Global Blockchain Financing Track Top 20: 1,543 venture capital investments with a total funding of more than 79.2 billion yuan

Author: Ting Yuan

Source: Zero One Finance

Editor's Note: The original title was "Global Blockchain Financing Track Top 20"

- Satoshi Nakamoto's theory of the crypto market after the bulls' collapse?

- Perspectives | Five conjectures for the blockchain industry in 2020

- Blockchain can't save traffic NetEase circle and other products failure revelation

The projects that were won were mainly concentrated in the two directions of digital assets and infrastructure / solutions. The number accounted for more than 58% and the amount accounted for more than 69%. In the segmented track field, exchanges maintain a high level of financing enthusiasm, financial and physical application scenarios or future development directions.

Digital assets lead the strongest outlet, and blockchain applications tend to diversify

At present, start-up companies have emerged in the global blockchain field in various subdivisions, from the upstream underlying technology and hardware to the downstream vertical applications in various industries and peripheral services.

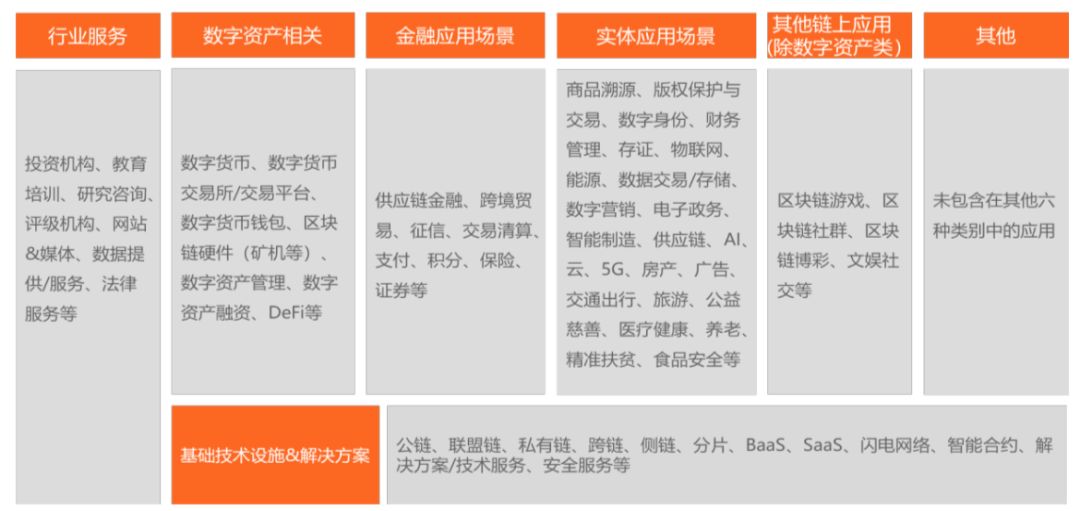

In order to observe the distribution of the track where the invested blockchain projects are located under the same standard, Zero One Think Tank divides blockchain applications into 7 first-level classifications and more than 60 second-level classifications from the perspective of architecture design. The following figure.

Figure 1: Blockchain industry classification

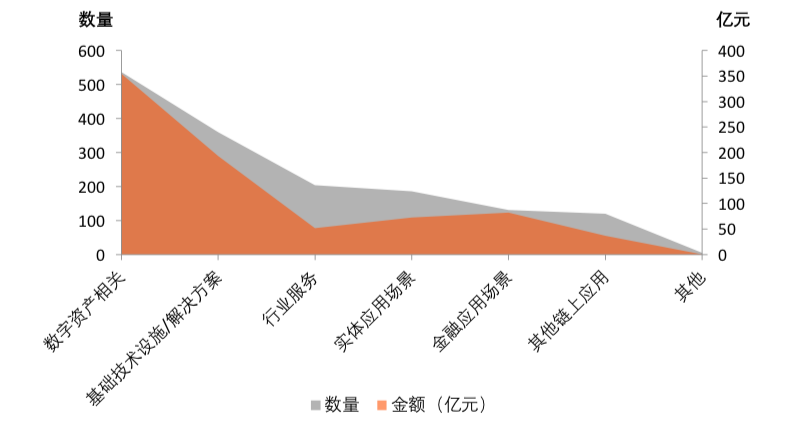

There are divergences in the amount and amount of 2 types of financing in the 7 major industry categories: industry services and financial application scenarios. The industry service has a large number of investments, but the financing amount is small; the financial application scenario has a small number of investments, but the financing amount is large. It may be because the global blockchain financial application is still in the early stages of exploration, but the entire financial system requires high security and risk, and the industry High barriers.

Figure 2: The amount and amount of the first-level classification financing of blockchain applications

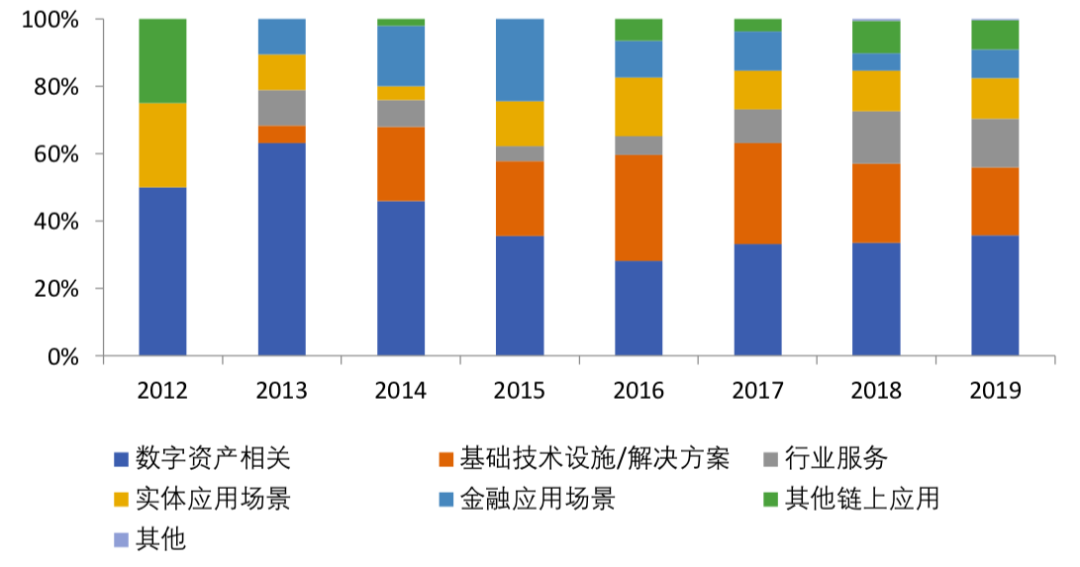

From the perspective of blockchain project financing over the years, digital assets have led the strongest market, and the proportion of financing each year remains high. Of the 19 financing projects in 2013, 12 were related to digital assets; in 2018, they reached a peak of 216.

From 2018 to 2019, the gap between various types of projects has gradually narrowed, and blockchain applications have become more diversified. As the value of blockchain is widely recognized, more and more industries are proposing their own blockchain solutions.

Figure 3: Trends in the amount of financing in the first-level classification of blockchain applications over the years

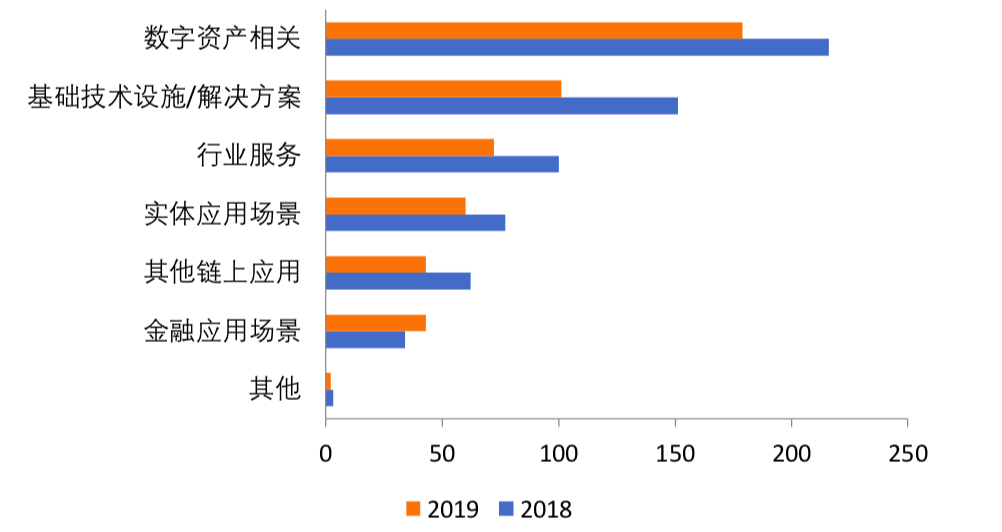

Figure 4: Comparison of the number of various projects in 2018 and 2019

Exchange track keeps financing hot, physical application scenarios need to be explored

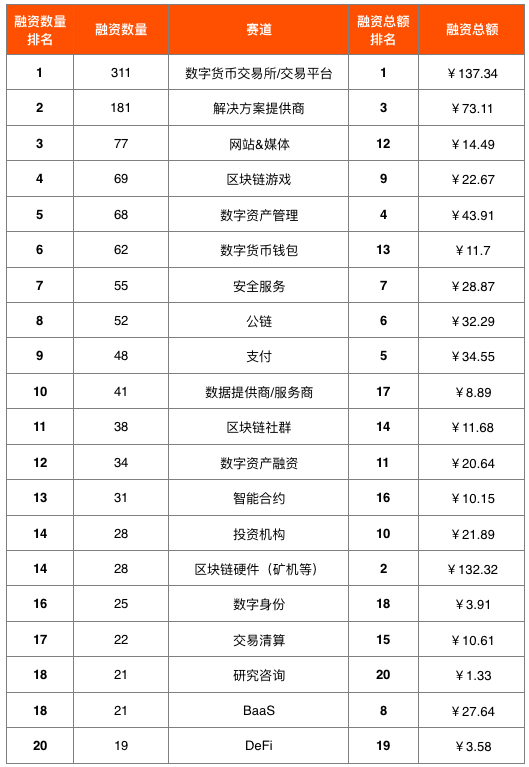

Digital currency exchanges / trading platforms are the hotspots of many investment institutions, with the number and amount of financing ranked first. The track has a total of 311 financings, accounting for 20.16% of the total financing projects, with a total financing of 13.734 billion yuan, accounting for 17.35% of the total financing. The solution provider's track investment followed closely with a total of 181 financings involving a total of 7.311 billion yuan.

Table 1: Top 20 global blockchain financing track from 2012 to 2019.11 (unit: 100 million yuan) (in descending order of financing amount)

Source: Open Channel, Zero One Think Tank

Note: Zero One Think Tank only counts the publicly disclosed financing amount, and converts the amount into RMB at the exchange rate on November 30.

In the Top 20 list of global blockchain financing tracks, the first-level classification of digital asset-related, infrastructure technology / solutions and industry services has the most subdivided tracks on the list, with 5, 6, and 4 sub-sectors respectively ; in finance In terms of physical application scenarios, there are fewer tracks on the list. Only the three tracks of payment, transaction clearing and digital identity have more projects to be financed.

On October 24th, the Political Bureau of the Central Committee of the Communist Party of China conducted the eighteenth collective study on the current status and trends of the development of blockchain technology. Innovative development.

CCTV commenters also pointed out that the application of blockchain is not speculation, but hopes to support the real economy through this technology. The perfect combination of blockchain and application scenarios is the correct way to open in the future, and it is also the direction strongly advocated by the country.

Most of the leading companies in the United States, financing rounds focused on strategic investment

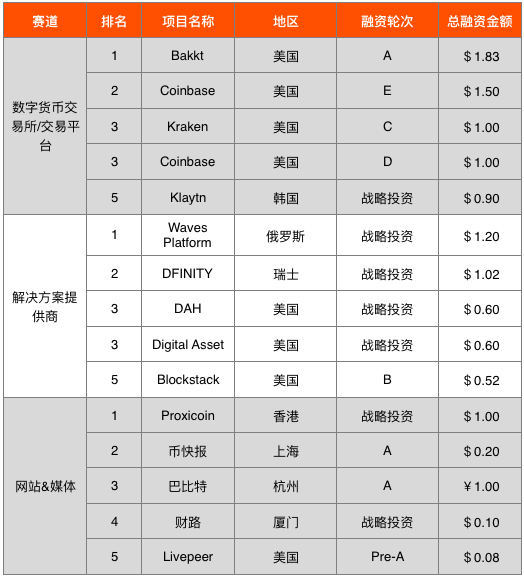

From the perspective of the number of blockchain financing tracks, the digital currency exchange / trading platform has always been the most popular track in the blockchain field, and it is also the most crowded track. The track's head project financing is in the middle and late stages, and the average investment for a single project is more than $ 100 million. Among them, Bakkt topped the list with $ 182.5 million in Series A funding; Coinbase has received two rounds of $ 100 million in funding.

The United States has the largest number of blockchain projects, with 13 distributed on various mainstream circuits. There are 6 in China, focusing on websites & media, and also involving application scenarios such as blockchain games. From the perspective of financing rounds, 56% of the projects received large financing in the strategic investment stage. The round A and previous projects generally had lower financing amounts. Only the US cryptocurrency investment management company CoinTracker received $ 225 million in round A financing.

Table 2: Top 5 of the main circuit financings of the global blockchain from 2012 to 2019.11 (unit: USD 100 million)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Comment: Why did Satoshi Nakamoto give up being the richest man in the world?

- Looking for "new rich mines" in the automotive industry: blockchain may become a breakthrough

- Opinion: 5 predictions for DeFi in 2020

- Case study | How government governance applies blockchain technology

- Latest Global Central Bank Digital Currency Guide

- Perspective | Bitcoin Operating System: What kind of applications will emerge from liberating information and communications?

- Dry goods | Starting from three bottlenecks to solve blockchain scalability issues