Why is Zhao Changpeng the “heir”?

Why is Zhao Changpeng the "heir"?Author: Blockingcryptonaitive

On June 5, 2023, Bloomberg reported that if Zhao Changpeng resigns due to regulatory difficulties, Richard Teng will become the next CEO of Binance.

After Bloomberg’s report, attention was once again focused on the regulatory difficulties that Binance faces after the collapse of FTX, and who Richard Teng is and why he might become Zhao Changpeng’s successor.

Who is Richard Teng?

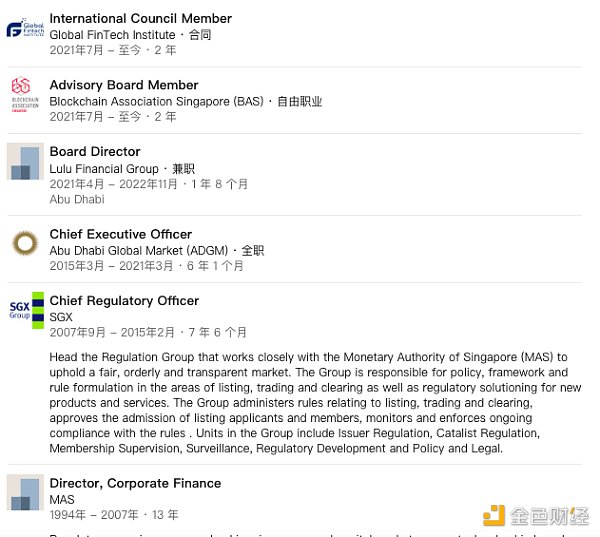

According to LinkedIn, Richard Teng, a 52-year-old Singaporean, studied at Nanyang Technological University in Singapore from 1991 to 1994. After university, he became a civil servant in Singapore and worked for the Monetary Authority of Singapore (MAS), rising to become director of MAS Corporate Finance.

- Will “Rare Cong” be the next crypto craze?

- Why is Polkadot called Layer 0?

- Ten Questions About the Metaverse: Is There Still Hope for Virtual Land?

During his tenure at MAS in Singapore, Richard Teng continued to study, graduating with a master’s degree from the University of Western Australia in 1998 and from the Wharton School of the University of Pennsylvania, a world-renowned business school, in 2004.

In 2007, Richard Teng left MAS in Singapore and moved to the Singapore Exchange (SGX), where he served as senior vice president, issuer regulatory head, and chief compliance officer.

In March 2015, Richard Teng joined the Abu Dhabi Global Market (ADGM) as CEO. According to ADGM, Teng’s tenure as CEO has won recognition from global regulatory agencies and industry organizations, such as ADGM winning the “Best International Financial Company in the Middle East and North Africa” award from Global Investor, a global investment publication, for four consecutive times.

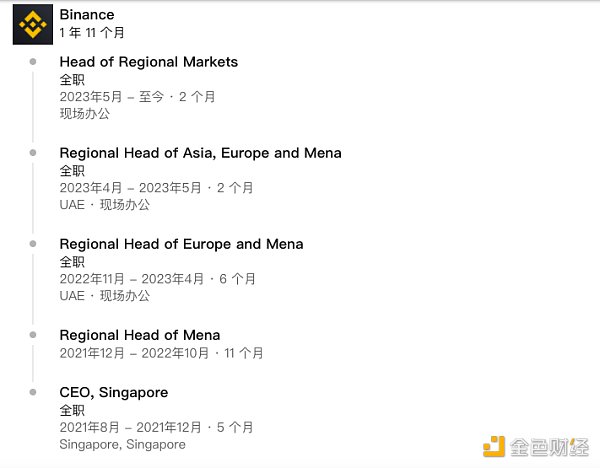

Richard Teng left ADGM in March 2021 and joined Binance in August 2021 as CEO of Binance Singapore.

Richard Teng’s rapid rise at Binance

According to Richard Teng’s personal LinkedIn, he was quickly promoted after joining Binance in 2021, especially after November 2022.

November 2022 was the time when FTX was hit by Binance CEO Zhao Changpeng and announced bankruptcy and collapse.

As we all know, the collapse of FTX has had a huge impact on the cryptocurrency industry, especially on institutional investors and regulatory agencies’ re-examination of the cryptocurrency industry.

Richard Teng was in charge of the Middle East and North Africa markets for nearly 11 months before November 2022. After November 2022, Richard Teng was quickly promoted at Binance, from being responsible for the European and Middle East and North Africa markets, to being responsible for the Asian, European, and Middle East and North Africa markets, and finally to being appointed to lead all regional markets outside the United States on May 29, 2023. Richard Teng accomplished all of this within 6 months.

What Happened at Binance in the Past Six Months

After a series of crypto institutions collapsed in 2022, especially the collapse of FTX, global regulatory agencies changed their attitudes toward the crypto industry and tended to strictly regulate it.

As the world’s largest centralized exchange, it goes without saying that Binance faces regulatory pressure.

In the past six months, Binance and Zhao Changpeng have faced increasing regulatory pressure from regulatory agencies in various countries, such as those in the United States, Canada, Australia, and Dubai.

On March 27, 2023, the US Commodity Futures Trading Commission (CFTC) announced that it had filed a civil lawsuit with the US Northern District Court of Illinois, accusing Zhao Changpeng and three entities operating the Binance platform of repeatedly violating the Commodity Exchange Act (CEA) and CFTC regulations.

Dubai, which has always been friendly to the crypto industry, is also strengthening its scrutiny of applicants for crypto currency licenses, requiring applicants such as Binance to provide more information. In April 2023, Bloomberg cited sources as saying that officials at the Dubai Virtual Asset Regulatory Authority (VARA) had recently asked Binance to provide more information about its ownership structure, governance, and audit procedures.

On May 13, 2023, Binance announced that it would no longer provide services to Canadian users and was actively withdrawing from the Canadian market due to changes in regulatory policies.

On May 18, 2023, Binance Australia tweeted that it had suspended AUD services due to the suspension of local payment service providers, and Binance Australia users could no longer make AUD deposits and withdrawals via bank transfer. From June 1, Binance will stop all AUD trading pairs.

Perhaps Zhao Changpeng chose Richard Teng because of his regulatory background and his ability to gain recognition from global regulatory agencies.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis of Binance’s new coin investment returns: What are the reasons behind the poor performance?

- Understanding the Opside ZK-PoW Algorithm Mechanism and Potential: How to Improve ZKP Generation Efficiency by 80%?

- Decentralized Storage Rising Star Datamall Chain Unique Mechanism Explained

- Metropolitan Museum of Art in New York to return $550,000 FTX donation

- OP Research: The Meme Coin Craze is the Ultimate Expression of Herd Mentality

- Analysis of Binance’s New Coin Investment Returns: The Exclusive Curse of Top 1

- Foresight Ventures: Rational View of Decentralized Computing Power Network