1 – 0.1%); and also set the highest bid price: 8100 USDT, indicating that the purchase price will not be higher than 8100 USDT.

After setting up, click the "Buy" button, the system will commission the iceberg for Xiao Wang, and according to the rules set above, make a deal, and then commission the next one.

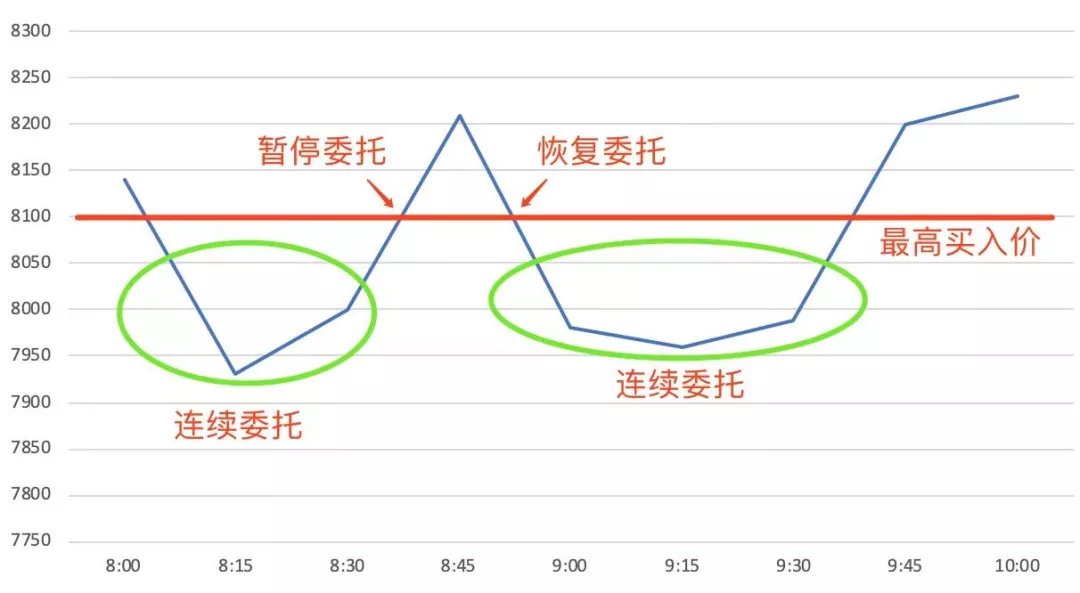

When the “latest transaction price” deviates too much from the entrusted price, the order is automatically withdrawn and re-delegated; when the “latest transaction price” is higher than the “highest bid price” set by Xiao Wang, the commission is stopped, and the latest transaction price is low. Restore at the highest bid price set by it; when the "total volume" of the commission is equal to the "total amount of commission", the commission will automatically stop.

The process is graphically represented as follows:

As shown in the above figure, when the latest transaction price is lower than the “maximum purchase price” set by Xiao Wang 8100 USDT, the system will make a continuous commission, when the latest transaction price is higher than the “highest purchase price” set by Xiao Wang 8100 USDT When the system stops the delegation.

The above is an iceberg commission-buy. If you want to make a large-value sell-off transaction for digital currency, you can also set up an iceberg commission. The principle and process are the same as the above example, so I won't go into details here.

In short, if you want to conduct large-value trading of digital assets and do not want to affect the market price too much, you can choose the iceberg commission for the order type.

Have you used the iceberg commission? What is the experience? Feel free to share your opinion in the message area.

——End——

『Declaration : This series of content is only for the introduction of blockchain science, and does not constitute any investment advice or advice. If there are any errors or omissions, please leave a message. You are not allowed to reprint this article by any third party without the authorization of the "Baihua Blockchain" sourced from this article. 』

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Science | ConsenSys: Privacy Technology on Ethereum

- Babbitt Column | Blockchain Essence: Performance Essence

- Dry Goods | Blockchain Economics: A Guide to Institutional Cryptography

- The MakerDAO rate has dropped to the lowest level in half a year. How to arbitrage from it?

- QKL123 market analysis | Bitcoin adjustment is nearing the end, or will start the slow cattle market (1104)

- Speed reading | Bitcoin S17+ new mining machine revenue evaluation; exchange wallet holds 6.7% of all bitcoin

- What are the major impacts of the accelerated development of the central bank's digital currency?