dYdX Founder: Hoping Cosmos’ influence doesn’t overshadow dYdX

dYdX founder hopes Cosmos won't overshadow dYdX.Since announcing its move to the Cosmos ecosystem, dYdX has received attention from both the Ethereum and Cosmos ecosystems. Some Ethereum OGs may not understand why such a popular application would migrate to the Cosmos ecosystem.

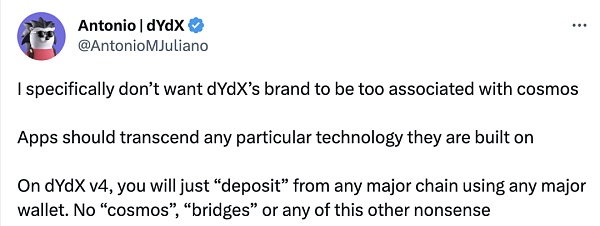

However, perhaps due to excessive attention, dYdX has also brought some interference or annoyance. dYdX founder Antonio expressed dissatisfaction directly on Twitter.

On dYdX v4, you can “deposit” using any major wallet from any major chain. No “Cosmos”, “Bridge” or any other nonsense. ”

- Exclusive Interview with Vechain Founder Sunny: From LV to Crypto World, Web3 is the Perfect Answer for Sustainable Development

- Why is Zhao Changpeng the “heir”?

- Will “Rare Cong” be the next crypto craze?

from: https://twitter.com/AntonioMJuliano/status/1664721673025617924

That is to say, from dYdX’s perspective, it is more important for everyone to focus on the application itself, such as users being able to deposit, rather than paying attention to what related technologies are being used behind the scenes.

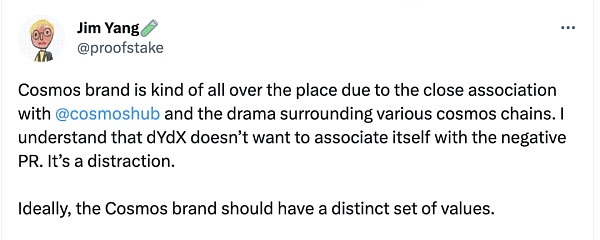

Twitter user Jim Yang commented on this:

from: https://twitter.com/proofstake/status/1604907391585509376

Jim also quoted his statement on the value of the Cosmos ecosystem in the past, namely:

-

Open source value

-

Decentralized value

-

Autonomy/Sovereignty

-

IBC

-

PMF value

-

Innovation value

-

Long-term value for the community

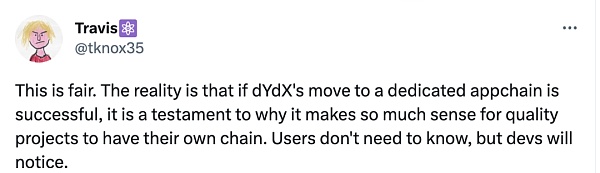

Community user Travis also commented interestingly:

from: https://twitter.com/tknox35/status/1664722955304067074

Twitter user XoXo_BubbleButt joked:

“Use the cosmos SDK, but ‘do not want the dYdX brand to be associated with cosmos’, a bit like Sprite being produced by Coca-Cola?”

But I think my favorite comment in the entire thread is this:

This is also my personal opinion. The Cosmos ecosystem narrowly refers to the chains developed using the Cosmos SDK, but in essence, they have little to do with the truly large Cosmos ecosystem, not to mention Binance Chain and Crypto.org, which actually do not want to play with Cosmos. So they may be part of the Cosmos ecosystem, but not the IBC ecosystem. The IBC ecosystem is the future, which has grand narrative power.

Through the criticism of dYdX founder, we can also make some guesses from the side, such as for dYdX currently, the more important thing may be the Cosmos SDK itself, and the relevance to IBC is not very prominent in the first stage at least.

Actually, this can also be understood. Many Cosmos ecological projects still focus on EVM compatibility. As for IBC, it is an additional benefit, such as the most direct way is to easily send assets to Osmosis for the entire Cosmos ecosystem to access and consume.

From the information currently revealed, Sei may be more native to Cosmos, which is evident in many places, such as when you look at Sei Network’s partners, a large proportion of them are Cosmos ecological chains using IBC, rather than other ecological chains as the main cooperation through cross-chain bridges. Of course, on the cross-chain bridge, the current test network is still EVM compatible, such as in the docking with Polygon and Solana.

It is natural for dYdX to prioritize EVM compatibility since it migrated from Ethereum. That is to say, the main wallet of dYdX in the future is likely to be Foxy, not Keplr.

After all, dYdX needs to solve the problem of personalized sovereignty and do fine optimization at the technical level, which is the main advantage of Cosmos SDK.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Why is Polkadot called Layer 0?

- Ten Questions About the Metaverse: Is There Still Hope for Virtual Land?

- Analysis of Binance’s new coin investment returns: What are the reasons behind the poor performance?

- Understanding the Opside ZK-PoW Algorithm Mechanism and Potential: How to Improve ZKP Generation Efficiency by 80%?

- Decentralized Storage Rising Star Datamall Chain Unique Mechanism Explained

- Metropolitan Museum of Art in New York to return $550,000 FTX donation

- OP Research: The Meme Coin Craze is the Ultimate Expression of Herd Mentality