Hourglass Finance: Providing Comprehensive Infrastructure for Time-Locked Tokens

Hourglass Finance provides infrastructure for time-locked tokens.Time-bound tokens

In the Hourglass protocol, time-bound tokens refer to tokens that represent assets pledged for a certain period of time in DEFI protocols such as Frax and Convex. These tokens are issued based on the ERC-1155 standard and can be traded on the HourGlass market.

- After submitting/locking 10 frxETH/ETH LP tokens for 3 months, you will receive 10 frxETH/ETH TBT tokens for 3 months.

Hourglass

HourGlass Finance is a protocol that provides time-bound token (TBT) services. It consists of two parts: a platform that allows users to stake their liquidity provider tokens (LP tokens) in vaults with different time restrictions, and a market that allows users to exchange or sell their time-bound LP tokens between different trading pairs to improve their liquidity and profits. These tokens can reflect the user’s staking duration and quantity.

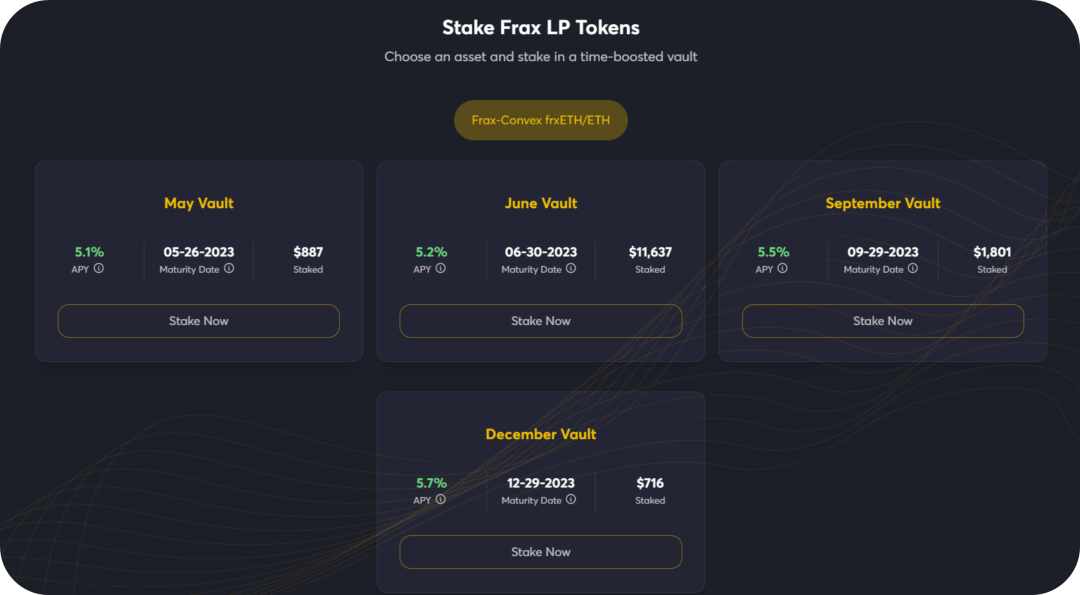

Staking platform

HourGlass provides different collateral pools for different LP assets and expiration dates. Currently, only LP tokens locked in the frxETH/ETH pool in Curve are open for staking. Users who stake LP tokens in the vault will receive TBT tokens (based on ERC-1155) as receipts. By holding TBT, holders can regularly receive profits through airdrops (which are verified and validated by Merkle tree). Once the staking period is over, TBT token holders can redeem LP tokens in mature vaults.

Trading market

HourGlass uses an order book model to match trades, and the targets have different discounts based on the length of the expiration time as compensation for the opportunity cost of time. Moreover, the trading situation on HourGlass can also be regarded as an indicator of DEFI protocols. The demand for time-bound tokens can reflect the liquidity situation.

- Understanding the Pros and Cons of FPGA and GPU Acceleration for Zero-Knowledge Proof Calculation

- Web3 IP: What’s Next?

- Deep analysis of the intent behind SEC’s lawsuit against Binance: a jurisdictional dispute or a show of power?

Generally speaking, if the demand for time-bound tokens is high, the liquidity situation is good because users are willing to obtain additional rewards and liquidity for long-term staking. If the demand for time-bound tokens is low, the liquidity situation is poor because users are unwilling to sacrifice flexibility and profits for long-term staking.

Governance

Currently, the HourGlass protocol does not charge any fees for the above functions, but DAO will discuss this at the end of 2023.

-

HourGlass Finance has a HourGlass Governance module for managing protocol parameters and functions.

-

HourGlass Governance uses a token called pitchFXS as its governance token, which is a wrapped token of Frax’s FXS token.

-

pitchFXS token holders can participate in governance voting of the HourGlass protocol and also lock their tokens on the HourGlass platform to receive more rewards.

Background

Founder

Hourglass was founded by @Charlie_Pyle, who is also the founder of @zetablockchain. ZetaChain is a blockchain based on Tendermint consensus and Cosmos SDK.

Investors

It has completed a $4 million seed round of financing. This round of financing was led by Electric Capital, with other participating investors including Coinbase Ventures, Hack VC, Tribe Capital, and Circle.

Summary

HourGlass is an innovative DEFI project that incentivizes users to lock their assets long-term in other DEFI protocols by issuing time-limited tokens (TBT). This allows these protocols to maintain a stable TVL and increase their security and sustainability. HourGlass also provides a market for these time-limited tokens, allowing users to trade their TBT without unlocking their assets. HourGlass provides comprehensive infrastructure for time-limited tokens, making them liquid and composable.

Disclaimer: This article is for research reference only and does not constitute any investment advice or recommendation. The project mechanism described in this article represents the personal views of the author, and is not related to the author or this platform in any way. Blockchain and cryptocurrency investments involve high market risks, policy risks, technical risks, and other uncertain factors. The secondary market token prices are volatile, and investors should make decisions prudently and independently bear investment risks. The author of this article or this platform is not responsible for any losses incurred by investors due to the use of the information provided in this article.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Apple Vision Pro priced at 25,000 yuan released, ushering in the next generation of human-computer interaction?

- Is Binance in trouble this time with “Li Chu” or “Taking on a Hot Potato”?

- 13 Key Points to Understand the SEC’s Lawsuit Against Binance and Changpeng Zhao

- Is “Li Chu” still a “hot potato”? Is Binance in trouble this time?

- dYdX Founder: Hoping Cosmos’ influence doesn’t overshadow dYdX

- Exclusive Interview with Vechain Founder Sunny: From LV to Crypto World, Web3 is the Perfect Answer for Sustainable Development

- Why is Zhao Changpeng the “heir”?